Customer Relationship Management Market Overview:

The global CRM market is witnessing significant growth, driven by increasing demand across industries such as retail, finance, healthcare, and technology. This market encompasses various CRM solutions, including cloud-based, on-premises, and industry-specific systems. Our report offers a comprehensive analysis of procurement trends, emphasizing cost-effective strategies and the integration of digital tools to optimize CRM adoption and management processes.

Key future challenges in procurement include managing vendor diversity, ensuring seamless integration with existing systems, and addressing rising demands for data security and compliance. Digital procurement tools and strategic sourcing are pivotal for streamlining the CRM procurement process and achieving competitive advantages. As global adoption of CRM solutions accelerates, organizations are utilizing market intelligence to enhance customer engagement and mitigate risks.

The CRM market is expected to sustain robust growth through 2032, with key highlights including:

- Market Size: The global CRM market is projected to reach USD 262.74 billion by 2032, growing at a CAGR of approximately 12.6% from 2024 to 2032.

- Sector Contributions: Growth in the CRM market is driven by:

- Digital Transformation: Rising adoption of cloud-based CRM solutions to enhance accessibility and scalability.

- Customer-Centric Strategies: Increasing focus on improving customer retention and personalized interactions through advanced analytics.

- Technological Innovations: Integration of artificial intelligence, machine learning, and predictive analytics into CRM platforms is enhancing decision-making and automation capabilities.

- Investment Trends: Businesses are investing in real-time data processing tools and integrated platforms to improve customer insights and operational efficiency.

- Regional Insights: North America remains a significant contributor due to widespread digital adoption and the presence of key industry players.

Key Trends and Sustainability Outlook:

- Enhanced Automation: Automation of CRM workflows, including lead management and customer service, is improving operational efficiency and customer experience.

- Data Privacy Focus: Increasing importance of compliance with global data protection regulations, such as GDPR, to ensure secure handling of customer information.

- Customization Demand: Growing need for industry-specific CRM solutions tailored to unique business processes and customer requirements.

- Sustainability Practices: Companies are emphasizing paperless operations and energy-efficient cloud solutions to align with sustainability goals.

- AI-Driven Insights: Leveraging AI for predictive analytics, sentiment analysis, and customer behaviour tracking to optimize engagement strategies.

Growth Drivers:

- Customer Experience Prioritization: Businesses are investing in CRM systems to deliver seamless and personalized customer experiences.

- Cloud Adoption: Transition to cloud-based solutions is driving flexibility, scalability, and cost-efficiency in CRM procurement.

- Regulatory Compliance: Rising demand for CRM systems that adhere to stringent data protection and privacy standards.

- Omnichannel Integration: Increasing emphasis on integrating CRM platforms with social media, email, and other communication channels for a unified view of customer interactions.

- Data-Driven Strategies: Organizations are leveraging CRM analytics to derive actionable insights and enhance decision-making.

Overview of Market Intelligence Services for the Customer Relationship Management Market:

Recent analyses highlight challenges such as vendor lock-in risks, integration complexities, and fluctuating costs for advanced features. Market intelligence reports provide actionable insights into CRM procurement opportunities, enabling businesses to identify cost-saving measures, enhance vendor negotiations, and build robust integration strategies. These insights ensure organizations maintain compliance, maximize return on investment, and achieve superior customer engagement outcomes.

Procurement Intelligence for Customer Relationship Management: Category Management and Strategic Sourcing:

To remain competitive in the CRM market, businesses are optimizing procurement processes through spend analysis and supplier performance tracking. Effective category management and strategic sourcing are crucial for reducing costs and ensuring consistent access to high-quality CRM solutions. By leveraging actionable market intelligence, organizations can refine their procurement strategies, secure favorable terms, and achieve long-term efficiency and customer success.

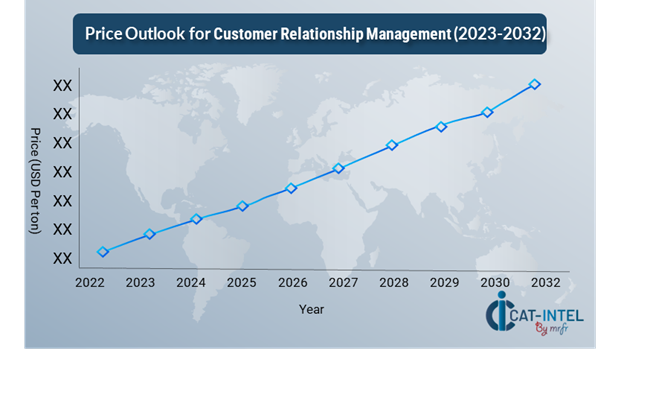

Pricing Outlook for Customer Relationship Management: Spend Analysis

The pricing outlook for Customer Relationship Management (CRM) systems is expected to remain moderately stable, with variations driven by several factors. Key determinants include the cost of software development and licensing, integration expenses, and the growing demand for advanced CRM features like artificial intelligence and analytics capabilities. Additionally, the shift toward cloud-based CRM solutions and the rising emphasis on data security and compliance requirements are contributing to potential upward pricing pressures.

