Butter Market Overview

The global butter market is projected to experience steady growth, with an estimated market size of approximately USD 65.67 billion by 2032, growing at a compound annual growth rate (CAGR) of 3.20% from 2024 to 2032. This growth is primarily driven by the rising demand for organic butter, health-conscious consumers opting for butter over margarine, and the increasing use of butter in food processing and culinary sectors.

Growth Rate: 3.20%

The market is witnessing innovations, including new product formulations catering to health-conscious consumers. As demand grows, there is a heightened focus on optimizing supply chain processes to manage production costs, maintain consistent quality, and ensure sustainability in butter manufacturing. Strategic sourcing and procurement management are crucial for stakeholders to navigate the fluctuating butter prices and enhance operational efficiencies.

Growth Drivers:

- Health Benefits: A growing trend toward natural fats and the increasing popularity of organic butter are driving market growth.

- Global Population Growth: As populations increase globally, so does the demand for dairy-based products like butter.

- E-commerce Growth: The rise in online grocery shopping is broadening butter product accessibility, enhancing consumer purchasing ease.

- Sustainability Initiatives: There is a significant rise in demand for sustainably produced butter, especially organic butter, in response to environmental concerns and changing consumer preferences.

Technological Transformation and Innovations:

- Technological Advancements in Dairy Production: Automation and innovations in dairy farming processes are improving butter yield and quality.

- Digital Procurement Tools: Digital tools are being employed to streamline procurement activities, predict market trends, and help stakeholders mitigate procurement challenges.

Key Trends and Sustainability Outlook:

- Sustainability Practices: More butter manufacturers are implementing environmentally friendly practices, such as reducing water consumption and minimizing greenhouse gas emissions in production.

- Organic Butter: Consumer demand for organic butter is expected to remain strong, driving suppliers to innovate and meet health-conscious demands.

- Supply Chain Management: Optimizing butter supply chains to ensure timely delivery and cost-efficiency is increasingly important for businesses to remain competitive in the market.

Regional Insights:

- North America & Europe: Both regions continue to dominate the butter market due to high per capita consumption and strong consumer demand.

- Asia-Pacific: The region is showing significant growth potential due to increasing urbanization and a rising preference for dairy-based products.

Overview of Market Intelligence Services for the Butter Market:

Market reports on the butter industry are helping procurement teams navigate challenges such as price fluctuations and supply chain disruptions. By leveraging these insights, stakeholders can enhance strategic sourcing, ensure cost-effective procurement, and secure high-quality products. These reports focus on market trends, pricing strategies, and innovative farming techniques that can help mitigate risks and optimize procurement processes in the butter market.

Procurement Intelligence for Almond Market: Category Management and Strategic Sourcing

In the butter market, companies are refining procurement strategies through spend analysis and strategic sourcing to ensure cost-effectiveness and high-quality supply. Leveraging market intelligence and category management helps businesses navigate price fluctuations, ensure timely availability, and foster sustainable sourcing practices. This approach is vital to addressing growing consumer demand for organic and specialty butters, enhancing supply chain resilience, and optimizing vendor relationships. With these practices, companies can maintain a competitive edge and secure reliable butter supplies.

Cost Breakdown for the Butter Market : Cost saving opportunities

- Raw Butter (60%)

- Description: This segment includes the base cost of butter production, focusing on the cost of milk and cream, which are the primary raw materials. Major production hubs include North America, Europe, and parts of Asia.

- Trends: Butter prices have been fluctuating due to changes in milk production costs, feed prices, and climatic conditions. In 2024, prices are expected to rise because of increased demand in sectors like bakery products and processed foods. Reduced milk production, driven by adverse weather patterns, will also contribute to rising prices. The overall price trend indicates continued increases in the coming years due to higher dairy input costs.

- Labor (XX%)

- Processing & Packaging (XX%)

- Infrastructure & Overheads (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the butter market, procurement optimization can drive significant cost savings. Strategies such as bulk purchasing agreements with dairy farmers and vertical integration help reduce raw material costs. Sustainable dairy practices and automation in production facilities can lower input and labour costs. Additionally, energy-efficient processing and optimized logistics reduce utility and transportation expenses. Collaborative marketing efforts further lower promotional costs, enhancing profitability while maintaining competitive pricing.

