Commercial Real Estate Market Overview

The global commercial real estate (CRE) market is poised for steady growth despite facing challenges like rising interest rates, inflation, and changes in tenant demands. Growth in sectors such as industrial spaces, affordable housing, and retail properties is expected to drive the market forward, with an annual growth rate forecast of around 5–6% across different asset classes, especially in multifamily, industrial, and retail sectors. Digital procurement tools and strategic supply chain management are becoming increasingly important for optimizing costs and responding to market volatility.

Growth rate: 5-6%

Key Growth Drivers and Trends

-

Technology Integration (PropTech): The rise of digital technologies such as smart buildings, energy-efficient systems, and PropTech solutions is reshaping the CRE market, enhancing operational efficiency, and making properties more attractive to tenants and investors.

-

Affordable Housing Demand: A significant demand for affordable housing is reshaping urban landscapes, with new construction methods, such as modular housing, emerging as solutions to address this need.

-

Rising Costs: Higher construction and material costs, exacerbated by labor shortages, are pushing CRE developers and property managers to adopt digital tools for more efficient procurement and supply chain management.

Sustainability Outlook

Sustainability in CRE is gaining traction with a growing emphasis on energy-efficient buildings, including solar power systems and water recycling technologies. These green practices not only reduce operational costs but also enhance the value of properties, making them more attractive to environmentally conscious tenants and investors.

Sector Contributions and Regional Insights

-

Industrial: The industrial real estate market continues to thrive, driven by demand for warehouses and distribution centers, especially as global supply chains adjust post-pandemic. However, growth in this sector may slow as demand stabilizes.

-

Office: The office space market is facing challenges, with vacancy rates rising. There is a noticeable trend toward higher demand for premium office spaces, while older properties struggle. Flexibility in office use, such as conversion into apartments or data centers, presents new opportunities.

-

Retail and Multifamily: Retail properties, particularly neighbourhood centers, continue to perform well. Meanwhile, multifamily properties remain in high demand, though rent growth has slowed recently.

Overview of Market Intelligence Services for the CRE

Strategic procurement practices and digital tools are critical for managing cost fluctuations and optimizing the supply chain in the CRE market. Market intelligence solutions are helping stakeholders make informed decisions in real time, ensuring access to high-quality building materials and services, even amid market uncertainties. This allows companies to stay competitive and manage risks effectively in a dynamic market.

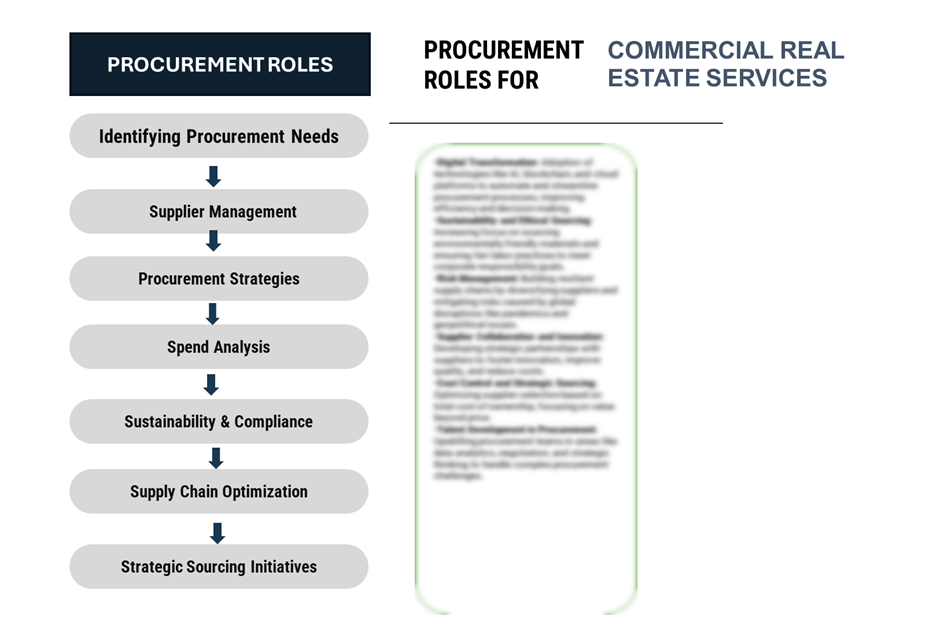

Procurement Intelligence for CRE Market: Category Management and Strategic Sourcing

The Commercial Real Estate (CRE) services market in 2024 is seeing growth, particularly in sectors like multi-family housing, industrial real estate, and data centers. Strategic sourcing and category management are key for optimizing procurement and improving supply chain efficiency. Digital procurement tools and market intelligence are essential for businesses to remain competitive by enhancing operations and adapting to market changes. Sustainability is also gaining focus, with eco-friendly construction and energy-efficient buildings becoming more prominent. Additionally, PropTech innovations are transforming property management, boosting operational efficiency in the sector.