Graph shows general upward trend pricing for customer relationship management and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement processes, enhance vendor management, and adopt scalable and efficient CRM platforms are essential for controlling costs. Leveraging digital tools for real-time monitoring, price forecasting, and efficient data integration planning can further optimize expenditures.

Partnering with reputable CRM providers, negotiating multi-year contracts, and ensuring seamless system integration are key strategies for managing CRM costs effectively. Despite these challenges, ensuring platform scalability, aligning with compliance standards, and adopting user-friendly interfaces will be critical to sustaining value-driven CRM investments.

Cost Breakdown for Customer Relationship Management: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Software Licensing and Subscriptions (50%)

- Description: A significant portion of CRM costs includes licensing fees for software or subscription costs for cloud-based CRM platforms. These expenses vary depending on the type of deployment (cloud or on-premises) and the scale of implementation.

- Trends: Companies are exploring strategies like volume-based discounts, bundled service agreements, and flexible pricing plans to manage costs. The adoption of open-source CRM solutions is also growing, offering a cost-effective alternative for small to medium-sized enterprises.

- Integration and Customization (XX%)

- Data Management and Security (XX%)

- Infrastructure & Overheads (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the CRM industry, optimizing procurement processes and employing strategic negotiation tactics can lead to significant cost savings and enhanced operational efficiency. Establishing long-term agreements with CRM vendors, particularly for enterprise-wide deployments, can secure better pricing and favourable terms such as volume-based discounts and extended support services. Bulk licensing purchases and multi-year contracts provide opportunities to lock in lower rates and mitigate price increases.

Collaborating with vendors focused on innovation and customization can offer additional advantages, including access to advanced CRM features and reduced costs through streamlined integrations. Leveraging digital tools for vendor management, such as real-time performance monitoring and demand forecasting systems, improves operational efficiency, minimizes downtime, and reduces overall procurement expenses. Diversifying vendor partnerships and adopting multi-vendor strategies help mitigate risks such as service outages or dependency on a single supplier, providing greater leverage during negotiations.

Supply and Demand Overview for Customer Relationship Management: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The CRM market is witnessing consistent growth, driven by increasing adoption across industries like retail, healthcare, and financial services. The balance between supply and demand is shaped by factors such as technological advancements, market competition, and data privacy regulations.

Demand Factors:

- Digital Transformation Initiatives: The growing need for businesses to enhance customer engagement and improve data-driven decision-making is driving demand for advanced CRM solutions.

- Remote Work Trends: The shift toward hybrid work environments has amplified the need for cloud-based CRM platforms that ensure seamless accessibility and collaboration.

- Customization Needs: Different industries require CRM systems tailored to meet specific operational needs and compliance standards.

- Integration Capabilities: The rising demand for CRMs capable of integrating with other enterprise systems, such as ERP and marketing tools, is pushing vendors to innovate.

Supply Factors:

- Technological Advancements: Innovations such as AI-driven analytics, process automation, and real-time data processing are improving CRM capabilities and market availability.

- Vendor Competition: A highly competitive vendor landscape is driving continuous improvements in features, scalability, and pricing options.

- Data Privacy Regulations: Compliance with stringent data security and privacy regulations influences supply dynamics and system development.

- Scalable Infrastructure: Increased investments in cloud infrastructure and platform scalability are ensuring consistent supply and system reliability.

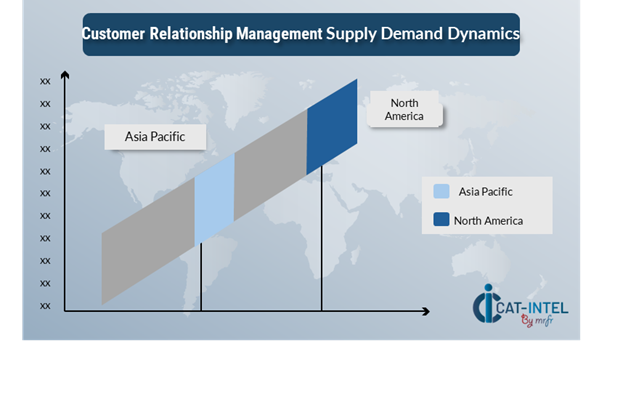

Regional Demand-Supply Outlook: Customer Relationship Management:

The Image shows growing demand for customer relationship management in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the CRM Market

North America, particularly the United States, remains a dominant player in the global CRM market due to several factors:

- Technological Advancements: The region is home to leading CRM vendors that drive innovation in features like predictive analytics, AI integrations, and omnichannel capabilities.

