Summary Overview

Credit Bureau Services Market Overview

The global credit bureaus market is experiencing significant growth, driven by increasing consumer credit demand, technological advancements, and expanding financial inclusion initiatives. This dynamic market is characterized by the collection and analysis of consumer credit information, which is essential for lenders and financial institutions in assessing creditworthiness.

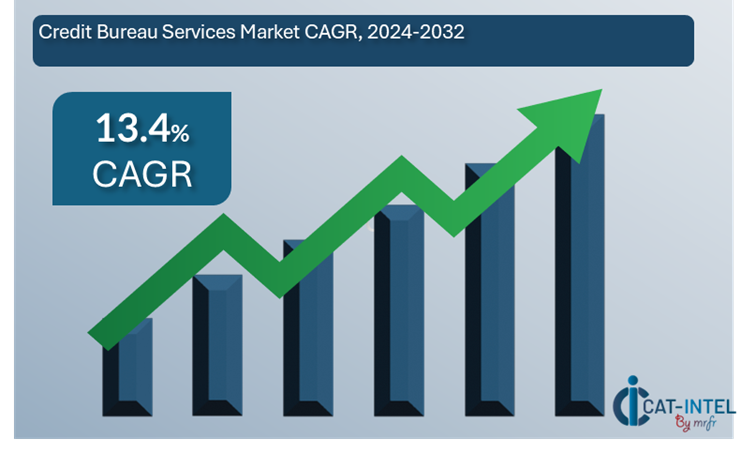

Market Size and Growth Rate:The credit bureaus market has demonstrated rapid expansion in recent years. In 2023, the market was valued at approximately USD 124.4 billion and is projected to reach around USD 385.6 billion by 2032, reflecting a compound annual growth rate (CAGR) of 13.4% from 2024 to 2032.

Sector Contributions:

-

Consumer Credit Demand: The surge in applications for credit cards, personal loans, and mortgages is propelling the need for comprehensive credit reporting services. For instance, the credit card application rate in the U.S. increased from 26.5% in 2021 to 27.1% in 2022. -

Financial Institutions: Lenders rely heavily on credit bureaus for accurate credit assessments to mitigate risks and make informed lending decisions.

Technological Transformation and Innovations:Advancements in data processing technologies, including the integration of alternative data sources and machine learning, are enhancing the accuracy and efficiency of credit assessments. Additionally, the adoption of blockchain technology is emerging as a significant trend, offering secure and transparent data-sharing platforms within the credit bureau industry.

Funding Initiatives:Government initiatives aimed at promoting financial inclusion are expanding access to credit services, thereby broadening the consumer base for credit bureaus. These efforts are particularly impactful in emerging markets, where access to credit has traditionally been limited.

Regional Insights:

-

North America: This region holds a substantial share of the credit bureaus market, attributed to its mature financial sector and high adoption of advanced credit scoring technologies. -

Asia-Pacific: Rapid economic development, increasing urbanization, and a rising middle class are driving demand for credit products, presenting lucrative opportunities for credit bureaus.

Key Trends and Sustainability Outlook:

-

Digital Transformation: The digitization of banking and financial services is streamlining credit assessment processes, improving accessibility, and enhancing user experience. -

Consumer Empowerment: There is a growing emphasis on consumer education regarding credit management, leading to increased demand for credit monitoring and identity protection services.

Growth Drivers:

-

Financial Inclusion: Efforts to extend credit access to underserved populations are expanding the customer base for credit bureaus. -

Regulatory Compliance: Stringent regulatory requirements necessitate accurate credit reporting and risk assessment, bolstering the demand for credit bureau services. -

Risk Management: Financial institutions' focus on mitigating credit risk underscores the importance of reliable credit bureau data.

Overview of Market Intelligence Services for the Credit Bureaus Market:Market intelligence reports provide detailed analyses of industry trends, competitive landscapes, and technological advancements. These insights assist stakeholders in making informed decisions, optimizing operations, and identifying growth opportunities within the credit bureaus market.

