Summary Overview

Global Construction Market Overview:

The worldwide construction market is steadily growing, driven by rising demand in areas such as residential, commercial, and infrastructure development. This market covers a wide range of construction options, including modular, sustainable, and smart building technologies. Our investigation delves deeply into procurement trends, with a focus on cost-cutting initiatives and the use of digital tools to optimize procurement and operations.

Looking ahead, important procurement difficulties will include controlling construction project costs, guaranteeing scalability, adhering to safety and regulatory standards, and integrating innovative technology with existing infrastructure. The implementation of digital procurement technologies and strategic sourcing will be critical in increasing construction efficiency and ensuring ongoing competitiveness. As global demand grows, businesses are increasingly relying on market intelligence to help increase operational efficiency, manage risks, and optimize resource allocation.

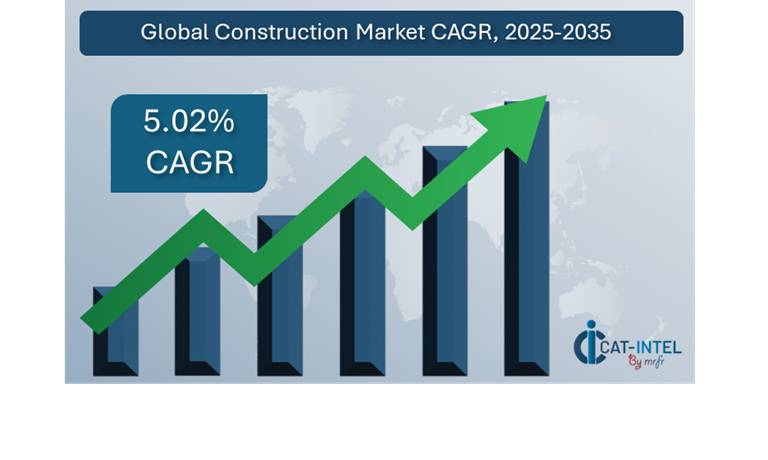

Market Size: The Global Construction market is projected to reach USD 14,800.21 billion by 2035, growing at a CAGR of approximately 5.02% from 2025 to 2035.

Growth Rate: 5.02%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: The increasing demand for real-time data and seamless process integration is crucial for optimizing operations within the construction supply chain.

Retail and E-Commerce Growth: As the construction industry expands into online platforms, there is a rising adoption of solutions to improve inventory management, demand forecasting, and client relationship management (CRM) within the supply and logistics segments.

Technological Transformation: Technological advancements such as AI and machine learning are transforming the construction market by enabling predictive analytics, risk management, and automation, allowing construction companies to enhance project planning.

Innovations: The rise of modular construction solutions is reshaping how projects are delivered, allowing companies to customize building processes, reduce costs, and improve project timelines.

Investment Initiatives: Increased investments in cloud-based construction management systems are driving efficiency and collaboration across teams by providing access to real-time data and remote project oversight, thus reducing infrastructure costs.

Regional Insights: North America and Asia Pacific continue to be leading contributors to the global construction market due to strong digital infrastructures.

Key Trends and Sustainability Outlook:

Cloud Integration: The construction industry is increasingly adopting cloud-based platforms to enhance scalability, reduce costs, and enable improved data access for remote project management and real-time updates across teams.

Advanced Features: The integration of emerging technologies such as AI, IoT, and blockchain is revolutionizing decision-making, increasing transparency, and streamlining operations by providing real-time data for critical construction processes.

Focus on Sustainability: Construction companies are utilizing modern solutions to track resources efficiently, optimize energy usage, and align with sustainability goals. This includes better waste management and sustainable sourcing practices, all enabled by advanced tracking and reporting systems.

Customization Trends: With the growing complexity of projects, there is an increasing demand for construction solutions tailored to specific sectors like residential, commercial, and infrastructure. These specialized tools help businesses better manage sector-specific challenges.

Data-Driven Insights: By incorporating advanced analytics into construction software, organizations can better estimate material requirements, optimize inventory management, and measure performance indicators, resulting in fewer delays and better project outcomes.

Growth Drivers:

Digital Transformation: The use of digital technologies is changing the way construction businesses approach project management, enhancing productivity and efficiency in planning, execution, and delivery.

Demand for Process Automation: Automating repetitive processes in construction projects is becoming increasingly important for decreasing operational bottlenecks, optimizing workflows, and enhancing overall efficiency.

Scalability Requirements: Construction businesses are increasingly looking for scalable systems and solutions that can expand with their changing business needs while maintaining seamless integration across project phases.

