Summary Overview

External Audit Services Market Overview:

The global external audit services market is growing steadily, driven by demand from industries like banking, healthcare, retail, and technology. The market is projected to reach $313 billion by 2031, with the external audit segment growing at a rate of 4.5% annually. The integration of AI and machine learning is transforming audits, making them faster and more accurate. However, these technologies come with high costs and concerns over data security and compliance.

Key challenges for this market include managing costs, ensuring scalability, maintaining data security, and integrating audit software with existing systems. Digital tools and strategic sourcing are essential for improving audit processes and staying competitive. As demand rises, companies are using market intelligence to boost efficiency and reduce risks. Firms need to address challenges related to cost management, scalability, data security, and technology adoption to stay competitive.

-

Market Size: The global External Audit Services market is projected to reach USD 390.42 billion by 2035, growing at a CAGR of approximately 5.90% from 2025 to 2035.

- Sector Contributions to the Growth of External Audit Services:

-

Manufacturing and Supply Chain Optimization: Auditors assess supply chain processes to ensure financial reporting aligns with efficiency goals and identify areas for cost-saving or process improvement. -

Retail and E-Commerce Growth: As retail and e-commerce expand, auditors review financial systems to ensure inventory management, demand forecasting, and customer data are compliant with regulations and financial standards.

-

Technological Transformation in External Audit Services: AI and Machine Learning: AI and machine learning help auditors process data faster and more accurately, automating routine tasks and detecting potential financial risks earlier in the process.

-

Cloud-Based Audit Tools: Cloud-based audit tools provide auditors with real-time access to client data, ensuring timely assessments of financial security, compliance, and reporting.

-

Blockchain for Transparency: Blockchain is being used in audits to ensure the integrity of financial data and provide transparent, tamper-proof audit trails.

-

Regional Insights: In regions like North America and Asia Pacific, digital auditing tools are gaining traction. Auditors must stay updated on local digital trends to ensure compliance with regional regulations.

Key Trends and Sustainability Outlook for External Audit Services:

-

Cloud Integration: As cloud services become more popular, auditors focus on assessing the security, scalability, and transparency of cloud-based financial systems. -

Advanced Features in Audit Tools: Technologies such as AI, IoT, and blockchain are becoming essential in audits, allowing auditors to provide more accurate insights into financial integrity and transparency.

-

Sustainability Focus: Auditors are playing a key role in verifying businesses’ sustainability efforts, ensuring that data related to resource usage, emissions, and compliance with sustainability goals are accurately tracked and reported.

-

Industry-Specific Customization: As industries such as healthcare or financial services require tailored audit approaches, auditors must ensure systems meet the specific regulatory and reporting needs of these sectors.

-

Data-Driven Insights: Modern auditing tools use data analytics to help auditors optimize financial processes and provide deeper insights into performance, helping businesses make informed decisions.

Growth Drivers for External Audit Services:

-

Digital Transformation in Business: The increasing use of digital tools in businesses allows auditors to analyse large volumes of data more efficiently and offer better insights into potential financial risks. -

Demand for Automation: As companies automate more processes, auditors ensure that these systems remain compliant and function correctly, reducing human error and improving overall efficiency.

-

Scalability of Businesses: Auditors focus on ensuring that businesses' financial systems can scale with growth, maintaining compliance and efficiency even as operations expand.

-

Regulatory Compliance Needs: With increasing global regulations, auditors are more involved in ensuring that businesses stay compliant by automating financial reporting and ensuring accurate data handling. -

Globalization and International Compliance: As businesses expand globally, auditors ensure that companies meet international compliance standards, handling multi-currency, multi-language, and cross-border regulations effectively.

Overview of Market Intelligence Services for External Audit Services:

Research shows that external audit firms face challenges like the need to lower costs, keep up with technology, and stay on top of changing regulations. Market intelligence reports give auditors useful insights to find cost-saving opportunities, improve processes, and manage risks. These insights also help audit firms stay up to date with industry standards, boost efficiency, and make sure financial reports are compliant.

Procurement Intelligence for External Audit Services: Category Management and Strategic Sourcing:

Audit firms are improving how they buy services and tools by focusing on spend analysis and tracking vendor performance. Smart category management and strategic sourcing are key for reducing costs and ensuring high-quality resources. By using market intelligence, auditors can refine their purchasing strategies, negotiate better deals, and pick the right software and services to support their work.

Pricing Outlook for External Audit Services: Spend Analysis and Market Trends:

Prices for external audit services can vary depending on economic conditions, tech trends, and new regulations. Audit firms need to keep an eye on pricing changes, especially as clients increasingly ask for audits driven by new technologies like AI, data analytics, and stronger security and compliance. These demands can raise prices, and auditors must help clients manage these costs.

Through spend analysis, auditors can track price trends to ensure they’re providing services that are both cost-effective and compliant. This also helps companies get the best value for their audit spending.

