Summary Overview

Cheque Processing Services Market Overview

The global cheque processing services market is witnessing significant advancements, driven by the adoption of digital banking, the increasing demand for faster and secure transactions, and the growth of remote cheque deposit solutions. This market is projected to grow steadily through 2032, with a compounded annual growth rate (CAGR) of approximately 6.1% from 2024 to 2032. As financial institutions strive to meet customer expectations for convenience and efficiency, cheque processing services are evolving with technological innovations and digital solutions. These services are becoming a core part of the digital transformation within banking, contributing to streamlining operations and reducing transaction time.

Market Size and Projections: The cheque processing services market is expected to reach USD 17.5 billion by 2032, growing at a CAGR of about 6.1% from 2024 to 2032. This growth is attributed to the widespread use of automation and digital tools that enhance transaction efficiency.

Growth rate: 6.1%

Sector Contributions:

-

Banking and Financial Services: The demand for faster, secure, and cost-efficient cheque processing services is primarily driven by the financial sector, which is adopting advanced cheque scanning and automation tools. -

Retail and E-commerce: As retail and e-commerce companies expand, the need for quick, secure cheque payments continues to rise, further driving demand for cheque processing services.

Regional Insights:

-

North America: The U.S. is a leading market for cheque processing services, owing to its well-established banking infrastructure and the widespread use of digital banking and cheque imaging technologies. -

Asia-Pacific: Rapid digital banking growth and increasing adoption of cheque processing solutions in emerging economies like India and China are set to drive market expansion in this region.

Growth Drivers:

-

Technological Advancements: The development of high-speed cheque scanners, automation in cheque processing, and digital cheque solutions are transforming the way financial institutions manage cheque transactions. -

Digital Banking and Mobile Payment Systems: The rapid expansion of online banking and mobile payment solutions is driving demand for efficient cheque processing services. -

Remote Deposit Capture (RDC): Increasing adoption of RDC services by businesses and individuals for cheque deposit is expected to significantly impact the market growth.

Key Trends:

-

Automation and AI Integration: The integration of artificial intelligence and machine learning algorithms in cheque processing services is expected to further enhance accuracy, speed, and security. -

Cloud-Based Solutions: Financial institutions are increasingly adopting cloud-based cheque processing services for better scalability, reduced operational costs, and enhanced data security. -

Cybersecurity Measures: As digital cheque processing grows, financial institutions are investing heavily in cybersecurity to protect against fraud and cyber threats.

Sustainability Outlook:

While digital transformation in cheque processing services is improving efficiency, sustainability efforts are also focusing on reducing the carbon footprint associated with physical cheque handling and processing. Increased reliance on electronic transactions is reducing paper waste and streamlining the entire cheque processing lifecycle.

Overview of Market Intelligence Services for Cheque Processing Services Market:

Recent reports highlight fluctuations in processing costs due to changes in regulatory standards and technology costs. To effectively manage these fluctuations, financial institutions are leveraging market intelligence services to optimize their purchasing decisions. By utilizing procurement analytics, businesses can enhance their risk management strategies, improve supplier relationships, and ensure a steady supply of innovative solutions.

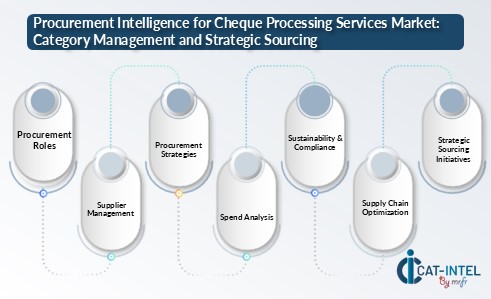

Procurement Intelligence for Cheque Processing Services Market: Category Management and Strategic Sourcing

"In the cheque processing services market, companies are refining their procurement strategies to ensure cost-effective procurement while enhancing the efficiency of their transaction systems. Strategic sourcing and category management have become increasingly important, especially as financial institutions adopt digital solutions for cheque processing. With the integration of AI-driven tools and automation technologies, procurement professionals are utilizing spend analysis solutions to gain insights into vendor performance, optimize supplier relationships, and reduce operational costs. By leveraging supply market intelligence, companies can ensure the timely availability of cutting-edge cheque processing technologies and secure high-quality services from vendors, fostering innovation in the rapidly evolving financial services sector."