Supply and Demand Overview of the Butter Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)"

Demand Factors:

- Health Trends: Butter is seeing renewed demand in markets focused on higher-fat, low-carb diets like keto and paleo. Consumer preferences for whole, natural foods are driving butter's resurgence, especially in North America and Europe.

- Rising Global Population: A growing global population increases the need for dairy products, including butter, to meet dietary needs in both developing and developed countries.

- Diverse Applications: Butter's use in baking, cooking, and as a key ingredient in many processed foods helps maintain strong demand. Its growing popularity in premium, organic, and artisanal food products also contributes to this trend.

- Plant-Based Alternatives: While dairy alternatives (like vegan butter) are on the rise, traditional butter still holds significant market share due to its preferred flavour and texture in cooking and baking, driving consistent demand in niche markets.

Supply Factors:

- Milk Production: The global supply of butter is directly tied to the availability of milk and cream. Dairy farming in major producing regions like the U.S., Europe, and Oceania determines butter supply levels, and weather conditions can impact milk production, affecting supply.

- Technological Advancements: Advances in dairy farming technology, including better feed practices, improved breeding, and efficient processing techniques, have helped stabilize and improve butter supply, meeting global demand.

- Sustainability Practices: Increased adoption of sustainable dairy farming practices is essential for maintaining a stable supply. However, concerns regarding the environmental impact of dairy production, particularly related to emissions and water use, are driving some producers to explore more sustainable alternatives.

- Market Competition: As demand for butter increases, producers face greater competition, particularly in price-sensitive markets. This leads to fluctuations in pricing and availability, especially during periods of supply shortages or high demand.

