Summary Overview

Financial Data Services Market Overview:

The global financial data services industry is expanding promptly, driven by increased demand in areas such as banking, investment, insurance, and fintech. This market encompasses a wide range of financial data solutions, including cloud, on-premises, and hybrid platforms. Our report presents an in-depth analysis of acquisition trends, with an emphasis on methods for reducing costs and the use of innovative

digital tools for enhanced financial operations and decision-making processes.

Key potential challenges in the financial data services sector include minimizing implementation costs, ensuring scalability, preserving data security, and integrating new data solutions into current infrastructure. Adoption of digital tools and strategic sourcing will be crucial to streamlining financial data operations and ensuring long-term competitiveness. As global demand continues to rise, enterprises are increasingly tapping into market.

-

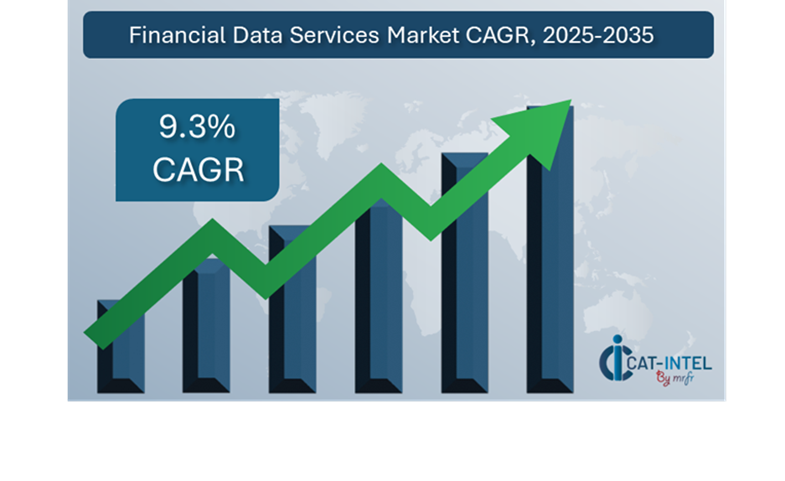

Market Size: The global Financial Data Services market is projected to reach USD 78 billion by 2035, growing at a CAGR of approximately 9.3% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Financial Services and Data Integration: Demand for real-time data analytics and seamless integration to accelerate financial operations and drive strategic choices is growing.

-

Investment and Wealth Management Expansion: Increased use of contemporary financial data solutions for portfolio management, risk assessment, and client relationship management (CRM).

-

Technological Advancements: AI and machine learning advancements are significantly enhancing financial data solutions through the provision of predictive analytics, real-time insights, and process automation.

-

Innovations: Modular financial data platforms allow businesses to decide on services that match their specific needs, cutting costs and complexity while maintaining flexibility.

-

Strategic Investments: Businesses are heavily investing in cloud-based financial data systems to cut infrastructure costs, improve remote access, and speed up decision-making.

-

Regional Insights: Asia Pacific and North America are significant contributors, owing to solid digital infrastructure, rising demand for cloud-based solutions, and widespread utilization of data-driven financial tools.

Key Trends and Sustainability Outlook:

-

Cloud Integration: Cloud-based financial data services offer more scalability, cost-efficiency, and superior data access, enabling seamless cross-border transactions.

-

Cutting-Edge Features: Incorporating AI, IoT, and blockchain technology into financial systems is altering decision-making, increasing automation, and ensuring data openness and security.

-

Commitment to Sustainability: Financial data solutions promote sustainable practices by improving resource management and enabling businesses to comply with regulatory requirements through accurate reporting and insights.

-

Customization Demand: Developing demand for specialized financial data modules designed for areas such as investment administration, financial services, and insurance, answering the demands of each industry.

-

Data-Driven Insights: Advanced analytics help firms boost forecasting accuracy, optimize asset management, and track critical financial metrics for more informed strategic planning.

Growth Drivers:

-

Digital Transformation: Enterprises are increasingly embracing digital technology to boost productivity, consolidate operations, and promote strategic growth goals.

