Fluff Pulp Market Overview

The global fluff pulp market is expanding steadily, driven by rising demand in a wide range of industries, including personal care, hygiene goods, and medicinal applications. This market offers a variety of fluff pulp varieties, including sustainable, bleached, and unbleached choices, to meet a wide range of consumer needs. Our investigation digs into procurement trends, with a focus on cost-cutting tactics and the use of modern technology to optimize manufacturing and supply chain procedures.

Key future problems in the fluff pulp market include cost management, consistent product quality, environmental sustainability, and logistics optimization. The use of digital technologies and innovative sourcing tactics is critical for increasing procurement efficiency and gaining long-term competitive advantages. As global demand increases, organizations are employing market intelligence to drive operational improvements, mitigate risks, and stay ahead in an increasingly competitive marketplace.

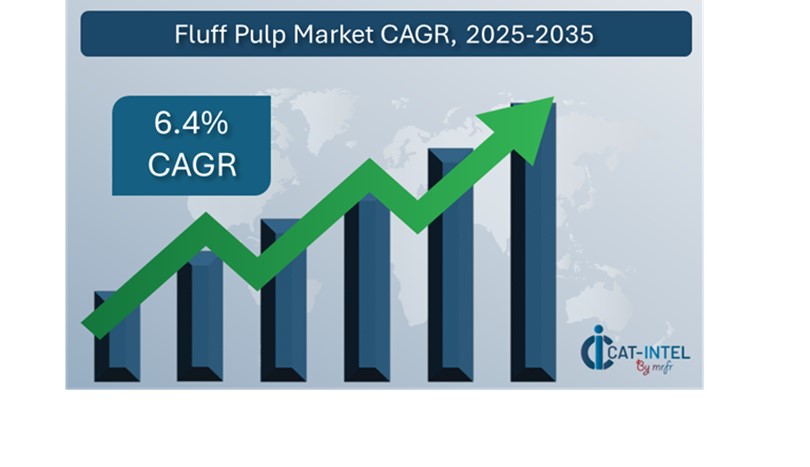

- Market Size: The global Fluff Pulp market is projected to reach USD 18.48 billion by 2035, growing at a CAGR of approximately 6.4% from 2025 to 2032

- Sector Contributions: Growth in the market is driven by:

- Manufacturing and Supply Chain Optimization: The increased demand for real-time data and process integration is pushing advancements in manufacturing and supply chain management. Businesses are investing in technologies that will speed production processes, minimize waste, and improve supply chain transparency.

- Retail and E-Commerce Growth: The rise of online shopping and retail activities has increased demand for fluff pulp in hygiene and personal care products. Companies are improving their inventory management and demand forecasting capabilities to ensure reliable supply and product availability.

- Technological Transformation: Automation and AI are improving production efficiency, waste reduction, and product quality in fluff pulp manufacturing. Machine learning and predictive analytics help businesses streamline processes and forecast demand more precisely.

- Innovations: Modular production systems enable enterprises to scale and adjust operations, addressing the growing need for tailored fluff pulp products in specialized industries like healthcare and hygiene. These advances are also reducing expenses and increasing operational flexibility.

- Investment Initiatives: Companies are focusing on sustainable and efficient fluff pulp production methods, including as eco-friendly processing technology and cloud-based resource management systems. These investments allow firms to cut infrastructure expenses while improving remote operations.