Graph shows general upward trend pricing for External Audit Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Optimizing Procurement Processes for External Audit Services help clients optimize their procurement processes by focusing on cost control, maintaining strong vendor relationships, and adopting the latest technologies. Using digital tools to track market trends and predict pricing is essential for managing audit service costs.

Firms are also advising clients to consider subscription models or long-term contracts with service providers to better control expenses. Even with rising demand for more advanced audits, auditors emphasize the importance of keeping audits scalable, efficient, and in line with changing regulations.

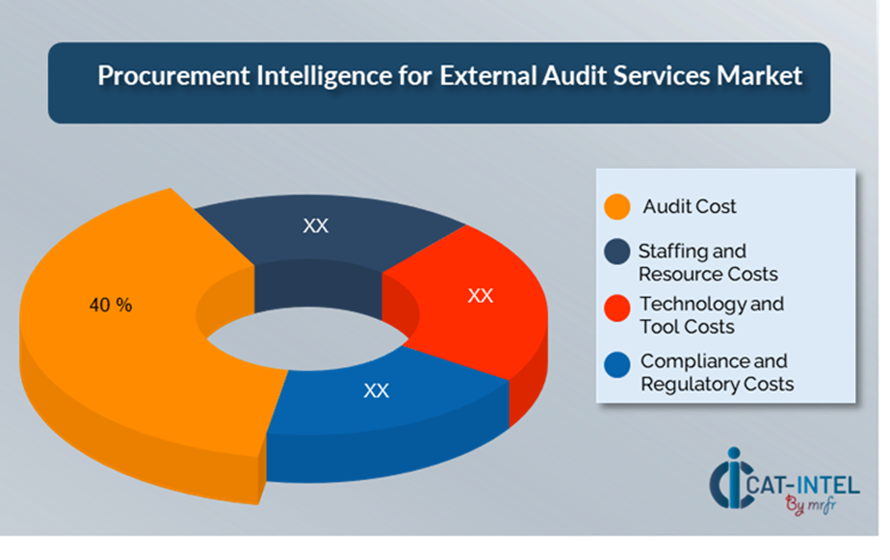

Cost Breakdown for ERP Software: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Audit Fees: (40%)

-

Description: Audit fees are the costs charged by external audit firms for providing their auditing services, typically based on the scope, complexity, and time required for the audit. -

Trend: There’s a trend towards more transparent and value-based pricing, where audit firms are increasingly offering flexible fee structures that align with the client’s needs and risk levels.

- Staffing and Resource Cost: (XX%)

- Technology and Tool Costs: (XX%)

- Compliance and Regulatory Costs: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Strategies for External Audit Services:

When it comes to external audit services, businesses can save costs by refining how they purchase these services and negotiating effectively. Long-term agreements with audit firms can lead to better pricing, including discounts based on volume or bundled service deals. Subscription models and multi-year contracts can help secure lower prices and protect against price increases over time.

Working with audit firms that use the latest technology—like AI and data analytics—can also bring cost savings in the long run. These technologies make audits more efficient and help reduce operational expenses. Additionally, using digital tools to manage contracts and track performance can increase transparency, prevent overuse of services, and make sure the company gets the most out of its audit spend. It’s also a good idea to work with multiple audit service providers, which can reduce reliance on a single vendor, mitigate risks, and give the company more negotiating power.

Supply and Demand Overview for External Audit Services: Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The market for external audit services is growing, with increasing demand for digital transformation, advanced technology, and specialized audits, especially in industries like finance, healthcare, and manufacturing.

Demand Factors:

-

Digital Transformation: More companies are seeking centralized data management and automation, driving up the need for audit services that can integrate with these technologies. -

Regulatory Compliance: Industries such as healthcare and finance require audits that ensure strict regulatory compliance, increasing demand for specialized services. -

Technological Advancements: As businesses rely more on data analytics and AI, there’s a rising need for audit services that incorporate these tools. -

Industry-Specific Needs: Different sectors need customized audit services that fit their unique operational and regulatory requirements.

Supply Factors:

-

Technological Advancements: New technologies like AI and cloud computing are helping audit firms deliver more efficient and accurate services, increasing competition among providers. -

Vendor Ecosystem: With more audit service providers available—both large firms and niche players—companies have more options to choose from. -

Global Economic Factors: Economic conditions, like exchange rates and labour costs, affect the pricing and availability of audit services. -

Scalability and Flexibility: Audit firms are offering more flexible and scalable services, which allow them to meet the needs of companies of all sizes.