-

Process Automation Demand: A growing reliance on modern financial data platforms to automate routine operations, minimize inefficiencies, and expedite decision-making.

-

Scalability Requirements: Financial institutions want data solutions that can scale with their developing operations, providing seamless connection with new markets and systems.

-

Regulatory Compliance: Financial data platforms help businesses follow exacerbated requirements by automating compliance reporting and promising data integrity and truthfulness.

-

Globalization Trends: A growing demand for financial data solutions that meet multi-currency, multi-language, and international legal requirements, aiding firms as they expand abroad.

Overview of Market Intelligence Services for the Financial Data Services Market:

Recent examinations have revealed significant problems that financial services businesses face when deploying new data solutions, including high implementation costs and the requirement for system individualization. Market intelligence studies offer actionable insights to assist organizations uncover ways to reduce expenses, optimize vendor management, and guarantee effective implementation. These insights also help to ensure compliance with industry rules, high-quality operational processes, and optimal expenditure control.

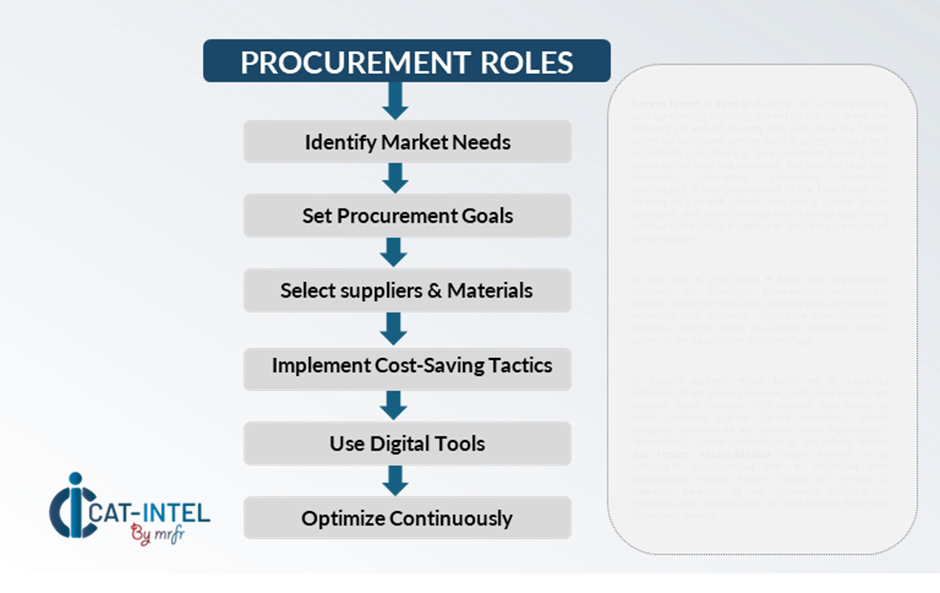

Procurement Intelligence for Financial Data Services: Category Management and Strategic Sourcing

To remain competitive in the financial data services industry, businesses are honing their procurement strategies through expenditure analysis and data vendor performance monitoring. Effective category management and strategic sourcing are critical for lowering procurement costs while simultaneously offering access to high-quality, innovative financial data solutions. Businesses can use market research to fine-tune their procurement strategy and negotiate favourable terms and secure the best solutions for their evolving data needs.

Pricing Outlook for Financial Data Services: Spend Analysis

The pricing outlook for financial data services is expected to stay moderately dynamic, with variations caused by a variety of factors. Technological advances, increased demand for cloud-based platforms, customization specifications, and regional pricing discrepancies are all key drivers. Additionally, increased integration of AI and IoT, as well as a greater focus on data security and regulatory compliance, have placed upward pressure on market price.

Graph shows general upward trend pricing for Financial Data Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic

Efforts to simplify procurement procedures, enhance vendor management, and begin implementing modular data solutions will be critical for cost control. Using digital technologies for market monitoring, pricing forecasting analytics, and applying efficient contract oversight techniques may significantly lower costs.

