Corporate Travel Market Overview

The global corporate travel market is experiencing rapid growth due to increasing globalization, business expansion, and the evolving nature of business travel. As companies place a greater emphasis on managing travel costs, improving efficiency, and ensuring the safety of employees, the demand for corporate travel services is intensifying. The market is being reshaped by the adoption of digital tools and data analytics, which are enhancing travel management systems, improving supplier performance, and optimizing travel budgets. Procurement intelligence solutions are becoming integral to companies as they seek to streamline their corporate travel strategies, leverage market insights, and mitigate risks related to travel disruptions and fluctuating costs.

The outlook for the corporate travel market is positive, with significant growth anticipated through 2032. Key trends indicate that digital transformation, sustainability, and the rise of remote work and hybrid business models are shaping the future of corporate travel. Companies are increasingly utilizing technology to manage travel programs efficiently and enhance the traveller experience, while also driving cost savings.

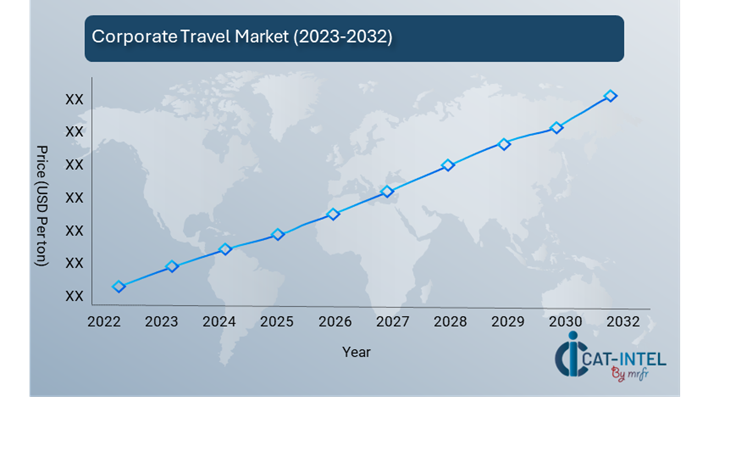

The corporate travel market is projected to reach approximately USD 1.9 trillion by 2032, reflecting a compound annual growth rate (CAGR) of about 7.5% from 2024 to 2032.

- Sector Contributions:

- Business Travel: Corporate travel services are essential for companies with a global presence, driving the demand for air travel, hotel accommodations, ground transportation, and event management.

- Technology Adoption: Advanced travel management platforms, including Artificial Intelligence (AI), Machine Learning (ML), and automation tools, are helping businesses optimize travel costs, enhance traveller safety, and ensure efficient booking systems.

- Technological Transformation and Innovations: The rise of AI and Big Data analytics in corporate travel procurement is facilitating predictive analytics for budgeting, demand forecasting, and improving overall travel management. Additionally, the adoption of mobile apps and cloud-based platforms is streamlining corporate travel programs, improving flexibility and tracking.

- Sustainability Initiatives: Increasing focus on sustainable travel practices is pushing businesses to opt for carbon offset programs, eco-friendly accommodations, and fuel-efficient travel options to meet sustainability goals.

- Regional Insights: North America and Europe are dominant regions in the corporate travel market due to the large number of multinational corporations. However, the Asia-Pacific region is expected to see rapid growth driven by increased business travel in emerging markets such as China and India.

Key Trends and Sustainability Outlook

- Sustainability Initiatives: Businesses are prioritizing sustainable travel options to reduce their carbon footprint, including green hotels, electric vehicles, and carbon offset programs.

- Digital Transformation: The use of AI, predictive analytics, and travel management platforms is transforming corporate travel procurement. Automation and data-driven insights are helping companies reduce costs and increase efficiency in their travel programs.

- Bleisure Travel: The increasing trend of "bleisure" (business + leisure) travel is reshaping how companies manage corporate trips, with employees often extending business trips for leisure purposes, driving demand for travel-related services.

- Cost Management: Companies are increasingly focusing on strategic sourcing and using data to negotiate favourable contracts with travel service providers, securing volume discounts and optimizing travel spend.

Growth Drivers:

- Globalization of Business: As businesses expand globally, corporate travel demand is increasing due to the need for face-to-face meetings and international business operations.

- Remote Work and Hybrid Models: The rise of hybrid work models has created new travel patterns, with an increased focus on flexibility and cost optimization.

- Technology and Data Analytics: Digital transformation through AI, predictive analytics, and travel management platforms is improving cost control, risk management, and traveller satisfaction.

- Sustainability Focus: Companies are aligning their travel strategies with sustainability goals, opting for greener travel alternatives to reduce their environmental impact.