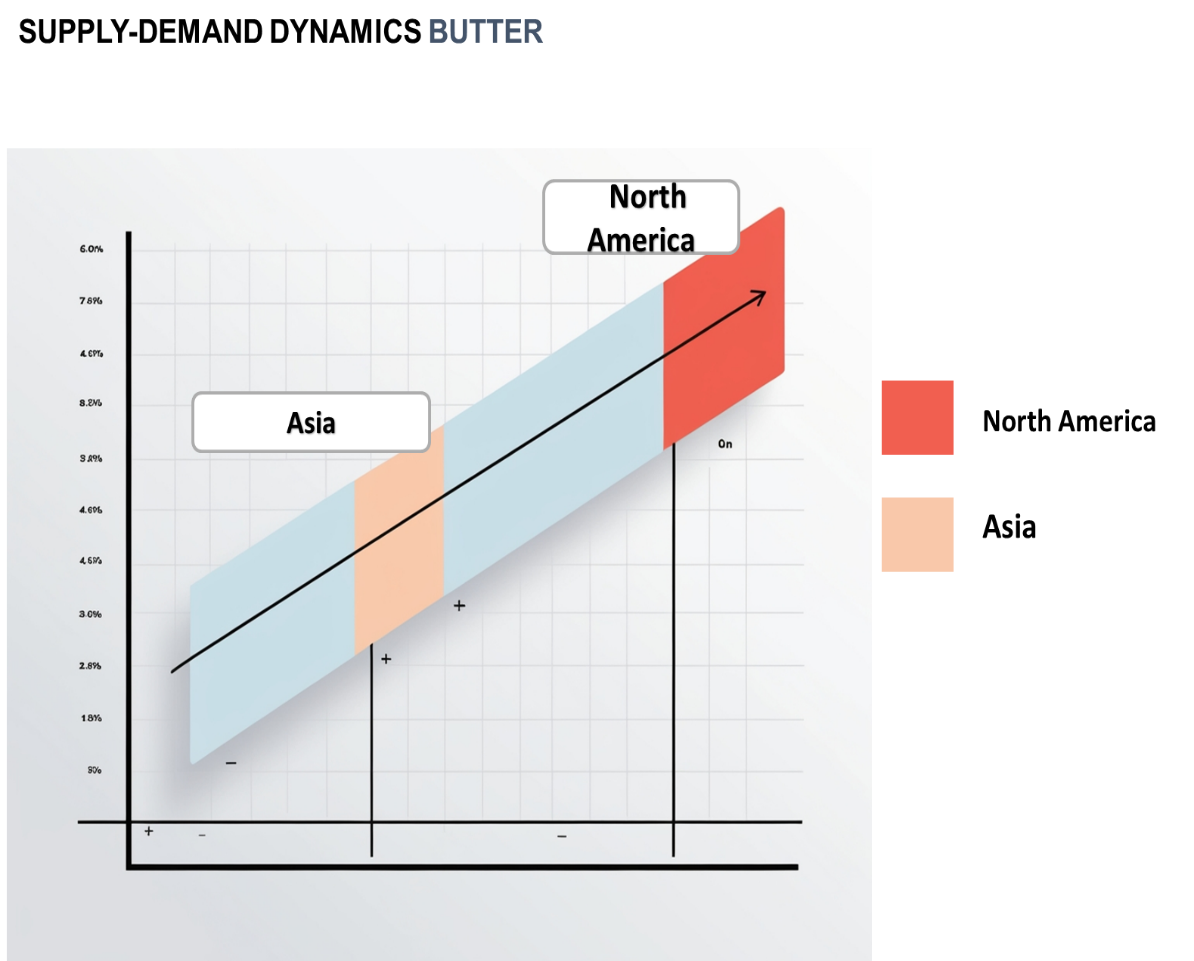

Regional Demand-Supply Outlook: Butter Market

The global butter market is shaped by distinct regional dynamics, with North America and Europe playing major roles in both production and consumption.

The image shows growing demand for Butter market in both North America and Asia, with potential price increases and increased competition

North America: A Key Player in the Butter Market

North America, especially the U.S. and Canada, is a leading producer and consumer of butter, with key characteristics driving its market:

- Leading Producers: The U.S. is a major butter producer, with substantial production coming from states like Wisconsin and California, which are central to North American dairy farming.

- Strong Export Market: North America is a key supplier of butter, exporting to markets like Mexico, Asia, and the Middle East. The demand for premium butter, particularly in bakery goods and processed foods, drives exports.

- Innovation in Product Offerings: North American producers are increasingly diversifying butter offerings, such as organic butter, grass-fed varieties, and plant-based alternatives, to cater to shifting consumer preferences.

- Focus on Sustainability: The push toward sustainable dairy farming practices in North America focuses on reducing environmental impact, especially regarding emissions and water usage, ensuring continued market viability.

- Consumer Trends: Health-conscious consumers in North America are turning back to butter as a source of healthy fats, particularly in keto and paleo diets. This shift drives continued growth in butter demand, especially for premium and organic varieties.

North America remains a key hub Butter market and its growth

Supplier Landscape: Supplier Negotiations and Strategies for the Butter Market

The butter market, like the almond industry, has a robust and diverse supplier landscape. This includes both global and regional suppliers providing critical materials and services necessary for dairy farming, processing, and distribution. Key suppliers in the butter market include those involved in supplying raw materials for milk production, including feed, equipment, and packaging materials, as well as those supplying ingredients for butter manufacturing.

Supplier relationships are crucial for ensuring the efficiency of production, product quality, and the sustainability of dairy farms. These relationships support butter producers in optimizing milk production, improving processing methods, and addressing environmental concerns. Additionally, packaging suppliers play an essential role in meeting the growing demand for premium butter products, particularly those focusing on organic and artisanal varieties.

Some of the key raw material suppliers in the butter market include:

- Land O'Lakes, Inc

- Fonterra

- BASF Agricultural Solutions

- Cargill

- Tetra Pak

- DeLaval

- Chr. Hansen

- Arla Foods

- Sealed Air Corporation

- John Deere

Key Development: Procurement Category significant development

|

Procurement Category |

Significant Development |

Impact/Trend |

|

|

Raw Materials (Milk & Cream) |

Sustainability in Dairy Farming |

Rising emphasis on sustainable farming practices to reduce carbon footprint and water usage, including grass-fed dairy and organic farming. |

|

|

Processing & Manufacturing |

Technological Advancements in Butter Production |

Automation and advanced dairy processing technology to improve yield, efficiency, and consistency. Increased focus on energy-efficient production. |

|

|

Packaging Materials |

Sustainable Packaging Solutions |

Growing demand for eco-friendly packaging, including biodegradable and recyclable materials to reduce environmental impact. |

|

|

Supply Chain & Logistics |

Supply Chain Transparency and Traceability |

Increased demand for traceability in the dairy supply chain to ensure quality and origin, especially for organic and premium butter. |

|

|

Product Innovation |

Rise of Plant-Based Butter Alternatives |

Expanding plant-based butter alternatives due to consumer demand for vegan and dairy-free products, impacting procurement of ingredients. |

|

|

Pricing & Cost Control |

Fluctuations in Feed Costs |

Rising global feed prices affecting milk production costs, which in turn impacts butter pricing. |