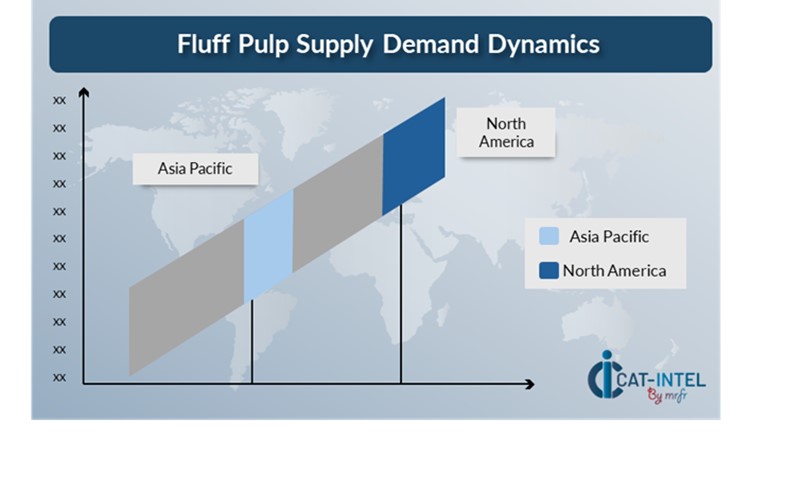

- Regional Insights: North America and Asia Pacific continue to drive expansion in the fluff pulp market, owing to strong production capabilities, technological advancements, and rising demand for sustainable, high-quality products.

Key Trends and Sustainability Outlook:

- Sustainability Focus: There is an increasing demand for environmentally acceptable, renewable ingredients in the production of fluff pulp. Manufacturers are increasing adopting sustainable practices to reduce environmental impact.

- Cloud Integration: The adoption of cloud-based supply chain management technology improves transparency and efficiency in fluff pulp production, as well as tracking and reporting for sustainability.

- Advanced Features: The use of AI, IoT, and automation in fluff pulp production is increasing operating efficiency, lowering waste, and improving supply chain visibility.

- Customization Trends: Rising demand for specialty fluff pulp products in industries such as healthcare and hygiene are driving an increase in customized manufacturing techniques and product requirements.

- Data-Driven Insights: Advanced analytics help fluff pulp manufacturers optimize production schedules, estimate demand better reliably, and track supply chain performance metrics.

Growth Drivers:

- Digital Transformation: The expanding application of digital tools and automation technology increases manufacturing productivity and operational efficiency in fluff pulp.

- Demand for Process Automation: The growing demand for high-quality, hypoallergenic, and absorbent fluff pulp is driving the need for automated production systems that can handle repetitive operations efficiently.

- Scalability Requirements: Companies in the fluff pulp industry are searching for scalable manufacturing procedures that can meet rising demand, notably in the hygiene and medical industries.

- Regulatory Compliance: Companies are making investments in technologies and processes that help them comply with environmental and safety laws, ensuring that their products satisfy international standards.

- Globalization: As worldwide demand for ecologically sound, high-quality materials develops, so does the need for adaptable production systems capable of supporting multi-region, multi-product operations.

Overview of Market Intelligence Services for the Fluff Pulp Market:

Recent evaluations of the fluff pulp market have found significant problems, including increased manufacturing costs and the need for specific product customization. Market intelligence studies provide useful insights into procurement prospects, allowing businesses to execute cost-cutting measures, optimize supplier relationships, and assure smooth product delivery. These insights also help organizations satisfy industry requirements, maintain high-quality manufacturing operations, and manage operational costs effectively.

Procurement Intelligence for Fluff Pulp: Category Management and Strategic Sourcing

