Summary Overview

Banking Self-service Channel & Payment Solutions Africa Market Overview:

The Banking Self-Service Channel and Payment Solutions market in Africa is witnessing rapid growth, driven by advancements in digital banking technologies, increasing financial inclusion, and rising demand for convenient payment options. This market includes a range of services, from ATMs and kiosks to mobile payment platforms and online banking solutions. Our report provides a detailed analysis of procurement trends, emphasizing cost-saving opportunities through strategic partnerships and the adoption of advanced payment solutions that enhance user experience and operational efficiency. Future challenges include the need for accurate demand forecasting and the integration of digital procurement tools to respond quickly to market dynamics. Strategic sourcing and effective procurement management are crucial for optimizing service delivery while ensuring compliance with financial regulations. As competition intensifies, banks and service providers are leveraging market intelligence and procurement analytics to strengthen supply chains and stay ahead in the evolving.The market outlook remains optimistic, with consistent growth anticipated through 2032 due to multiple factors:Market Size: The bank card market is expected to reach USD 60.7 billion by 2032, growing at a compound annual growth rate (CAGR) of around 10.6% from 2024 to 2032.Growth Rate:10.6%Sector Contributions: Growth is driven primarily by:

Banking and Financial Services: The need for accessible ATMs and mobile banking solutions is propelling market expansion.Telecommunications: Growing mobile penetration across Africa supports digital and mobile payment adoption.Technological Transformation and Innovations: Advancements in pharmacokinetics and data analytics are driving progress in improving. Investment Initiatives: Financial institutions are investing in secure self-service platforms and advanced payment solutions to enhance financial accessibility and operational efficiency. Regional Insights: Sub-Saharan Africa is experiencing significant demand due to high mobile usage and efforts to improve financial inclusion, with increasing interest in digital solutions across urban and rural regions.Key Trends and Sustainability Outlook:Digital Banking Expansion: Adoption of Digital in Financial institutions are rapidly integrating digital banking channels and payment solutions to improve customer reach and convenience.Technological Innovation: Emerging technologies like artificial intelligence (AI) and biometric authentication are transforming self-service banking, enhancing security and accessibility.

Sustainability Efforts: Emphasis on sustainable practices, such as energy-efficient kiosks and digital receipts, is reducing the environmental impact of banking services. Increased Demand for Mobile Payments: The high adoption rate of mobile money and digital wallets in Africa is driving demand for mobile-friendly banking solutions. Enhanced Security Measures: Improved cybersecurity and fraud prevention measures are critical as the adoption of digital payment channels grows. Growth Drivers: Financial Inclusion Initiatives: The drive to provide banking access to unbanked and underbanked populations is spurring growth in self-service channels. Mobile Penetration: The increase in mobile device usage across Africa facilitates the expansion of mobile banking and payment solutions. Cost Reduction and Operational Efficiency: Self-service solutions like ATMs and mobile banking reduce the need for in-branch services, lowering operational costs. Environmental Awareness: Financial institutions are adopting sustainable practices to meet consumer and regulatory expectations for eco-friendly operations. Customization and Personalization: Banks are focusing on personalized customer experiences through digital channels, such as tailored mobile banking services, to improve user satisfaction and loyalty.Overview of Market Intelligence Services for the Banking Self-Service Channel & Payment Solutions Africa Market:

Recent studies highlight challenges in the Banking Self-Service Channel & Payment Solutions market in Africa, driven by increasing operational costs and the growing complexity of digital payment ecosystems. Market reports provide detailed cost analysis and insights into procurement savings opportunities, enabling banks and service providers to optimize expenditures while delivering high-quality solutions. By leveraging these insights, stakeholders can implement cost-saving strategies, streamline procurement processes, and enhance operational efficiency, ensuring sustained growth and compliance in a rapidly evolving financial landscape.Procurement Intelligence for Banking Self-Service Channel & Payment Solutions Africa:To stay competitive in Africa's Banking Self-Service Channel & Payment Solutions market, companies are optimizing procurement strategies by employing spend analysis tools to monitor vendor expenses and enhance supply chain efficiency with market intelligence. Effective category management and strategic sourcing are vital for achieving cost-effective procurement and ensuring the timely availability of essential technologies and resources to deliver reliable and innovative payment solutions. Pricing Outlook for Banking Self-service Channel & Payment Solutions Africa: Spend Analysis The pricing outlook for banking self-service channels and payment solutions in Africa is expected to remain stable in the near term, although modest price increases may be seen due to several key factors. These include rising costs of digital infrastructure, secure technology integration, and compliance with local regulations. As demand for mobile banking, ATMs, and contactless payments grows across the continent, the added costs of secure transactions and upgrading infrastructure may lead to incremental price adjustments in the self-service and payment solutions market.Graph shows general upward trend pricing for Banking Self-service Channel & Payment Solutions Africa and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.- Demand Factors

Regional Demand-Supply Outlook for Banking Self-Service Channels and Payment Solutions in Africa:The Image shows growing demand for banking self-service channels and payment in both Africa and North America, with potential price increases and increased Competition. Africa: Dominance in Banking Self Service Channels and Payment Solution in Africa.

