Summary Overview

CEP Market Overview

The Australian Courier, Express, and Parcel Services (CEP) market is undergoing rapid growth, driven by an expansion in e-commerce, increasing consumer demand for fast delivery services, and the development of innovative logistics solutions. The market has seen significant investments in automation, robotics, and last-mile delivery solutions, creating a dynamic and competitive landscape. Our report provides a comprehensive analysis of key procurement trends, focusing on cost optimization strategies, supplier performance management, and future challenges within the Australian CEP market. We also highlight the role of digital transformation in streamlining procurement processes and enhancing supply chain efficiency.

The outlook for the Australian CEP market is robust, with projections indicating steady growth through 2032, largely fuelled by e-commerce expansion and technological advancements. Strategic procurement and supply chain management are becoming increasingly essential as competition in the CEP industry intensifies. Companies are leveraging market intelligence and procurement analytics to optimize their operations, improve cost management, and enhance service delivery.

The Australian CEP market is poised for substantial growth, with several key trends and projections indicating a steady increase in demand through 2032:

-

Market Size: The Australian CEP market is projected to reach approximately AUD 9.3 billion by 2032, reflecting a compound annual growth rate (CAGR) of about 5.2% from 2024 to 2032.

Growth Rate: 5.2%

Key Growth Drivers and Trends

-

E-commerce Boom: The rapid growth of e-commerce is a primary driver for the increasing demand for courier, express, and parcel services in Australia. Consumers’ preference for faster and more flexible delivery options is creating new opportunities for CEP companies to cater to this expanding market. -

Technological Advancements: Automation and robotics are revolutionizing delivery operations, enhancing efficiency and reducing costs. The use of drones and electric vehicles for last-mile delivery is also gaining traction in Australia, further improving service offerings. -

Sustainability Initiatives: CEP companies are adopting eco-friendly solutions such as electric vehicles, sustainable packaging, and route optimization technologies to reduce carbon emissions and align with global sustainability goals. -

Health and Safety: The ongoing focus on health and safety standards is leading to an increase in demand for contactless and hygienic delivery methods. This is further bolstered by innovations in delivery tracking and safety measures, ensuring safe and timely deliveries. -

Regional Insights: Sydney and Melbourne remain the central hubs for CEP services, but there is growing demand in regional and remote areas, driven by e-commerce businesses expanding their reach across the country.

Sustainability Outlook

-

Sustainability in Operations: More CEP providers in Australia are investing in sustainable practices, such as using alternative fuels for transport, implementing energy-efficient technologies in warehouses, and reducing packaging waste. -

Rise of Digital Transformation: Digital procurement tools and data analytics are enhancing supply chain visibility and streamlining procurement practices. These tools allow CEP providers to track performance in real time and optimize their operational strategies to maintain competitive advantage. -

Improved Last-Mile Delivery Solutions: Companies are focusing on enhancing last-mile delivery capabilities, including integrating more efficient tracking systems and optimizing delivery routes to reduce costs and delivery times. -

Consumer Demand for Faster Deliveries: Consumers are increasingly demanding faster, same-day, or next-day deliveries, leading to an increased focus on last-mile delivery innovations and the need for CEP providers to adopt flexible service options.

Growth Drivers

-

E-commerce Growth: The surge in online shopping and the demand for fast and reliable delivery services is one of the main factors driving the growth of the CEP market in Australia. -

Digital Procurement: The adoption of digital procurement solutions allows for real-time supplier performance monitoring, optimized route planning, and better cost management, driving efficiency and reducing operational costs. -

Regulatory Changes: New regulations, including stricter environmental and safety standards, are pushing CEP companies to invest in cleaner technologies and sustainable logistics solutions. -

Technological Innovation: The rise of automation in warehousing, sorting, and last-mile delivery is contributing to the growth of the CEP market, reducing labour costs and enhancing operational efficiency. -

Infrastructure Development: Investments in logistics infrastructure, including smart warehouses, enhanced road networks, and port facilities, are helping facilitate smoother and faster deliveries across Australia.

Overview of Market Intelligence Services for the CEP Market in Australia

The Australian CEP market is witnessing increasing complexity in pricing dynamics, driven by fluctuating fuel prices, regulatory changes, and consumer demand shifts. Market reports offer detailed insights into cost forecasts, procurement strategies, and risk management approaches that help stakeholders navigate these challenges. By leveraging market intelligence solutions, companies can better manage costs, optimize their supply chains, and mitigate risks. Strategic sourcing practices, alongside performance management of suppliers, are critical to achieving long-term success in this competitive market. By utilizing these insights, CEP companies can streamline their operations, enhance service delivery, and remain competitive in an ever-changing market.

