Summary Overview

Finance Accounting and Outsourcing Market Overview:

The need in sectors including manufacturing, retail, healthcare, and logistics is fuelling the steady expansion of the global market for finance, accounting, and outsourcing. This market includes a range of financial services, such as hybrid, on-premises, and cloud-based options. With a focus on cost optimization tactics and the use of digital tools to improve procurement and operational procedures, our report offers a thorough examination of procurement trends for finance accounting and outsourcing. Maintaining data security, controlling implementation costs, assuring scalability, and integrating financial solutions with current systems are some of the major procurement issues of the future. To ensure long-term competitiveness and maximize the adoption of financial services, digital procurement tools and strategic sourcing are crucial. As demand continues to increase globally, businesses are using market intelligence to reduce risks and improve operational efficiency.

-

Market Size: The global finance and accounting outsourcing market is projected to reach USD 123.45 billion by 2035, growing at a CAGR of approximately 12.1% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: Growing need for real-time data and smooth process integration to optimize operations and cut down on inefficiencies is driving market growth.

-

Retail and E-Commerce Growth: The expansion of retail and e-commerce involves the use of accounting and financial systems to improve customer relationship management (CRM), demand forecasting, and inventory management.

-

Technological Transformation: Financial services are being improved by advances in AI and machine learning, which make predictive analytics and automation possible for more effective

-

Innovations: Businesses may choose and include just the functions they require using modular accounting and finance solutions, which lowers expenses and complexity.

-

Investment Initiatives: To reduce infrastructure costs and provide remote access to necessary tools and data, businesses are investing in cloud-based financial systems.

-

Regional Insights: Strong digital infrastructure and rising use of cloud-based financial solutions have made North America and Asia Pacific major contributors to industry expansion.Key Trends and Sustainability Outlook:

-

Cloud Integration: The integration of the cloud: Because of its scalability, cost-effectiveness, and improved access to real-time data, cloud-based financial systems are becoming more and more popular.

-

Advanced Features: The incorporation of blockchain, IoT, and AI into financial processes is improving transparency, automation, and decision-making.

-

Focus on Sustainability: By improving tracking, reporting, and auditing capabilities, financial solutions are facilitating improved resource management and adherence to sustainability objectives.

-

Customization Trends: Increasing demand for financial modules designed specifically for industries such as manufacturing and healthcare, which enable more individualized service offers.

-

Data Driven Insights: Businesses may improve operational efficiency by forecasting demand, optimizing inventory, and monitoring financial performance measures with the use of advanced analytics.

Growth Drivers:

-

Digital Transformation: The transformation to digital Increased productivity and efficiency in accounting and financial operations are being driven by businesses' increasing usage of digital technologies.

-

Demand for Process Automation: Process automation is becoming more and more necessary as firms rely on digital solutions to automate monotonous financial processes, cut down on errors, and streamline operations so they can concentrate on making strategic decisions.

-

Scalability Needs: To accommodate growing operational needs and ensure seamless connection with other systems, businesses are looking for financial solutions that can grow with them.

-

Regulatory Compliance: By automating reporting, monitoring financial activities, and preserving data accuracy for audits, financial systems are helping to ensure that businesses follow requirements.

-

Globalization: The concept of globalization financial solutions that provide multi-currency, multi-language, and international compliance are becoming more and more in demand as they enable companies to function smoothly in a variety of worldwide marketplaces.

Overview of Market Intelligence Services for Finance Accounting and Outsourcing Market:

Key issues in the accounting, finance, and outsourcing sectors have been brought to light by recent investigations. These include the requirement for customized solutions and high implementation costs. Market intelligence studies give businesses practical insights into procurement prospects, assisting them in finding ways to cut costs, managing suppliers more effectively, and enhancing implementation success. These insights also maintain high-quality operating procedures, guarantee adherence to industry standards, and efficiently control expenses

Procurement Intelligence for the Finance Accounting and Outsourcing: Category Management and Strategic Sourcing. Businesses are using spend analysis and vendor performance tracking to streamline procurement procedures to stay competitive in the financial services industry. Strategic sourcing and efficient category management are essential for cutting procurement costs and guaranteeing a consistent flow of superior financial products. Businesses can improve their procurement tactics and negotiate advantageous terms for their financial solution by utilizing actionable market intelligence.