Africa: Dominance in Banking Self Service Channels and Payment Solution in Africa.

Africa Market Strength: The Africa region, particularly in South Africa, Nigeria, Kenya is a dominant player in banking self-service channels characterized by:

1. Demand for Financial Inclusion: There is a rising demand for accessible banking services, especially in rural and semi-urban regions, as efforts to bring financial services to underserved populations gain momentum. This drives the growth of debit and prepaid card distribution. 2. Expansion of Digital Banking Infrastructure: Investments in digital banking and mobile payment systems in South Africa are fuelling demand for secure, high-quality self-service solutions. The move towards cashless payments is increasing the need for secure and efficient card options. 3. Regulatory Compliance and Security Standards: South Africa's stringent regulatory frameworks ensure that bank cards comply with data protection and security standards, enhancing consumer confidence and supporting market expansion. 4. Technological Innovation: Advancements such as biometric authentication, contactless payments, and the use of eco-friendly materials are driving innovation in the market, improving the functionality of bank cards and making them more appealing to a diverse range of users. Supplier Landscape: Supplier Negotiations and Strategies for Banking Self-Service Channels & Payment Solutions in AfricaThe supplier landscape for Banking Self-Service Channels and Payment Solutions in Africa is diverse, with both global and regional players offering digital payment services and self-service technologies. These suppliers play a critical role in shaping market dynamics by influencing pricing, technological innovation, and system accessibility. The market is highly competitive, including major banks, fintech firms, and technology providers focused on delivering secure, user-friendly solutions. Currently, there is significant consolidation among key players, but smaller fintech companies and emerging firms are gaining traction by focusing on niche solutions and advanced payment methodologies. Some key suppliers in the African banking self-service and payment solutions market include

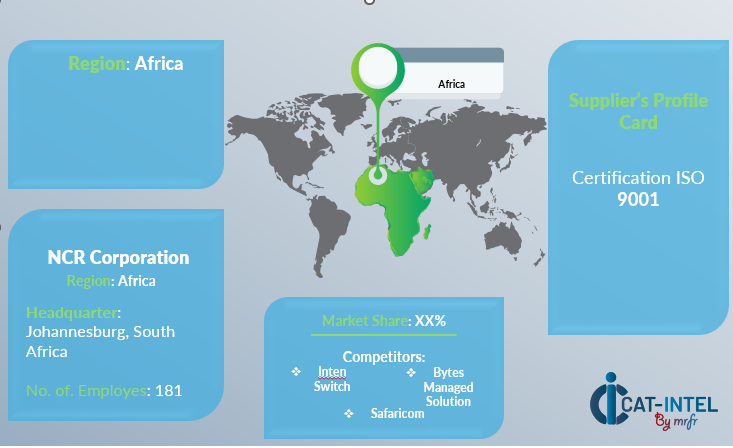

Supplier Landscape: Supplier Negotiations and Strategies for Banking Self-Service Channels & Payment Solutions in AfricaThe supplier landscape for Banking Self-Service Channels and Payment Solutions in Africa is diverse, with both global and regional players offering digital payment services and self-service technologies. These suppliers play a critical role in shaping market dynamics by influencing pricing, technological innovation, and system accessibility. The market is highly competitive, including major banks, fintech firms, and technology providers focused on delivering secure, user-friendly solutions. Currently, there is significant consolidation among key players, but smaller fintech companies and emerging firms are gaining traction by focusing on niche solutions and advanced payment methodologies. Some key suppliers in the African banking self-service and payment solutions market include- NCR Corporation

- Mastercard

- Visa

- PayPal

- Flutter wave

- MFS Africa

- Interswitch

- YAP

- Chipper Cash

- Paga

Key Developments Procurement Category Significant Development:

Key Developments Procurement Category Significant Development:

Banking Self-service Channel & Payment Solutions Africa Attribute/Metric |

Details |

Market Sizing |

The Bank card market is expected to reach USD 60.7 billion by 2032, growing at a compound annual growth rate (CAGR) of around 10.6% from 2024 to 2032. |

Banking Self-service Channel & Payment Solutions Africa Technology Adoption Rate |

Around 60% of African banks and fintech firms are integrating advanced technologies to enhance self-service options and payment efficiency. |

Top Banking Self-service Channel & Payment Solutions Africa Strategies for 2024 |

Focus on expanding mobile payment solutions, improving security through digital banking. |

Banking Self-service Channel & Payment Solutions Africa Process Automation |

50% of financial institutions have automated self-service kiosks, mobile payments, and transaction. |

Banking Self-service Channel & Payment Solutions Africa Process Challenges |

Major challenges include infrastructure limitations, security concerns, and regulatory compliance in different African regions. |

Key Suppliers |

Leading providers include Interswitch, Flutter wave, pay stack, MFS Africa, and Mastercard, offering comprehensive payment solutions. |

Key Regions Covered |

Key markets include Nigeria, Kenya, South Africa, Egypt, and Ghana, increasing mobile payments usage. |

Market Drivers and Trends |

Growth driven by mobile phone penetration, digital banking adoption, financial inclusion efforts, and government initiatives to support cashless economies. |