Partnering with respected financial data service providers, negotiating long-term contracts, and examining subscription-based pricing structures are all essential cost-management methodologies. Despite these challenges, prioritizing scalability, ensuring successful implementation, and adopting cloud-based platforms will be pivotal in maintaining cost-effectiveness while driving operational excellence.

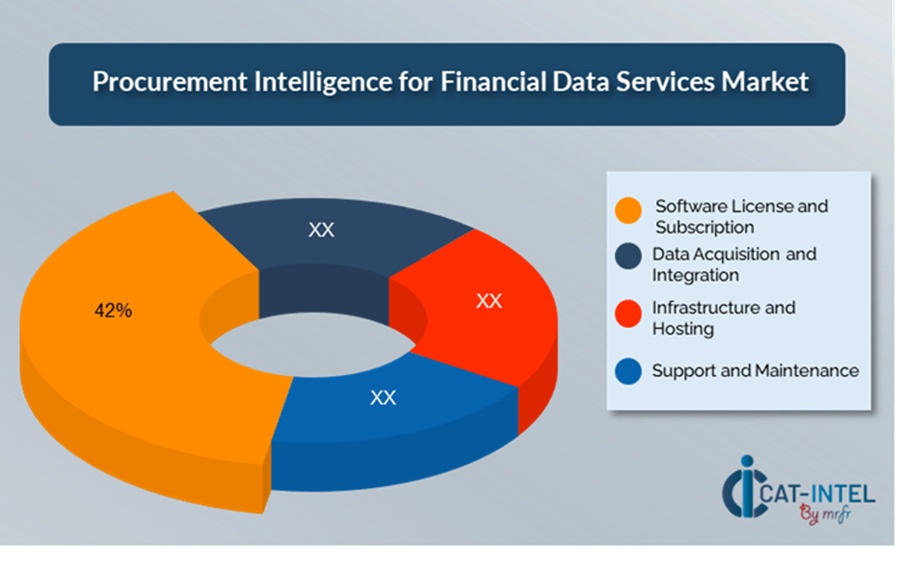

Cost Breakdown for Financial Data Services: Total Cost of Ownership (TCO) and Cost-Saving Opportunities:

- Software License and Subscription Fees: (42%)

-

Description: Cover the costs of obtaining access to financial data services, whether through one-time licenses for on-premises systems or recurrent subscription payments for cloud platforms.

-

Trends: Cloud-based subscription models enable scalability, flexibility, and reduced upfront costs. Pricing is tiered based on usage and features.

- Data Acquisition and Integration Costs: (XX%)

- Infrastructure and Hosting Costs: (XX%)

- Support and Maintenance Costs: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the financial data services industry, boosting procurement tactics and employing advantageous negotiations tactics can lead to substantial cost savings and improved operational productivity. Establishing long-term agreements with providers of financial data platforms, particularly those offering cloud-based solutions, can lead in more effectively pricing structures and advantageous terms, such as volume discounts and bundled service packages. Based on subscriptions models and multi-year agreements allow companies to safeguard less interest rates as well as preserve towards the cost boosts over time.

Collaborating alongside financial data service providers that prioritize innovation and scalability brings introduced benefits such as access to advanced analytics, AI cooperation, and modular architecture, all of which contribute to reducing long-term functional costs. Implementing digital procurement tools, such as contract management platforms and usage analytics, improves open communication, prevents over-provisioning, and optimizes data solution utilization.

Supply and Demand Overview for Financial Data Services: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The financial data services market is witnessing experienced rise, driven by increased digital transformation activities across industries involving banking, insurance, and investment. The dynamics of supply and demand are driven by advancements in technology, specific sector requirements, and global economic circumstances.

Demand Factor:

-

Digital Transformation Initiatives: The growing need for centralized data management, predictive analytics, and automation is driving up the demand for financial data services across all industries.

-

Cloud Adoption Trends: As more individuals turn to cloud-based data solutions, there is an increased need for scalable, subscription-based systems that provide better accessibility and real-time data.