- High Adoption Rates: Businesses across sectors such as finance, healthcare, and retail are adopting CRM platforms to enhance customer relationships and drive operational efficiency.

- Focus on Data Security: Compliance with strict data privacy regulations like GDPR and CCPA ensures the development of secure CRM systems, increasing market confidence.

- Sustainability Initiatives: Vendors are integrating sustainability practices, such as reducing energy consumption in cloud operations and promoting digital transformation to minimize resource usage.

- Custom Solutions: Investment in customized CRM platforms tailored to industry-specific needs supports innovation and strengthens the region's market position.

North America Remains a key hub Customer Relationship Management price drivers Innovation and Growth.

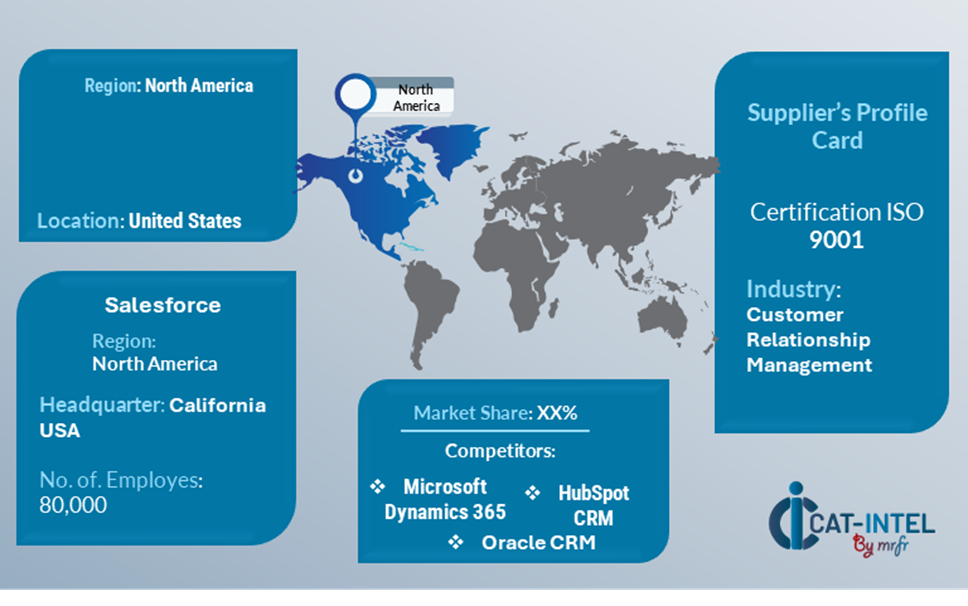

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the CRM market is diverse and highly competitive, comprising a mix of global leaders and regional players driving innovation and service quality. These suppliers significantly influence pricing structures, feature advancements, and customization options. Established CRM providers dominate the market with comprehensive solutions, while smaller, niche-focused vendors cater to specific demands, such as industry-tailored platforms and affordable, open-source options.

The CRM supplier ecosystem spans major technology hubs, featuring leading vendors and emerging providers meeting global and regional business requirements. As the adoption of CRM systems grows across industries like retail, healthcare, and financial services, suppliers are advancing their capabilities, incorporating cutting-edge technologies like artificial intelligence, and adopting flexible pricing models to deliver scalable, user-friendly, and cost-effective solutions.

Key Suppliers in the CRM Market Include:

- Salesforce

- Microsoft Dynamics 365

- HubSpot

- Zoho CRM

- Oracle CRM

- SAP Customer Experience

- Pipedrive

- SugarCRM

- Freshworks CRM

- Nimble

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The CRM market is experiencing robust growth driven by increasing adoption across industries such as retail, healthcare, and finance, especially in emerging markets. |

|

Sustainability Focus |

There is a growing emphasis on sustainable CRM practices, such as energy-efficient data centers and eco-friendly cloud infrastructure, to minimize environmental impact. |

|

Product Innovation |

CRM providers are expanding their product portfolios by offering AI-driven analytics, industry-specific solutions, and enhanced mobile CRM applications. |

