Dairy Derivatives Market Overview:

The global dairy derivatives market is experiencing steady growth, driven by rising demand across various sectors including food and beverage, pharmaceuticals, and animal feed. This market encompasses a range of dairy derivatives such as whey protein, milk powder, lactose, and cheese powder. Our report provides an in-depth analysis of procurement trends, emphasizing strategies for cost optimization and the integration of digital tools to enhance procurement and manufacturing processes.

Key future challenges in procurement include managing price volatility of raw materials, ensuring supply chain stability, and responding to increasing demands for product innovation and quality. Digital procurement tools and strategic sourcing will play a crucial role in optimizing the dairy derivatives supply chain and improving long-term competitiveness. As global demand continues to grow, companies are leveraging market intelligence to drive efficiency and mitigate risks.

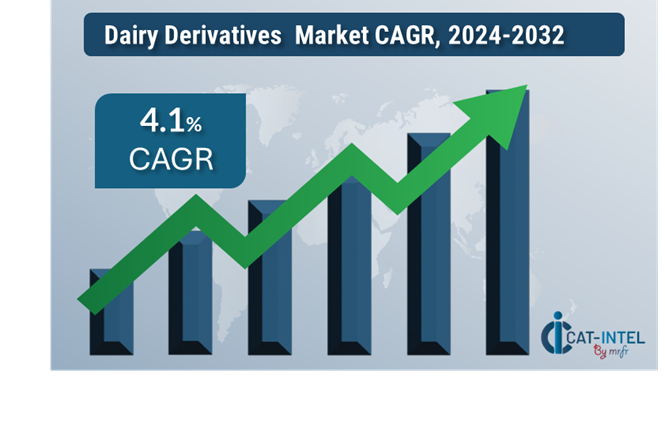

The dairy derivatives market is expected to maintain steady growth through 2032, with key highlights including:

- Market Size: The global dairy derivatives market is projected to reach USD 63 billion by 2032, growing at a CAGR of approximately 4.1 % from 2024 to 2032.

Growth Rate: 4.1%

- Sector Contributions: Growth in the market is being driven by:

- Food and Beverage Demand: The increasing use of dairy derivatives in processed foods, protein supplements, and beverages.

- Nutritional Supplements: Rising demand for protein-enriched products and dairy-based supplements.

- Technological Advancements: Innovations in dairy processing technologies are improving product quality, nutritional content, and manufacturing efficiency.

- Investment in Manufacturing: Companies are investing in modern production technologies, such as automated whey protein extraction lines and real-time quality monitoring systems, to improve operational efficiency and reduce costs.

- Regional Insights: Europe remains a major contributor due to its strong dairy farming sector and the growing demand for dairy derivatives in the food and beverage industry.

Key Trends and Sustainability Outlook:

- Enhanced Digital Integration: Automation in dairy processing and manufacturing is improving efficiency, reducing errors, and optimizing production workflows.

- Sustainable Sourcing: Increasing focus on environmentally friendly dairy farming practices and reducing the carbon footprint of dairy derivative production.

- Product Customization: Rising demand for tailored dairy derivatives to meet specific nutritional, dietary, and regulatory needs.

- Data-Driven Manufacturing: Using big data and analytics to optimize production processes and maintain high-quality standards.

Growth Drivers:

- Health and Wellness Trends: Growing consumer preference for high-protein dairy products, including whey protein and milk powders, driven by the increasing awareness of health and fitness.

- Pharmaceutical and Nutraceutical Demand: Expanding use of dairy derivatives in pharmaceuticals, dietary supplements, and functional foods.

- Regulatory Standards: Tightening regulations in food safety and nutritional labelling are boosting the demand for certified and traceable dairy derivatives.

- Sustainability Initiatives: Companies are investing in sustainable dairy sourcing practices and eco-friendly packaging to meet consumer demand for environmentally responsible products.

- Customization: Increased demand for dairy derivatives tailored to specific applications such as infant formula, sports nutrition, and vegan alternatives.

Overview of Market Intelligence Services for the Dairy Derivatives Market:

Recent market analyses have identified key challenges such as fluctuations in raw material prices, supply chain disruptions, and increasing demand for specialized dairy derivatives. Market intelligence services provide valuable insights into procurement opportunities, helping companies identify cost-saving strategies, optimize supplier relationships, and improve supply chain resilience. These services also support compliance with industry regulations and ensure high-quality standards while managing procurement costs effectively.

Procurement Intelligence for Dairy Derivatives: Category Management and Strategic Sourcing:

To remain competitive in the dairy derivatives market, companies are refining procurement processes by employing spend analysis for vendor management and improving supply chain efficiency through market intelligence. Effective category management and strategic sourcing are essential for reducing procurement costs and ensuring the consistent supply of high-quality dairy derivatives. By leveraging actionable market insights, businesses can streamline procurement strategies and secure the best terms for their dairy derivative needs.