Procurement Intelligence for Credit Bureau Services Market: Category Management and Strategic Sourcing

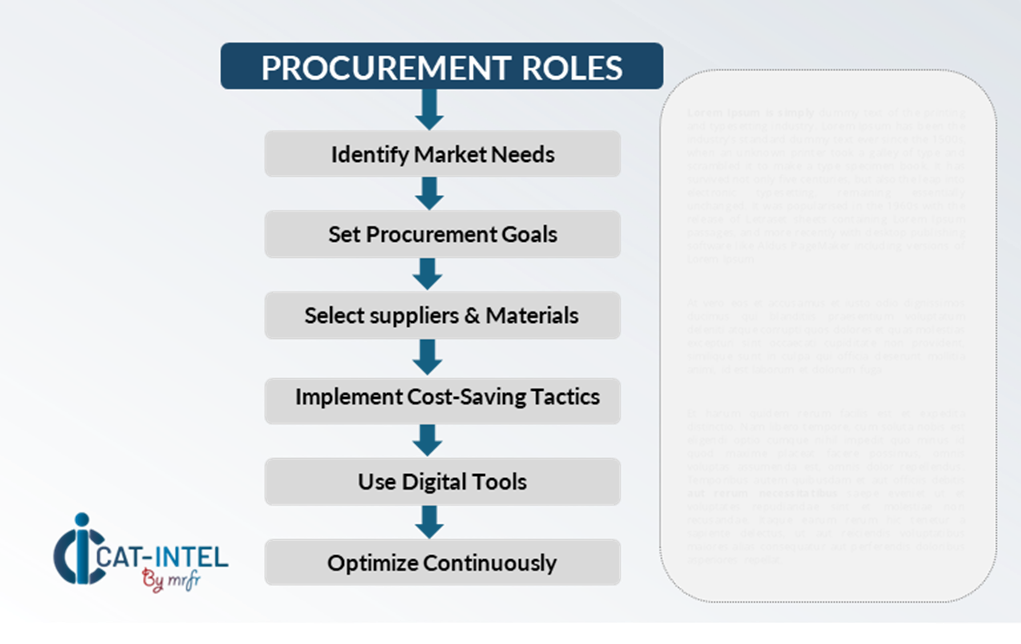

"To stay ahead in the credit bureau services market, companies are optimizing procurement strategies, leveraging advanced spend analysis solutions for vendor spend analysis, and improving operational efficiency through supply market intelligence. Procurement category management and strategic sourcing are becoming critical in achieving cost-effective procurement, ensuring timely access to accurate credit data, and maintaining compliance with regulatory standards. Organizations are also focusing on supplier performance management and implementing risk mitigation strategies to navigate dynamic market conditions effectively."

Pricing Outlook for Credit Bureau Services Market: Spend Analysis

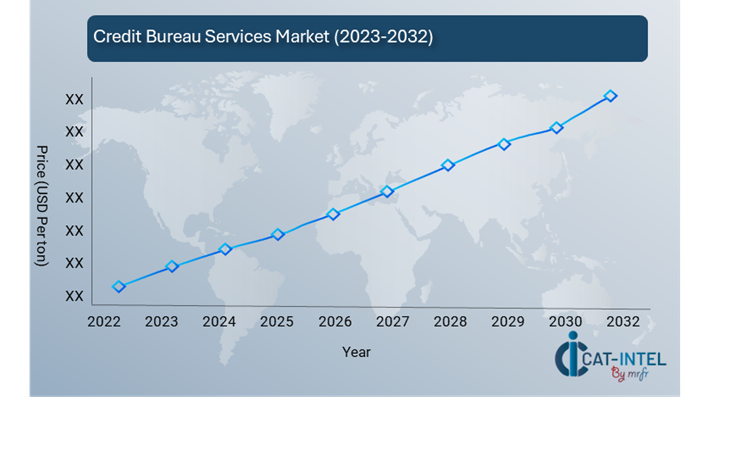

The credit bureau services market is experiencing a dynamic pricing landscape influenced by evolving technology, regulatory compliance requirements, and increasing demand for credit reporting and analytics services. This complex environment reflects the ongoing changes in financial services and consumer credit behaviour.