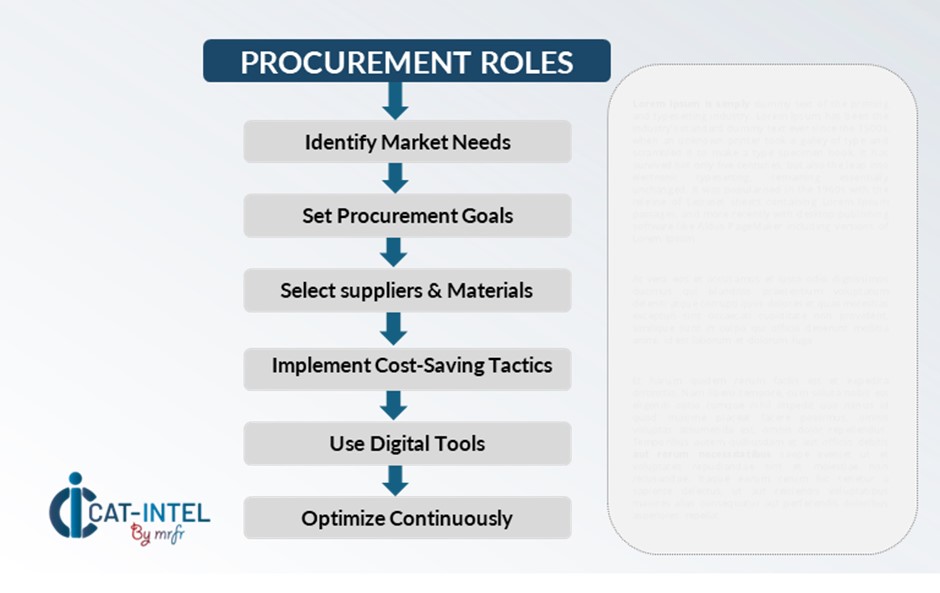

To remain competitive in the fluff pulp industry, businesses are improving their procurement procedures through rigorous spend monitoring and supplier performance tracking. Effective category oversight and strategic sourcing are critical for lowering procurement costs and ensuring a steady supply of high-quality commodities. Businesses can use actionable market intelligence to optimize their procurement strategies, negotiate favourable terms, and enhance the overall efficiency of their fluff pulp supply chain.

Pricing Outlook for Fluff Pulp: Spend Analysis

The price prognosis for fluff pulp is projected to be moderately volatile, impacted by factors such as technological improvements, demand for sustainable resources, and regional supply chain variances. Price changes are mostly driven by expanding demand for eco-friendly pulp, customization for specific industries, and rising environmental compliance demands. Furthermore, the rising emphasis on merchandise quality, supply chain efficiency, and waste minimization is driving higher prices.

To effectively manage procurement expenses, optimize supply chain processes, improve supplier relationships, and implement customized sourcing strategies. Using digital technologies for market monitoring, price forecasting, and contract administration can help you save even more money.

Partnering with dependable suppliers, negotiating long-term contracts, and investigating flexible pricing methods are all effective strategies for controlling fluff pulp costs. Despite the hurdles, concentrating on sustainability, ensuring product quality, and investing in scalable production systems will be critical to maintaining cost-effectiveness and market competitiveness.

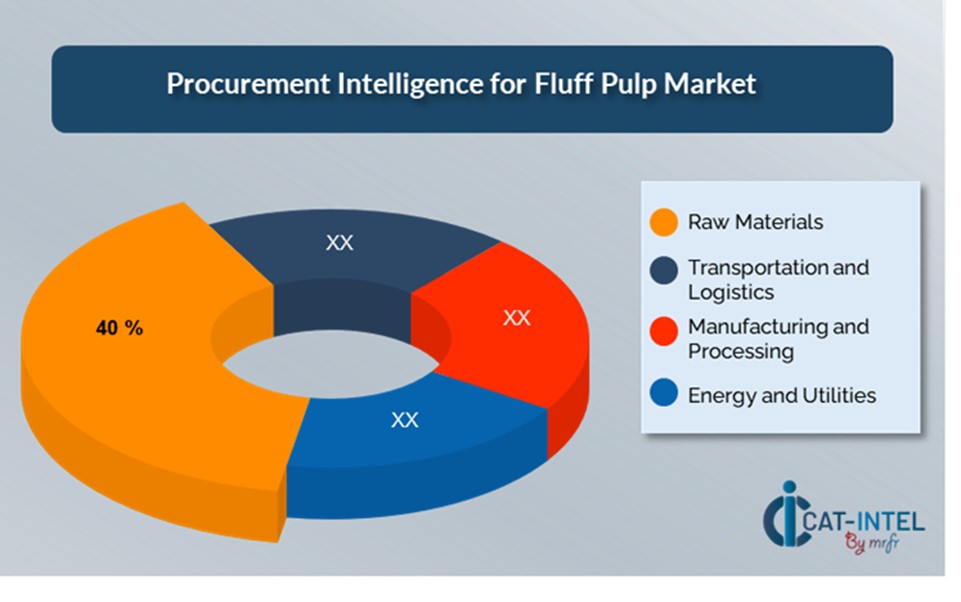

Cost Breakdown for Fluff Pulp: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Materials: (40%)

- Description: Raw material costs are the expenses spent when purchasing wood pulp, which is the basic input in the creation of fluff pulp. Factors influencing the price include wood availability, market demand, and volatility in timber prices.