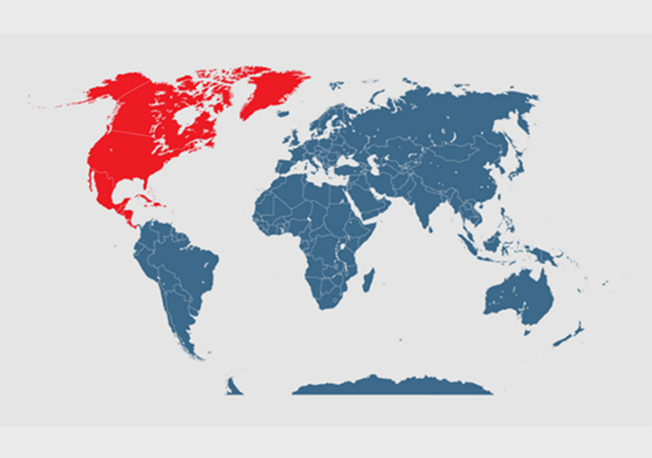

Regional Demand-Supply Outlook: External Audit Services:

The Image shows growing demand for External Audit Services in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the External Audit Services Market

North America, particularly the United States, is a dominant force in the global External Audit Market due to several key factors:

-

Strict Regulations: North America has tough financial rules, which create a consistent need for audit services to ensure businesses stay compliant. -

Home to Major Audit Firms: Big audit firms like Deloitte, PwC, and EY are based in North America, making the region a key player in the audit services market. -

Adoption of New Technology: North American firms are quick to implement new tech like AI and blockchain, which makes audits faster and more efficient. -

Strong Business Environment: With many large companies across various industries, North America consistently requires external audit services to meet financial and operational needs. -

Global Influence: As a global business hub, North America sets international standards that increase demand for audit services, both locally and globally.

North America Remains a key hub External Audit Services Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies in External Audit Services

The external audit services market is competitive, with big global firms and smaller, regional ones offering various services. Major firms like Deloitte, PwC, EY, and KPMG lead the market, providing a wide range of audit services to large businesses. Smaller, specialized firms focus on specific industries or offer unique services like forensic accounting or IT audits.

Across different regions, both well-known international firms and local players are adapting to industry needs. As businesses focus more on staying compliant and managing risks, audit firms are improving their tech, like using AI and data analytics, and offering flexible services to meet new demands.

Key Suppliers in the External Audit Market include:

- Grant Thornton

- Deloitte

- PricewaterhouseCoopers (PwC)

- Ernst & Young (EY)

- KPMG

- BDO International

- RSM International

- Crowe

- Protiviti

- Mazars

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The demand for external audit services is growing as more businesses focus on staying compliant, managing risks, and meeting regulatory requirements, especially in emerging markets where business activity is expanding. |

Cloud Adoption |

More companies are moving to cloud-based audit services because they offer greater flexibility, cost savings, and the ability to work remotely, which is especially important with the rise of hybrid work setups. |

Product Innovation |

Audit firms are adding new services, like AI-driven data analysis and real-time risk assessments, along with customized solutions for specific industries such as healthcare, finance, and manufacturing. |

Technological Advancements |

New technologies like machine learning, blockchain, and robotic process automation (RPA) are helping audit firms work more efficiently, providing valuable insights and automating repetitive tasks. |

Global Trade Dynamics |

Changes in trade laws, compliance rules, and regional economic policies are driving the need for more external audits, particularly for multinational companies dealing with complex financial situations. |

Customization Trends |

Businesses are increasingly looking for audit services that can be customized to meet their specific needs, with flexible plans and the ability to integrate with other tools for more personalized solutions. |

|

External Audit Services Attribute/Metric |

Details |

Market Sizing |

The global External Audit Services market is projected to reach USD 390.42 billion by 2035, growing at a CAGR of approximately 5.90% from 2025 to 2035.

|

|

External Audit Services Technology Adoption Rate |

Approximately 60% of businesses worldwide use external audit services to ensure compliance and maintain financial transparency, with a growing focus on adopting AI and cybersecurity practices. |

Top External Audit Services Industry Strategies for 2025 |

Key strategies for audit firms in 2025 include using AI for better accuracy in audits, enhancing cybersecurity, analysing data to manage risks more effectively, and ensuring they stay ahead of changing regulations. |

External Audit Services Process Automation |

Around 50% of audits are now automated, covering tasks like collecting data, checking compliance, and assessing risk, helping firms work faster and cut costs. |

|

External Audit Services Process Challenges |

Main challenges in the audit market include high fees, ensuring the security of sensitive data, adapting to constantly changing regulations, and maintaining audit quality while keeping costs under control. |

Key Suppliers |

The audit firms Grant Thorton, EY, KPMG, and PwC lead the market, offering comprehensive services to various industries. |

Key Regions Covered |

The top regions for external audit services are North America and Asia-Pacific, with demand particularly strong in industries like finance, healthcare, and manufacturing. |

Market Drivers and Trends |

The demand for external audits is increasing due to stricter regulations, the growing use of advanced technologies like AI, and a greater need for businesses to manage risk and maintain financial transparency. |