A line chart illustrating the pricing outlook for the credit bureau services industry from 2024 to 2032 shows a consistent upward trend, with gradual price increases over the forecast period.

Our advanced analysis highlights a steady growth trajectory in pricing for credit bureau services, driven by several key factors, including:

-

Technological Advancements: Investment in technologies such as AI, machine learning, and blockchain for enhanced credit data analysis and security is contributing to rising service costs. -

Regulatory Compliance: Increasingly stringent regulatory requirements for data privacy and credit reporting standards are pushing service providers to allocate more resources, affecting pricing structures. -

Rising Demand for Data Insights: Financial institutions' growing reliance on real-time credit data and analytics is driving up service demand and associated costs. -

Global Expansion: As credit markets expand globally, particularly in emerging economies, service providers face new operational and infrastructure costs, contributing to pricing variability. -

Data Security Costs: Enhanced measures for data protection and cybersecurity to address consumer privacy concerns are adding to operational expenditures.

Cost Breakdown for the Credit Bureau Services Market: Cost-Saving Opportunities

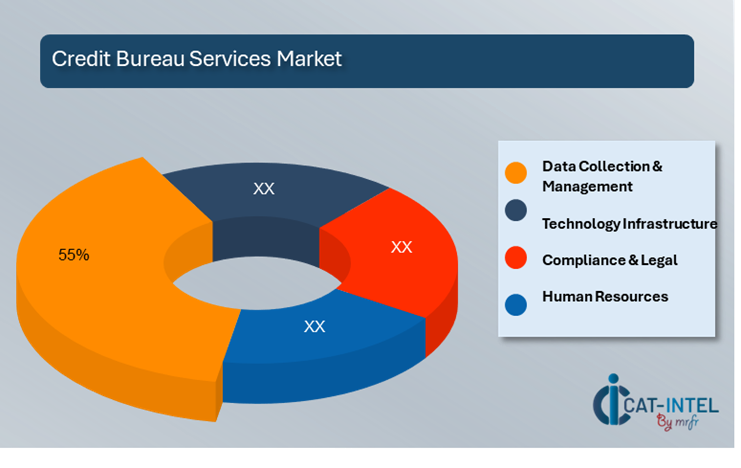

- Data Collection & Management (55%)

-

Description: Represents the majority of operational costs, including the acquisition, verification, and management of vast volumes of consumer credit data from various sources. -

Trends: Costs are rising due to the integration of alternative data sources and the implementation of advanced data management systems to improve accuracy and compliance. Investments in real-time data capabilities and artificial intelligence tools are also contributing to cost increases.

- Technology Infrastructure (XX%)

- Compliance & Legal (XX%)

- Human Resources (XX%)

Cost-Saving Opportunity: Negotiation Lever and Purchasing Strategies

In the credit bureau services market, cost-saving opportunities include collaborative purchasing to negotiate bulk discounts, adopting automation to reduce labour costs, and consolidating vendors to achieve economies of scale. Investing in AI-driven analytics and regulatory compliance tools minimizes operational inefficiencies and penalties. Performance-based contracts and outsourcing non-core functions further enhance cost efficiency, enabling stakeholders to optimize procurement and maintain a competitive edge.

Supply and Demand Overview of the Credit Bureau Services Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The credit bureau services market is expanding rapidly, driven by digital transformation, increased financial inclusion, and growing demand for real-time credit data solutions. Rising consumer credit activity and regulatory requirements further fuel market growth.

Demand Factors:

-

Rising Credit Activity: Increasing consumer and business credit activities drive demand for credit data, scoring, and monitoring services. -

Digital Transformation: Adoption of digital lending platforms and fintech solutions amplifies the need for real-time credit assessments. -

Regulatory Compliance: Enhanced financial regulations require frequent credit checks and reporting, boosting service demand. -

Globalization of Finance: Expanding global trade and financial markets increase demand for cross-border credit insights and risk assessments.

Supply Factors:

-

Technological Advancements: Integration of AI and machine learning in credit data processing ensures efficient and scalable supply of services. -

Data Partnerships: Collaboration with financial institutions and alternative data providers strengthens data availability and reliability. -

Global Presence: Leading credit bureaus expanding operations in emerging markets enhance supply capacity and accessibility. -

Vendor Competition: Increasing competition among service providers improves product offerings and ensures competitive pricing.