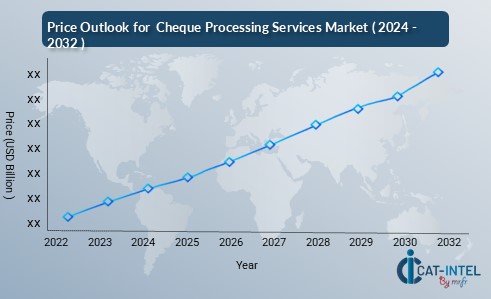

Pricing Outlook for Cheque Processing Services Market: Spend Analysis

The cheque processing services market is currently navigating a dynamic pricing landscape, driven by factors such as technological advancements, regulatory compliance costs, and evolving consumer expectations. This pricing volatility reflects the growing demand for more efficient, secure, and digital solutions, alongside the need to invest in infrastructure and cybersecurity.

line chart illustrating the projected pricing outlook for the Cheque Processing Services market from 2024 to 2032.

Key Pricing Factors:

-

Technological Upgrades: The ongoing integration of advanced technologies such as artificial intelligence, machine learning, and high-speed cheque scanning systems is increasing the initial costs for cheque processing services. These advancements are essential to improving efficiency and security, but they come with higher upfront investments. -

Regulatory Compliance Costs: Financial institutions face rising costs related to adhering to updated regulations for cheque processing, particularly regarding fraud prevention and anti-money laundering measures. This drives up operational costs for service providers, which can lead to price adjustments. -

Cybersecurity Investments: As cheque processing services are increasingly digitized, significant investments in cybersecurity measures are required to protect sensitive financial data. These investments are a key driver of price increases, as service providers must ensure the highest levels of security. -

Demand for Faster Processing: As customer expectations for speed and convenience grow, financial institutions and businesses are seeking faster cheque processing systems, which often involve higher costs due to the use of cutting-edge technology and automation.

Projected Pricing Trends (2024 to 2032): Our analysis suggests a steady upward trajectory in pricing for cheque processing services, reflecting the increasing costs associated with technology adoption, regulatory requirements, and cybersecurity. The market will experience moderate price growth, driven by these factors:

-

Rising Operational Costs: With technological upgrades and compliance pressures, pricing for cheque processing services is projected to increase by approximately 4.5% annually through 2032. -

Competitive Pressures: As new players enter the market and existing ones adopt innovative solutions, competitive pricing pressures will keep price fluctuations within a manageable range, with some volatility influenced by regional and economic factors.

Cost Breakdown for the Cheque Processing Services Market: Cost-Saving Opportunities

- Technology & Infrastructure (50%)

-

Description: This category includes the costs related to the purchase, implementation, and maintenance of advanced cheque processing technology, such as image-based processing systems, automation tools, and secure payment platforms. -

Trends: The rise of digital transformation and the growing adoption of AI and machine learning technologies in cheque processing are driving up initial costs. However, these technologies are expected to reduce long-term costs by improving efficiency, reducing manual labour, and decreasing the chances of fraud. Automation and system integration are also critical in managing the high volume of cheque transactions. As of 2024, ongoing investments in infrastructure are essential to accommodate these technological shifts.

- Labor (XX%)

- Regulatory Compliance & Security (XX%)

- Overheads & Miscellaneous (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies for the Cheque Processing Services Market

In the cheque processing services market, cost savings can be achieved through strategic negotiation. Companies can secure discounts by partnering with technology providers for automation and AI-based systems, reducing labour and error costs. Shifting to cloud-based solutions lowers infrastructure expenses, while outsourcing certain functions and sharing services with other firms cuts operational costs. Negotiating cost-effective compliance and risk management solutions, as well as optimizing courier services for physical cheque transportation, further drives savings and improves efficiency. These strategies help streamline procurement and enhance profitability in a competitive market.