Pricing Outlook for Dairy Derivatives: Spend Analysis

The pricing outlook for dairy derivatives is expected to remain relatively stable, though subject to fluctuations influenced by several key factors. Changes in the costs of raw materials, such as milk, whey, and other dairy components, fluctuations in transportation expenses, and evolving regulatory standards related to food safety and sustainability are significant drivers of price trends. Additionally, the growing demand for high-quality, protein-enriched dairy products is contributing to upward price pressures, particularly in specialized derivatives such as whey protein and milk powder.

Graph shows general upward trend pricing for Dairy Derivatives and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement processes, improve supplier management, and adopt innovative dairy processing technologies will be key in controlling costs. Utilizing digital tools for market analysis, price forecasting through advanced analytics, and efficient supply chain management will help enhance cost control.

Collaborating with reliable dairy derivative suppliers, negotiating long-term contracts, and optimizing production processes are essential strategies for effectively managing price variations. Despite these challenges, maintaining product quality, meeting sustainability goals, and adopting cutting-edge manufacturing practices will be crucial for sustaining cost efficiency.

Cost Breakdown for Dairy Derivatives: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Materials (50%)

- Description: The primary costs in dairy derivative procurement involve purchasing raw materials such as milk, whey, casein, and other dairy by-products. These costs are heavily influenced by global milk production levels, seasonal variations, and regional sourcing conditions.

- Trends: Companies are increasingly sourcing milk and dairy derivatives from local farms to reduce transportation costs and mitigate the impact of price fluctuations. The rise in demand for premium dairy derivatives, such as whey protein and organic milk powders, also influences pricing. The trend towards using more sustainable and organic raw materials is also increasing costs, often resulting in higher premiums for such options.

- Labor (XX%)

- Packaging (XX%)

- Infrastructure & Overheads (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the dairy derivatives industry, optimizing procurement processes and utilizing strategic negotiation tactics can lead to significant cost reductions and enhanced operational efficiency. Establishing long-term partnerships with dairy suppliers, particularly in key milk-producing regions, can result in better pricing and favourable terms such as volume discounts, fixed pricing, and reduced transportation costs. Bulk purchasing and forward contracts can also help secure better rates and shield against price volatility.

Collaborating with suppliers that emphasize sustainability, and innovation can offer additional benefits, including access to eco-friendly dairy derivatives and cost savings through more efficient production processes. Utilizing digital tools for supply chain management, such as real-time inventory tracking, demand forecasting systems, and analytics, can streamline operations, minimize shortages, and reduce overall procurement costs. Diversifying supplier networks and adopting multi-supplier strategies can mitigate risks such as raw material shortages or production disruptions, while providing greater negotiating leverage.

Supply and Demand Overview for Dairy Derivatives: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The dairy derivatives market is experiencing steady growth, driven by increasing demand from sectors like food processing, nutrition, and pharmaceuticals. The balance between supply and demand is influenced by factors like milk production levels, regulatory changes, and global trade conditions.

Demand Factors:

- Health and Nutritional Trends: The growing demand for high-protein dairy derivatives, including whey protein, casein, and milk powder, is driven by the increasing popularity of protein supplements and health-conscious consumer behaviour.

- Sustainability Goals: The rising focus on sustainable and eco-friendly practices in food production has led to increased demand for dairy derivatives sourced from environmentally responsible operations.

- Functional Food and Beverage Requirements: The need for dairy derivatives in functional foods, beverages, and infant formula is growing as consumers seek more nutritious and tailored options.

- Customization Trends: There is a rising demand for customized dairy derivatives, including specialized proteins and flavours, to meet the diverse needs of the food and beverage industry.

Supply Factors:

- Milk Production Levels: The availability and cost of raw milk, which fluctuates due to seasonal conditions and regional variations, significantly impact the supply and cost of dairy derivatives.

- Technological Advancements: Innovations in dairy processing, such as membrane filtration and ultrafiltration techniques, are improving the production of dairy derivatives with higher efficiency and better quality.

- Global Trade and Regulations: International trade policies, tariffs, and the need for compliance with health and safety standards influence the pricing and availability of dairy derivatives in global markets.

- Operational Efficiency: Improvements in dairy farming practices, processing techniques, and logistics systems are ensuring more consistent supply and reduced lead times in the production of dairy derivatives.

Regional Demand-Supply Outlook: Dairy Derivatives

The Image shows growing demand for Dairy Derivatives in both Europe and Asia Pacific, with potential price increases and increased Competition.