Overview of Market Intelligence Services for the Corporate Travel Market

Recent market analysis indicates fluctuations in corporate travel pricing due to factors such as inflation, fluctuating fuel prices, and economic uncertainties. Market intelligence services offer in-depth reports and forecasts to help stakeholders navigate these fluctuations, optimize their procurement strategies, and minimize the impact of rising costs. By leveraging data from procurement analytics and market insights, companies can make informed decisions, optimize their travel budgets, and maintain control over their travel expenses.

Procurement Intelligence for Corporate Travel Market: Category Management and Strategic Sourcing

To stay competitive in the corporate travel market, companies are optimizing procurement strategies by leveraging spend analysis solutions for vendor spend analysis and enhancing travel program efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming increasingly important in achieving cost-effective procurement and ensuring the timely availability of corporate travel services, including flights, hotels, and ground transportation.

Pricing Outlook for Corporate Travel Market: Spend Analysis

The corporate travel market is experiencing a dynamic pricing environment influenced by multiple factors such as fluctuating demand, rising fuel costs, changing travel policies, and the evolving preferences of business travellers. This shifting landscape has resulted in increased complexities for organizations managing their travel budgets and supplier relationships.

Our advanced analysis indicates a steady upward trend in corporate travel costs, driven by several key factors:

- Rising Airfare and Hotel Costs: The increasing demand for business travel, coupled with fuel price volatility and rising accommodation rates, is driving up costs in both air travel and hotel bookings.

- Increased Demand for Premium Services: As companies focus more on employee satisfaction and safety, there is a higher demand for premium travel services, including business class flights, upscale hotels, and private transportation, contributing to price increases.

- Supply Chain Disruptions: Ongoing disruptions in the global travel supply chain, including limited flight availability and hotel capacity, are causing supply shortages that affect pricing.

- Post-Pandemic Recovery: The resurgence of corporate travel after the COVID-19 pandemic, combined with changing travel policies and requirements, has created fluctuating price trends as demand begins to outpace supply in key regions.

- Sustainability Trends: There is increasing pressure on companies to integrate sustainable travel options, such as carbon-offset programs and eco-friendly transportation choices, which can lead to higher costs for these services.

Cost Breakdown for Corporate Travel Market: Cost Saving Opportunities

- Airfare (40%)

- Description: This category represents the cost of flights, including both domestic and international air travel for corporate trips. Airfare prices are influenced by factors such as fuel costs, flight demand, and the availability of premium services.

- Trends: Airfares have been volatile due to fluctuating fuel prices, changing airline policies, and shifts in demand post-pandemic. As of 2024, business travel airfares are expected to rise due to increased demand, limited capacity, and inflationary pressures in fuel prices. Companies can reduce costs by booking in advance, using negotiated corporate rates, and selecting budget-friendly airlines for non-premium travel.

- Hotel Accommodation (XX%)

- Transportation (XX%)

- Meals & Per Diem (XX%)

- Technology & Communication (XX%)

- Miscellaneous & Overheads (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the corporate travel market, optimizing procurement through strategic negotiation can result in significant cost savings. Key strategies include securing bulk discounts through corporate contracts with airlines and hotels, implementing travel policies to encourage advance bookings, and establishing preferred supplier agreements. Group travel coordination, technology integration for better tracking, and optimizing the mix of transportation options also contribute to reducing costs. By leveraging data analytics and automated tools, companies can efficiently manage travel expenses, ensuring cost-effective and streamlined travel management.

Supply and Demand Overview of the Corporate Travel Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The corporate travel market is evolving rapidly, driven by the recovery of business travel post-pandemic, an increasing focus on cost management, and the adoption of technology in travel management. The demand for corporate travel is influenced by factors such as business growth, the need for international collaboration, and employee preferences for flexible travel options.

Demand Factors:

- Business Recovery & Expansion: As businesses recover from pandemic disruptions, the demand for corporate travel is increasing, particularly for international and cross-regional meetings and conferences.

- Technology Integration: The use of travel management platforms and tools to optimize travel bookings and costs is driving demand for efficient corporate travel solutions.

- Cost Management: Companies are more focused on cost control, pushing for better rates, more flexible terms, and greater transparency in their travel spending.

- Remote Work & Hybrid Models: The rise of hybrid work models is increasing the need for business travel for team collaborations, site visits, and client meetings.

Supply Factors:

- Airline and Hotel Supply: Key suppliers in the corporate travel market, including airlines and hotels, are adjusting capacity to meet growing demand while managing fluctuating costs due to fuel prices and labour shortages.

- Technology Adoption: The availability of advanced travel management systems and software helps streamline booking processes and optimize supplier management, contributing to supply efficiency.

- Global Supply Chain Issues: Ongoing global supply chain challenges, including labour shortages in the airline and hospitality industries, can impact the supply of corporate travel services, influencing pricing and availability.

- Competition Among Travel Providers: Increased competition among airlines, hotels, and travel agencies results in better service offerings, pricing options, and enhanced travel experiences for corporate clients.