- Trend: There is a growing trend of getting sustainable and certified wood pulp, which is driving both cost rises and demand for environmentally acceptable manufacturing processes.

- Transportation and Logistics: (XX%)

- Manufacturing and Processing: (XX%)

- Energy and Utilities: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the fluff pulp business, streamlining procurement processes and using strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Long-term partnerships with suppliers, particularly those that provide sustainable, high-quality pulp, can result in more attractive price structures and terms, such as volume-based discounts and bundled service packages. Flexible pricing methods, such as subscription-based agreements and multi-year contracts, offer opportunities to achieve reduced rates while protecting against price swings.

Collaborating with suppliers who value innovation and sustainability provides additional benefits, such as access to innovative manufacturing methods and sustainable supplies, which lower long-term costs. Implementing digital procurement solutions, such as contract management systems and supply chain analytics, improves transparency, reduces waste, and maximizes material utilization. Diversifying supplier alternatives and implementing a multi-vendor strategy an reduce dependency on a single provider, mitigate risks like supply chain disruptions, and strengthen negotiating power.

Supply and Demand Overview for Fluff Pulp: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The fluff pulp market is steadily expanding, buoyed by rising demand for sustainable materials in areas such as personal care, healthcare, and consumer products. Technological advances, industry-specific requires, and global economic conditions all have an impact on market dynamics.

Demand Factors:

- Sustainable Initiatives: The growing need for environmentally friendly, renewable materials is boosting demand for high-quality fluff pulp in a variety of industries.

- Eco-Friendly Trends: The move toward sustainable production and materials is driving up demand for high-quality, absorbent fluff pulp.

- Industry-Specific Requirements: Industries such as healthcare and personal care demand fluff pulp that adheres to hygienic, medicinal, and regulatory standards.

- Supply Chain Integration: There is an increasing demand for raw materials that can be seamlessly integrated into a wide range of product lines and production processes.

Supply Factors:

- Technological Advancements: Innovations in automation, artificial intelligence, and sustainable manufacturing technologies are improving fluff pulp offerings and increasing supplier competition.

- Vendor Ecosystem: A rising number of suppliers, both niche and large-scale, present purchasers with a varied range of possibilities.

- Global Economic Factors: Currency exchange rates, labour costs, and regional production rates all have an impact on fluff pulp prices and availability.

- Scalability and Flexibility: Modern fluff pulp production is becoming more modular, allowing suppliers to accommodate to organizations of different sizes and complexities.

Regional Demand-Supply Outlook: Fluff Pulp

North America: Dominance in the Fluff Pulp Market

North America, particularly the United States, is a dominant force in the global Fluff Pulp market due to several key factors:

- Strong Demand from Personal Care and Hygiene Industries: There is a large personal care, hygiene, and infant care product industry. The demand for high-quality absorbent materials in diapers, feminine hygiene products, and adult incontinence products propels the market.

- Technological Advancement and Innovation: North America is home to prominent producers who are always innovating in fluff pulp production. The region is employing cutting-edge technologies to improve manufacturing efficiency while maintaining high quality standards.

- Sustainability Focus: The region is placing a greater emphasis on ecologically friendly and sustainable activities. Many North American industries are using environmentally friendly production practices and renewable raw resources.

- Access to High-Quality Raw Materials: North America, notably the United States and Canada, has enormous forest resources, providing a consistent supply of wood pulp, a critical raw ingredient.

- Strong Manufacturing Infrastructure: North America has a well-developed manufacturing infrastructure that is supported by sophisticated logistics and supply chain systems. This enables efficient production, timely distribution, and lower operational costs, positioning the region as a dominating competitor in the fluff pulp industry.

