Summary Overview

Crude Oil Market Growth Overview:

The global crude oil market continues to play a pivotal role in energy production and industrial development, serving as a primary resource for transportation, power generation, and manufacturing industries. The market encompasses various crude oil grades and derivatives that cater to diverse industrial needs. Our report offers a comprehensive analysis of procurement trends, focusing on cost management strategies and leveraging digital tools to optimize procurement and refining processes.

Key challenges in crude oil procurement include volatility in global oil prices, geopolitical uncertainties, and evolving environmental regulations. Strategic sourcing and the use of digital procurement tools are essential for stabilizing supply chains and improving competitiveness. With demand anticipated to rise, market intelligence aids companies in mitigating risks and maximizing operational efficiency.

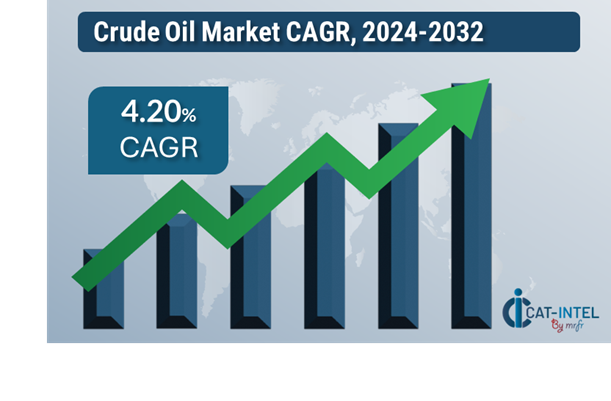

The crude oil market is projected to maintain steady growth through 2032, with the following key highlights:

-

Market Size: The global crude oil market is projected to reach USD 10.57 billion by 2032, growing at a CAGR of approximately 4.20 % from 2024 to 2032.

-

Sector Contributions: Growth is driven by: -

Energy Demand Growth: Expanding energy consumption in emerging economies continues to drive demand for crude oil and its derivatives. -

Industrial Applications: Growing use in petrochemicals, transportation fuels, and manufacturing sustains the market's importance. -

Technological Transformation and Innovations: Advancements in refining technologies, digital monitoring systems, and efficient extraction methods are reducing production costs and improving environmental compliance. -

Investment Initiatives: Companies are focusing on upgrading infrastructure, including advanced refineries and automated supply chain systems, to enhance efficiency and reduce operational risks. -

Regional Insights: North American regions remain key contributors, driven by extensive reserves, technological investments, and expanding production capacities.

Key Trends and Sustainability Outlook:

-

Enhanced Digital Integration: Adoption of digital tools for real-time tracking, inventory management, and procurement analytics is streamlining crude oil operations. -

Advanced Extraction Methods: Techniques such as hydraulic fracturing and enhanced oil recovery (EOR) are increasing production efficiency while addressing environmental concerns. -

Focus on Sustainability: Efforts to lower carbon emissions and implement cleaner extraction processes are reshaping the industry's approach to sustainability. -

Market Diversification: Demand for derivatives such as biofuels and specialty chemicals is increasing, reflecting diversification trends in crude oil utilization. -

Data-Driven Decision-Making: The use of analytics and big data is optimizing procurement processes and enabling predictive maintenance of equipment.

Growth Drivers:

-

Global Energy Demand: Expanding industrial and residential energy needs are key drivers for crude oil demand. -

Transportation Sector: Growing demand for automotive and aviation fuels continues to bolster the market. -

Regulatory Standards: Compliance with safety, quality, and environmental regulations is driving the adoption of advanced crude oil handling techniques. -

Sustainability Goals: Increasing investments in renewable derivatives and environmentally friendly refining practices are addressing global sustainability objectives. -

Technological Progress: Continuous advancements in drilling and refining technologies are improving production capabilities and reducing costs.

Overview of Market Intelligence Services for the Crude Oil Market:

Recent studies have identified challenges such as fluctuating crude oil prices and the complexities of meeting diverse quality standards. Market intelligence reports provide critical insights into procurement opportunities, enabling companies to optimize vendor selection, negotiate favorable terms, and maintain supply chain stability. These reports also help ensure compliance with environmental and regulatory requirements while achieving cost-efficiency in procurement.