Regulatory Compliance: Meeting industry rules, such as safety standards, environmental policies, and labour laws, is a top priority for construction companies. Advanced solutions assist firms in complying by automating reporting processes and assuring accuracy.

Globalization: The global expansion of construction projects has increased demand for solutions that support different languages, currencies, and international standards, allowing organizations to better manage cross-border projects.

Overview of Market Intelligence Services for the Global Construction Market:

Recent evaluations have highlighted important issues in the construction sector, such as excessive project prices and the need for tailored solutions to specific operational requirements. Market intelligence studies are increasingly important in giving actionable insights into procurement prospects, assisting businesses in identifying cost-cutting strategies, optimizing supplier relationships, and increasing the likelihood of project success. These insights also help to assure compliance with industry rules, high-quality operational processes, and optimal cost management.

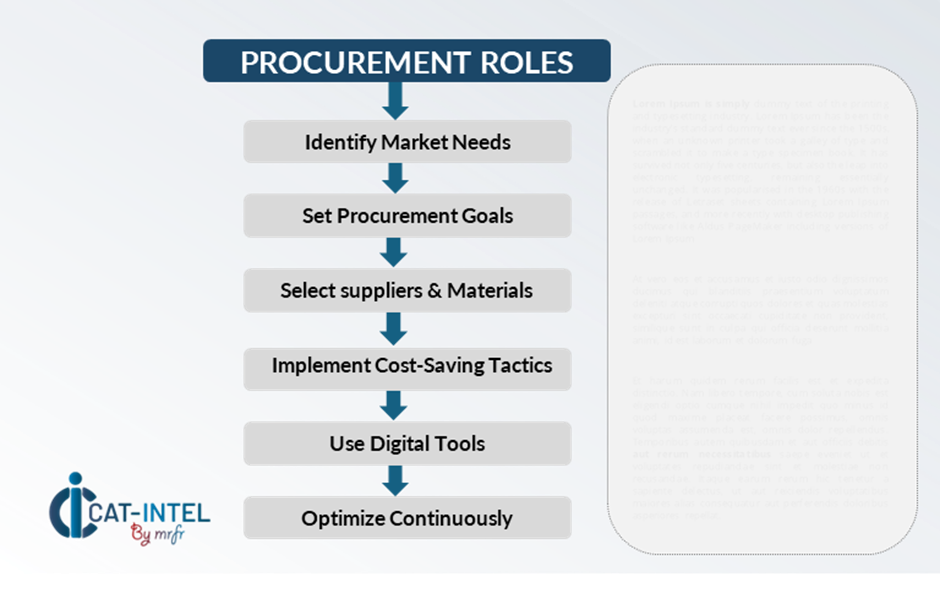

Procurement Intelligence for Global Construction: Category Management and Strategic Sourcing

Companies are refining their procurement methods to preserve a competitive advantage in the construction business, with an emphasis on spend analysis and supplier performance tracking. Effective category management and strategic sourcing are crucial for lowering procurement costs while assuring the timely supply of quality construction goods and services. building organizations can use market intelligence to improve their procurement procedures, negotiate better terms with suppliers, and achieve the best deals for their building needs. This technique not only reduces costs but also promotes long-term growth by optimizing the acquisition of critical resources.

Pricing Outlook for Global Construction: Spend Analysis

The construction market's pricing forecast is projected to remain dynamic, impacted by a number of major factors. These include technical developments, increased demand for sustainable construction solutions, project customization requirements, and regional pricing differences. Furthermore, there is a greater integration of smart technologies such as AI and IoT, as well as rising safety and regulatory compliance needs.

Graph shows general upward trend pricing for Global Construction and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement processes, improve vendor management, and implement novel construction technologies are critical for managing escalating project costs. Using digital technologies for market monitoring, advanced analytics-based pricing forecasting, and efficient contract administration can considerably improve cost control and overall project finance management.

Partnering with reputable suppliers, negotiating long-term contracts, and investigating subscription-based pricing structures for important construction technology are all critical tactics for successful expense management. Despite these hurdles, focusing on scalability, guaranteeing robust project implementation, and incorporating cloud-based solutions will be critical to sustaining cost-effectiveness and operational excellence in the construction industry.