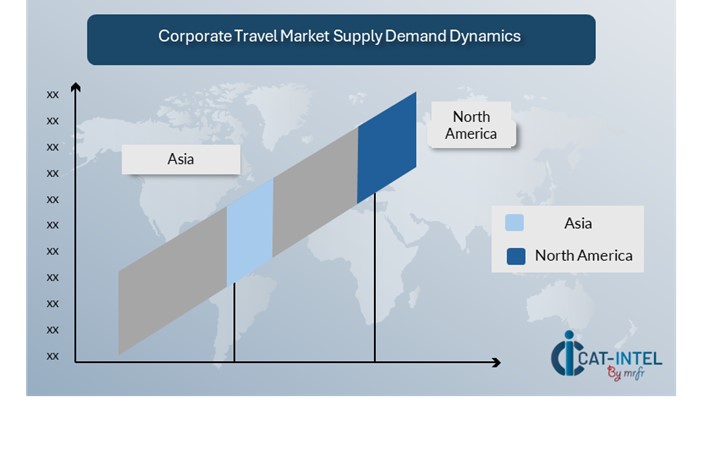

Regional Demand-Supply Outlook: Corporate Travel Market

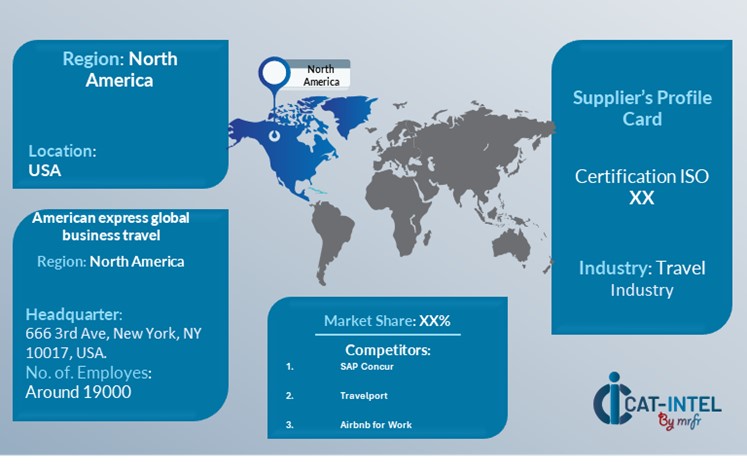

North America: A Key Player in the Corporate Travel Market

North America, particularly the U.S., plays a crucial role in the corporate travel market, characterized by:

- Leading Market Share: The U.S. holds a significant share of the global corporate travel market due to its large number of multinational corporations and frequent international business engagements.

- Strong Demand from Business Expansion: With businesses recovering from pandemic disruptions, demand for corporate travel is on the rise, particularly in sectors like finance, technology, and consulting.

- Technology Integration: Corporate travel management tools are being widely adopted by U.S. companies to optimize costs and enhance efficiency, driving further demand for technology solutions in the market.

- Cost Management Focus: Companies are seeking cost-effective travel options, leading to increased competition among suppliers for offering the best rates and value-added services.

- Sustainability Initiatives: Corporate responsibility for reducing carbon footprints is pushing companies to consider more sustainable travel options, like carbon offset programs and green hotels, positioning the U.S. market as a leader in responsible corporate travel.

North America remains a key hub for Corporate Travel market and its growth

Supplier Landscape: Supplier Negotiations and Strategies – Corporate Travel Market

The corporate travel market has a diverse and competitive supplier landscape, consisting of global and regional players that provide essential services and products for business travel. Key suppliers offer services such as airline bookings, hotel accommodations, car rentals, travel management software, and business event coordination, all of which play a critical role in streamlining corporate travel operations and ensuring a seamless experience for business travellers.

Currently, the supplier landscape is characterized by strategic relationships between corporate travel agencies, travel management companies, and service providers. These partnerships focus on optimizing travel costs, enhancing the traveller experience, and ensuring safety and compliance. In addition, the rise of digital tools and platforms is transforming the landscape, with many suppliers offering integrated solutions to simplify booking, expense management, and reporting.

Some of the key suppliers in the corporate travel market include:

- American Express Global Business Travel

- BCD Travel

- CWT (Carlson Wagonlit Travel)

- Travel Leaders Group

- Expedia Group

- Booking Holdings

- Sabre Corporation

- SAP Concur

- Travelport

- Airbnb for Work

Key Development: Procurement Category significant development

|

Category |

Significant Development |

|

Technology Integration |

Increasing adoption of travel management software (e.g., SAP Concur, Expensify) to streamline bookings, improve visibility, and enhance reporting capabilities. |

|

Supplier Consolidation |

Leading corporate travel management companies (e.g., BCD Travel, American Express Global Business Travel) are consolidating their supplier base to negotiate better rates and streamline processes. |

|

Sustainability Initiatives |

Growing emphasis on sustainable travel, with companies seeking eco-friendly options such as carbon offset programs, electric car rentals, and sustainable hotel options. |

|

Cost Optimization Strategies |

Use of data analytics and artificial intelligence to predict travel spending trends, optimize routes, and negotiate better rates with airlines, hotels, and car rental agencies. |

