Fracking Proppants Market Overview:

The global fracking proppants market is steadily expanding, buoyed by rising demand from important industries including as oil and gas, electricity, and mining. This market contains a wide range of proppants, including ceramic, sand, and resin coated proppants, each with its own set of advantages depending on operational requirements. Our paper provides a detailed examination of procurement trends, with an emphasis on cost cutting initiatives and the use of innovative technology to improve supply chain and operational operations.

Key issues in the fracking proppants business include cost management, product quality assurance, and environmental and regulatory compliance. As global demand grows, businesses are increasingly relying on market intelligence solutions to increase operational efficiency, sourcing strategies, and supply chain risk management. Embracing advanced digital tools and sustainability practices is crucial for companies aiming to maintain competitiveness and ensure long-term growth in this dynamic sector.

- Market Size: The global Fracking Proppants market is projected to reach USD 28.02 billion by 2035, growing at a CAGR of approximately 10.18% from 2025 to 203

Growth Rate: 10.18%

- Sector Contributions: Growth in the market is driven by:

- Manufacturing and Supply Chain Optimization: There is a growing demand for real time data and process integration to expedite fracking proppant production and transportation, enhancing operational efficiency across the whole supply chain.

- Expansion of the Oil and Gas Industry: As global energy demand rises, the use of improved fracking proppants is critical for increasing extraction rates, productivity, and cost effectiveness in the oil and gas industry.

- Technological Advancements: Innovations like artificial intelligence and machine learning are being incorporated into fracking proppant production, allowing predictive analytics to improve production schedules and reduce waste. Automation improves the efficiency of production processes.

- Product Customization: New trends indicate a shift towards more customized proppants, such as resin coated and ceramic proppants, fitted to specific well conditions and geological formations. This customization improves overall well performance and reduces downtime.

- Investment Initiatives: Companies are increasingly investing in high-performance, long-lasting fracking proppants, notably ceramic proppants that can handle higher pressure and deeper wells. Furthermore, investment in sustainable manufacturing processes is increasing.

- Regional Insights: North America and Asia Pacific remain major contributors to the fracking proppants industry. The North American oil and gas business is rapidly embracing modern proppants, while Asia Pacific is investing more in energy extraction technologies.

Key Trends and Sustainability Outlook:

- Sustainable Practices: As environmental concerns mount, the industry is focusing on creating ecofriendly fracking proppants and implementing sustainable production procedures. Companies are following requirements to lessen their environmental effect and improve resource efficiency.

- Advanced Features: The use of technology such as IoT in fracking operations improves real time data monitoring, decision making, and well management.

- Customization Trends: There is an increasing demand for customized fracking proppants that fit the specific needs of diverse extraction conditions (e.g., high pressure, deepwater drilling), allowing enterprises to optimize their operations and reduce operational risks.

- Data Driven Insights: With the emergence of advanced analytics, organizations in the fracking proppants industry are better able to estimate demand, track product performance, and improve inventory management, resulting in increased operational efficiency.

Growth Drivers:

- Digital Transformation: An increased dependence on digital tools and technology is increasing the fracking industry's productivity, particularly through automation and data analytics that optimize the use of proppants in drilling operations.

- Demand for Process Automation: Businesses are increasingly depending on automated production and delivery systems to streamline the manufacturing and distribution of fracking proppants, lowering costs and improving operational speed.

- Scalability Requirements: As the oil and gas industry expands, there is a greater need for scalable solutions in proppant production and logistics that can manage larger orders and high demand projects without sacrificing quality.

- Regulatory Compliance: As environmental impact and sustainability requirements tighten, players in the fracking proppants sector are implementing solutions to assure compliance while also reducing environmental harm through improved tracking and reporting.

- Globalization: As oil and gas extraction expands across borders, proppants that are suitable for varied geological conditions and can satisfy international energy extraction compliance criteria will be in high demand.

Overview of Market Intelligence Services for the Fracking Proppants Market:

Recent investigations have revealed significant hurdles in the fracking proppants sector, including as high production costs, supply chain complications, and the requirement for customization to fit unique well conditions. Market intelligence studies provide useful information that assist businesses identify cost cutting methods, optimize supplier relationships, and ensure faster product integration. These insights also help with complying to industry standards, producing high quality products, and successfully managing expenses.