Europe: Dominance in the Dairy Derivatives Market

Europe continues to dominate the global dairy derivatives market due to several factors:

- Strong Dairy Industry: Countries like Germany, France, and the Netherlands have well-established dairy farming and processing sectors, ensuring consistent supply and high-quality products.

- Technological Advancements: European manufacturers are leaders in dairy processing innovation, employing cutting-edge technologies to enhance product quality and operational efficiency.

- Regulatory Standards: Strict regulations and quality control in European dairy production ensure high safety standards for dairy derivatives, making them highly trusted in international markets.

- Focus on Sustainability: Europe is increasingly focusing on sustainability, with many dairy producers adopting practices such as organic dairy farming and reducing environmental impact in production processes.

Europe Remains a key hub Dairy Derivatives price drivers Innovation and Growth.

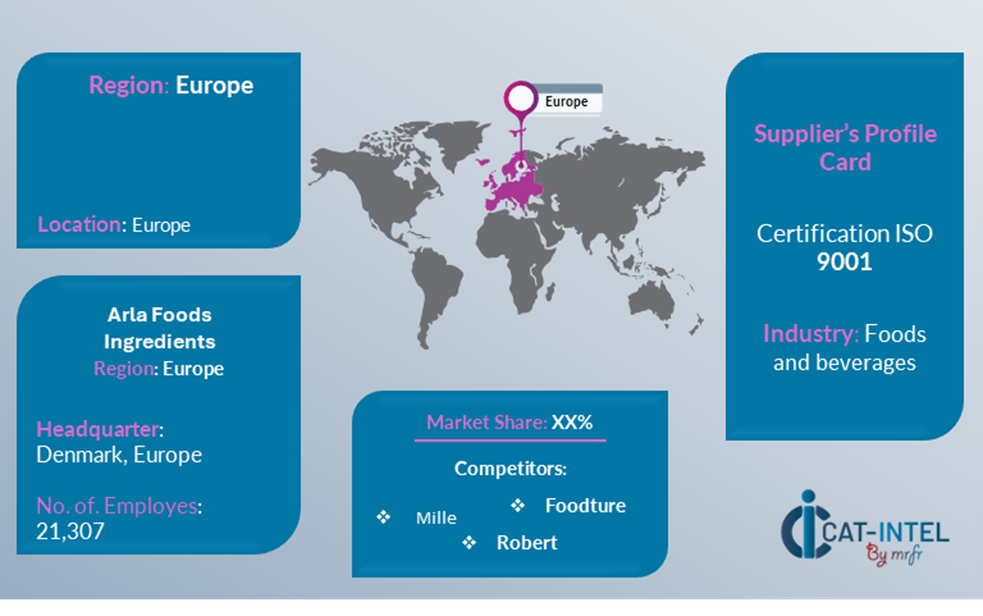

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the dairy derivatives market is diverse and highly competitive, with a mix of global and regional suppliers shaping industry dynamics. These suppliers play a crucial role in factors such as pricing, product innovation, and service quality. The market is dominated by established manufacturers that offer a wide variety of dairy derivative solutions, while smaller, specialized suppliers focus on niche demands, such as customized dairy ingredients and specialty products tailored to specific dietary needs or regulatory standards.

The dairy derivatives supplier ecosystem spans key dairy-producing regions globally, with leading players and emerging suppliers catering to both global and regional needs. As the demand for dairy derivatives continues to rise in sectors like food processing, nutrition, and pharmaceuticals, suppliers are enhancing production capabilities, integrating advanced processing technologies, and adopting sustainable practices to provide high-quality, cost-effective, and eco-friendly dairy ingredients.

Key Suppliers in the Dairy Derivatives Market Include:

- Arla Foods Ingredients

- Nestlé Professional

- Fonterra Co-operative Group

- Glanbia Nutritional’s

- Danone S.A.

- Lactalis Ingredients

- Saputo Inc.

- Friesland Campina

- Tetra Pak

- Kerry Group

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The dairy derivatives market is experiencing consistent growth, driven by increasing demand in sectors such as food processing, nutrition, and pharmaceuticals, especially in developing economies. |

|

Sustainability Focus |

There is a growing emphasis on sustainable dairy derivatives, with a rising demand for ingredients derived from eco-friendly production processes and a shift towards using less resource-intensive methods. |

|

Product Innovation |

Dairy derivative manufacturers are expanding their product portfolios, offering specialized ingredients such as lactose-free, low-fat, and plant-based alternatives to meet diverse consumer needs. |

|

Technological Advancements |

Innovations in dairy processing technologies, such as membrane filtration and advanced fermentation techniques, are enhancing product quality, improving nutritional profiles, and reducing production costs. |

