Summary Overview

Clean Services Market Overview

The global clean services market is witnessing accelerated growth, driven by increasing demand across commercial, industrial, and residential sectors. This growth is propelled by heightened hygiene awareness, outsourcing trends, and technological advancements in cleaning solutions. The market benefits from the growing adoption of eco-friendly practices and government-backed initiatives promoting sustainability.Our report provides a detailed analysis of procurement trends, focusing on cost optimization through strategic sourcing, supplier management, and innovative cleaning technologies. We highlight key challenges, including labour shortages and cost volatility, while emphasizing the role of digital procurement tools in forecasting and managing market dynamics effectively.

Key Market Insights and Projections

-

Market Size: The global clean services market is expected to reach approximately USD 92 billion by 2032, growing at a CAGR of 6% from 2024 to 2032.

Growth rate: 6%

Sector Contributions:

-

Commercial Sector: Offices and educational institutions dominate the market due to increasing emphasis on maintaining professional and hygienic environments. Outsourced cleaning services are prevalent due to their cost-effectiveness and superior quality. -

Healthcare Sector: Demand for infection control and adherence to stringent hygiene standards drive growth. -

Residential Sector: Changing lifestyles and rising disposable incomes have fueled demand for professional residential cleaning services.

Technological Transformation:The market is benefiting from innovations such as automated cleaning robots and AI-based solutions for predictive maintenance. Digital procurement tools play a crucial role in supplier performance assessment, cost control, and inventory optimization.

Regional Insights:

-

North America: The largest market, with the U.S. leading in demand for outsourced services and eco-friendly cleaning products. -

Asia-Pacific: Anticipated to grow rapidly due to urbanization and increasing hygiene awareness.

Key Trends and Sustainability Outlook

-

Sustainability Initiatives: Emphasis on green cleaning practices and water-saving technologies. -

E-commerce Growth: Digital platforms are expanding the reach and accessibility of cleaning services. -

Health Trends: The demand for disinfection services remains high, especially in healthcare and educational facilities.

Growth Drivers

-

Health and Safety Standards: Regulatory compliance boosts the demand for professional cleaning services. -

Global Population Growth: Higher urban population density increases demand for hygienic living and working conditions. -

Corporate Outsourcing: Companies seek cost-saving and efficiency benefits by outsourcing cleaning tasks.

Market Intelligence Services for the Clean Services Market

Market intelligence services for the clean services market offer critical insights to navigate challenges such as pricing fluctuations driven by labour shortages and rising raw material costs. These reports provide detailed cost forecasting, enabling stakeholders to understand pricing trends and labour market dynamics comprehensively. They also include strategies for risk mitigation, addressing supply chain disruptions, and improving vendor performance. Furthermore, strategic sourcing insights are offered, helping businesses identify high-performing suppliers and streamline procurement processes for optimal efficiency and cost-effectiveness. This holistic approach supports stakeholders in maintaining competitiveness and resilience in a dynamic market environment.

Procurement Intelligence for Clean Services Market: Category Management and Strategic Sourcing

To thrive in the clean services market, companies are optimizing procurement strategies with a focus on category management, strategic sourcing, and supplier diversification. Advanced analytics and AI tools are enhancing decision-making by offering insights into cost modelling and performance tracking. Sustainability initiatives, including green procurement practices, are becoming critical in supplier selection, aligning with eco-friendly goals. These approaches ensure cost-efficiency, service quality, and compliance with environmental and labour standards.

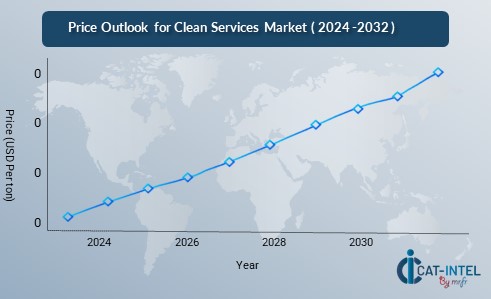

Pricing Outlook for Clean Services Market: Spend Analysis

The clean services market is navigating a pricing landscape influenced by factors such as labour costs, supply chain fluctuations, and increasing demand for eco-friendly cleaning solutions. This dynamic environment is being shaped by evolving consumer expectations and sustainability trends, which are adding complexity to pricing models.

