Forgings Overview:

The global forgings market is steadily expanding, driven by demand from industries such as automotive, aerospace, energy, and manufacturing. This market includes several types of forgings, including as open-die, closed-die, and rolled rings. Our paper analyses procurement trends in depth, with an emphasis on cost-cutting methods and the use of emerging technologies to expedite procurement and manufacturing processes.

Key future problems in the forgings business include controlling production costs, assuring scalability, preserving the durability of materials, and integrating new manufacturing techniques into existing production systems. Digital production tools and efficient procurement are critical for optimizing the use of new forging technology and maintaining long-term competitiveness. As global demand continues to climb, businesses are using market intelligence to improve operational efficiency, product quality, and risk mitigation.

- Market Size: The global Forgings market is projected to reach USD 171.78 billion by 2035, growing at a CAGR of approximately 5.4% from 2025 to 2035.

Growth Rate: 5.4%

Sector Contributions: Growth in the market is driven by:

- Production and Supply Chain Optimization: Real-time data and process integration are becoming increasingly important for streamlining forging operations and optimizing supply chains.

- Automotive and Aerospace Growth: The use of advanced forging techniques to increase product quality, reduce weight, and improve performance in automotive and aerospace applications is driving growth in the forgings market.

- Technological Transformation: Advancements in manufacturing technology, such as artificial intelligence, machine learning, and automation, are altering the forging industry. Enable predictive maintenance, process improvement, and improved production efficiency.

- Forging Innovations: The rise of customizable forging solutions enables manufacturers to adapt to specific consumer demands, reducing waste and increasing product precision, while also implementing specialized forging processes such as near-net shaping to reduce material costs and improve product quality.

- Investment Initiatives: Companies are investing in cutting-edge forging technologies, including as automated systems and high-tech manufacturing facilities, to increase efficiency, lower operational costs, and enable remote monitoring for constant enhancement of processes.

- Regional Insights: Asia Pacific and North America continue to be major markets for forgings due to strong industrial sectors and widespread usage of digital technology in production.

Key Trends and Sustainability Outlook:

- Sustainability Focus: The forgings sector is increasingly emphasizing sustainable manufacturing techniques. With rising environmental concerns, businesses are optimizing energy use, decreasing material waste, and increasing recycling efforts in forging operations.

- Integration of Advanced Features: Innovations like automation and real-time monitoring boost production capacities, quality control, and contribute to more efficient operations.

- Customization Trends: There is an increasing need for forgings with tailored qualities for certain industries such as aerospace, automotive, and energy to suit the specialized requirements of these high-demand sectors.

- Data-Driven Insights: Advanced analytics are being utilized to optimize production, predict demand, and improve quality control in the forging process, allowing for better material forecasting, waste reduction, and supply chain efficiency.

Growth Drivers:

- Digital Transformation: The forging sector is increasingly using digital tools to improve industrial efficiency. These tools serve to improve scheduling, supply chain management, and entire operational effectiveness.

- Demand for Automation: The growing reliance on automated solutions to handle repetitive activities and enhance process efficiency is a major driver of growth in the forgings industry. Automated methods assist cut labour expenses and improve uniformity.

- Scalability Needs: As demand for forged components rises, firms look for scalable solutions to increase capacity for production and integrate novel technologies to support long-term growth.

- Regulatory Compliance: The forging business is under rising regulatory strain to comply with environmental and quality standards. Manufacturers can ensure compliance by using digital tools and systems such as automated documentation and quality control.

- Globalization: As global trade expands, there is a greater demand for forged items that match international specifications. Manufacturers are focusing on providing high-quality, low-cost products that can be easily modified to satisfy global market demands

Overview of Market Intelligence Services for the Forgings Market:

Recent research has revealed important problems in the forgings sector, including high manufacturing costs and the demand for customised forging solutions. Market intelligence studies provide firms with meaningful data that assist them identify procurement opportunities, streamline supplier management, and improve implementation efficiency. These insights also help to ensure compliance with industry standards, high-quality manufacturing processes, and effective cost management.