Pricing Outlook for Commercial Real Estate Services Market: Spend Analysis

The Commercial Real Estate (CRE) services market is currently experiencing pricing fluctuations, influenced by a range of economic, environmental, and market dynamics. These factors include rising construction costs, demand for high-quality properties, and shifts in tenant needs.

Key Factors Influencing Pricing Trends:

-

Rising Construction and Operational Costs: Increased labor costs, material shortages, and inflation are impacting the cost of new builds and property maintenance, leading to higher rental rates and property prices across various sectors.

-

Shift in Demand: The demand for multi-family housing, industrial real estate, and green-certified buildings is driving pricing pressures. As companies and consumers become more focused on sustainability and energy efficiency, properties with these features tend to command higher prices.

-

Market Volatility: Interest rate changes and the evolving demand for office and retail spaces are contributing to pricing fluctuations. Offices, especially in urban areas, are experiencing price instability due to the rise of remote working, while industrial spaces are seeing demand-driven price increases due to e-commerce growth.

-

Environmental Factors: The growing emphasis on sustainability in the CRE sector is driving investment in energy-efficient buildings, but this also results in higher construction costs. However, properties with green certifications and energy-saving technologies tend to fetch premium prices in the market

Cost Breakdown for Commercial Real Estate Services Market: Cost Saving Opportunities

-

Property Acquisition (45%)

-

Description: This represents the cost associated with acquiring commercial real estate properties, including land purchases and building acquisitions. Prices vary based on location, property type, and market demand.

-

Trends: Property acquisition costs have increased due to inflation, rising construction material costs, and competitive demand for prime locations. As of 2024, property prices are anticipated to remain high, particularly in urban centers and areas with high demand for office and residential spaces.

-

-

Labor (XX%)

-

Processing & Packaging (XX%)

-

Infrastructure & Overheads (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the commercial real estate services market, cost savings can be achieved through strategies such as bulk purchasing for construction materials, adopting sustainable building practices, and optimizing property management with digital tools. Outsourcing non-core services like cleaning and security can reduce operational costs, while leveraging technology for energy efficiency can lower utility expenses. Additionally, negotiating favourable financing and insurance terms, along with offering long-term lease incentives, can further drive down costs and improve profitability. These approaches help enhance operational efficiency and maximize returns in a competitive market.

Supply and Demand Overview of the Commercial Real Estate Services Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The commercial real estate services market is evolving with changing demand drivers, including urbanization, technological advancements, and shifting workplace dynamics. The demand for commercial properties remains strong, particularly in prime locations, while supply factors are influenced by construction costs, regulatory pressures, and market competition.

Demand Factors:

-

Urbanization: Rapid urban growth and population expansion increase the need for commercial office space, retail outlets, and industrial facilities.

-

Workplace Flexibility: The rise of hybrid work models and flexible office spaces is driving demand for adaptable commercial properties.

-

E-Commerce Growth: The boom in e-commerce has led to a surge in demand for logistics and warehousing spaces.

-

Sustainability and Green Buildings: Growing demand for energy-efficient and environmentally friendly buildings aligns with consumer and business sustainability goals.

Supply Factors:

-

Construction Costs: Rising material costs and labor shortages are impacting the supply of new commercial real estate, particularly in high-demand urban areas.

-

Regulatory and Zoning Restrictions: Local government regulations and zoning laws can limit the availability of prime commercial real estate, affecting supply.

-

Technological Integration: Innovations like smart building technologies and automation improve property management efficiency and can increase supply availability.

-

Market Competition: Intense competition among developers and investors influences property availability and pricing, driving quality improvements and shaping market dynamics.