Pricing Outlook for Finance Accounting and Outsourcing: Spend Analysis

It is anticipated that the price landscape for outsourcing and financial services would continue to be quite volatile, with several variables potentially influencing changes. Technological developments, the increasing need for cloud-based solutions, customization requirements, and regional pricing differences are some of the major influencing factors. Financial services expenses are also rising as a result of the growing use of AI and IoT interfaces, as well as increased worries about data security and regulatory compliance.

Graph shows general upward trend pricing for Finance Accounting and Outsourcing and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to improve vendor management, streamline procurement procedures, implement modular financial solutions, crucial for cost containment. Cost efficiency can be increased by employing effective contract management procedures, price forecasting through analytics, digital technologies for market monitoring. Effective management techniques include investigating subscription-based pricing models, negotiating multi-year contracts, and collaborating with reputable service suppliers. Notwithstanding these obstacles, scalability, seamless deployment, and adoption of cloud-based systems will be essential for preserving operational excellence and cost-effectiveness in consideration of pricing outlook.

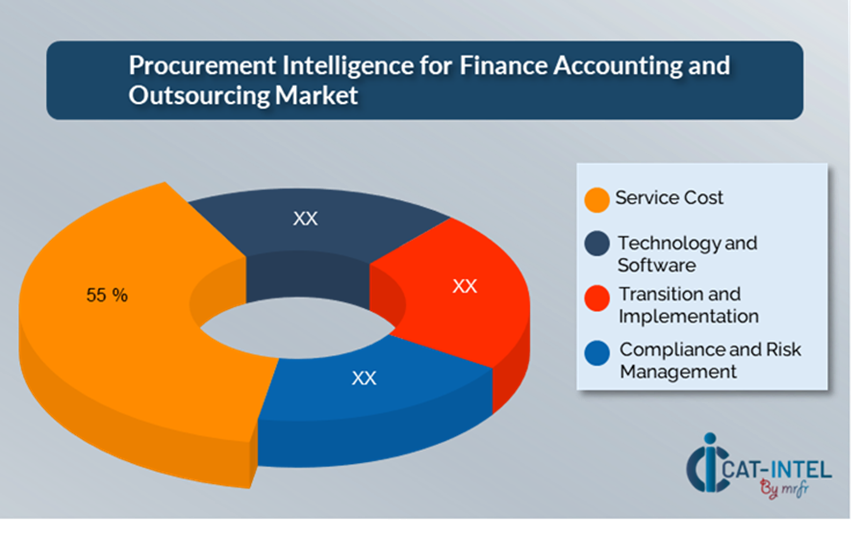

Cost Breakdown for Finance Accounting and Outsourcing: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Service Fees: (55%)

-

Description: Depending on the complexity and extent of the service, service fees are payments made to outsourcing providers for duties like payroll and bookkeeping.

-

Trends: Businesses are combining services with a single provider to save money, and performance-based pricing is increasing, with costs depending on value produced.

- Technology and Software Costs: (XX%)

- Transition and Implementation Costs: (XX%)

- Compliance and Risk Management Costs: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

Using strategic bargaining techniques and optimizing procurement can result in considerable cost savings and improved operational efficiency in the finance, accounting, and outsourcing sectors. Favourable pricing, volume discounts, and bundled packages can be obtained through long-term contracts with cloud-based providers. Multi-year contracts and subscription models aid in securing reduced rates and guarding against price rises.

Long-term expenses can be decreased by collaborating with creative, scalable suppliers to have access to modular solutions, AI, and advanced analytics. Utilizing digital technologies like as use statistics and contract management reduces over-provisioning, maximizes software use, and enhances transparency. Adopting a multi-vendor strategy and diversifying vendors lowers reliance, lowers risks, and increases bargaining power.

