Summary Overview

Flavours Market Overview:

The global Flavors industry is expanding swiftly, fuelled by increased consumer interest in industries like as food and beverage, cosmetics, prescription drugs, and household items. This market offers a wide variety of Flavors options, including natural, artificial, and organic ingredients. Our report presents an in-depth analysis of procurement trends, with a concentration on cost optimization tactics and the use of modern digital tools to improve procurement and operations processes.

Key issues in the Flavors procurement landscape include managing sourcing prices, assuring scalability, maintaining product consistency and conforming to strict quality standards. Adopting digital procurement technologies and strategic sourcing approaches is crucial for accelerating taste innovation and assuring long-term growth. As global demand continues to climb, businesses are leveraging market intelligence to boost operational efficiency, expand product offerings, and mitigate supply chain risks, all while meeting evolving consumer preferences for clean-label and sustainable ingredients.

-

Market Size: The global Flavors market is expected to reach a size of approximately USD 30.81 billion by 2035, growing at a Compound Annual Growth Rate (CAGR) of 5.9% during the forecast period from 2025 to 2035.

Growth Rate: 5.9%

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: The Flavors market is focusing on real-time data and integrated processes to streamline manufacturing, decrease waste, and fulfill rising demand across industries.

-

Growth in Retail and E-Commerce: With the advent of retail and e-commerce, taste firms are focusing on inventory management and demand forecasting to ensure product availability and improve customer relationship management.

Technological Transformation: AI and machine learning improve taste creation through predictive analytics and automation, allowing enterprises to forecast trends and increase manufacturing efficiency.

Innovations: Modular solutions enable organizations to pick and integrate only necessary capabilities, lowering costs and complexity.

Investment Initiatives: Companies are investing in cloud-based technologies to reduce infrastructure costs and improve accessibility. This allows for distant collaboration and faster decision-making.

Regional Insights: Asia Pacific and North Pacific dominate the tastes market with strong digital infrastructure and growing demand for plant-based and clean-label products.

Key Trends and Sustainability Outlook:

-

Cloud Integration: The growing popularity of cloud-based systems offers scalability, cost-efficiency, and greater data access, allowing for faster market adaption. -

Advanced Features: AI, IoT, and blockchain enhance transparency, automation, and traceability in Flavors creation and sourcing. -

Sustainability Focus: Flavors companies are optimizing resource management and sustainability objectives, as well as tracking environmental effect throughout the production process. -

Customization Trends: There is a growing demand for industry-specific taste solutions for sectors such as food, drinks, and cosmetics. -

Data-Driven Insights: Advanced analytics can help businesses estimate demand, optimize inventory, and stay ahead of market trends.

Growth Drivers:

-

Digital transformation: The Flavors industry is steadily embracing digital technologies to improve productivity and optimize operations. Companies utilize innovative software technologies to improve Flavors development, production, and distribution processes, resulting in increased overall efficiency.

-

Demand for Process Automation: Automating repetitive businesses in Flavors manufacturing, such as sourcing and quality control, is growing increasingly crucial. This lowers operational bottlenecks and shortens time-to-market for new products.

-

Scalability Needs: As the Flavors industry grows, businesses are looking for solutions that can scale with their operations, delivering seamless integration across different production locations and regions and maintaining consistent quality.

-

Regulatory Compliance: Flavors firms automate processes to meet food safety and labeling laws. Automation enhances data accuracy and streamlines reporting, eliminating the risk of errors.

-

Globalization: To meet globally Flavors demand, firms require systems that handle several currencies, languages, and foreign regulations. This ensures they can efficiently manage operations in several regions while adhering to local standards and consumer preferences.

Overview of Market Intelligence Services for the Flavors Market

According to recent estimates, issues facing the Flavors market include high implementation costs and demands for system customization. Market data delivers essential details that enable businesses to identify cost-cutting opportunities, optimize supplier management, and improve product development performance. These insights also help to ensure compliance with industry standards while maintaining high-quality production processes and effectively controlling expenses.