Regional Demand-Supply Outlook: Credit Bureau Services Market

The image depicts a surge in demand for Credit Bureau Services across North America and Asia, driven by the growing need for financial inclusion and credit risk management.

North America: A Key Player in the Credit Bureau Services Market

-

Leading Providers: North America hosts major credit bureaus, including global leaders such as Experian, Equifax, and TransUnion, ensuring a steady supply of high-quality credit insights. -

Advanced Solutions: Providers leverage cutting-edge technologies like AI, machine learning, and blockchain for efficient credit scoring, fraud detection, and real-time monitoring. -

Regulatory Requirements: Stringent financial regulations and increasing compliance mandates drive consistent demand for credit bureau services in the region. -

Consumer Credit Growth: Rising consumer credit activities, including mortgages and personal loans, fuel service demand. -

Market Expansion: Collaboration with fintech companies and digital lenders enhances service accessibility and broadens market reach.

North America remains a key hub for Credit Bureau services market and its growth

Supplier Landscape: Supplier Negotiations and Strategies in the Credit Bureau Services Market

The credit bureau services market comprises a diverse array of global and regional suppliers providing essential data, technology, and services for credit reporting, scoring, and risk assessment. Key suppliers offer various services, including data collection, analytics, and reporting solutions, which are crucial for the efficiency and sustainability of credit assessment processes.

Currently, the supplier landscape is characterized by strong relationships between credit bureaus and data providers, financial institutions, and technology partners. This collaboration is essential for maintaining data accuracy, enhancing analytical capabilities, and ensuring compliance with regulatory standards.

Some of the key suppliers in the credit bureau services market include:

- Equifax Inc.

- Experian PLC

- TransUnion LLC

- FICO

- S&P Global Inc.

- Moody's Corporation

- CRIF High Mark Credit Information Services Pvt. Ltd

- LexisNexis Risk Solutions

- Intuit Inc.

- ClearScore Technology Ltd.

Key Development: Procurement Category significant development

Key Development |

Description |

Impact |

Digital Procurement Platforms |

Adoption of advanced software solutions that integrate information, automate processes, and provide analytics. |

Streamlines procurement activities, enhances data accuracy, and improves decision-making. |

Agile Procurement Practices |

Implementation of flexible and responsive procurement strategies to adapt to market changes. |

Increases procurement efficiency and responsiveness to dynamic market conditions. |

Sustainability Integration |

Incorporation of environmental and social considerations into procurement decisions. |

Promotes responsible sourcing and supports corporate sustainability goals. |

Advanced Data Analytics |

Utilization of data analytics to gain insights into spending patterns and supplier performance. |

Enables informed decision-making and identifies opportunities for cost savings. |

Supplier Collaboration |

Strengthening partnerships with suppliers to drive innovation and improve product quality. |

Enhances supplier relationships and fosters mutual growth. |

Procurement Attribute/Metric |

Details |

Market Sizing |

Valued at $124.4 billion in 2023, projected to reach $385.6 billion by 2032, with a CAGR of 13.4% from 2024 to 2032. |

Adoption of Credit Bureau Services |

Growing utilization by financial institutions, lenders, and consumers for credit assessments and financial decision-making. |

Top Strategies for 2024 |

Focus on technological advancements, data security enhancements, and expansion into emerging markets. |

Automation in Credit Reporting |

Increasing implementation of automated systems for data collection, analysis, and reporting to improve efficiency and accuracy. |

Procurement Challenges |

Addressing data privacy concerns, ensuring compliance with evolving regulations, and managing the integration of diverse data sources. |

Key Suppliers |

Major players include Experian, Equifax, TransUnion, and Dun & Bradstreet, offering comprehensive credit reporting and analytics services. |

Key Regions Covered |

North America, Europe, and Asia-Pacific, with significant demand from the U.S., India, and China. |

Market Drivers and Trends |

Expansion of financial inclusion, increased consumer credit demand, and regulatory requirements are driving market growth. |