Benzene Market Overview

The global benzene market is witnessing steady growth, driven by robust demand in key sectors such as automotive, chemicals, and construction. This market is influenced by technological advancements in production processes, increasing consumption of benzene-derived products like styrene and aniline, and expanding infrastructure development projects in emerging economies. With strategic investments in chemical production capacities and a rising focus on sustainability, the benzene market is poised to continue its growth trajectory through 2034. Additionally, we address future procurement challenges and emphasize the importance of digital procurement tools in accurately forecasting market needs to keep clients ahead in this dynamic landscape. Strategic sourcing and procurement management play a crucial role in streamlining the procurement process for Benzene development. As competition intensifies, companies are leveraging market intelligence solutions and procure analytics to optimize their supply chain management systems.

The global benzene market is expected to exhibit a strong growth rate through 2034, with key projections:

- Market Size: The market is projected to reach approximately USD 110 billion by 2034, growing at a compound annual growth rate (CAGR) of around 5.5% from 2024 to 2034.

- Sector Contributions:

- Automotive Industry: The revival of the automotive sector, particularly in North America, is driving demand for benzene-based products such as styrene used in plastics, synthetic rubber, and tires.

- Chemical Industry: The production of chemicals, especially in countries like Germany and India, is pushing the need for benzene derivatives used in a wide range of products from pharmaceuticals to construction materials.

- Technological Transformation and Innovations: Advances in chemical engineering and catalytic technologies are enhancing the efficiency and sustainability of benzene production processes. Innovations such as the integration of bio-based feedstocks and advanced refining techniques are addressing environmental concerns and optimizing production yields. In addition, supplier performance management and vendor performance assessment are becoming critical for companies in this competitive landscape, ensuring the consistent supply of high-quality benzene while mitigating risks in the supply chain.

- Funding Initiatives: Government investments, particularly in infrastructure and environmental initiatives, are fostering the demand for benzene-derived products like epoxy and phenolic resins.

- Regional Insights: North America and Europe are major markets for benzene, but Asia-Pacific, particularly China and India, is witnessing significant growth, driven by infrastructure projects and a rising focus on industrial innovation.

Key Trends and Sustainability Outlook

- Bio-based Benzene: Growing environmental awareness and stricter regulations in developed countries are promoting the adoption of bio-based benzene. This segment is forecasted to grow at a CAGR of 6.2% through 2034.

- Collaborative R&D: Increased investment in R&D collaborations, particularly in the chemical and automotive industries, is driving the consumption of benzene derivatives.

Growth Drivers

- Government Policies: Initiatives and funding programs are accelerating research and industrial development.

- Digital Transformation: Advancements in chemical production and distribution are streamlining the supply chain and improving product accessibility.

- Infrastructure Development: Significant construction and infrastructure projects, especially in India, are fueling demand for resins and other benzene derivatives.

Overview of Market Intelligence Services for the Benzene Market

The benzene market is witnessing increasing costs due to raw material price fluctuations and growing demand for digital solutions in chemical production. Market reports offer detailed forecasts to help stakeholders navigate these financial dynamics, highlighting cost-saving strategies and procurement opportunities to optimize resource management. By leveraging these insights, companies can stay competitive and manage market challenges effectively

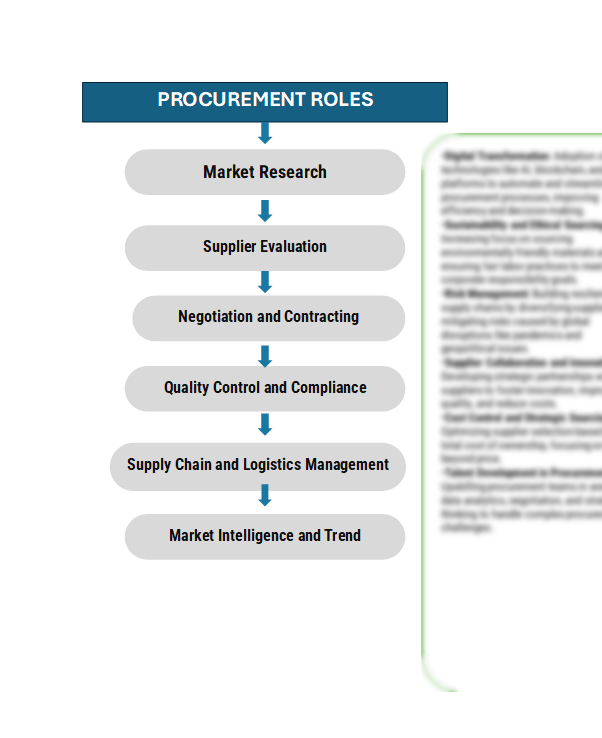

Procurement Intelligence for Benzene market: Category Management and Strategic Sourcing

"To stay ahead in the benzene market, companies are optimizing procurement strategies, leveraging spend analysis solutions for vendor spend analysis, and enhancing supply chain efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming vital in achieving cost-effective procurement and ensuring timely availability of high-quality benzene for downstream applications in industries such as chemicals, plastics, and pharmaceuticals."