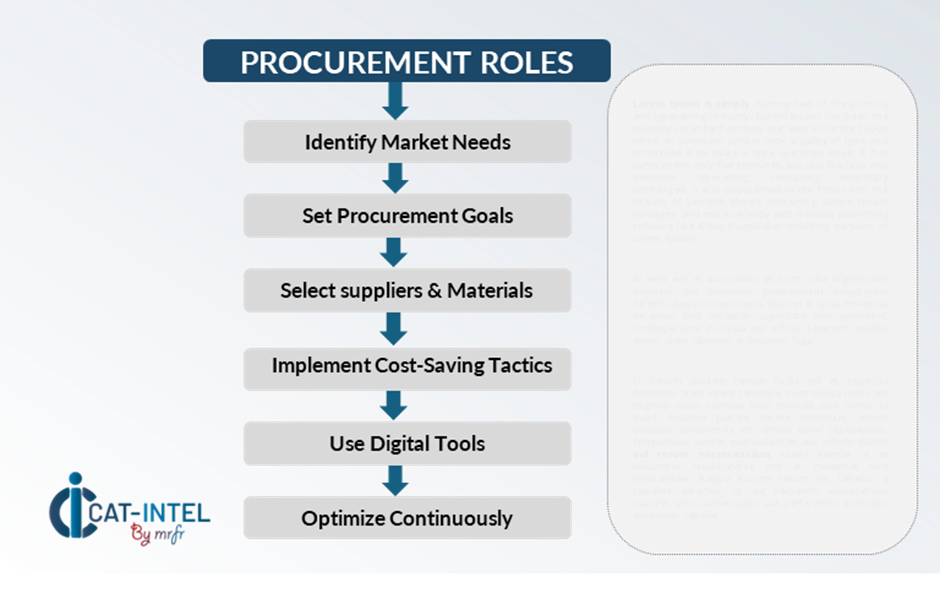

Procurement Intelligence for Flavors: Category Management and Strategic Sourcing

To remain competitive in the Flavors market, businesses are improving their procurement processes through spend analysis and vendor performance tracking. Effective category management and strategic sourcing are critical to lowering ingredients. By leveraging actionable market intelligence, businesses can improve their procurement strategies and negotiate favourable terms with suppliers for their Flavors ingredient needs

Pricing Outlook for Flavors: Spend Analysis

The price outlook for Flavors ingredients is projected to remain moderately volatile, impacted by several major factors. Technology developments, desire for natural and organic components, customized necessities, and regional price discrepancies will all play important roles. Additionally, increasing consumer preference for sustainability, quality, and transparency is raising prices in some segments of the market.

Graph shows general upward trend pricing for Flavors and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, strengthen supplier relationships, and implement flexible sourcing models are critical for cost control. Using digital tools for market monitoring, pricing forecasting, and effective contract administration may significantly lower costs.

Building strong partnerships with dependable suppliers, negotiating long-term contracts, and looking into bulk purchasing prospects are all useful techniques for controlling ingredient costs. Despite these hurdles, emphasizing scalability, guaranteeing consistent product quality, and investing in sustainable sourcing will be essential for maintaining cost-effectiveness and operational excellence in the Flavors market.

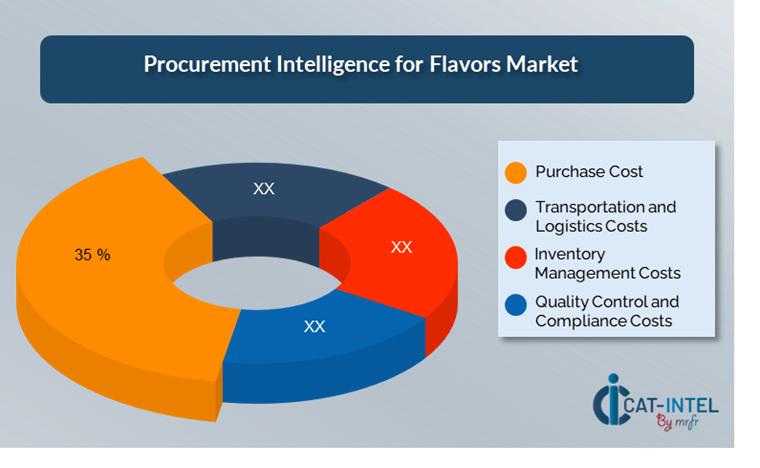

Cost Breakdown for Flavors: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Purchase Costs: (35%)

-

Description: The upfront cost paid to acquire Flavors ingredients, including the supplier's margin.

-

Trend: Fluctuations in raw material prices and supplier pricing strategies can impact this cost.

- Transportation and Logistics Costs: (XX%)

- Inventory Management Costs: (XX%)

- Quality Control and Compliance Costs: (XX%

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Flavors market, streamlining procurement processes and implementing strategic negotiation strategies can result in significant cost savings and increased operational efficiency. Long-term partnerships with Flavors ingredient suppliers, particularly those that provide sustainable and traceable sourcing, can result in more favourable pricing structures and terms, such as volume discounts and packaged products. Subscription-based pricing models and multi-year contracts help to lock in reduced rates and defend against price swings.