Supply and Demand Overview of the Cheque Processing Services Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The cheque processing services market is experiencing notable growth driven by the shift towards digitalization, increasing demand for secure and efficient financial transactions, and the ongoing need for automated cheque processing solutions. The demand for cheque processing services is supported by the rising adoption of electronic payments, banking automation, and the global push for improved operational efficiency in financial institutions.

Demand Factors:

-

Digital Transformation: The growing adoption of digital payment systems, such as mobile banking and e-payments, increases demand for integrated cheque processing services that enable secure and quick transaction handling. -

Security Concerns: Rising concerns about fraud prevention and security in financial transactions boost the demand for advanced cheque processing services with built-in fraud detection and risk management features. -

Regulatory Compliance: Increasing regulatory requirements for transaction reporting and compliance with financial industry standards drive demand for reliable cheque processing services that ensure compliance and mitigate risks. -

Growing Financial Inclusion: Expanding banking access in emerging economies increases the demand for cheque processing services as more people and businesses adopt banking services.

Supply Factors:

-

Technology Integration: Advancements in cheque imaging and automation technologies allow service providers to enhance efficiency, reduce processing time, and offer cost-effective solutions to meet growing demand. -

Established Industry Leaders: Large financial institutions and established cheque processing service providers, including fintech firms, dominate the supply side by offering integrated solutions that meet the diverse needs of clients. -

Cost Optimization: The competitive nature of the market pushes service providers to optimize their supply chains, adopting cloud-based solutions and outsourcing non-core functions to reduce costs while maintaining service quality. -

Market Consolidation: Ongoing mergers and acquisitions among cheque processing service providers result in an evolving competitive landscape, influencing service pricing, availability, and innovation.

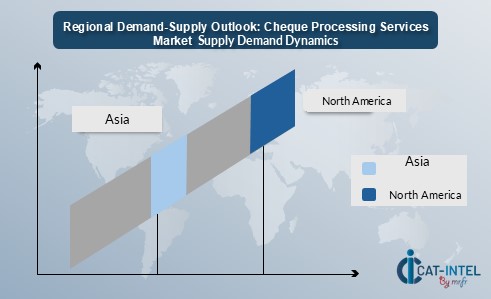

Regional Demand-Supply Outlook: Cheque Processing Services Market

The cheque processing services market is experiencing significant demand across multiple regions, driven by the increasing need for secure, efficient, and cost-effective transaction processing solutions. The market is witnessing growth in North America and Asia-Pacific, with both regions displaying unique trends in demand and supply dynamics.

North America: A Key Player in the Cheque Processing Services Market

-

Dominant Financial Institutions: North America, particularly the U.S., is home to large financial institutions and banks that lead the adoption of cheque processing automation, providing significant demand for processing services. -

Technological Advancements: The region is at the forefront of implementing advanced cheque imaging, optical character recognition (OCR), and fraud detection technologies to streamline cheque processing and reduce operational costs. -

Regulatory Compliance: Stringent regulatory requirements in the U.S. and Canada regarding financial transactions and anti-fraud measures drive the demand for secure and compliant cheque processing services. -

Innovation in Payment Systems: Banks and financial institutions are integrating cheque processing services with digital payment solutions, leading to an increasing demand for services that combine traditional and modern transaction processing. -

Consumer Trends: The push toward digital banking and increased reliance on online and mobile banking services is gradually reducing cheque usage but still requires efficient cheque processing for legacy users and businesses.