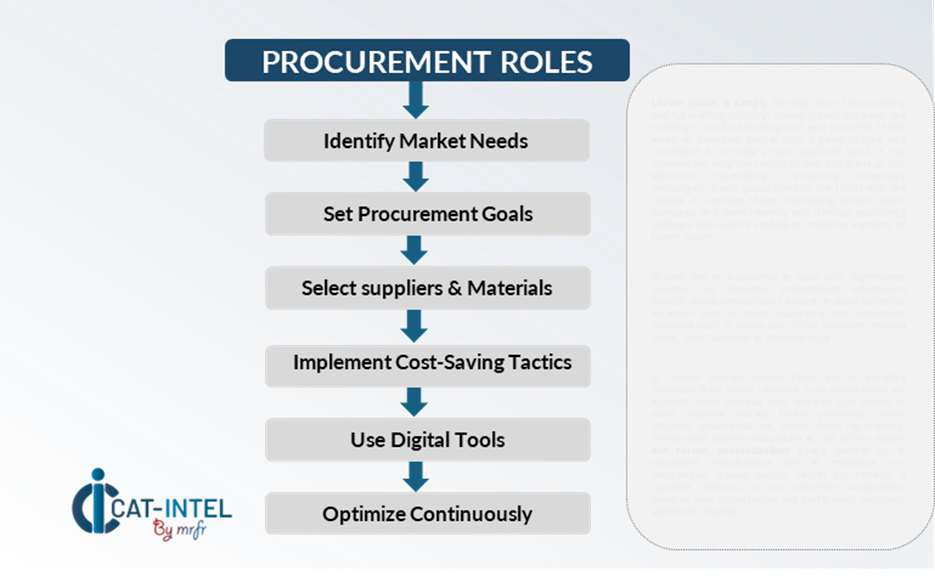

Procurement Intelligence for Fracking Proppants: Category Management and Strategic Sourcing

To remain competitive in the fracturing proppants industry, organizations are improving procurement processes through spend analysis and vendor performance evaluation. Effective category management and strategic purchasing are critical in minimizing procurement costs while guaranteeing a consistent supply of high-quality proppants. Businesses can use actionable market intelligence to improve their procurement strategies, negotiate better terms with suppliers, and secure a consistent, cost-effective supply of proppants that meet their specific operational needs.

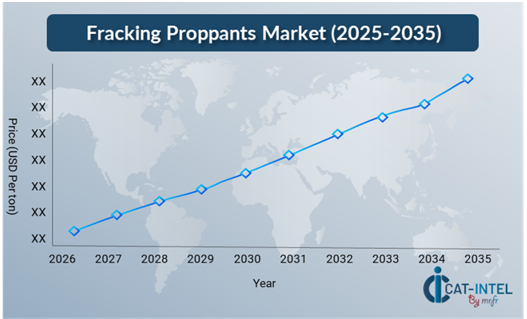

Pricing Outlook for Fracking Proppants: Spend Analysis

The price prognosis for fracking proppants is projected to continue moderately volatile, with changes caused by a variety of causes. Technological developments in proppant production, demand for specialist proppants such as ceramic and resin coated choices, and regional pricing variances due to logistical costs are all major drivers. Furthermore, the growing emphasis on environmental sustainability and adherence to laws, combined with the increased use of modern technologies in extraction operations, may put upward pressure on proppant cost.

Graph shows general upward trend pricing for Fracking Proppants and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement processes, strengthen supplier relationships, and implement more efficient manufacturing methods are critical for cost control. Leveraging digital tools for market monitoring, price forecasting via analytics, and effective contract management can help to increase cost efficiency in the purchase of fracking proppants.

Partnering with dependable suppliers, establishing lengthy agreements, and exploring flexible pricing structures will be critical methods for properly managing tenant expenditures. Regardless of market challenges, concentrating on scalability, assuring high quality production, and implementing sustainable practices will be critical to maintaining cost effectiveness and operational success in fracking operations.

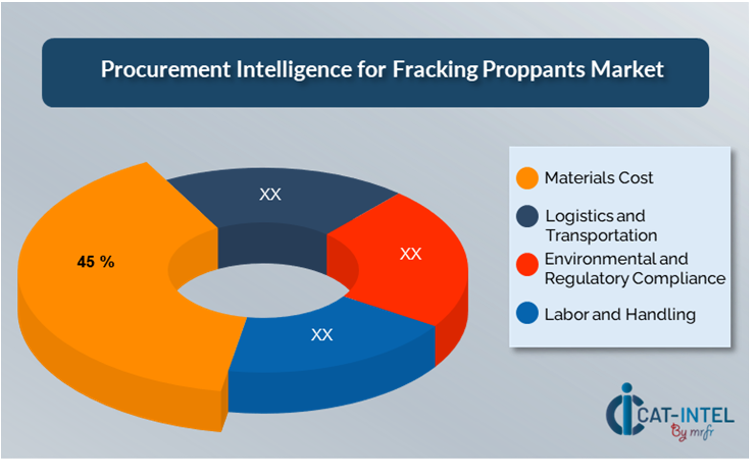

Cost Breakdown for Fracking Proppants: Total Cost of Ownership (TCO) and Cost Saving Opportunities

- Material Cost: (45%)

-

- Description: This includes the cost of basic materials like as sand, ceramic, and resin coated proppants, which varies according on the well's specifications and performance needs.

-

- Trend: The use of locally obtained, cost effective materials is on the rise, as is the demand for high performance proppants for more complex wells.