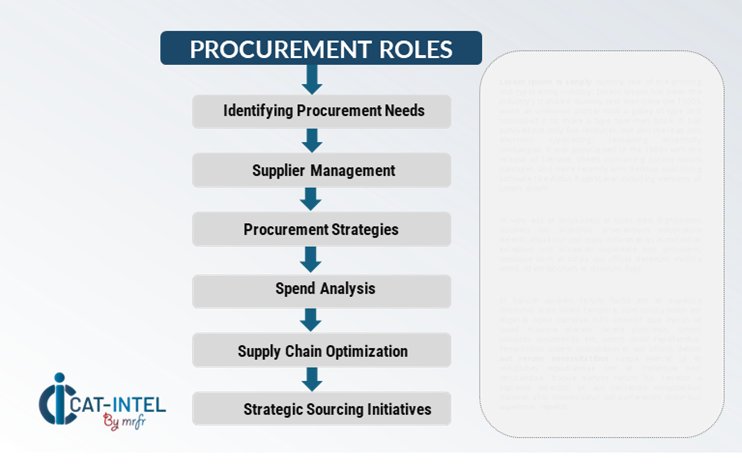

Procurement Intelligence for Courier, Express, and Parcel Services (CEP) Market: Category Management and Strategic Sourcing - Australia

"To remain competitive in the Australian Courier, Express, and Parcel Services (CEP) market, companies are refining their procurement strategies by utilizing spend analysis solutions to evaluate vendor spend and leveraging supply market intelligence to enhance supply chain efficiency. Procurement category management and strategic sourcing have become essential in achieving cost-effective procurement, ensuring timely delivery, and optimizing service quality. By strategically managing supplier relationships, companies in the CEP industry can reduce costs, improve operational performance, and better meet the growing demand for fast and reliable delivery services."

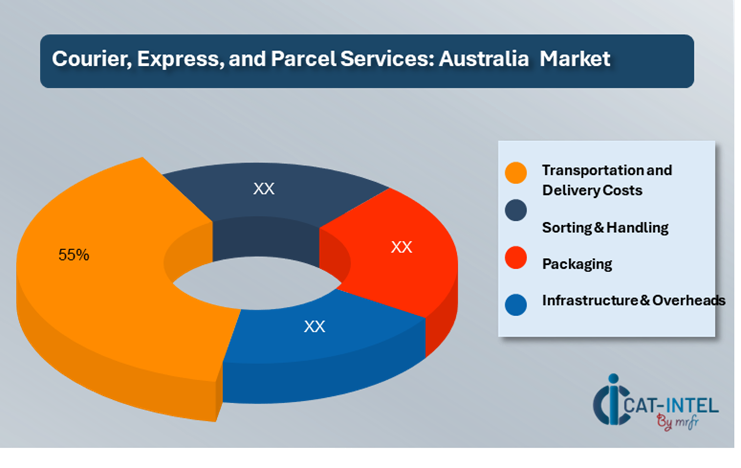

Cost Breakdown for the Courier, Express, and Parcel Services (CEP) Market: Cost Saving Opportunities – Australia

- Transportation and Delivery Costs (55%)

-

Description: This represents the bulk of the cost in the CEP market, covering transportation, fuel, vehicle maintenance, and last-mile delivery. The cost varies depending on the service provider, the type of delivery (standard or express), and the geographic region within Australia. -

Trends: Fuel costs, driver shortages, and increasing demand for same-day or next-day delivery have driven up transportation costs. Additionally, ongoing challenges in securing cost-effective transportation routes and adapting to urban congestion have increased costs. However, the rise of electric vehicles and sustainable transportation solutions is expected to lower costs over time. As of 2024, prices are expected to remain volatile due to global fuel price fluctuations and increasing demand for rapid delivery services.

- Labor (XX%)

- Sorting & Handling (XX%)

- Packaging (XX%)

- Infrastructure & Overheads (XX%)

Cost saving opportunity: Negotiation Lever and Purchasing Negotiation Strategies

In the Courier, Express, and Parcel Services (CEP) market in Australia, cost-saving opportunities arise through strategic purchasing and negotiation. Businesses can secure bulk discounts by consolidating shipments and forming buying groups, while technology integration, such as automation and AI-driven route optimization, reduces labour and transportation costs. Energy-efficient fleets and packaging optimization further lower operational expenses. Additionally, freight optimization and outsourcing to third-party logistics providers offer economies of scale, contributing to overall cost reductions. These strategies enable businesses to improve procurement efficiency and remain competitive in a growing market.