Supply and Demand Overview for Finance Accounting and Outsourcing: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The market for finance, accounting, and outsourcing is expanding steadily due to growing efforts at digital transformation in sectors like manufacturing, retail, and healthcare. Global economic conditions, industry-specific customisation requirements, and technological breakthroughs all influence supply and demand dynamics. Demand Factors:

-

Digital Transformation Initiatives: Demand for accounting and finance solutions is being driven by industries' increasing need for centralized data management and process automation.

-

Cloud Adoption Trends: The need for scalable and subscription-based services is rising because of a move toward cloud-based financial solutions.

-

Industry-Specific Requirements: Industries like manufacturing and healthcare need financial services that are adapted to operational procedures and regulatory standards.

-

Integration Capabilities: The need for financial systems that can easily interact with other corporate software and Internet of Things devices is growing.

Supply Factors:

-

Technological Advancements: New developments in cloud computing, AI, and machine learning are improving financial services offerings and increasing supplier competition.

-

Vendor Ecosystem: The expanding quantity of financial service providers, encompassing both large and niche vendors, guarantees a wide range of choices for purchasers

-

Global Economic Factors: Regional adoption rates of technology, labour costs, and exchange rates affect the cost and accessibility of financial solutions.

-

Scalability and Flexibility: As contemporary financial solutions grow more modular; vendors may now serve companies of different sizes and complexity levels.

Regional Demand-Supply Outlook: Finance Accounting and Outsourcing

The Image shows growing demand for Finance Accounting and Outsourcing in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Finance Accounting and Outsourcing Market

North America, particularly the United States, is a dominant force in the global Finance Accounting and Outsourcing market due to several key factors:

-

Advanced Infrastructure for Technology: Because of its highly developed technology infrastructure, North America can incorporate cloud-based solutions, automation tools, and sophisticated accounting and finance software.

-

Obtaining Skilled Talent: Certified accountants, financial analysts, and experts in compliance, regulations, and financial reporting are among the many highly qualified people in the area.

-

Favourable Environment: North America is a desirable place for outsourcing providers to operate because of its stable regulatory framework and well-defined compliance standards (such as GAAP and Sarbanes-Oxley), which guarantee that companies adhere to legal and financial obligations.

-

Robust Business Environment: The existence of global businesses, financial institutions, and multinational firms raises demand for accounting and finance services that are outsourced, which propels market expansion.

-

Economical Outsourcing Options: North American businesses are increasingly looking to outsource non-core finance to reduce operating costs.

North America Remains a key hub Finance Accounting and Outsourcing Price Drivers Innovation and Growth.