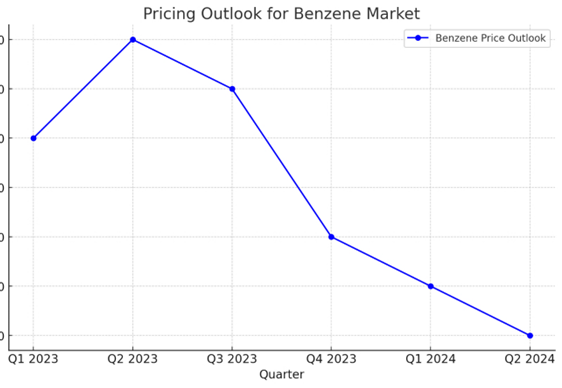

Pricing Outlook for Benzene Market: spend analysis

The benzene market is navigating a complex pricing environment, influenced by a combination of global supply chain dynamics, crude oil production adjustments, and regional demand fluctuations. Recent trends indicate a generally bearish outlook for Q4 2023, primarily driven by weak demand in key downstream sectors like styrene and cumene, coupled with an oversupply in regions like Europe and Asia-Pacific.

Here is a line chart that illustrates the pricing outlook for the Benzene market over the past quarters and into the future. As seen in the chart, the prices are on a slight decline, reflecting the bearish market conditions in Q4 2023 and the expected trend into Q1 2024

Here is a line chart that illustrates the pricing outlook for the Benzene market over the past quarters and into the future. As seen in the chart, the prices are on a slight decline, reflecting the bearish market conditions in Q4 2023 and the expected trend into Q1 2024

Comprehensive Price Forecast

The global benzene market is expected to face continued pricing pressure in the short-term, as supply-demand imbalances persist across major regions. In North America, for instance, reduced petrochemical activity and lower import volumes from major U.S. ports have contributed to a decline in benzene prices. Similarly, in Europe, sluggish consumer goods production has pressured prices downward despite moderate supply levels

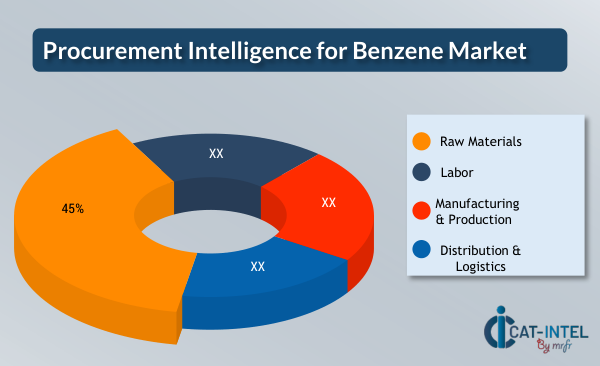

Cost Breakdown for the Benzene market: Cost saving opportunities

- Raw Materials (45%)

- Description: The primary raw material for benzene production is naphtha, which is derived from crude oil. The price of naphtha significantly impacts the overall cost structure of benzene.

- Trends: The global supply chain for naphtha is currently facing disruptions, especially due to geopolitical issues like the Red Sea crisis, affecting benzene exports. Additionally, rising container shipping costs have strained supply routes, pushing up overall costs

- Labor (XX%)

- Description: XX

- Trends: XX

- Manufacturing & Production (XX%)

- Description: XX

- Trends: XX

- Distribution & Logistics (XX%)

- Description: XX

- Trends: XX

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the benzene market, procurement optimization can lead to significant cost savings. Strategies like supply chain consolidation, energy efficiency improvements, and logistics optimization are essential. By leveraging digital tools for better forecasting and maintaining strategic raw material sourcing, companies can reduce costs and improve operational efficiency. Additionally, scheduled maintenance helps minimize production disruptions. These measures, when combined, enable manufacturers to navigate market fluctuations, enhance profitability, and improve overall process efficiency

Supply and Demand Overview of the Benzene Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)"

The benzene market is experiencing strong demand driven by its use in a wide range of industries, including automotive, chemicals, and electronics. Key drivers such as global industrialization, the rise in consumer goods production, and increasing demand for petrochemicals are all contributing to the growth.

Demand Factors:

- Industrial Growth: The expanding demand for chemicals and plastics in automotive and consumer goods sectors propels benzene consumption, especially in regions like Asia-Pacific.