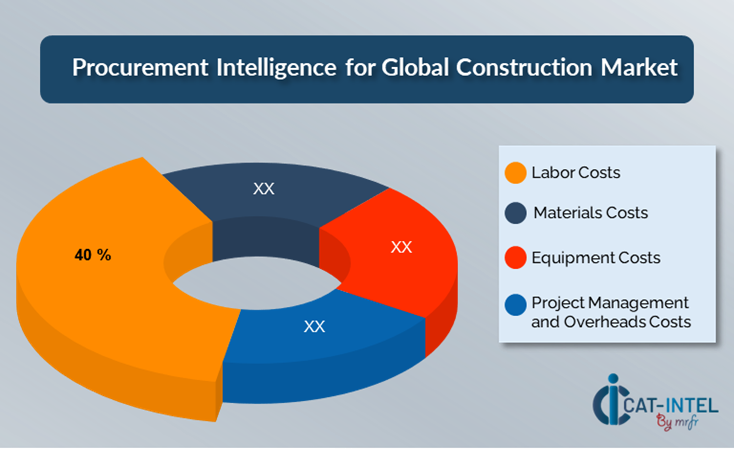

Cost Breakdown for Global Construction: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Labor Costs: (40%)

Description: Labor expenditures often make up a large component of the total cost of ownership (TCO) in building projects. This comprises pay for workers, subcontractors, and management people participating in various stages of the project.

Trends: Construction labour expenses are trending towards automation and digitalization, with the increased use of robotics, artificial intelligence, and machine learning to minimize reliance on manual labour.

Material Costs: (XX%)

Equipment Costs: (XX%)

Project Management and Overheads Costs: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the construction sector, managing procurement processes and using smart negotiation methods are critical for obtaining considerable cost savings and increasing overall project efficiency. Long-term relationships with suppliers, particularly those that provide new and scalable construction technologies, can result in better price structures and conditions. These agreements frequently feature volume-based discounts, bundled service packages, and other incentives that might assist lower expenses over time. Adopting subscription-based models and negotiating multi-year contracts with construction suppliers can help you lock in reduced prices and reduce the impact of future price volatility.

Construction businesses can gain access to advanced analytics, smart technologies such as AI and IoT, and modular solutions that optimise resource allocation, streamline operations, and reduce long-term operational costs by collaborating with vendors who value innovation and scalability. Using digital procurement technologies, such as contract management platforms and use analytics, improves transparency, reduces over-purchasing or over-provisioning, and assures efficient resource utilization. Furthermore, diversifying vendor options and implementing a multi-vendor approach can assist minimize reliance on a single supplier, manage risks such as service disruptions, and boost negotiation power, resulting in better project outcomes and cost controls.

Supply and Demand Overview for Global Construction: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The global construction market is steadily expanding, driven by the growing demand for modernization, digital transformation, and the use of innovative technologies. The supply and demand dynamics in the construction industry are influenced by technical breakthroughs, project-specific customization requirements, and macroeconomic considerations.

Demand Factors:

Digital Transformation Initiatives: Companies are implementing digital solutions to better project management, communication, and resource allocation across construction sites.

Cloud Adoption Trends: The construction industry's migration to cloud-based platforms is generating demand for scalable, subscription-based tools. These solutions give construction organizations the ability to grow operations while providing real-time project monitoring and management.

Industry-unique Requirements: Different sectors of the construction industry, such as infrastructure, residential, and commercial, require solutions that are adapted to unique project requirements, safety rules, and operational workflows.

Integration Capabilities: Real-time data interchange between different platforms provides better decision-making and more efficient coordination across project phases.

Supply Factors:

Technological Advancements: Include advances in AI, machine learning, and cloud computing, which improve the functionality and efficiency of building solutions. These breakthroughs enable predictive analytics for project schedules, AI-based design optimization, and the automation of mundane construction jobs.

Vendor Ecosystem: The number of providers in the construction technology market is growing, with everything from large-scale software vendors to specialized, niche businesses.

Global Economic Factors: Exchange rates, labour costs, and regional technology adoption rates all have a substantial impact on the pricing and availability of construction technologies.

Scalability and Flexibility: Modern building technologies are becoming more modular, allowing suppliers to cater to projects of various sizes. Scalable solutions enable construction organizations to use tools that can scale with their demands, from modest residential

Regional Demand-Supply Outlook: Global Construction

The Image shows growing demand for Global Construction in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Global Construction Market

North America, particularly the United States, is a dominant force in the Global Construction market due to several key factors:

Strong Infrastructure Development: North America spends heavily in large-scale infrastructure projects such as transportation, urban development, and renewable energy.

Technological Innovations: The region is leading the way in implementing cutting-edge construction technology such as Building Information Modelling (BIM), automation, Artificial Intelligence (AI), and sustainable building practices.