Procurement Attribute/Metric for Corporate Travel Market

|

Procurement Attribute/Metric |

Details |

|

Market Sizing |

The global corporate travel market is projected to grow from USD 1.18 trillion in 2023 to USD 1.9 trillion by 2032, with a CAGR of 7.5% during the forecast period. |

|

Adoption of Travel Management Solutions |

The increasing reliance on travel management software and mobile apps (e.g., SAP Concur, TravelPerk) is driving efficiency, with more companies using tech to streamline bookings and expense tracking. |

|

Top Strategies for 2024 |

Focus on cost optimization, increasing the adoption of sustainable travel policies, and improving employee safety and wellness during travel. |

|

Automation in Corporate Travel |

Over 50% of companies are automating travel booking and expense management using AI-driven tools to reduce administrative burden and enhance accuracy in travel-related expenses. |

|

Procurement Challenges |

Key challenges include fluctuating travel costs, ensuring duty of care for employees, and managing travel disruptions in global markets. |

|

Key Suppliers |

Major players in the corporate travel space include American Express Global Business Travel, BCD Travel, Carlson Wagonlit Travel, and FCM Travel Solutions. |

|

Key Regions Covered |

Major markets include North America, Europe, and Asia-Pacific, with significant demand from the U.S., Germany, and China for corporate travel management services. |

|

Market Drivers and Trends |

Growth is driven by the increasing global business travel, the adoption of sustainable travel initiatives, and the expanding use of technology to optimize travel experiences. |

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide a comprehensive analysis of global corporate travel suppliers. We offer spend analysis, supplier performance evaluations, and market insights to help you source travel services efficiently and cost-effectively, ensuring access to the best providers and competitive pricing.

We assist in evaluating the Total Cost of Ownership (TCO) by considering travel-related expenses such as ticketing, accommodation, transportation, duty of care, and expense management tools. Our cost analysis services ensure you understand the full financial impact of corporate travel procurement.

Our risk management framework identifies potential disruptions like global travel restrictions, price fluctuations, and supplier reliability issues. We offer solutions that help mitigate risks and ensure a consistent, secure travel experience for employees.

Our Supplier Relationship Management (SRM) services guide you in building strong relationships with corporate travel suppliers. We focus on improving collaboration, negotiating favourable terms, and ensuring consistent quality in services like booking, accommodations, and transportation.

We provide a breakdown of procurement best practices in corporate travel, including strategic sourcing models, supplier categorization, price benchmarking, and contract management. These practices ensure informed and efficient procurement decisions.

Digital transformation is crucial for streamlining corporate travel procurement. We offer solutions that integrate automation, AI, and data analytics to optimize travel booking, expense management, and supplier performance, improving overall efficiency and transparency.

Our supplier performance management solutions help you assess and monitor corporate travel providers, ensuring they meet quality, service level, and compliance standards. This enhances decision-making, reduces procurement risks, and strengthens supplier relationships.

We offer negotiation insights and strategies to help secure favourable pricing, volume discounts, and flexible terms with corporate travel suppliers. Our data-driven approach ensures your negotiations are backed by market intelligence and performance metrics.

We provide advanced market analysis tools that offer insights into global travel trends, supplier market share, pricing forecasts, and demand patterns. These tools help you understand the market landscape, identify opportunities, and make informed purchasing decisions.

Our procurement solutions include guidance on regulatory compliance in corporate travel, including travel policies, duty of care, and legal requirements. We help ensure all travel suppliers adhere to industry standards and local regulations for employee safety and corporate governance.

We provide strategies to manage disruptions by identifying alternative suppliers, establishing contingency plans, and staying updated on travel restrictions and market trends. Our insights help ensure a stable and efficient corporate travel program.

Through our supplier performance tracking tools, we help you monitor travel service quality, cost efficiency, and adherence to contractual terms. Regular evaluations and reports ensure continuous improvement and better decision-making.

We assist in identifying travel suppliers that follow sustainable practices, including eco-friendly accommodations, carbon offset programs, and green transportation options. Our services help you meet corporate social responsibility goals while optimizing travel procurement.

Our pricing analysis services allow you to compare travel costs across different suppliers and regions. We track pricing trends, market dynamics, and negotiation strategies to help secure the best value for your corporate travel needs.

We provide an in-depth analysis of market opportunities and risks, focusing on emerging trends in corporate travel, changing regulations, and global travel disruptions. Our insights help you stay competitive by identifying new opportunities and addressing potential risks in the market.