- Demand for Petrochemicals: Benzene is a core component in the production of styrene, phenol, and other chemicals, driving demand as petrochemical industries grow.

- Shift Towards Clean Energy: While the shift to clean energy may reduce reliance on some fossil fuels, the demand for chemicals derived from petrochemicals, including benzene, remains high.

- Technological Advancements: Innovations in the manufacturing of products such as electronics and plastics create new avenues for benzene demand.

Supply Factors:

- Crude Oil Availability: The supply of benzene is closely linked to crude oil production, as it is primarily produced from naphtha, which is derived from crude oil.

- Refining Capacity: Increased refining capacity and technological innovations in refinery processes help enhance the supply of benzene.

- Geopolitical Tensions: Political instability in key oil-producing regions can disrupt benzene production, impacting the global supply chain.

- Production Flexibility: Many refineries are adapting their processes to allow for the flexible production of multiple chemicals, including benzene, in response to market demands.

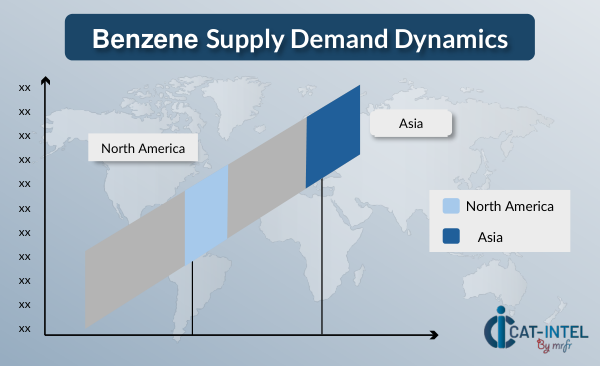

Regional Demand-Supply Outlook: Benzene Market

Asia-Pacific: Dominance in the Benzene Market Asia-Pacific, especially China and India, dominates the global benzene market, driven by:

- High Industrial Output: China and India are major manufacturing hubs, fueling high benzene consumption for various applications, especially in the automotive and electronics industries.

- Robust Petrochemical Industry: Both countries have heavily invested in expanding their petrochemical industries, increasing demand for benzene.

- Strategic Supply Chains: Key players in the region are focusing on strengthening supply chains to meet the growing domestic and international demand.

- Competitive Pricing: Competitive pricing strategies and investments in refining capacity in the region are enhancing the supply of benzene at cost-effective prices.

- Global Trade Influence: Asia-Pacific’s strong industrial base and export capacity make it a crucial player in shaping global benzene market trends.

ASIA remains a key hub Benzene innovation and growth

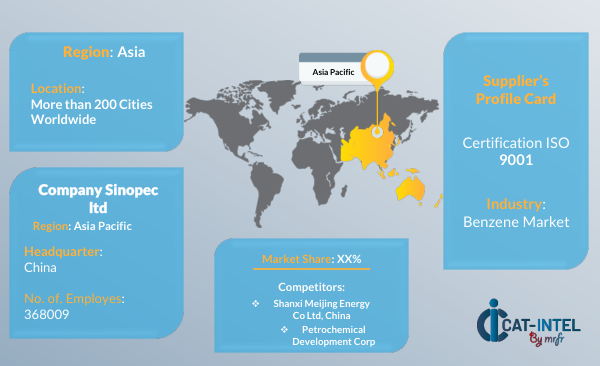

Supplier Landscape: Supplier Negotiations and Strategies

The supplier penetration in the benzene market is substantial, with a growing number of global and regional players contributing to the production and distribution of benzene. These suppliers play a crucial role in the overall market dynamics, impacting pricing, innovation, and accessibility. The market is highly competitive, with suppliers ranging from large-scale petrochemical corporations to specialized chemical manufacturers focusing on efficient production and supply chain management.

Currently, the supplier landscape is characterized by significant consolidation among top-tier petrochemical companies, which dominate the market share. However, emerging suppliers and regional players are also expanding their footprint by focusing on cost-efficient production methods and catering to local demand.

Some of the key suppliers in the benzene market include:

- ExxonMobil Corporation

- SABIC (Saudi Basic Industries Corporation)

- Shell Chemicals

- BASF SE

- Chevron Phillips Chemical Company

- Sinopec ltd

- Dow Inc.

- China National Petroleum Corporation (CNPC)

- LyondellBasell Industries N.V.