-

Industry-Specific Requirements: Businesses such as banking and insurance seek information solutions that are tailored to regulatory frameworks and specific operational processes.

-

Integration Capabilities: As businesses embrace more sophisticated systems, there is an increasing demand for financial data services that can communicate effortlessly with current business software and IoT devices.

Supply Factors:

-

Technological Advancements: Innovations in AI, machine learning, and cloud computing are transforming the financial data services market, enhancing service providers' capabilities and boosting competitiveness.

-

Vendor Ecosystem: A broad spectrum of financial data service providers, from major established companies to small boutique vendors, provide consumers with a variety of options to satisfy their individual requirements.

-

Global Economic Factors: Exchange rates, labor costs, and regional variations in the adoption of digital technologies all have a bearing on pricing and availability of financial data solution

-

Scalability and Flexibility: Considering increasing demand for modular, scalable data services, suppliers offer flexile solutions that cater to organizations of varying sizes, from startups to large financial institutions.

Regional Demand-Supply Outlook: Financial Data Services

The Image shows growing demand for Financial Data Services in both Asia Pacific and North America, with potential price increases and increased competition.

Asia Pacific: Dominance in the Financial Data Services

Asia Pacific, particularly Japan, is a dominant force in the global Financial Data Services market due to several key factors:

-

Rapid Digital Transformation: Asia-Pacific is undergoing a rapid digital transformation, resulting in greater demand for advanced financial data services.

-

Growing Financial Sector: This region has a substantial, increasing financial market, particularly in China, India, and Japan, that demands robust data solutions.

-

Technological Advancements: The widespread adoption of AI, blockchain, and cloud technologies boosts the delivery of financial data services.

-

Vibrant Fintech Ecosystem: Asia-Pacific is home to a plethora of innovative fintech businesses, companies are driving the development of advanced financial data solutions.

-

Regulatory Evolution: As Asia-Pacific's financial rules develop, there is a growing need for specialized, compliant data services to control risk and maintain transparency.

Asia Pacific remains a key hub for Financial Data Services Price Drivers Innovation and Growth.

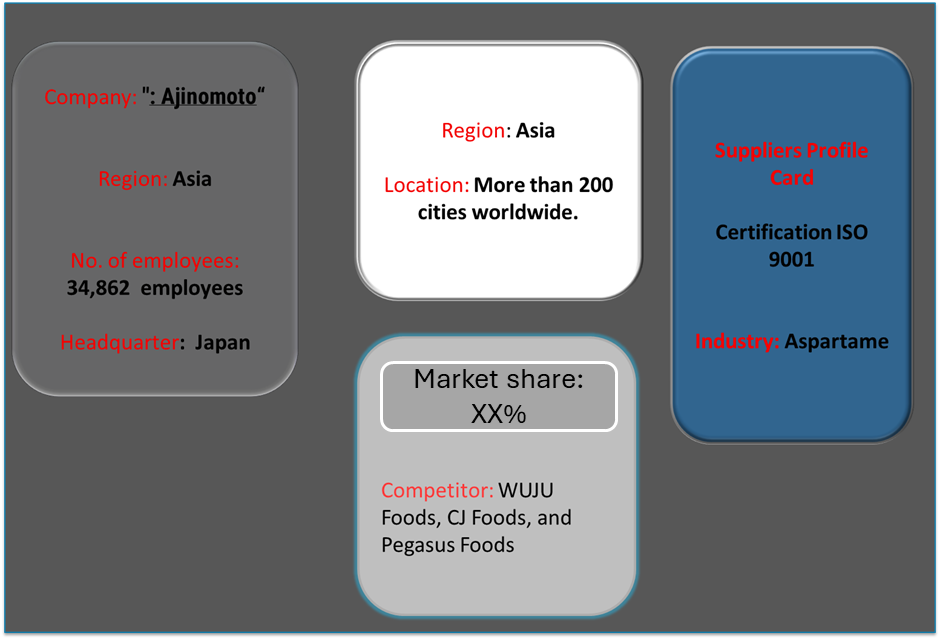

Supplier Landscape: Supplier Negotiations and Strategies

The financial data services market has a comparably diversified and competitive supplier ecosystem, with both global players and specialized regional providers. These suppliers have a significant effect on essential components such as pricing models, custom data solutions, and service quality. Established global companies dominate the market, providing comprehensive information solutions, while smaller, niche providers specialize in certain financial sectors or offer unique capabilities such as sophisticated analytics, AI integration, and real-time data processing.