|

Global Trade Dynamics |

Changes in global trade policies, tariffs, and regulatory frameworks are influencing the supply chains for dairy derivatives, affecting availability, pricing, and market entry strategies. |

|

Customization Trends |

Increasing demand for customized dairy derivatives, such as tailored nutritional profiles and functional ingredients for specific applications in health supplements and fortified foods, is gaining momentum. |

|

Dairy Derivatives Attribute/Metric |

Details |

|

Market Sizing |

The global dairy derivatives market is projected to reach USD 63 billion by 2032, growing at a CAGR of approximately 4.1 % from 2024 to 2032. |

|

Dairy Derivatives Technology Adoption Rate |

Around 45% of dairy derivative manufacturers are adopting advanced processing technologies, such as membrane filtration, fermentation, and plant-based innovations to enhance efficiency and quality. |

|

Top Dairy Derivative Industry Strategies for 2024 |

Key strategies include focusing on plant-based alternatives, improving sustainability practices, optimizing ingredient quality, and expanding customization for health-conscious consumers. |

|

Dairy Derivatives Process Automation |

Approximately 35% of dairy derivative producers have implemented automation in production, quality control, and packaging to enhance productivity and reduce costs. |

|

Dairy Derivatives Process Challenges |

Key challenges include managing raw material supply fluctuations, ensuring compliance with food safety regulations, meeting evolving consumer preferences, and addressing sustainability concerns. |

|

Key Suppliers |

Leading suppliers in the dairy derivatives market include Fonterra Co-operative Group (New Zealand), Arla Foods Ingredients (Denmark), and Glanbia Nutritional’s (USA), offering a variety of dairy-based products. |

|

Key Regions Covered |

Prominent dairy derivative manufacturing regions include North America, Europe, and Asia-Pacific, with strong demand in food processing, nutritional supplements, and beverage industries. |

|

Market Drivers and Trends |

Growth is driven by increasing demand for dairy-based functional ingredients, plant-based dairy alternatives, advancements in production technologies, and rising consumer demand for health and wellness products. |

Frequently Asked Questions (FAQ):

A1: Our procurement intelligence services provide comprehensive market analysis for dairy derivatives, identifying key suppliers and evaluating market trends. We offer spend analysis, supplier assessments, and strategic sourcing guidance to help secure reliable dairy ingredient suppliers at competitive prices.

A2: We assist in assessing the TCO for dairy derivatives by considering factors such as raw material costs, manufacturing expenses, logistics costs, and sustainability practices. This holistic approach ensures you fully understand the financial impact of sourcing dairy ingredients.

A3: Our risk management services address challenges like raw material price fluctuations, supply chain disruptions, and regulatory compliance. These strategies help mitigate risks and ensure a smooth, cost-effective dairy derivative procurement process.

A4: Our Supplier Relationship Management (SRM) services focus on fostering strong partnerships with dairy derivative suppliers. We support contract negotiations, performance tracking, and supplier integration into your supply chain to ensure long-term success.

A5: We recommend best practices such as supplier segmentation, cost analysis, quality control, and monitoring supply chain efficiency to facilitate transparent and effective dairy derivative sourcing.

A6: Digital tools optimize dairy derivative procurement by automating supply chain processes, enhancing inventory management, and streamlining order fulfilment. These advancements lead to cost savings and better operational performance.

A7: Our supplier performance management services evaluate critical factors such as delivery punctuality, product consistency, and compliance with food safety standards. This ensures reliable supplier performance in the long run.

A8: We assist in negotiations by leveraging market insights, conducting cost benchmarks, and utilizing strategies like bulk purchasing and flexible delivery schedules. These tactics help secure favourable terms with dairy derivative suppliers.

A9: We provide market analysis tools that offer valuable insights into raw material costs, supplier trends, and production forecasts. These tools support data-driven decision-making for your dairy derivative procurement strategies.

A10: We guide you in adhering to industry regulations and internal policies by ensuring that suppliers meet relevant food safety, sustainability, and quality standards, maintaining compliance throughout the sourcing process.

A11: We recommend strategies like diversifying your supplier base, implementing contingency plans, and establishing alternative logistics channels to minimize potential disruptions in dairy derivative procurement.

A12: Our tracking solutions monitor essential performance metrics, such as product quality, delivery accuracy, and customer service, helping you assess supplier reliability and make informed decisions for future sourcing.

A13: We identify suppliers that prioritize eco-friendly practices, such as sustainable dairy farming and reducing the environmental impact of production processes, helping align your procurement strategy with sustainability goals.

A14: Our pricing analysis compares supplier rates, tracks market trends, and applies effective negotiation strategies to secure competitive pricing for high-quality dairy derivatives, ensuring cost-efficient sourcing.