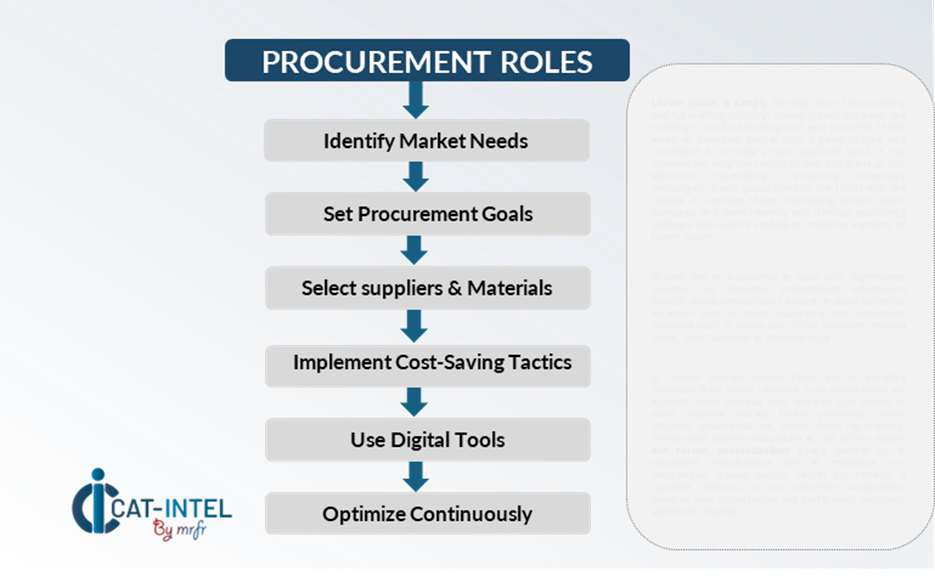

Procurement Intelligence for Forgings: Category Management and Strategic Sourcing

To remain competitive in the forgings industry, organizations are streamlining procurement procedures through detailed spend analysis and supplier performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs while guaranteeing a consistent supply of high-quality forged components. Businesses can use actionable market intelligence to improve their procurement strategy, negotiate better terms with suppliers, and source cost-effective and high-quality supplies for their production needs.

Pricing Outlook for Forgings: Spend Analysis

The pricing prognosis for forged components is projected to be moderately dynamic, with potential changes caused by a variety of variables. Manufacturing technological developments, desire for tailored offerings, and geographical pricing disparities are all significant drivers. Furthermore, the growing use of automation, combined with a greater emphasis on sustainability, is placing upward pressure on forging prices.

Graph shows general upward trend pricing for Forgings and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, strengthen vendor relationships, and implement flexible forging solutions are critical for cost control. Digital solutions for market monitoring, pricing forecasting via analytics, and contract administration simplification can all help to increase cost efficiency.

Partnering with reputable forging suppliers, negotiating long-term agreements, and investigating volume-based pricing models are critical tactics for effectively minimizing forging expenses. Despite these limitations, focusing on scalability, assuring high-quality output, and investing in improved manufacturing technologies will be key to maintaining cost-effectiveness and operational excellence in the forging sector.

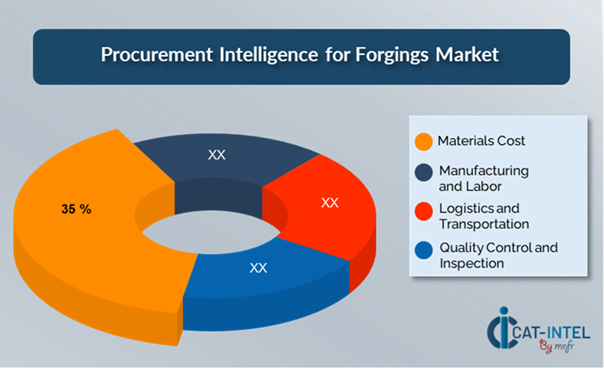

Cost Breakdown for Forgings: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Material Cost: (35%)

-

- Description: Material costs for forging, such as steel and aluminium, have a substantial impact on the total cost of ownership.

-

- Trends: The sector is focusing on material optimization, sustainable alloys, and supply chain diversity to control material price changes.