- Reliance Industries Limited

Key Development: procurement category significant development

|

Development/Trend |

Description |

Emerging Capabilities/Impact |

|

Increased Demand for Benzene |

Rising demand from industries such as automotive, electronics, and textiles. |

Boost in production capacity by major refiners. Enhanced demand for high-purity benzene. |

|

Technological Advancements |

New technologies in refining and petrochemical production processes. |

More efficient benzene extraction, lower production costs, and improved environmental impact. |

|

Sustainability Focus |

Shift towards cleaner production methods and reducing carbon footprints. |

Adoption of green technologies, such as carbon capture and cleaner catalytic processes. |

|

Growth in Asian Markets |

Increased consumption of benzene in emerging Asian markets, particularly China and India. |

Expansion of refining capabilities and new petrochemical plants in Asia. |

|

Procurement Attribute/Metric |

Details |

|

Market Sizing |

The global benzene market is projected to grow from USD 59.3 billion in 2024 to USD 110 billion by 2032, with a CAGR of 5.5% (2024-2032). |

|

Benzene Production and Consumption Rate |

50% of global benzene production is consumed in the production of styrene, followed by its use in synthetic rubber and other chemicals. |

|

Top Benzene Market Strategies for 2024 |

Focus on improving production efficiencies, expanding into emerging markets, enhancing supply chain resilience, and increasing sustainability initiatives. |

|

Benzene Production Technology |

40% of benzene production is from catalytic reforming, while around 35% comes from steam cracking of hydrocarbons. |

|

Benzene Market Challenges |

Key challenges include fluctuating crude oil prices, environmental regulations, and managing supply chain disruptions. |

|

Key Suppliers |

Leading suppliers include ExxonMobil, Royal Dutch Shell, Sinopec, BASF, and Reliance Industries. These companies dominate the global benzene supply chain. |

|

Key Regions Covered |

North America, Europe, Asia-Pacific, and Rest of the World. Major focus on the U.S., China, India, and Japan due to high benzene demand in these regions. |

|

Market Drivers and Trends |

Growth driven by demand in the petrochemical industry, increasing demand for styrene, and a shift toward cleaner production technologies. Emerging trends include bio-based benzene and sustainability in the production process. |

Frequently Asked Questions (FAQ):

Our procurement intelligence services offer a comprehensive analysis of the global supplier landscape, identifying key suppliers in the benzene market. We provide spend analysis, supplier performance evaluations, and market intelligence to help you source benzene efficiently and cost-effectively.

We assist in evaluating the Total Cost of Ownership (TCO) for sourcing benzene by factoring in procurement costs, logistics, storage, and lifecycle management expenses. Our cost analysis services help ensure you understand the long-term financial impact of benzene procurement.

We offer a detailed risk management framework that highlights potential supply chain disruptions, regulatory challenges, and supplier reliability. Our solutions help mitigate risks associated with sourcing and ensure a reliable supply of benzene.

Our Supplier Relationship Management (SRM) services guide you in establishing strong partnerships with benzene suppliers. We focus on improving collaboration, negotiating favorable terms, and ensuring consistent product quality while maintaining cost efficiency.

We provide a thorough breakdown of procurement best practices for the benzene market, including sourcing models, supplier categorization, pricing strategies, and contract management that ensure informed, strategic procurement decisions.

Digital transformation is crucial for streamlining benzene procurement processes. We offer solutions that incorporate automation and data analytics, enabling you to track supplier performance, monitor market trends, and optimize procurement strategies in real-time.

Our supplier performance management solutions help you assess and monitor benzene suppliers, ensuring they meet quality, delivery, and compliance standards. This enables better decision-making and supplier retention, reducing procurement risks.

We provide insights into negotiation strategies, offering support in supplier negotiations to secure favorable pricing, volume discounts, and flexible payment terms. Our data-driven approach ensures your negotiations are backed by market intelligence.

We offer advanced market analysis tools that provide insights into global trends, supplier market share, and price forecasts. This data helps in understanding market conditions, identifying opportunities, and making more informed purchasing decisions.

Our procurement solutions include guidance on regulatory compliance in the benzene market. We help you navigate complex procurement processes, ensuring that all suppliers adhere to regulatory standards and meet safety requirements.

We offer strategies to mitigate supply chain disruptions by identifying backup suppliers, establishing contingency plans, and monitoring supply market outlooks. Our insights into the supplier landscape help you ensure a stable and continuous benzene supply.

Through our supplier performance tracking tools, we help you monitor supplier quality, delivery timelines, and compliance. Regular supplier evaluations and performance reports provide transparency and help you optimize future procurement decisions.

We assist in identifying suppliers who implement sustainable practices in benzene production and distribution. Our services include sustainability assessments, ensuring that the suppliers you choose meet your environmental and ethical standards.

Our pricing analysis services allow you to compare benzene costs across different suppliers, ensuring you achieve competitive pricing. We analyze pricing trends, negotiation levers, and market dynamics to secure the best value for your organization.

We provide an in-depth analysis of market opportunities and risks, highlighting emerging trends in benzene production, trade, and applications. Our insights help you stay ahead of the competition by identifying strategic procurement opportunities in the benzene market.