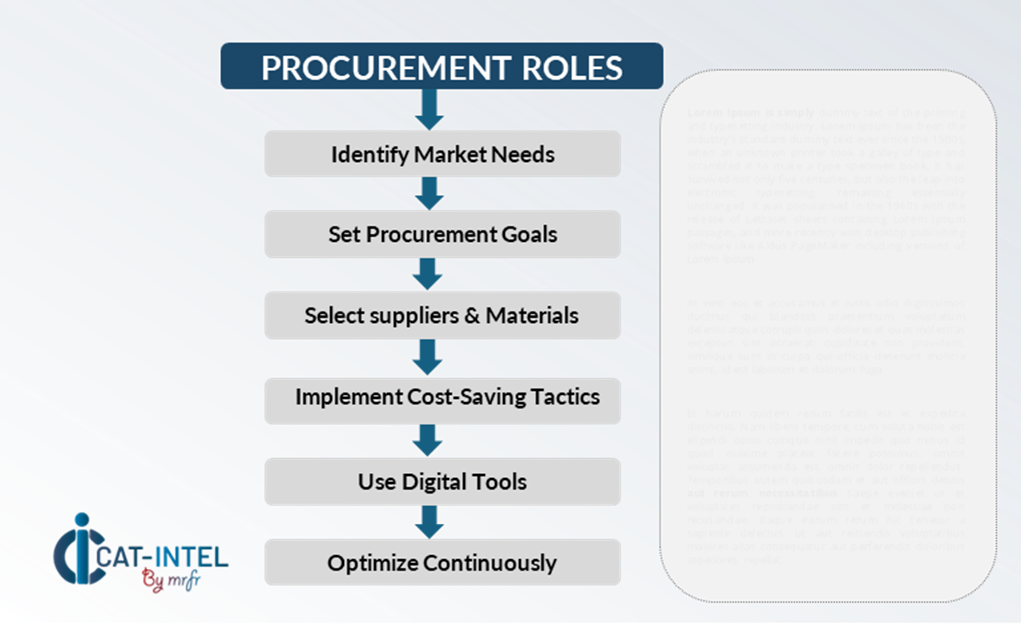

Procurement Intelligence for Crude Oil: Category Management and Strategic Sourcing:

To remain competitive, organizations are refining their procurement strategies by leveraging spend analysis, vendor performance monitoring, and market insights. Effective category management and strategic sourcing are essential for minimizing procurement costs, securing reliable supply chains, and maintaining quality standards. With actionable market intelligence, businesses can enhance their procurement frameworks and negotiate optimal terms, ensuring long-term operational success in the dynamic crude oil market.

Pricing Outlook for Crude Oil: Spend Analysis

The pricing outlook for crude oil is expected to exhibit moderate volatility, influenced by various critical factors. Key drivers include fluctuations in global crude oil demand, geopolitical tensions, changes in extraction and refining costs, and regulatory shifts aimed at reducing environmental impacts. Additionally, the transition towards cleaner energy sources and growing interest in sustainable practices are contributing to evolving price dynamics.

Graph shows general upward trend pricing for crude oil and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to enhance procurement strategies, optimize supplier relationships, and invest in advanced refining technologies are essential for managing costs effectively. Utilizing digital tools for market analysis, price forecasting, and supply chain monitoring can improve cost predictability and efficiency.

Collaborating with reliable crude oil suppliers, securing favourable long-term contracts, and adopting innovative extraction techniques are vital strategies for addressing pricing challenges. Ensuring compliance with regulatory standards, maintaining operational efficiency, and focusing on sustainable practices will be critical to achieving long-term cost control in the crude oil market.