- Manufacturing and Labor (XX%)

- Logistics & Transportation (XX%)

- Quality Control and Inspection (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the forgings business, streamlining procurement processes and implementing strategic negotiation tactics can result in significant cost savings and increased operational efficiency. Long-term relationships with forging suppliers, particularly those that provide sophisticated manufacturing methods and bespoke solutions, can result in more attractive price structures and terms, such as volume-based discounts and bundled service packages. Negotiating multi-year contracts or securing volume commitments allows businesses to lock in more competitive pricing and decrease the impact of price variations over time.

Collaborating with forging suppliers who prioritize innovation and scalability provides additional benefits, such as access to modern materials, automated processes, and bespoke forging solutions, all of which assist to reduce long-term operational expenses. Implementing digital technologies for procurement, such as vendor loyalty platforms and usage data, improves transparency and eliminates over-ordering and improves material use. Furthermore, broadening supplier options and implementing a multi-supplier approach can reduce reliance on a single provider, decrease risks such as supply chain disruptions, and increase bargaining power.

Supply and Demand Overview for Forgings: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The forgings market is steadily expanding, driven by technological breakthroughs, industry-specific customized requirements, and the changing dynamics of global supply and demand. The rising demand for advanced manufacturing techniques and material advances, particularly in industries such as automotive, aerospace, and energy, is a major driver of this expansion.

Demand Factors:

- Technological Advancements: The increased emphasis on process automation and new manufacturing technologies is increasing demand for high-quality forged components, particularly in industries that require accuracy and dependability.

- Customization Needs: Various industries, such as automotive and aerospace, demand forged components with unique material qualities and compliance to rigorous standards.

- Sustainability and Efficiency Goals: There is a growing need for sustainable manufacturing techniques, such as energy-efficient forging processes and the use of reused components, which is encouraging suppliers to innovate and adapt.

- Integration Capabilities: The growing demand for forgings that integrate with other modern manufacturing systems, including as automated production lines and digital monitoring tools, is driving the development of smart forging technologies.

Supply Factors:

- Technological Innovation: Automation, artificial intelligence, and machine learning are improving forging processes, increasing product quality, and lowering manufacturing costs. This increases providers' competitiveness by allowing them to deliver improved precision and efficiency in their products.

- Vendor Ecosystem: The expansion of the forgings market has resulted in a broad spectrum of suppliers, from massive amounts manufacturers to specialist forging providers. This diversity provides buyers with a wide array of choices for sourcing high-quality forgings at competitive prices.

- Global Economic Factors: Exchange rates, labour costs, and differential rates of technological adoption across regions all have an impact on pricing, manufacturing capacity, and the availability of forging solutions in the worldwide market.

- Scalability and Flexibility: Modern forging solutions are becoming more scalable and customisable, allowing providers to meet the needs of companies of all sizes, from small-scale manufacturers to major corporations that require complicated and high-volume forged components.

Regional Demand-Supply Outlook: Forgings

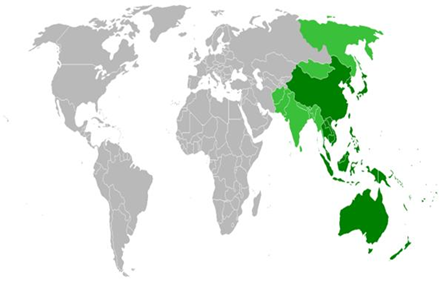

The Image shows growing demand for Forgings in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Forgings Market

Asia Pacific, particularly Japan, is a dominant force in the global Forgings market due to several key factors:

- Strong Manufacturing Base: Asia-Pacific countries, particularly China, India, Japan, and South Korea, have a thriving manufacturing industry. The region is a major hub for industries such as automotive, aircraft, and industrial machinery.

- Growing Automotive and Aerospace Industries: Asia-Pacific's automotive and aerospace industries are quickly increasing. These industries rely on high-quality forged parts for engine, chassis, and other key components.

- Cost-Effective Production: Countries in Asia-Pacific, such as China and India, have lower labour and production costs than industrialized regions. This enables the cost-effective manufacture of forged components, establishing the region as a preferred forging supply location.

- Technology Advancements: The Asia-Pacific region is home to cutting-edge technology breakthroughs in forging processes. Countries such as Japan are known for their advanced forging techniques, such as precision forging and automation.