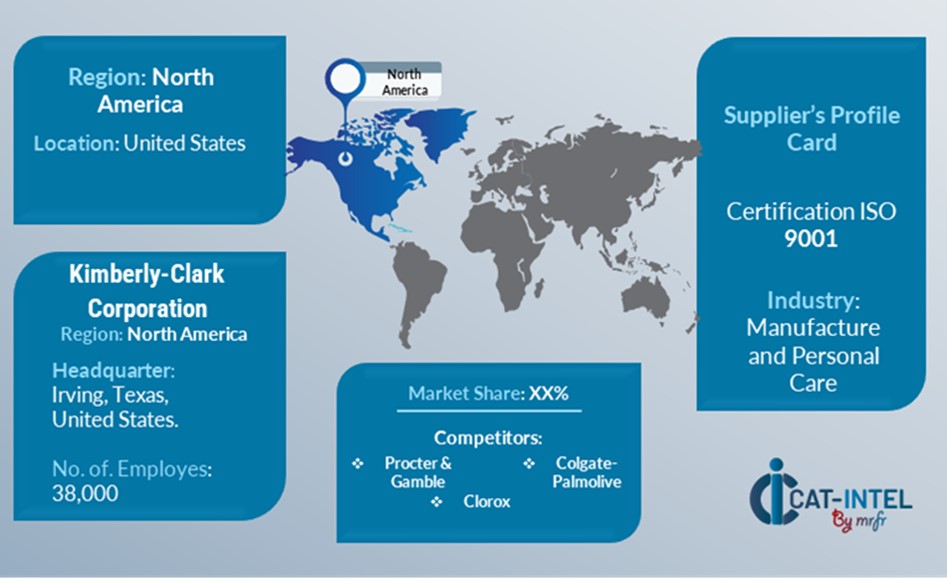

Supplier Landscape: Supplier Negotiations and Strategies

The fluff pulp market's supplier landscape is diversified and competitive, with global leaders and regional players influencing industry dynamics. These vendors have a significant impact on pricing, material quality, and customisation options. Large, well-established suppliers dominate the market, offering a diverse range of high-quality fluff pulp, while smaller, niche businesses cater to specialized needs, such as eco-friendly or hypoallergenic pulp for specific industries.

The fluff pulp supplier ecosystem includes both worldwide and creative local suppliers that cater to specific industrial needs. As organizations prioritize sustainability and efficiency in operations, fluff pulp providers are expanding their offers to include sustainable production processes, sophisticated materials, and flexible pricing structures to satisfy changing business demands.

Key Suppliers in the Fluff Pulp Market Include:

- Kimberly-Clark Corporation

- Procter & Gamble

- Sappi Lanaken Mill

- Stora Enso

- Domtar Corporation

- Georgia-Pacific, LLC

- Verso Corporation

- Asia Pulp and Paper (APP)

- Rayonier Advanced Materials

- Glenn Springs Holdings

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The fluff pulp market is expanding rapidly due to increased demand for sustainable materials in a variety of industries, particularly in emerging economies that value eco-friendliness and operational efficiency. |

|

Cloud Adoption |

The demand for flexibility, cost-efficiency, and remote accessibility in supply chains and manufacturing processes is driving a shift toward more sustainable, scalable production methods. |

|

Product Innovation |

Fluff pulp suppliers are improving their goods with novel features such as hypoallergenic, absorbent, and eco-friendly materials that are customized to certain industries such as personal care, healthcare, and hygiene products. |

|

Technological Advancements |

Automation, AI, and IoT integration are helping to improve production processes, increase efficiency, and reduce waste in fluff pulp manufacturing. |

|

Global Trade Dynamics |

Changes in global trade legislation, environmental policies, and economic situations are influencing the demand and supply of fluff pulp, particularly in multinational corporations with complex supply networks. |

|

Customization Trends |

Businesses are increasingly looking for fluff pulp solutions that may be customized to meet their specific product needs, such as specialty packaging or absorbent products, as well as integrate with sustainable sourcing strategies |

|

Fluff Pulp Attribute/Metric |

Details |

|

Market Sizing |

The global Fluff Pulp market is projected to reach USD 18.48 billion by 2035, growing at a CAGR of approximately 6.4% from 2025 to 2035. |

|

Fluff Pulp Technology Adoption Rate |

Approximately 60% of enterprises in important industries have used advanced fluff pulp solutions, indicating a substantial move toward sustainable, eco-friendly materials for increased scalability and operational flexibility.