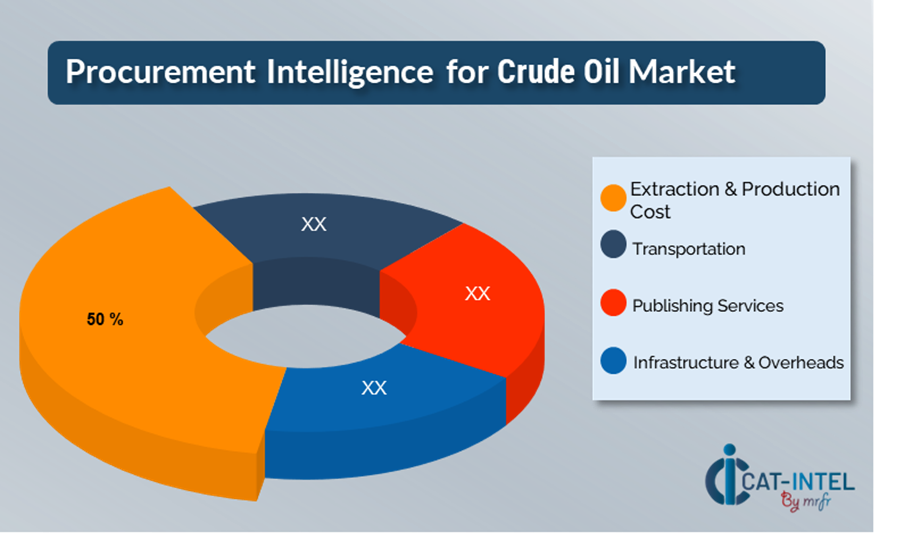

Cost Breakdown for Crude Oil: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Extraction and Production Costs (50%)

-

Description: A significant portion of crude oil expenses arises from the extraction process, including drilling, labor, and the deployment of advanced technologies. Costs are influenced by factors such as the complexity of the reserves, geographic location, and energy requirements for extraction. -

Trends: Companies are leveraging enhanced recovery techniques, automated drilling systems, and energy-efficient practices to optimize production costs. Partnerships with technology providers and investments in renewable energy integration are also shaping cost trends.

- Transportation (XX%)

- Publishing Services (XX%)

- Infrastructure & Overheads (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the crude oil industry, optimizing procurement processes and employing strategic negotiation tactics are essential for achieving cost savings and enhancing operational efficiency. Establishing long-term contracts with reliable oil suppliers, particularly in key production regions, can secure favourable pricing and terms such as volume discounts, fixed prices, and reduced transportation costs. Bulk purchasing and forward contracts offer additional opportunities to lock in lower rates and minimize the impact of price fluctuations.

Collaborating with suppliers that focus on technological advancements and sustainability can provide further advantages, such as access to cleaner energy sources, innovations in extraction processes, and reduced environmental compliance costs. Implementing digital tools for procurement management, including real-time tracking and predictive analytics, enhances operational efficiency, reduces lead times, and cuts overall procurement costs. Diversifying supplier networks and adopting multi-supplier strategies can help mitigate risks, such as geopolitical disruptions or supply chain bottlenecks, while increasing leverage during negotiations.

Supply and Demand Overview for Crude Oil: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The global crude oil market is characterized by fluctuating demand, influenced by factors such as geopolitical tensions, global economic growth, and energy transitions. The balance between supply and demand is shaped by production capabilities, technological advancements, and evolving regulations aimed at reducing carbon emissions.

Demand Factors:

-

Energy Consumption: The growing demand for energy, particularly in emerging markets, continues to drive crude oil consumption across multiple sectors. -

Industrial Applications: Crude oil remains a critical input for sectors such as transportation, petrochemicals, and manufacturing, driving consistent demand. -

Geopolitical Tensions: Political instability in key oil-producing regions often affects demand projections and oil prices. -

Regulatory Changes: Increasing regulations surrounding environmental impact and carbon emissions are shaping demand patterns, with a focus on cleaner and more efficient energy sources.

Supply Factors:

-

Production Capacity: The ability to meet global demand relies on the production capacity of oil reserves, the development of new reserves, and technological improvements in extraction methods. -

Geopolitical Events: Conflicts, trade disputes, and sanctions in oil-producing countries can disrupt supply and impact global pricing. -

Technological Advancements: Innovations such as fracking and enhanced oil recovery (EOR) are boosting production capabilities, improving supply reliability. -

OPEC Influence: The decisions of OPEC and other major oil producers have a significant impact on global supply and pricing strategies.

Regional Demand-Supply Outlook: Crude Oil North America:

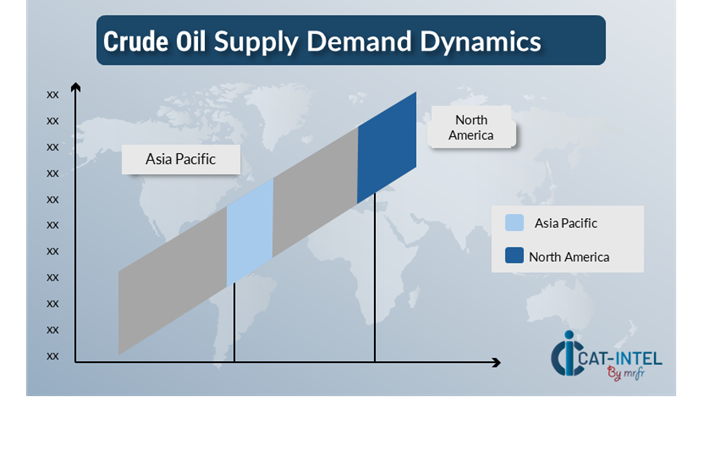

The Image shows growing demand for crude oil in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance on Crude Oil Market