Our advanced analysis indicates a steady increase in clean services prices, driven by several key factors:

-

Rising Labor Costs: Labor shortages and higher wages, especially in cleaning staff, are contributing to price increases across the industry. -

Demand for Sustainable Solutions: The growing emphasis on green cleaning services, which include eco-friendly products and sustainable practices, is pushing prices upward due to the higher costs of these specialized services. -

Regulatory Compliance: Increasingly stringent cleaning and safety standards in various industries are raising operational costs, which influence service pricing. -

Technological Advancements: Adoption of automation and advanced cleaning technologies adds a premium to service pricing as businesses invest in efficient, labour-reducing tools.

Cost Breakdown for the Clean Services Market: Cost-Saving Opportunities

- Labor (50%)

-

Description: The largest cost component in clean services, covering wages, benefits, and recruitment for cleaning staff across various sectors (commercial, industrial, residential). -

Trends: Labor costs have increased due to a tightening labour market, higher wage expectations, and demand for skilled workers in cleaning and maintenance. Companies are seeking ways to reduce labour costs through automation and the use of cleaning technologies. The shift towards part-time or outsourced labour is also becoming more common to manage costs.

- Cleaning Supplies & Equipment (XX%)

- Transportation & Logistics (XX%)

- Overheads & Administrative Costs (XX%)

Cost-Saving Opportunity: Negotiation Levers and Purchasing Negotiation Strategies in the Clean Services Market

In the clean services market, optimizing procurement can drive significant cost savings and improve operational efficiency. Collaborative purchasing allows businesses to negotiate bulk discounts on cleaning supplies, chemicals, and equipment. Sustainable cleaning practices, such as using eco-friendly and reusable products, can help reduce overall supply costs. Implementing automated cleaning systems and technologies such as robotic cleaners and IoT-enabled equipment minimizes labour costs and improves productivity. Additionally, energy-efficient cleaning solutions lower utility expenses, while optimizing transportation routes helps reduce logistics and fuel costs. Long-term contracts with suppliers and service providers can secure favourable pricing, and group purchasing agreements with other companies help share costs on supplies and equipment.

Supply and Demand Overview of the Clean Services Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The clean services market is witnessing steady growth driven by increasing urbanization, heightened awareness of hygiene, and the demand for regular cleaning in commercial, residential, and industrial sectors. The growing need for cleaning services is fuelled by consumer preferences for clean and sanitized environments, as well as the expanding demand for eco-friendly solutions.

Demand Factors:

-

Hygiene Awareness: The rising global concern for hygiene, particularly post-pandemic, is driving demand for regular cleaning and sanitation services across industries like healthcare, education, hospitality, and retail. -

Urbanization: The growth of cities and the increasing number of commercial and residential buildings are expanding the need for cleaning services. -

Environmental Sustainability: An increasing demand for eco-friendly cleaning solutions is driving the market for green cleaning services and sustainable cleaning products. -

Facility Management Growth: As businesses grow, the demand for professional facility management services, including cleaning, is also increasing, especially in industries like real estate and healthcare.

Supply Factors:

-

Labor Availability: The availability of skilled cleaning personnel, particularly in urban areas, plays a significant role in meeting service demand. Labor shortages or fluctuations can impact service availability. -

Technological Advancements: The integration of automation and advanced cleaning technologies, such as robotic cleaners and IoT-enabled devices, is enhancing service efficiency and quality. -

Sustainable Cleaning Practices: Growing adoption of eco-friendly cleaning products and practices ensures a consistent supply of services that meet the demand for green cleaning. -

Market Competition: Intense competition among cleaning service providers leads to innovation in service offerings and pricing strategies, affecting service availability and cost.

Regional Demand-Supply Outlook: Clean Services Market

The clean services market is experiencing increasing demand in various regions, driven by the need for hygiene and sanitation, particularly in commercial, residential, and industrial sectors.