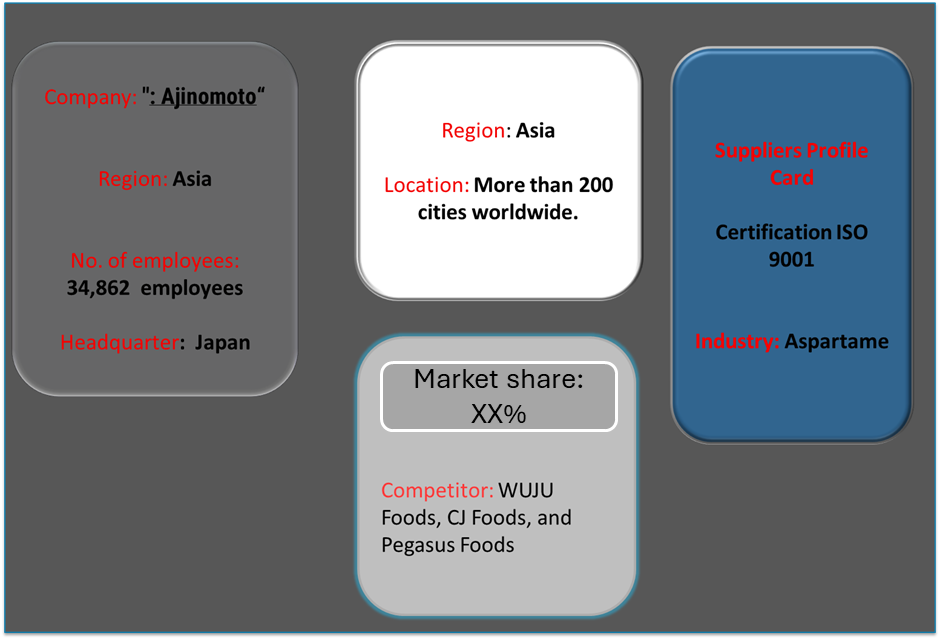

Supplier Landscape: Supplier Negotiations and Strategies

The finance, accounting, and outsourcing industries have a varied and fiercely competitive supplier landscape, with a mix of regional and international players that influence market dynamics. Important elements including service quality, service customisation, and price structures are influenced by these suppliers. Established firms with complete financial solutions dominate the market, while smaller, specialist players concentrate on business sectors or special features like AI integration and advanced analytics. In important technology regions, the supplier ecosystem consists of both creative local firms meeting industry-specific needs and well-known international vendors. As companies place a higher priority on operational effectiveness and digital transformation, suppliers are developing cloud capabilities, incorporating state-of-the-art technology, and providing flexible subscription plans to satisfy changing business demands.

Key Suppliers for Finance Accounting and Outsourcing include:

- Genpact

- Accenture

- Deloitte

- PwC (PricewaterhouseCoopers)

- Ernst & Young (EY)

- KPMG

- Tata Consultancy Services (TCS)

- Cognizant

- Infosys BPM

- Capgemini

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The market for finance, accounting, and outsourcing is expanding significantly as more companies use digital solutions to increase productivity, manage resources more effectively, and streamline operations, particularly in emerging economies. |

Cloud Adoption |

With the advent of hybrid work arrangements, there is a growing trend for cloud-based financial solutions due to the requirement for scalability, cost-effectiveness, and remote accessibility. |

Product Innovation |

With real-time data processing, AI-powered analytics, and industry-specific solutions designed for industries like manufacturing, retail, and healthcare, financial service providers are broadening their product offerings. |

Technological Advancements |

By automating repetitive tasks and offering predictive insights, innovations like robotic process automation (RPA), machine learning, and IoT integration are improving financial services capabilities. |

Global Trade Dynamics |

The market for finance and accounting outsourcing is being impacted by changes in regional economic policies, compliance standards, and international trade restrictions, especially for multinational corporations managing intricate tax and reporting obligations. |

Customization Trends |

Demand for accounting and finance outsourcing services that are suited to business requirements—like adaptable service models and integration with specialist financial instruments to guarantee more individualized, effective solutions is rising.

|

|

Finance Accounting and Outsourcing Attribute/Metric |

Details |

Market Sizing |

The global finance and accounting outsourcing market is projected to reach USD 123.45 billion by 2035, growing at a CAGR of approximately 12.1% from 2025 to 2035.

|

Finance Accounting and Outsourcing Technology Adoption Rate |

About 70% of companies have digitalized or outsourced their accounting and finance operations, moving toward automation and artificial intelligence. |

Top Finance Accounting and Outsourcing Industry Strategies for 2025 |

Leading Sector Approaches for 2025 Automating financial tasks, utilizing AI for analytics, implementing cloud-based solutions, and placing a high priority on data protection are important tactics. |

Finance Accounting and Outsourcing Process Automation |

Automation of Processes for increased accuracy and lower expenses, 60% of companies automate financial procedures such transaction processing, tax computations, and reporting. |

Finance Accounting and Outsourcing Process Challenges |

Data security, employee opposition to outsourcing, legacy system integration, and compliance maintenance are some of the process's difficulties. |

Key Suppliers |

Leading suppliers for finance and accounting outsourcing include Accenture, Deloitte and PwC (PricewaterhouseCoopers)

|

Key Regions Covered |

Prominent regions with strong digital infrastructure and rising use of cloud-based financial solutions have made North America and Asia Pacific major contributors to industry expansion. |

Market Drivers and Trends |

Cost-effective financial management, real-time insights, artificial intelligence, and adherence to changing tax and accounting laws are the main drivers of growth. |