Supply and Demand Overview of the Courier, Express, and Parcel (CEP) Market in Australia: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Australian Courier, Express, and Parcel (CEP) market is experiencing significant growth, driven by factors such as the rise of e-commerce, increasing consumer expectations for fast and reliable delivery services, and technological advancements in logistics. This growth is particularly evident in the surge of online shopping, which has led to higher demand for efficient parcel delivery solutions.

Demand Factors:

-

E-commerce Expansion: The rapid growth of online shopping has significantly increased the demand for CEP services, as consumers expect quick and reliable delivery of purchased goods. -

Consumer Expectations: There is a growing expectation for faster delivery times and real-time tracking, prompting CEP providers to enhance their service offerings. -

Technological Advancements: Innovations in logistics technology, such as automation and data analytics, are driving demand for more efficient and cost-effective delivery solutions. -

Global Trade: The expansion of international trade has increased the need for cross-border CEP services, contributing to market growth.

Supply Factors:

-

Market Growth: The Australian CEP market is projected to reach USD 11.13 billion in 2024, with a compound annual growth rate (CAGR) of 5.12% expected through 2030. -

Key Players: Major companies operating in the Australian CEP market include Australia Post, DHL Group, FedEx, Singapore Post, and Toll Group. -

Service Segments: The domestic segment accounts for the largest share by destination, while the international segment is the fastest growing. -

Infrastructure Development: Ongoing investments in logistics infrastructure, such as distribution centers and transportation networks, are enhancing supply capabilities to meet rising demand.

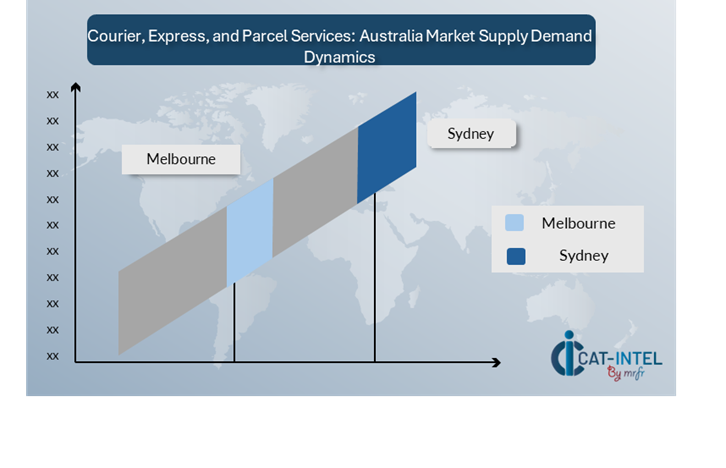

Regional Demand-Supply Outlook: Courier, Express, and Parcel (CEP) Services Market in Australia

The Courier, Express, and Parcel (CEP) services market in Australia is seeing robust growth, driven by increasing e-commerce demand, consumer expectations for fast deliveries, and advancements in logistics technologies. As a key player in the Asia-Pacific region, Australia’s CEP market is evolving rapidly.

Australia: A Key Player in the CEP Market

Australia plays a critical role in the CEP services market, characterized by:

-

Leading Providers: Major players such as Australia Post, Toll Group, and international companies like DHL and FedEx dominate the market, ensuring efficient service delivery across the country. -

Strong Domestic Demand: The continued expansion of online retail drives demand for fast, reliable delivery services within Australia. This is particularly evident in sectors like fashion, electronics, and food delivery services. -

Innovation in Services: The integration of advanced technologies such as automation, drone deliveries, and real-time tracking systems enhance delivery accuracy and speed, making Australian companies more competitive in the global market. -

Sustainability Focus: Increased adoption of sustainable practices such as electric vehicles for deliveries, energy-efficient warehousing, and green packaging solutions are helping providers meet environmental goals while maintaining competitiveness. -

E-commerce and Global Growth: With the rising demand for online shopping, especially post-pandemic, CEP services are experiencing rapid growth. The expansion of Australian e-commerce businesses into global markets further boosts demand for reliable, cross-border delivery solutions.