|

|

Top Fluff Pulp Industry Strategies for 2025 |

Adopting sustainable production processes, integrating automation to increase efficiency, focusing on high-quality hypoallergenic products, and leveraging mobile technology to improve supply chain visibility and accessibility are all important measures.

|

|

Fluff Pulp Process Automation |

To improve operational efficiency and minimize costs, over 50% of fluff pulp production operations now automate routine functions such as inventory management, quality control, and compliance reporting.

|

|

Fluff Pulp Process Challenges |

Rising production costs, guaranteeing consistent material quality, supply chain disruptions, and the necessity for ongoing investment in sustainable and innovative production technologies.

|

|

Key Suppliers |

Kimberly-Clark Corporation, Procter & Gamble and Sappi Lanaken Mill are among the market's leading suppliers of fluff pulp, which provide high-quality, environmentally friendly materials to industries such as personal care, healthcare, and consumer products.

|

|

Key Regions Covered |

North America and Asia-Pacific are prominent regions for fluff pulp adoption, with major demand coming from the personal care, healthcare, and hygiene product industries.

|

|

Market Drivers and Trends |

Growth is being driven by expanding demand for sustainable materials, increased adoption of environmentally friendly production methods, and the need for improved product customization and waste reduction in fluff pulp manufacture.

|

Frequently Asked Questions (FAQ):

Our procurement intelligence services offer detailed analysis of the fluff pulp supplier market, evaluating major providers and industry trends. We provide spend analysis, supplier evaluations, and sourcing strategies to help secure high-quality, sustainable fluff pulp at competitive prices.

We assist in assessing the TCO for fluff pulp by considering factors such as procurement costs, transportation expenses, and processing fees. This comprehensive analysis ensures a clear understanding of the overall financial impact of sourcing fluff pulp.

Our risk management services focus on challenges like supply chain disruptions, price volatility, and supplier reliability. We help identify and mitigate risks to ensure a secure and cost-effective fluff pulp procurement process.

Our Supplier Relationship Management (SRM) services focus on fostering strong partnerships with fluff pulp suppliers. We assist with contract negotiations, performance tracking, and ensuring smooth integration into your operations.

We recommend best practices such as supplier segmentation, sustainability assessments, and regular performance monitoring. These practices help optimize procurement efficiency and ensure consistent supply of quality fluff pulp.

Digital tools streamline fluff pulp procurement by automating supplier selection, improving contract management, and tracking inventory. These advancements enhance procurement efficiency and reduce operational costs.

Our supplier performance management services track key metrics such as delivery timelines, product quality, and cost efficiency. This ensures reliable supplier performance and optimizes long-term sourcing decisions.

We help negotiate favourable terms by leveraging market insights, benchmarking supplier prices, and employing strategies such as long-term contracts and flexible payment terms to secure the best deal for fluff pulp sourcing.

We offer tools that provide in-depth analysis of pricing trends, supplier capabilities, and supply chain forecasts. These resources enable data-driven decision-making for sourcing fluff pulp.

We ensure compliance by confirming that fluff pulp suppliers adhere to industry regulations, sustainability standards, and environmental policies, helping maintain compliance across sourcing activities.

We recommend diversifying supplier relationships, leveraging sustainable sourcing practices, and developing contingency plans to reduce the impact of supply chain disruptions in fluff pulp procurement.

Our tracking solutions monitor performance metrics like delivery accuracy, material quality, and cost control, helping assess supplier reliability and inform future sourcing decisions.

We identify suppliers who prioritize sustainable practices, such as using eco-friendly production methods, energy-efficient processes, and recyclable materials, aligning with your sustainability goals.

Our pricing analysis compares supplier rates, monitors market trends, and applies negotiation techniques to secure competitive pricing while ensuring high-quality, sustainable fluff pulp.

We recommend diversifying suppliers, establishing long-term contracts, and building strategic stockpiles to mitigate risks associated with supply chain disruptions and market fluctuations. Additionally, forecasting demand and collaborating with suppliers for better lead time visibility can help ensure a consistent and reliable supply of fluff pulp.