|

|

Supplier Relationships |

Collaborative Procurement for Bulk Purchasing |

Stronger partnerships with dairy farms and suppliers for bulk purchases, leading to cost savings and improved supply stability. |

|

|

Procurement Attribute/Metric |

Details |

|

Market Sizing |

The global butter market is projected to grow from USD 35.56 billion in 2023 to USD 65.67 billion by 2032, with a CAGR of 3.2% during the forecast period. |

|

Adoption of Butter-Based Products |

Increasing consumer demand for premium butters, including grass-fed, organic, and flavoured butters, alongside a growing interest in plant-based butter alternatives. |

|

Top Strategies for 2024 |

Focus on sustainable farming practices, production of high-quality organic butter, and innovation in plant-based butter alternatives. |

|

Automation in Butter Processing |

Over 30% of butter processing facilities are implementing automation for churning, packaging, and quality control, optimizing efficiency and reducing labor costs. |

|

Procurement Challenges |

Major challenges include volatility in milk prices, fluctuations in dairy feed costs, and managing supply chain disruptions due to environmental factors. |

|

Key Suppliers |

Key suppliers include Fonterra, Arla Foods, Land O'Lakes, and Kerry Group, focusing on high-quality dairy butter and plant-based alternatives. |

|

Key Regions Covered |

Major markets include North America, Europe, and Asia-Pacific, with high demand in the U.S., Europe, and India for both traditional and plant-based butters. |

|

Market Drivers and Trends |

Driven by health trends supporting grass-fed and organic dairy, the rising popularity of plant-based products, and increasing demand for premium, specialty butters. |

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide comprehensive insights into the global butter supplier landscape. We assist with spend analysis, supplier evaluations, market intelligence, and cost-effective sourcing strategies, ensuring you access the best suppliers and competitive pricing.

We support TCO analysis for butter procurement by factoring in procurement costs, transportation, storage, processing expenses, and any additional costs related to fluctuating milk prices. This helps ensure a clear understanding of the long-term financial impact of butter sourcing.

Our risk management framework focuses on potential disruptions in the dairy supply chain, milk price volatility, climate-related risks, and regulatory changes. We offer strategies to mitigate risks and ensure consistent butter supply.

Our Supplier Relationship Management (SRM) services help you build strong partnerships with butter suppliers. We guide you in improving collaboration, securing favorable terms, and ensuring consistent quality while optimizing cost-efficiency.

We provide guidance on procurement best practices specific to the butter market, including supplier categorization, contract management, strategic sourcing, and price negotiations to ensure well-informed and effective procurement decisions.

Digital transformation streamlines butter procurement through automation, data analytics, and supplier performance monitoring. We offer real-time tracking and market insights to optimize procurement strategies, improve efficiency, and reduce risks.

Our supplier performance management services help track butter suppliers, ensuring they meet quality, delivery, and compliance standards. We provide performance evaluations to optimize procurement decisions and strengthen supplier relationships.

We support negotiation strategies backed by market intelligence. Our insights help you secure favorable pricing, volume discounts, and flexible terms, ensuring you achieve the best deal with butter suppliers.

We offer advanced market analysis tools that provide insights into butter price forecasts, supplier share, and global trends. This data helps identify market opportunities, make informed purchasing decisions, and monitor market conditions.

Our procurement services guide you in ensuring that butter suppliers adhere to local and international food safety, quality, and environmental regulations. We help navigate complex compliance requirements in the dairy industry.

We offer strategies to mitigate supply chain disruptions, including identifying alternative suppliers, creating contingency plans, and monitoring milk production trends to maintain a stable butter supply.

Our supplier performance tracking tools enable you to monitor butter supplier quality, delivery timelines, and compliance. Continuous evaluations and reports provide transparency, helping optimize future procurement decisions.

We help identify butter suppliers that implement sustainable farming practices, such as reducing carbon footprints and supporting ethical sourcing. Our sustainability assessments ensure that your suppliers meet environmental and social responsibility standards.

Our pricing analysis services compare butter costs across suppliers and regions, ensuring competitive pricing. We analyse market trends and leverage pricing data to negotiate the best deals and optimize cost-efficiency.

We provide a comprehensive analysis of market opportunities and risks in the butter industry. Our insights focus on emerging trends, milk production forecasts, price volatility, and evolving consumer demand for organic and plant-based butter alternatives.