North America remains a key hub Cheque processing services market and its growth

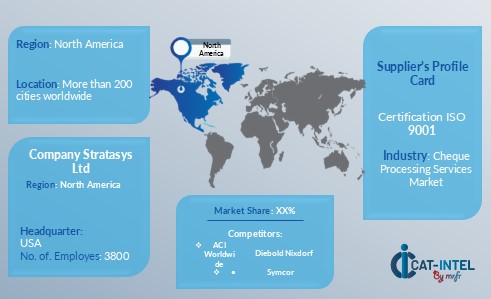

Supplier Landscape: Supplier Negotiations and Strategies in the Cheque Processing Services Market

The cheque processing services market has a diverse and dynamic supplier landscape, comprising both global and regional players who provide essential solutions, technologies, and services required for efficient cheque processing. Key suppliers deliver services such as cheque imaging, fraud detection, software solutions, and hardware for processing systems, all critical to ensuring accurate, secure, and compliant cheque transactions.

Currently, the supplier landscape is characterized by partnerships between financial institutions, technology providers, and payment solutions companies. These collaborations help enhance cheque processing efficiency, integrate new technologies like optical character recognition (OCR), and improve overall transaction security. In addition, hardware suppliers that provide cheque scanning machines and cheque sorters are key to maintaining high processing throughput.

Some of the key suppliers in the cheque processing services market include:

- FIS (Fidelity National Information Services)

- ACI Worldwide

- Jack Henry & Associates

- Diebold Nixdorf

- NCR Corporation

- Symcor

- Kofax

- Global Payments Inc.

- Fiserv

- Vormetric (a Thales company)

Key Development: Procurement Category Significant Developments

Development Area |

Description |

Impact |

Adoption of Digital Payment Solutions |

Integration of cheque processing with digital payment systems, such as mobile banking apps and real-time payment solutions. |

Increases the speed and efficiency of cheque clearing and reduces processing time. |

Cheques Imaging Technology |

Implementation of cheque imaging solutions to enable electronic transmission of cheque data for faster processing. |

Reduces the need for physical cheque transportation, lowering operational costs. |

Fraud Detection and Security Enhancements |

Development of advanced fraud detection systems utilizing machine learning and artificial intelligence to identify suspicious cheque activities. |

Improves security and reduces fraud risk in cheque processing. |

Cloud-Based Processing Systems |

Migration to cloud platforms for cheque processing services, allowing for better scalability and flexibility in handling transactions. |

Enhances system efficiency and scalability, enabling more seamless cheque handling across regions. |

Regulatory Compliance Automation |

Automation of compliance checks to ensure adherence to banking regulations and anti-money laundering (AML) policies. |

Minimizes the risk of non-compliance and related penalties, while ensuring faster processing. |

Sustainability Initiatives |

Adoption of eco-friendly solutions such as paperless cheque processing and reducing carbon footprints in cheque handling. |

Supports environmental sustainability goals while also cutting costs related to paper usage. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The global cheque processing services market is projected to grow from USD 5.45 billion in 2023 to USD 17.5 billion by 2032, with a CAGR of 6.1% during the forecast period. |

Adoption of Digital Payment Solutions |

The growing integration of cheque processing with mobile banking apps and real-time payment solutions, reflecting the shift towards digitalisation in financial services. |

Top Strategies for 2024 |

Focus on automation, adoption of cheque imaging technologies, enhanced fraud detection systems, and partnerships with technology providers to streamline processing. |

Automation in Cheque Processing |

Over 35% of cheque processing services are incorporating automated cheque scanning and verification systems to reduce manual errors and processing time. |

Procurement Challenges |

Key challenges include managing fraud risks, compliance with evolving regulatory requirements, and ensuring the security of digital cheque transactions. |

Key Suppliers |

Major players include FIS Global, Diebold Nixdorf, Jack Henry & Associates, and NCR Corporation, specializing in providing cheque processing solutions and technologies. |

Key Regions Covered |

Major markets include North America, Europe, and Asia-Pacific, with significant demand from the U.S., the U.K., and emerging markets in India and China. |

Market Drivers and Trends |

Growth is driven by the need for faster cheque clearing, enhanced fraud protection, rising digital payment adoption, and regulatory compliance across banking sectors. |