Large Market Size and Economic Strength: North America, notably the United States, has one of the world's largest and most stable economies, which creates a strong demand for residential and commercial construction projects ranging from real estate developments to industrial facilities.

Government Funding and Policy Support: North American governments often allocate significant funding for infrastructure and construction projects, such as the U.S. Infrastructure Investment and Jobs Act.

Skilled Workforce and Construction Expertise: North America has a highly skilled labour force, along with established construction companies with years of experience in complex projects.

North America Remains a key hub Global Construction Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The global construction market's supplier landscape is similarly diversified and highly competitive, with a mix of large international corporations and regional players impacting crucial elements such as price structures, service quality, and product offers. This diversified ecosystem influences the availability and uptake of technology necessary for construction project management, operations, and resource optimization. The construction market is shaped by both major global suppliers, which provide comprehensive solutions such as project management software and integrated construction platforms, and regional suppliers, who focus on local needs, regulatory requirements, or niche market segments such as sustainable construction or modular building technologies.

Pricing methods in the construction technology sector vary greatly, with some providers offering flexible, scalable subscription-based pricing and others providing more traditional licensing model. Furthermore, customization is important, as businesses increasingly seek solutions adapted to the unique needs of specific building sectors, such as commercial, residential, or infrastructure projects.

Key Suppliers in the Global Construction market include:

Bechtel Corporation

China State Construction Engineering Corporation

Vinci

China Railways Group

Skanska

Fluor Corporation

ACC Limited

Turner Construction Company

Bouygues Construction

Tutor-Perini Corporation

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The worldwide construction market is expanding rapidly, driven by the growing demand for operational efficiency, increased productivity, and better resource management, particularly in emerging regions. As construction firms face more demand and tighter budgets, the implementation of new technology and systems is helping to streamline operations and improve project outcomes.

|

Cloud Adoption |

Cloud-based technologies allow for real-time collaboration across teams, project tracking from any location, and quicker data exchange, which is especially crucial given the increasingly hybrid structure of construction teams.

|

Product Innovation |

As construction organizations seek more advanced and specialized solutions, there is an increasing demand for software and tools that include AI-powered analytics, real-time data processing, and industry-specific modules.

|

Technological Advancements |

Technological advancements include AI, machine learning, and IoT integration, which are considerably improving construction project management skills. These improvements provide predictive insights, real-time data collecting, and automated routine chores, all of which help to improve operations, decrease project delays, and allocate resources more efficiently. |

Global Trade Dynamics |

Changes in international trade legislation, compliance requirements, and regional economic policies have an impact on construction supply chains and the adoption of new construction technology.

|

Customization Trends |

The demand for construction software that can be adjusted to unique company requirements is increasing. Modular construction technology solutions that enable businesses to integrate third-party products and tailor their systems to match project needs are becoming increasingly popular. |

Global Construction Attribute/Metric |

Details |

Market Sizing |

The Global Construction market is projected to reach USD 14,800.21 billion by 2035, growing at a CAGR of approximately 5.02% from 2025 to 2035.

|

Global Construction Technology Adoption Rate |

Around 65% of construction companies worldwide have adopted new technology, with a substantial move toward cloud-based systems for increased scalability, real-time data access, and better project management.

|

Top Global Construction Industry Strategies for 2025 |

Using AI and machine learning to forecast project outcomes, optimise resource allocation, and mitigate risk. Streamlining construction operations with modular technology solutions to increase productivity, save costs, and provide flexibility. Prioritizing cybersecurity to protect important project data and mitigate potential breaches.

|

Global Construction Process Automation |

Approximately 55% of construction projects use automation for basic operations including project scheduling, procurement management, and compliance reporting.

|

Global Construction Process Challenges |

Increased project costs due to shifting material prices and manpower shortages. Employees and contractors who are unfamiliar with new technologies or procedures may be resistant to change. Data integration issues from disparate systems affecting several project stakeholders.

|

Key Suppliers |

Leading Suppliers in the market include Bechtel Corporation, China State Construction Engineering Corporation and Vinci, specialize in construction machinery and technology solutions.

|

Key Regions Covered |

Regions like North America and Asia Pacific are leading due to high demand due to urbanization, industrialization, and large-scale infrastructural development.

|

Market Drivers and Trends |

There is a rising demand for infrastructure development, particularly in urban areas. Cloud-based solutions are becoming increasingly popular for streamlining project management and collaboration. Real-time data and predictive insights are becoming increasingly important in managing complicated construction projects. |