North America remains an essential player in both crude oil production and consumption:

-

Shale Oil Boom: The U.S. has become one of the world’s largest oil producers due to the rise of shale oil, which has reshaped global supply dynamics. -

Technological Innovations: Advances in drilling technologies and extraction techniques, such as hydraulic fracturing, have helped increase production efficiency and reduce costs. -

Regulatory Focus: North America is implementing stricter environmental regulations and transitioning toward more sustainable energy sources, impacting crude oil demand and supply dynamics. -

Energy Transition: While still a major oil consumer, North America’s growing focus on renewable energy sources is affecting long-term demand projections for crude oil.

North America Remains a key hub Crude Oil price drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the crude oil market is diverse, with a combination of global oil giants and regional producers shaping industry trends. These suppliers significantly influence key factors such as pricing, production capacity, and supply reliability. Major players in the market dominate production, refining, and distribution, while smaller, specialized suppliers focus on niche markets, such as offshore drilling or alternative oil extraction methods.

The crude oil supplier ecosystem consists of established multinational oil companies, along with national oil corporations and independent producers, catering to both global and regional needs. As global demand for crude oil fluctuates, suppliers are enhancing production capacities, adopting advanced drilling technologies, and integrating sustainable practices to meet market needs efficiently while remaining competitive.

Key Suppliers in the Crude Oil Market Include:

- ExxonMobil

- Royal Dutch Shell

- Saudi Aramco

- BP

- Chevron

- TotalEnergies

- ConocoPhillips

- Gazprom

- Lukoil

- Oman Oil Company

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The crude oil market is experiencing consistent growth, driven by rising energy demands across industries such as transportation, manufacturing, and power generation, especially in developing economies. |

Sustainability Focus |

There is an increasing emphasis on reducing the carbon footprint associated with crude oil operations through advancements in emission control technologies and investment in renewable energy integration. |

Product Innovation |

Oil producers are developing cleaner refining techniques, producing low-sulfur fuels, and diversifying into biofuel blends to meet evolving regulatory and environmental requirements. |

Technological Advancements |

The adoption of cutting-edge technologies such as horizontal drilling, hydraulic fracturing, and enhanced oil recovery methods is improving extraction efficiency, maximizing reserves, and reducing operational costs. |

Global Trade Dynamics |

Shifts in international trade agreements, geopolitical tensions, and changes in export-import policies are influencing crude oil prices, supply stability, and market competitiveness. |

Customization Trends |

Increasing demand for customized crude oil solutions, such as specialized blends for specific industrial applications and low-carbon products, is shaping production and supply chain strategies. |

|

Crude Oil Attribute/Metric |

Details |

Market Sizing |

The global crude oil market is projected to reach USD 10.57 billion by 2032, growing at a CAGR of approximately 4.20 % from 2024 to 2032. |

Technology Crude Oil Adoption Rate |

Around 60% of oil producers are integrating advanced technologies such as digital oilfield solutions, AI-driven analytics, and automated drilling systems to enhance operational efficiency. |

Top Crude Oil Industry Strategies for 2024 |

Key strategies include optimizing production efficiency, investing in carbon capture technologies, diversifying into renewable energy, and enhancing supply chain resilience. |

Process Crude Oil Automation |

Approximately 45% of crude oil companies have implemented automation in extraction, refining, and distribution processes to reduce costs and increase productivity. |

Process Crude Oil Challenges |

Major challenges include fluctuating crude oil prices, regulatory pressures on emissions, geopolitical tensions, and ensuring a sustainable energy transition. |

Key Suppliers |

Prominent suppliers in the crude oil industry include ExxonMobil (USA), Saudi Aramco (Saudi Arabia), and BP (UK), offering diverse energy solutions globally. |

Key Regions Covered |

Major crude oil-producing regions include the Middle East, North America, and Russia, with significant demand in transportation, energy, and manufacturing sectors. |

Market Drivers and Trends |

Growth is driven by increasing global energy demand, technological advancements in oil recovery, expanding industrialization, and a gradual shift toward low-carbon fuel solutions. |