Partnering with suppliers who promote innovation and scalability provides additional benefits, like access to advanced analytics, sustainability certifications, and customisable ingredient options, all of which help to reduce long-term operational expenses. Implementing digital procurement technologies such as contract management systems and usage analytics improves transparency, reduces overstocking, and maximizes ingredient consumption. Diversifying supplier sources and using multi-supplier techniques can reduce reliance on a single vendor, mitigate supply chain risks, and enhance negotiating power.

Supply and Demand Overview for Flavors: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The tastes industry is also growing steadily, driven by rising consumer demand for innovative, sustainable, and diversified Flavors solutions in industries such as food and beverage, cosmetics, and medicines. Technological breakthroughs, industry-specific needs, and global economic considerations all have an impact on supply and demand in this market.

Demand Factors:

-

Digital Transformation Initiatives: The desire for improved data management and process automation is driving demand for enhanced taste formulation tools, tracking systems, and production technologies that streamline operations in a variety of industries.

-

Cloud Adoption Trends: As cloud-based platforms become more prevalent, there is a greater demand for scalable Flavors production solutions that enable firms to access real-time data, collaborate globally, and track ingredient procurement.

-

Industry-Specific Requirements: Sectors including food and beverage and medicines need taste solutions that meet regulatory standards, health guidelines, and operational workflows, driving demand for customized offerings.

-

Integration Capabilities: Flavors solutions that connect with supply chain management systems and IoT devices for real-time production monitoring are in high demand.

Supply Factors:

-

Technological Advancements: Advancements in AI, machine learning, and cloud technologies improve Flavors creation and production processes, allowing suppliers to provide more customized, high-quality, and cost-effective options.

-

Vendor Ecosystem: The industry is seeing an increase in the number of Flavors ingredient suppliers, both concentrated and large-scale, providing enterprises with different sourcing options and flexibility in satisfying customer demands.

-

Global Economic Factors: Exchange rates, labour costs, and regional swings in objectives for sustainability all have an impact on Flavors element pricing and availability, which influences market dynamics.

-

Scalability and Flexibility: Modern Flavors solutions becoming more modular and adaptable, allowing suppliers to cater to businesses of all sizes, from small craft food producers to large multinational corporations.

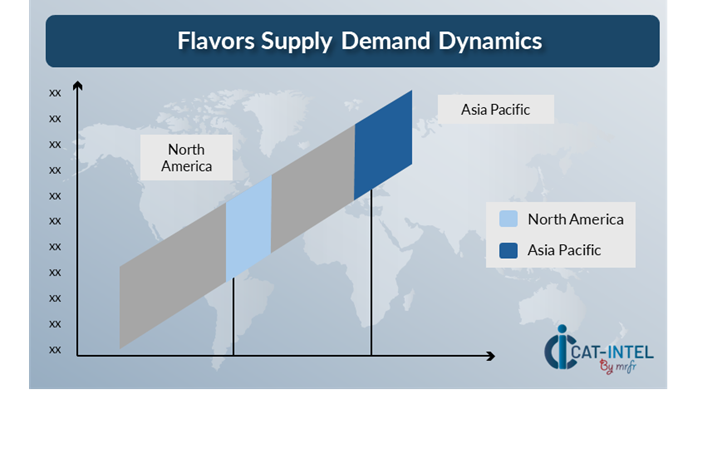

Regional Demand-Supply Outlook: Flavors

The Image shows growing demand for Flavors in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the ERP Software Market

Asia Pacific, particularly Japan, is a dominant force in the global flavours market due to several key factors:

-

Large Consumer Base: Large population creates a huge demand for a varied range of Flavors in the food and beverage, cosmetics, and pharmaceutical sectors. This high consumer demand drives growth and creativity in the flavour sector.

-

Growing Middle-Class Population: As the median income grows in emerging economies, there is a greater demand for premium, individualized, and innovative Flavors goods, particularly in the food and beverage industry.

-

Food & Beverage Innovation: Asia Pacific is known for its vast culinary diversity, leading to in the ongoing development of new and distinct Flavors profiles. This region is a hub of Flavors innovation, which drives both domestic and international market demand.

-

Cost-Effective Manufacturing: Many nations in the area, including China and India, benefit from lower manufacturing costs due to affordable labour, allowing Flavors companies to increase output while maintaining competitive prices.

-

Strong Supply Chain and Export Capabilities: Asia Pacific has a well-developed supply chain infrastructure and export network, particularly in China, Japan, and India. This enables regional Flavors manufacturers to meet global demand while also expanding their market reach efficiently.

Asia Pacific remains a key hub for Flavors Price Drivers Innovation and Growth.