- Supportive Government Policies: Governments in Asia-Pacific provide advantageous policies and incentives, including as tax rebates and infrastructure support, to stimulate investment in manufacturing and forging industries.

Asia Pacific Remains a key hub Forgings Price Drivers Innovation and Growth.

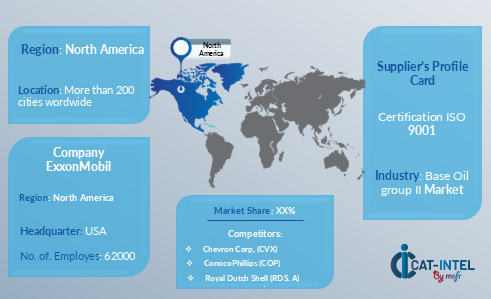

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the forgings market is similarly diversified and fiercely competitive, with a mix of major, established manufacturers and smaller, specialized providers defining industry trends. These suppliers have an impact on key elements such as cost, material quality, production capacities, and lead times. The market is dominated by established forging companies that provide comprehensive solutions for high-volume, demanding needs, while niche suppliers focus on specific sectors such as aerospace or automotive, offering tailored products and innovative features like lightweight materials or advanced heat treatments

The forging supplier ecosystem spans key manufacturing regions such as Asia Pacific, North America and Europe, with both global giants and regional specialists catering to the specific needs of various industries. As businesses prioritize cost effectiveness, sustainability, and material innovation, forging suppliers are investing in sophisticated manufacturing technologies like automation, artificial intelligence, and Internet of Things integration to improve production capacities and satisfy changing market needs. Furthermore, many forging suppliers are using flexible pricing models that include volume-based discounts, long-term partnerships, and bespoke solutions to meet customer needs. This adaptability, combined with the integration of cutting-edge technology, enables suppliers to remain competitive and meet the evolving needs of numerous industries.

Key Suppliers in the Forgings market include:

- Nippon Steel Corporation

- ArcelorMittal

- ThyssenKrupp AG

- Eagle Forge & Machine Company

- Aichi Steel Corporation

- Precision Cast Parts Corporation (PCC)

- Kobe Steel Limited.

- Alcoa Corporation.

- Indian Forgings and Steels Limited.

- Futaba Industrial Company Ltd.

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The forgings market is rapidly expanding, driven by rising demand in industries such as automotive, aerospace, and energy. Companies attempt to improve manufacturing efficiency, shorten lead times, and satisfy higher quality standards. |

|

Cloud Adoption |

The forgings industry is increasingly using cloud-based solutions due to the requirement for scalability, remote monitoring, and cost-effectiveness. Manufacturers are progressively migrating their production management and operational activities to cloud platforms, enabling better supply chain management. |

|

Product Innovation |

Forging providers are diversifying their services to satisfy changing industry expectations. Advanced materials, 3D printing, and AI-powered production monitoring systems are examples of innovations that improve material precision and cater to industries with requirements such as aerospace, automotive, and energy. |

|

Technological Advancements |

Automation, AI, and IoT integration are greatly improving forging operations. These technologies enable scheduled upkeep, real-time monitoring, and process automation, which helps manufacturers improve efficiency, minimize downtime, and improve product uniformity. |

|

Global Trade Dynamics |

Changes in trade rules, compliance requirements, and regional economic policies are all influencing the forgings industry. As firms encounter obstacles such as tariffs, supply chain disruptions, and evolving trade regulations, they are increasingly relying on advanced forecasting and supply chain management systems to negotiate this complexity while maintaining production efficiency. |

|

Customization Trends |

Modular techniques and integration with third-party systems are becoming more significant. This trend enables enterprises in numerous industries to optimize their forging processes and gain more flexibility and control over their output operations, leading to improved outcomes in areas such as quality, cost-efficiency, and lead time. |

|

Forgings Attribute/Metric |

Details |

|

Market Sizing |

The global Forgings market is projected to reach USD 171.78 billion by 2035, growing at a CAGR of approximately 5.4% from 2025 to 2035. |

|

Forgings Technology Adoption Rate |

Approximately 60% of enterprises in the forgings industry have used modern manufacturing technology, with a rising emphasis on automation and smart manufacturing. |