In Australia, Sydney remains a key hub CEP Services market and its growth

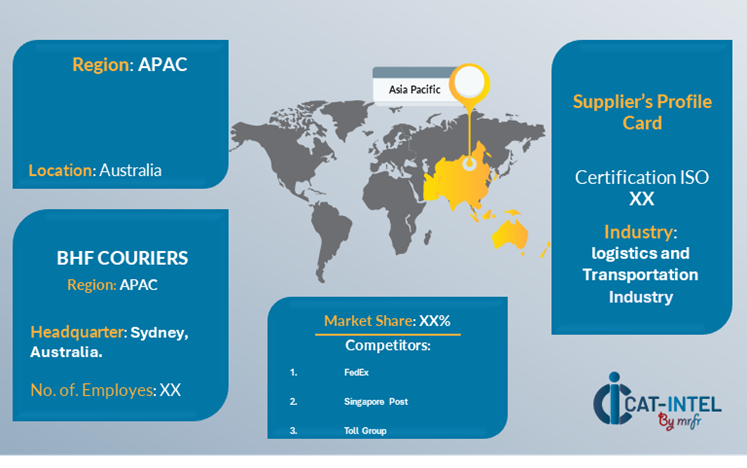

Supplier Landscape: Supplier Negotiations and Strategies in the Australian Courier, Express, and Parcel (CEP) Services Market

The Australian Courier, Express, and Parcel (CEP) services market is characterized by a diverse and competitive supplier landscape, comprising both domestic and international players that provide critical services essential for the efficient delivery of parcels and express shipments. Key suppliers offer a range of services, including domestic and international shipping, warehousing, last-mile delivery, and logistics technology solutions, all of which contribute to the overall efficiency and sustainability of the CEP industry.

Currently, the supplier landscape is characterized by strong relationships between CEP service providers and their partners, including technology providers, warehousing solutions, and last-mile delivery specialists. This collaboration is essential for maintaining service quality, enhancing delivery speed, and ensuring customer satisfaction.

Some of the key players in the Australian CEP market include:

- Australia Post

- DHL Group

- FedEx

- Singapore Post

- Toll Group

- Aramex Australia

- Direct Couriers Pty Ltd

- BHF Couriers

- Freightways

- FRF Holdings Pty Ltd

Key Development: Procurement Category significant development

Category |

Key Development |

Impact |

E-commerce Growth |

The rapid expansion of e-commerce, particularly due to the rise of online shopping, has significantly increased demand for CEP services in Australia. |

Higher volume of parcel deliveries, leading to increased demand for CEP services and innovation. |

Last-Mile Delivery Innovations |

Companies are investing in last-mile delivery solutions, including drones, autonomous vehicles, and electric delivery vehicles to enhance delivery efficiency and reduce carbon emissions. |

Improved delivery speeds, reduced costs, and a shift towards sustainable practices. |

Technological Integration |

Integration of advanced technology such as AI-driven route optimization, automated warehouses, and tracking systems to improve operational efficiency and customer experience. |

Better operational efficiency, improved customer satisfaction, and cost savings. |

Sustainability Initiatives |

Growing focus on sustainable practices, such as carbon-neutral deliveries and packaging reductions, led by major companies like Australia Post and FedEx. |

Reduced environmental impact and compliance with regulatory standards. |

Procurement Attribute/Metric |

Details |

Market Sizing |

The Australian CEP market is projected to 9.3 billion 2032, with an expected CAGR of 5.2% |

Adoption of CEP Services |

The rise of online shopping has significantly increased demand for CEP services, leading to a growing number of businesses operating within the sector. |

Top Strategies for 2024 |

Emphasis on sustainable practices, product diversification (same-day delivery, international shipping), and robust supply chain management. |

Automation in CEP Processing |

Over 40% of CEP facilities are adopting advanced sorting and delivery technologies to improve operational efficiency and reduce waste. |

Procurement Challenges |

Fluctuating fuel prices, climate-related risks, and maintaining quality during peak demand periods. |

Key Suppliers |

Major players include Australia Post, DHL Group, FedEx, Singapore Post, and Toll Group. |

Key Regions Covered |

Primarily serves domestic markets within Australia, with significant international demand from the United States, China, and the United Kingdom. |

Market Drivers and Trends |

Growth driven by e-commerce activities, technological advancements (GPS, automated sorting), and rising consumer expectations for faster, flexible, and transparent services. |