|

Technological Advancements |

Advancements like AI-powered chatbots, predictive analytics, and machine learning are enhancing CRM functionalities, improving customer insights, and streamlining workflows. |

|

Global Trade Dynamics |

Changes in data protection regulations, international trade agreements, and compliance standards are shaping CRM adoption and influencing vendor strategies globally. |

|

Customization Trends |

Rising demand for tailored CRM solutions to meet specific business needs, such as omni-channel support and industry-focused features, is becoming increasingly prominent. |

|

CRM Attribute/Metric |

Details |

|

Market Sizing |

The global CRM market is projected to reach USD 262.74 billion by 2032, growing at a CAGR of approximately 12.6% from 2024 to 2032. |

|

CRM Technology Adoption Rate |

Around 60% of businesses are adopting advanced CRM technologies, such as AI-powered analytics, cloud-based platforms, and automation, to enhance customer engagement and operational efficiency. |

|

Top CRM Industry Strategies for 2024 |

Key strategies include adopting AI-driven insights, integrating omnichannel solutions, improving customer personalization, and focusing on data security and privacy compliance. |

|

CRM Process Automation |

Approximately 45% of CRM users have implemented automation in customer interaction, sales tracking, and service management to improve efficiency and reduce manual workloads. |

|

CRM Process Challenges |

Major challenges include managing data privacy concerns, maintaining system integration across channels, ensuring user adoption, and addressing scalability issues. |

|

Key Suppliers |

Leading CRM providers include Salesforce, Microsoft Dynamics 365, and HubSpot, offering a range of CRM solutions for various industries and business needs. |

|

Key Regions Covered |

Prominent CRM markets include North America, Europe, and Asia-Pacific, with significant adoption in retail, healthcare, and finance sectors. |

|

Market Drivers and Trends |

Growth is driven by the increasing need for personalized customer experiences, advancements in AI and machine learning, rising demand for cloud-based solutions, and improving customer retention strategies. |

Frequently Asked Questions (FAQ):

A1: Our procurement intelligence services provide a comprehensive analysis of the CRM software market, identifying key providers and evaluating industry trends. We offer spend analysis, supplier evaluations, and sourcing strategies to help secure the best CRM solutions at competitive prices.

A2: We help evaluate the TCO for CRM systems by considering licensing costs, implementation expenses, training fees, support costs, and any ongoing subscription or maintenance charges. This helps provide a full understanding of the long-term financial commitment involved in sourcing CRM solutions.

A3: Our risk management services address challenges such as data security concerns, system integration issues, and ensuring compliance with regulations like GDPR. These strategies support secure and effective CRM procurement processes.

A4: Our Supplier Relationship Management (SRM) services help build strong partnerships with CRM vendors. We assist with contract negotiations, track vendor performance, and help ensure smooth integration of CRM systems into your business operations.

A5: We recommend best practices such as evaluating CRM vendors based on scalability, integration capabilities, and customer support. Additionally, regular monitoring of system performance ensures efficient CRM procurement and continued value delivery.

A6: Digital tools improve CRM procurement by automating data collection, enhancing customer insights through analytics, and optimizing vendor management processes. These advancements streamline CRM sourcing, reduce costs, and boost efficiency.

A7: Our supplier performance management services evaluate key metrics such as system uptime, user support responsiveness, and update frequency. This ensures CRM vendors deliver consistent performance and meet service level agreements over time.

A8: We help negotiate advantageous terms by leveraging market insights, benchmarking pricing, and using strategies like volume-based discounts and flexible contract terms. These approaches secure better pricing and service conditions from CRM providers.

A9: We provide tools that offer detailed insights into CRM market trends, vendor capabilities, customer satisfaction ratings, and pricing forecasts. These resources enable data-driven decision-making for your CRM procurement strategies.

A10: We help ensure compliance by guiding you to select CRM systems that adhere to industry regulations, data privacy laws, and internal policies. This ensures compliance with GDPR, CCPA, and other relevant standards during CRM procurement.

A11: We recommend strategies such as diversifying CRM vendors, establishing contingency plans for system downtimes, and securing cloud-based solutions with robust service level agreements to mitigate potential disruptions.

A12: Our tracking solutions monitor performance metrics like system reliability, update frequency, and customer support satisfaction. This helps evaluate CRM vendor performance and informs future procurement decisions.

A13: We identify CRM vendors that focus on eco-friendly practices, such as energy-efficient data centres and reducing the carbon footprint of their operations. This helps align your CRM procurement with your sustainability goals.

A14: Our pricing analysis compares CRM vendor rates, monitors market trends, and employs negotiation techniques to secure competitive pricing without compromising on functionality, user experience, or service quality.