|

Top Forgings Industry Strategies for 2025 |

The forgings market's key strategies include integrating AI and machine learning for predictive maintenance, automating production processes for enhanced efficiency, using sustainable and energy-efficient forging technologies, and prioritizing quality control systems to satisfy regulatory standards. |

|

Forgings Process Automation |

Approximately 50% of forging companies are employing automation to optimize regular activities such as inventory management, production scheduling, and quality control, improve operational efficiency, eliminate human error, and improve product uniformity. |

|

Forgings Process Challenges |

Key challenges in the forgings business include high upfront costs for modern manufacturing technologies and the complexity of maintaining and upgrading equipment, and resistance to adopting new technologies among workers and ensuring product quality consistency during scaling remain prevalent. |

|

Key Suppliers |

Leading forging providers include Nippon Steel Corporation, ArcelorMittal and ThyssenKrupp AG who provide a variety of solutions to industries such as aerospace, automotive, and energy. |

|

Key Regions Covered |

Asia-Pacific North America, and Europe, are key locations for forging technology adoption, with major sectors such as automotive, aerospace, and energy driving significant demand. |

|

Market Drivers and Trends |

The forgings market is expanding due to the growing demand for high-quality, long-lasting components, particularly in the automotive and aerospace industries, the adoption of automation alongside digital fabrication tools, a growing emphasis on ethical manufacturing practices, and innovations in materials and technologies such as AI and IoT integration. |

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide comprehensive analysis of the forging supplier market, identifying major providers and evaluating industry trends. We offer spend analysis, supplier evaluations, and sourcing strategies to help secure high-quality forged components at competitive prices.

We assist in assessing the TCO for forged components by accounting for raw material costs, production expenses, transportation, and maintenance. This detailed analysis ensures a clear understanding of the overall financial impact of sourcing forged parts.

Our risk management services address challenges such as supply chain disruptions, price volatility, quality control, and vendor reliability. These strategies help ensure a secure and cost-effective procurement process for forging solutions.

Our Supplier Relationship Management (SRM) services focus on building strong partnerships with forging suppliers. We assist in contract negotiations, track supplier performance, and support the integration of suppliers into your manufacturing processes.

We recommend best practices such as vendor segmentation, quality assessments, lead time evaluations, and performance monitoring. These practices enable efficient, transparent, and reliable procurement of forged components.

Digital tools optimize forging procurement by automating vendor selection, tracking production progress, and improving supplier communication. These advancements reduce costs, enhance operational performance, and provide real-time data to drive decision-making.

Our supplier performance management services evaluate critical metrics such as on-time delivery, product quality, and production consistency. This helps ensure reliable supplier performance and supports long-term relationships with forging partners.

We support negotiations by leveraging market insights, benchmarking raw material prices, and utilizing strategies such as long-term agreements and volume-based pricing. These approaches help secure favourable terms for forged components.

We offer tools that provide detailed insights into material costs, vendor capabilities, and production trends. These resources enable data-driven decisions in sourcing forged components, optimizing procurement strategies.

We help you adhere to industry regulations, quality standards, and environmental requirements by ensuring that suppliers meet necessary compliance criteria. This maintains alignment with your organization’s procurement policies.

We recommend diversifying supplier relationships, maintaining inventory buffers, and leveraging advanced manufacturing technologies to mitigate disruptions in forging supply chains. This ensures uninterrupted production and timely deliveries.

Our tracking solutions monitor key performance metrics such as delivery timelines, product quality, and vendor support. This helps assess supplier reliability and informs future sourcing decisions.

We identify forging suppliers that focus on energy-efficient production processes, sustainable material sourcing, and environmentally friendly manufacturing practices. These suppliers help align your sourcing with sustainability goals.

Our pricing analysis compares vendor rates, tracks raw material trends, and applies negotiation strategies to secure cost-effective forging solutions while maintaining product quality and meeting operational needs.

We help ensure high-quality standards by conducting thorough supplier assessments, including audits of their manufacturing processes, quality control systems, and certifications. Additionally, we recommend establishing clear quality criteria and performance metrics in contracts, and implementing regular inspections or testing of forged components to ensure they meet your specifications and industry standards.