Future of Dismounted Soldier Systems Market Trends & Adoption Roadmap 2019–2035

EXECUTIVE SUMMARY

Key Data Points for Informed Decision-Making

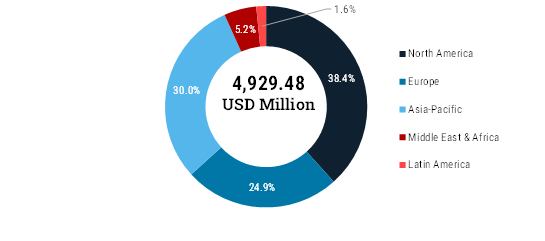

The global dismounted soldier system market was valued at USD 4,929.48 million in 2024 and is anticipated to grow at a CAGR of 6.8% during the forecast period to attain the value of USD 9,883.62 million in 2035.The global market for Dismounted Soldier Systems (DSS) is quickly evolving due to changes in international politics, advancements in technology in technology and rising efforts to modernize armies everywhere. Due to larger defense budgets among NATO and allied countries and the urgent and the urgent requirement for modern battlefield systems, the market is expanding in North America, Europe, the Asia-Pacific region and elsewhere. and elsewhere. Growth is driven by the need for technologies that provide better awareness in all conditions, including low-light, thermal and all- thermal and all-weather targeting. Creating devices that use multiple EO data sources, smart helmets with HUDs and safe EO communication communication solutions is supporting the trend toward flexible and networked equipment for soldiers. Because of the U.S. Army’s Soldier Lethality Soldier Lethality Cross-Functional Team and its major budgets, North America dominates the market. Canada supports NATO’s standards and standards and continually invests in modernization which helps Canada lead the region. In Europe, because of the Russia-Ukraine conflict, member conflict, member states in NATO are boosting military spending and encouraging shared soldier systems. More attention is given to small, tough small, tough gadgets for fighting in cities and mixed warfare zones and the use of AR, AI and EO technology is on the rise. Because China, India, China, India, Japan and South Korea are modernizing their defense capabilities, the Asia-Pacific region is seeing rapid market growth. Due to growth. Due to constant problems and tensions along borders, many countries are turning to advanced surveillance, thermal imaging and improved and improved communication devices. Strong manufacturing at home, incentives for new technology and partnerships with other nations strengthen nations strengthen the region’s role as a leading business area.

Based on the type, the global dismounted soldier system market is bifurcated into Thermal Weapon Sight, Monocular and Binocular, Night Vision Night Vision Devices, Fusion Devices (Night + Fusion), Electro-Optical (EO) Sensors Systems, and Others. Further the Electro-Optical (EO) Sensors Optical (EO) Sensors Systems is classified into Rangefinders, Cameras, GPS, and Others. The Electro-Optical (EO) Sensors System segment dominated the market with a value of USD 1,596.67 million in 2024 and is expected to reach USD 3,270.44 million by 2035.

Client Needs

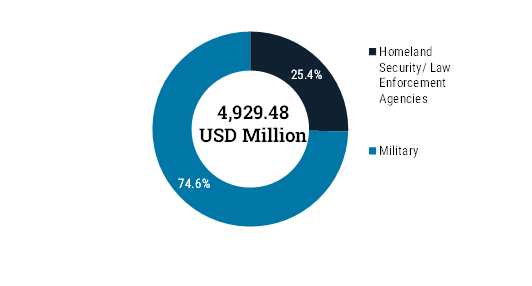

On the basis of End User, the market is segmented into Homeland Security/ Law Enforcement Agencies, and Military. The military segment was valued at USD 3,676.41 million in 2024 and is expected to attain the value of USD 7,234.14 million by 2035 with a CAGR of 6.6% from 2025 to 2035.

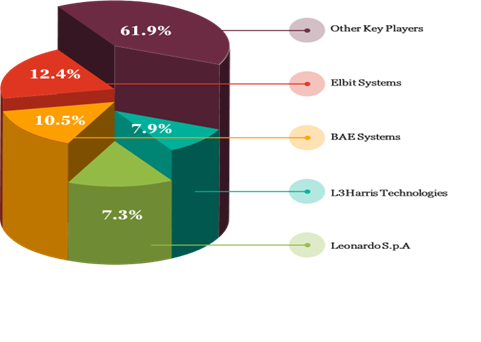

The market is competitive, with all the players competing to gain maximum market share. Rising inclination towards adoption of sustainable materials and manufacturing over traditional methods in technology, increasing tensions between various nations and rise of defense spending across the globe are some of the key primary factors contributing to the change and innovation in the dismounted soldier system market. In recent years, major market participants have adopted strategies such as improved research & development efforts, innovation, and capacity enhancements in production plants. It is expected to develop further growth for this industry in the coming years.