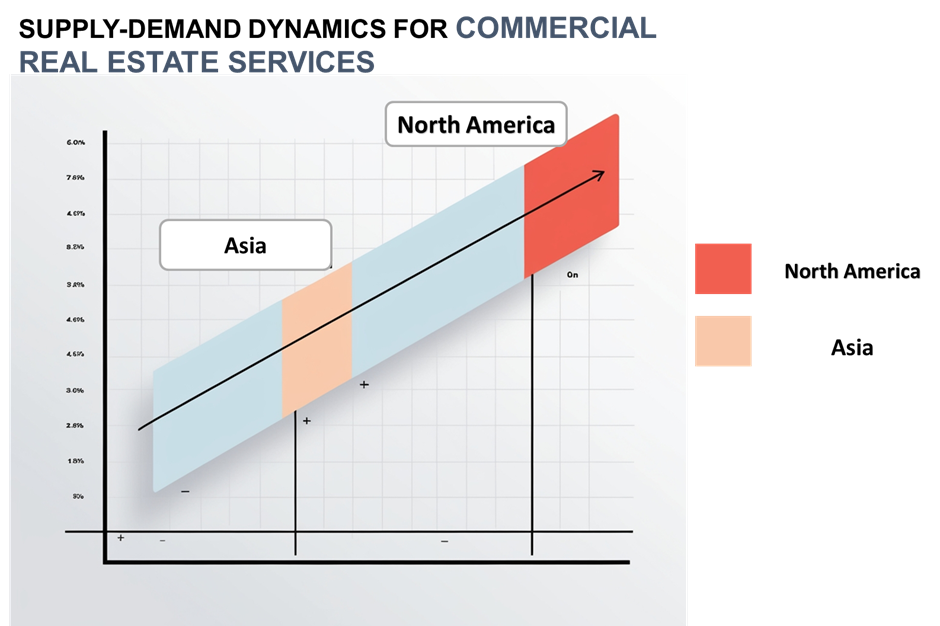

Regional Demand-Supply Outlook: Commercial Real Estate Services Market

The commercial real estate services market is experiencing varying demand trends across key regions, influenced by factors like urbanization, technological advancements, and shifting work patterns.

North America: A Key Player in the Commercial Real Estate Services Market

-

Leading Markets: The U.S. dominates the North American market, with major cities like New York, Los Angeles, and Chicago driving demand for office, retail, and industrial spaces.

-

Strong Investment Flow: North America sees significant investment in commercial real estate, particularly from institutional investors, creating a competitive market for prime properties.

-

Flexibility in Demand: The growing trend toward hybrid work models has led to an increased demand for flexible office spaces, co-working hubs, and mixed-use properties.

-

Sustainability Focus: U.S. developers are embracing green building initiatives and energy-efficient technologies, addressing both market demand and environmental concerns.

-

E-Commerce Expansion: The rise of online shopping continues to fuel demand for logistics and distribution centers, particularly in urban outskirts and industrial zones.

North America remains a key hub CRE market and its growth

Supplier Landscape: Supplier Negotiations and Strategies in the Commercial Real Estate Services Market

The commercial real estate services market is supported by a broad range of suppliers, including construction firms, property management companies, technology providers, and financial institutions. These suppliers play a crucial role in supporting the development, management, and leasing of commercial properties.

Key suppliers in the commercial real estate services market include:

-

JLL (Jones Lang Lasalle)

-

CBRE Group, Inc.

-

Cushman & Wakefield

-

Colliers International

-

CBRE Global Investors

-

WeWork

-

Prologis

-

Hines

-

CoStar Group

-

Avison Young

Key Development: Procurement Category in the Commercial Real Estate Services Market

|

Development |

Description |

Impact on Market |

|

Digital Transformation |

Adoption of digital tools for property management, lease management, and data analytics. |

Enhances operational efficiency, improves decision-making, and reduces costs. |

|

Sustainability Initiatives |

Increased focus on sustainable building practices, energy-efficient designs, and green certifications (e.g., LEED). |

Attracts environmentally conscious tenants and investors, reducing long-term costs. |

|

Automation in Property Management |

Use of AI and IoT for real-time property management, predictive maintenance, and energy optimization. |

Streamlines property management, reduces operational costs, and improves tenant satisfaction. |

|

Outsourcing Property Management |

Third-party property management services becoming more common, allowing businesses to focus on core activities. |

Reduces overhead costs and improves resource allocation. |

|

Flexible Leasing Models |

Rise in demand for flexible office space and coworking arrangements, driven by remote work trends. |