North America: A Key Player in the Clean Services Market North America, particularly the U.S. and Canada, plays a dominant role in the clean services market, characterized by:

-

Leading Providers: Many cleaning service providers in the region, offering a wide range of services for both commercial and residential clients, ensuring a high level of competition and service availability. -

Strong Demand in Commercial Sectors: The demand for cleaning services in office buildings, healthcare facilities, retail spaces, and hospitality sectors is rising due to stricter hygiene standards and increasing awareness of cleanliness. -

Technological Integration: The use of innovative cleaning technologies, such as robotic cleaners and eco-friendly solutions, enhances the efficiency and quality of services, catering to environmentally conscious consumers and businesses. -

Focus on Sustainability: Increasing focus on sustainable cleaning practices, such as green cleaning solutions and eco-friendly products, is driving the demand for services that align with environmental regulations and consumer preferences. -

Consumer Trends: Growing concerns about hygiene, especially post-pandemic, continue to fuel the demand for frequent and professional cleaning services in both residential and commercial spaces, helping to maintain safe and sanitary environments.

North America remains a key hub Clean Services market and its growth

Supplier Landscape: Supplier Negotiations and Strategies in the Clean Services Market

The clean services market has a broad and varied supplier landscape, consisting of both global and regional players that provide essential products and services for the cleaning and maintenance industry. Key suppliers offer cleaning equipment, cleaning chemicals, safety products, and technology solutions, all of which contribute to the efficiency and sustainability of cleaning operations.

Currently, the supplier landscape is characterized by strong partnerships between cleaning service providers and suppliers of cleaning materials and equipment. This collaboration is critical in ensuring high-quality service delivery, cost-efficiency, and the adoption of eco-friendly and sustainable practices in the cleaning industry. Suppliers of cleaning chemicals and materials play a significant role in catering to the growing demand for specialized and green cleaning solutions.

Some of the key suppliers in the clean services market include:

- Diversey Holdings

- Ecolab

- SC Johnson Professional

- CLEANICHEM

- Procter & Gamble Professional

- Kärcher

- Rentokil Initial

- Sealed Air

- Kimberly-Clark Professional

- NSS Enterprises

Key Developments in Procurement Categories

Procurement Category |

Significant Development |

Impact |

Cleaning Chemicals |

Increasing demand for eco-friendly and sustainable cleaning products, including green-certified and biodegradable chemicals. |

Improved sustainability and reduced environmental impact. |

Cleaning Equipment |

Introduction of smart cleaning technology, such as IoT-enabled cleaning machines and robotics for efficient cleaning. |

Enhanced efficiency, reduced labor costs, and innovation. |

Janitorial Services |

Expansion of specialized cleaning services for high-risk areas such as hospitals, schools, and food processing plants. |

Higher demand for skilled labor and specialized services. |

Waste Management |

Integration of waste segregation and recycling solutions to reduce waste in cleaning operations. |

Promotes sustainability and cost-saving in waste disposal. |

Safety and PPE Supplies |

Advancements in personal protective equipment (PPE), including more comfortable, durable, and sustainable options. |

Increased employee safety and improved work conditions. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The global clean services market is projected to grow from USD 55.7 billion in 2023 to USD 92 billion by 2032, with a CAGR of 6% during the forecast period. |

Adoption of Clean Services |

Growing demand for sustainable cleaning practices, eco-friendly chemicals, and smart cleaning technologies to enhance operational efficiency and meet environmental standards. |

Top Strategies for 2024 |

Focus on automation in cleaning, adoption of green cleaning solutions, investment in training for specialized cleaning services, and integration of waste management solutions. |

Automation in Clean Services |

Increasing use of robotic cleaning systems and IoT-based equipment, with nearly 30% of cleaning companies integrating smart technologies for efficiency and cost reduction. |

Procurement Challenges |

Key challenges include rising labour costs, maintaining cleaning standards during staff shortages, and meeting environmental regulations with eco-friendly solutions. |

Key Suppliers |

Major suppliers include ISS A/S, Aramark, Rentokil Initial, and Sodexo, with a focus on providing sustainable, high-quality cleaning and facility management services. |

Key Regions Covered |

Key markets include North America, Europe, and Asia-Pacific, with strong demand from the U.S., the UK, and emerging markets like India and China. |

Market Drivers and Trends |

Growth driven by the demand for eco-friendly cleaning solutions, rise in hygiene awareness post-pandemic, and increasing use of smart technology in cleaning processes. |