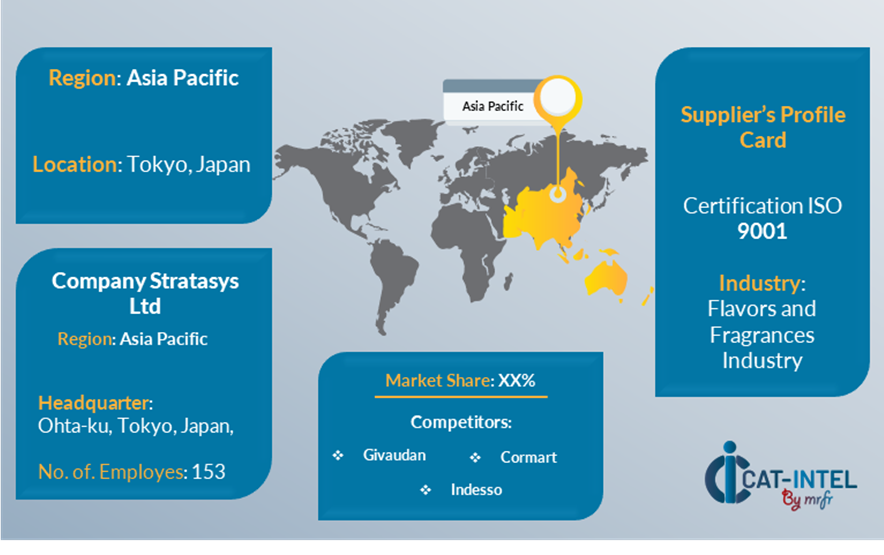

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the Flavors market is both comprehensive and competitive, with a combination of global and regional firms establishing industry trends. These suppliers have an impact on critical elements such as ingredient pricing, product customisation, and service quality. The market is dominated by major, well-established Flavors ingredient providers with broad product offerings, while smaller, concentrated competitors focus on specific industries or demands, such as natural or sustainable Flavors solutions.

The Flavors supplier ecosystem spans significant regions, with renowned worldwide vendors and creative local suppliers meeting industry-specific needs. As businesses prioritize innovation and operational efficiency, Flavors suppliers are improving their offers with novel technologies, sustainable sourcing processes, and flexible pricing arrangements to satisfy shifting market needs.

Key Suppliers of the Flavors Market include:

- Takasago

- Givaudan

- Firmenich

- International Flavors & Fragrances (IFF)

- Symrise

- Sensient Technologies

- Mane

- Daesang Corporation

- Kerry Group

- Austrian Flavors

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The tastes market is expanding as businesses seek novel ways to meet increased consumer demand, particularly in emerging nations. |

Cloud Adoption |

Cloud-based Flavors solutions are gaining popularity due to their scalability, cost-effectiveness, and remote accessibility, which enable hybrid work methods |

Product Innovation |

Flavors suppliers are implementing AI-powered analysis, real-time testing, and industry-specific solutions to keep up with market trends. |

Technological Advancements |

Machine learning, IoT, and automation are revolutionizing taste creation by increasing uniformity and efficiency |

Global Trade Dynamics |

Changes in trade rules and regional economic policies influence Flavors sourcing and distribution |

Customization Trends |

The increasing demand for personalized taste solutions drives businesses to seek modular, adaptable services that communicate easily with business processes. |

Flavors Attribute/Metric |

Details |

Market Sizing |

The global Flavors market is expected to reach a size of approximately USD 30.81 billion by 2035, growing at a Compound Annual Growth Rate (CAGR) of 5.9% during the forecast period from 2025 to 2035. |

Flavors Technology Adoption Rate |

Around 60% of taste companies have incorporated digital technologies, with a rising emphasis on cloud-based solutions for scalability and flexibility.

|

Top Flavors Industry Strategies for 2024 |

Key tactics include using AI to identify trends, optimizing operations with modular solutions, prioritizing sustainability, and boosting accessibility through mobile platforms.

|

Flavors Process Automation |

To improve efficiency, over 50% of Flavors companies automate regular processes such as inventory management, quality control, and regulatory compliance.

|

Flavors Process Challenges |

High implementation costs, employee reluctance to change, data integration concerns, and the need for ongoing innovation and regulatory upgrades are all major challenges.

|

Key Suppliers |

Leading suppliers for Flavors market include Takasago, Givaudan and Firmenich for sustainable sourcing processes, and flexible pricing arrangements to satisfy shifting market needs. |

Key Regions Covered |

Prominent regions for Flavors market are Asia Pacific and North Pacific with strong digital infrastructure and growing demand for plant-based and clean-label products. |

Market Drivers and Trends |

Consumer demand for individualized, clean-label products is driving growth, as is the emergence of plant-based and sustainable components and the integration of advanced technologies like AI and IoT in Flavors development.

|