Offers businesses greater flexibility and cost-efficiency in real estate decisions. |

|

Procurement Attribute/Metric |

Details |

|

Market Sizing |

The commercial real estate services market is projected to grow from USD 1.03 trillion in 2023 to USD 1.39 trillion by 2032, with a CAGR of 5-6% during the forecast period. |

|

Adoption of Technology |

Increasing adoption of PropTech solutions, including AI, IoT, and blockchain, for property management, investment analysis, and tenant services. |

|

Top Strategies for 2024 |

Focus on sustainability initiatives, digital transformation, flexible leasing models, and tenant-centric services. |

|

Automation in Property Management |

Growing automation in property management with AI and IoT technologies for predictive maintenance, energy optimization, and real-time monitoring. |

|

Procurement Challenges |

Key challenges include fluctuating property values, evolving regulatory landscapes, and managing tenant demands for flexible spaces. |

|

Key Suppliers |

Major players include CBRE Group, JLL (Jones Lang Lasalle), Cushman & Wakefield, and Colliers, providing property management, leasing, and advisory services. |

|

Key Regions Covered |

Major markets include North America, Europe, and Asia-Pacific, with significant demand in the U.S., China, and India. |

|

Market Drivers and Trends |

Growth driven by demand for flexible office spaces, increased focus on sustainability, digitalization of property services, and global real estate expansion. |

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide comprehensive market analysis, including supplier performance evaluations, cost benchmarking, and market trends. We help you identify the best service providers, negotiate favourable terms, and ensure efficient sourcing in the commercial real estate sector.

We assist in calculating the Total Cost of Ownership (TCO) by analyzing not only the direct procurement costs but also operational expenses, maintenance, property taxes, and utility costs. Our solutions ensure a full understanding of long-term financial commitments involved in real estate procurement.

Our risk management services help identify risks related to market volatility, property values, and regulatory changes. We offer strategies to mitigate risks, such as diversifying property portfolios and ensuring compliance with local laws to protect against potential disruptions.

Our Supplier Relationship Management (SRM) services guide you in fostering long-term, collaborative partnerships with commercial real estate providers. We focus on improving communication, negotiation, and ensuring service quality, leading to better cost management and operational efficiencies.

We provide insights into procurement best practices, such as creating a clear sourcing strategy, evaluating supplier performance, and managing contracts effectively. These practices help ensure transparent, strategic decision-making and cost control in real estate procurement.

Digital transformation enhances procurement through automation, AI-driven property management tools, and data analytics for market forecasting and supplier evaluation. This allows for real-time tracking of property trends, improved decision-making, and streamlined procurement processes.

Supplier performance management ensures that commercial real estate service providers meet quality, compliance, and delivery expectations. We help track performance, ensuring timely service, adherence to budgets, and alignment with business objectives for optimal value.

Our data-driven negotiation strategies help secure favourable leasing terms, pricing structures, and service level agreements (SLAs). We provide insights into market conditions, enabling more effective negotiations for commercial real estate contracts.

Our market analysis tools offer insights into market trends, competitive pricing, supply chain conditions, and regional property demand. These tools help you stay informed about market dynamics and identify opportunities to optimize your real estate portfolio.

We provide solutions to navigate the complex regulatory environment in the commercial real estate market, ensuring compliance with zoning laws, property taxes, environmental regulations, and industry standards.

Our strategies include identifying alternative suppliers, developing contingency plans, and monitoring the supply market to respond swiftly to disruptions. We help ensure continuity in service delivery despite external challenges like economic shifts or property market instability.

We offer tools to track the performance of service providers, including property managers, contractors, and leasing agents. Regular evaluations and performance reports provide valuable insights into service quality and help inform future procurement decisions

We assist in selecting suppliers who prioritize sustainability through green building certifications, energy-efficient designs, and eco-friendly practices. Our sustainability assessments ensure that your real estate procurement aligns with environmental and corporate responsibility goals.

Our pricing analysis tools provide comparative insights into market rates, helping you secure competitive pricing. We analyse market conditions, demand trends, and regional price fluctuations to ensure you get the best value for your commercial real estate services.

We provide a detailed analysis of emerging trends, such as the growing demand for flexible workspaces and sustainability-driven construction, alongside risks like economic downturns or shifts in property demand. Our insights help identify strategic procurement opportunities and manage market risks effectively.