The dismounted soldier system market is extremely competitive, with players competing, partnering, and investing heavily in research and

Vendor Share Analysis, 2024

COMPARATIVE ANALYSIS: KEY PLAYERS FINANICAL

| Company | Revenue (USD Million) | Gross Profit |

| Teledyne FLIR LCC | 5,670 | 2,435 |

| L3Harris Technologies, Inc | 21,325 | 5,526 |

| BAE Systems | 33,061 | 22,913 |

| Elbit Systems | 6,828 | 1,642 |

| Leonardo S.p.A. | 18,501 | 2,100 |

| Thales Group | 21,503 | 5,597 |

| Safran S.A. | 28,868 | 4,156 |

| Aselan A.Ş. | 3,403 | 1,080 |

| Rheinmetall AG | 10,156 | 5,544 |

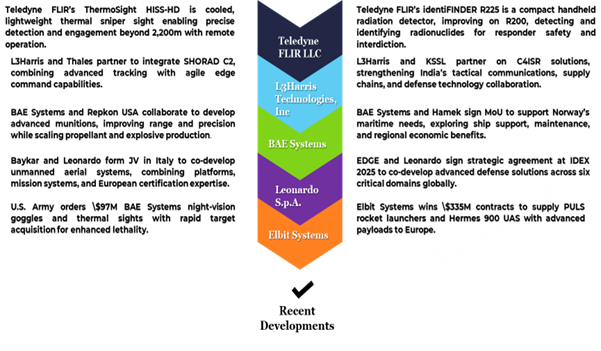

Recent Developments

Regulations

Defense Procurement Regulations: Dismounted Soldier Systems must comply with national military procurement standards, such as the U.S. FAR/DFARS or equivalent defense acquisition rules in NATO and allied countries. These regulations govern technical evaluations, safety certifications, and battlefield readiness before field deployment.

Cybersecurity & Data Compliance : As DISMOUNTED SOLDIER SYSTEM integrates digital tech (wearables, communication systems, AI), it falls under strict cybersecurity regulations like CMMC (U.S.), NIST 800-171, and GDPR (EU).

Encryption, secure data handling, and real-time threat protection are regulatory priorities.

Export Control & Licensing: DISMOUNTED SOLDIER SYSTEM products are classified as sensitive military equipment and are subject to export control laws like ITAR (U.S.), EAR, and the Wassenaar Arrangement. International suppliers face licensing challenges and country-specific compliance to avoid embargo violations or sanctions.

Interoperability & NATO Standards: DISMOUNTED SOLDIER SYSTEM solutions must meet STANAG and MIL-STD standards for interoperability across multinational forces. This is critical for allied operations and joint deployments.

Environmental and Human Factors Compliance: Growing attention on DISMOUNTED SOLDIER SYSTEM systems complying with ergonomic, safety, and environmental regulations (e.g., RoHS, REACH in Europe). Designs must consider soldier fatigue, electromagnetic safety, and eco-friendly components.

PATENT ANALYSIS

|

APPROACH

The report’s findings are based on a comprehensive hybrid research methodology, integrating both primary and secondary approaches. Secondary research involved analyzing defense procurement databases, government publications, annual reports, and industry white papers to establish a foundational understanding of market dynamics.

Primary research included in-depth interviews with industry experts, defense contractors, and procurement officials to validate data and gather on-ground insights. Additionally, technology roadmapping and trend analysis were employed to assess future adoption patterns, innovation pipelines, and investment priorities. This blended methodology ensured reliable, actionable, and forward-looking insights tailored to the evolving dismounted soldier systems market landscape.

BACKGROUND OF THE STUDY

The background of this study lies in the increasing global emphasis on soldier modernization programs, where dismounted soldier systems (DSS) play a critical role in enhancing situational awareness, survivability, and operational effectiveness.

Growing threats from asymmetric warfare, rising counter-insurgency operations, and the proliferation of unmanned systems have pushed militaries to invest in advanced electro-optical sensors, night vision, thermal sights, and AR-based wearable technologies.

At the same time, challenges such as integration with legacy systems, power management, and cost constraints continue to shape adoption. This study provides a structured understanding of evolving defense priorities, technological innovations, and regional procurement trends.

GLOBAL DISMOUNTED SOLDIER SYSTEM MARKET, BY TYPE, 2019–2035 (USD MILLION)

| Type | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2035 | CAGR (2025-2035) |

Thermal Weapon Sight | 1,029.16 | 962.90 | 967.40 | 1,051.29 | 1,076.47 | 1,115.39 | 2,252.60 | 6.8% |

Monocular and Binocular Night Vision Devices |

823.29 |

771.67 |

776.66 |

845.51 |

867.29 |

900.25 |

1,853.25 |

7.0% |

Fusion Devices (Night + Fusion) | 623.71 | 581.48 | 582.11 | 630.34 | 643.12 | 663.99 | 1,288.35 | 6.4% |

| Electro-Optical (EO) Sensors Systems | 1,463.63 | 1,371.21 | 1,379.41 | 1,501.00 | 1,538.94 | 1,596.67 | 3,270.44 | 7.0% |

| Rangefinders | 412.74 | 388.65 | 392.96 | 429.75 | 442.83 | 461.74 | 997.48 | 7.5% |

| Cameras | 526.91 | 491.92 | 493.14 | 534.73 | 546.32 | 564.82 | 1,111.95 | 6.6% |

| GPS | 322.00 | 300.81 | 301.75 | 327.40 | 334.72 | 346.28 | 686.79 | 6.7% |

| Others | 201.98 | 189.83 | 191.57 | 209.11 | 215.07 | 223.83 | 474.21 | 7.3% |

| Others | 623.71 | 579.61 | 578.36 | 624.22 | 634.77 | 653.18 | 1,218.98 | 6.1% |

| Total | 4,563.50 | 4,266.87 | 4,283.94 | 4,652.36 | 4,760.59 | 4,929.48 | 9,883.62 | 6.8% |

BY END USER

BY REGION