The financial data service company ecosystem encompasses key technology destinations, with prominent worldwide vendors and innovative regional companies catering to specific industry needs such as banking, investment, and insurance. As firms emphasize digital transformation and data-driven decision-making, vendors in the finance information services market have upgraded their cloud offerings, integrated emerging technologies, and provided flexible subscriptions models to meet the evolving demands of businesses seeking operational efficiency and scalability.

Key Suppliers in the Financial Data Services Market include:

- Nikkei

- Bloomberg

- Thomson Reuters (Refinitiv)

- S&P Global

- FactSet

- Moody’s Analytics

- Morningstar

- IHS Markit

- Fitch Solutions

- Oracle Financial Services Analytical Applications

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The financial data services industry is experiencing explosive growth, driven by rising demand from businesses wishing to streamline operations, improve decision-making, and better data management, in particular developing nations. |

Cloud Adoption |

A substantial evolution toward cloud-based financial data solutions is taking place, driven by the demand for scalability, cost-efficiency, and increased accessibility, particularly in the context of versatile scheduling and global teams. |

Product Innovation |

Financial data service providers have expanded their offerings to include advanced features such as AI-driven analytics, real-time data processing, and particular to an industry solution for banking, investment, and insurance. |

Technological Advancements |

Emerging technologies such as machine learning, IoT integration, and robotic process automation (RPA) are revolutionizing the financial data services landscape by delivering predictive insights, automating standard procedures, and optimizing decision-making processes. |

Global Trade Dynamics |

Shifting trade rules, compliance standards, and regional economic policies all have a bearing on the adoption of financial data solutions, especially among multinational firms that maintain complex financial data and function globally. |

Customization Trends |

In the financial data services businesses, there is a growing need for solutions that can be customized to meet distinctive company needs. Organizations are increasingly looking for versatile, modular architectures and interaction with third-party tools to personalize their data solutions and better fit with their specific operational requirements. |

|

Financial Data Services Attribute/Metric |

Details |

Market Sizing |

The global Financial Data Services market is projected to reach USD 78 billion by 2035, growing at a CAGR of approximately 9.3% from 2025 to 2035. |

Financial Data Services Technology Adoption Rate |

About 62% of global financial institution ns have implemented advanced data solutions, with a substantial move toward cloud-based platforms for enhanced scalability, real-time insights, and cost-efficiency. |

Top Financial Data Services Industry Strategies for 2025 |

Key strategies involve utilizing AI for predictive analytics, boosting data-driven decision-making with real-time financial insights, embracing blockchain for transparency, and strengthening cybersecurity. |

Financial Data Services Process Automation |

To boost output and eliminate human error, over 50% of all financial data solutions now automate businesses such as risk assessment, compliance reporting, and portfolio management.

|

Financial Data Services Process Challenges |

Major issues include data migration challenges, high implementation costs, integrating with legacy systems, and maintaining data security and privacy standards.

|

Key Suppliers |

Leading suppliers in the market are Bloomberg, Thomson Reuters (Refinitiv) and Nikkei, provided flexible subscriptions models to meet the evolving demands of businesses seeking operational efficiency and scalability.

|

Key Regions Covered |

Prominent regions are Asia Pacific and North America, owing to solid digital infrastructure, rising demand for cloud-based solutions, and widespread utilization of data-driven financial tools.

|

Market Drivers and Trends |

Growth is currently driven by the rising need for accurate and real-time data analytics, the adoption of cloud-based financial platforms, demand of enhanced data security, and the integration of AI, machine learning, and blockchain technologies.

|