- Logistics and Transportation: (XX%)

- Environmental and Regulatory Compliance: (XX%)

- Labor and Handling: (XX%)

Cost Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the fracking proppants sector, streamlining procurement processes and using smart negotiation strategies can result in significant cost reductions and increased operational efficiency. Longterm relationships with reputable proppant suppliers, particularly those that provide high performance, long-lasting solutions such as ceramic and resin coated proppants, can result in more favourable price structures and terms, such as volume driven discounts and bundled service packages. Adopting flexible, long-term contracts and paid for pricing models for proppant supply can also help you get more competitive rates and reduce price variations over time. These contracts can help stabilize costs while ensuring a consistent supply of high-quality proppants for energy extraction operations.

Partnering with suppliers who prioritize innovation and scalability can give additional benefits, such as access to innovative technology, sustainable production processes, and customized extraction solutions. This lowers long-term operational expenses and guarantees that businesses have possession of the most appropriate tools for their initiatives. Implementing digital procurement technologies, such as contract management systems and use analytics platforms, improves transparency, reduces over purchasing, and optimizes the use of resources, hence avoiding waste and inefficiencies.

Supply and Demand Overview for Fracking Proppants: DemandSupply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The global fracking proppants industry is steadily expanding, driven by increased demand for energy resources and technical breakthroughs in extraction methods. Demand and supply dynamics in this sector are influenced by variables such as the expanding need for improved proppants, regulatory standards, and regional economic conditions.

Demand factors:

- Energy Production and Expansion: The growing global need for energy, notably oil and gas, necessitates the use of outstanding durability fracking proppants that can boost extraction efficiency and well production.

- Sustainability Trends: Rising environmental concerns and tougher energy extraction rules are increasing demand for environmentally sound proppant solutions, such as ceramic proppants and resin coated options.

- Customisation Requirements: The oil and gas sector operate in several geological conditions, the demand for specialized proppants tailored to specific well requirements is on the rise.

- Technological Integration: As data analytics, IoT, and automation become more prevalent in fracking operations, there is a growing demand for proppants that can integrate smoothly with additional technology to increase performance and save costs.

Supply Factors:

- Technological Advancement: Innovations in proppant production, such as the invention of more durable and efficient proppants, are improving supplier offerings and increasing market competition.

- Vendor Ecosystem: With an increasing number of suppliers, ranging from largescale manufacturers to boutique producers specializing in exceptionally well or sustainable proppants, buyers in the fracking business have a diverse range of options.

- Global Economic Factors: Economic variables like as oil and gas pricing, regional supply chain circumstances, and labour costs affect the availability and pricing of proppants across different markets.

- Scalability and Flexibility: Proppant suppliers are increasingly providing scalable solutions to meet the diverse needs of fracking operations, ranging from small, localized projects to largescale, worldwide extraction endeavours. This flexibility enables providers to satisfy the different needs of energy firms worldwide.

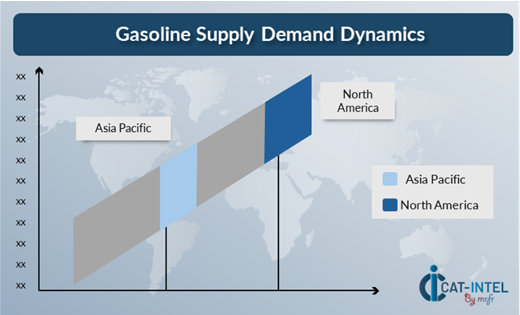

Regional Demand Supply Outlook: Fracking Proppants

The Image shows growing demand for Fracking Proppants in both North America and Asia Pacific, with potential price increases and increased Competition.

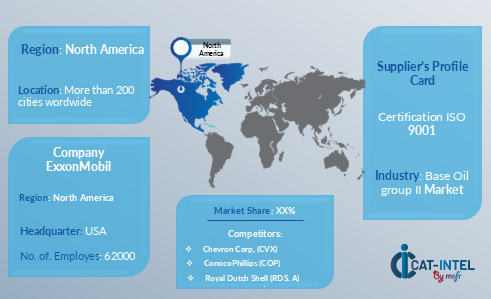

North America: Dominance in the Fracking Proppant Market

North America, particularly the United States, is a dominant force in the global Fracking Proppant market due to several key factors:

- Shale Oil and Gas Deposits: North America, notably the United States, has some of the world's greatest shale oil and gas deposits, including the Permian Basin and the Eagle Ford Shale.

- Advanced Fracking Technology: The region is a leader in innovation and the use of advanced hydraulic fracturing techniques. North American corporations invest extensively in R&D, fuelling the demand for high performance fracking proppants.

- Strong Industry Infrastructure: North America has a widely recognized oil and gas infrastructure, which includes a reliable raw material supply chain, proppant manufacturing facilities, and access to advanced logistical networks.

- Regulatory Environment: The United States has clear regulatory frameworks that encourage the growth of the oil and gas industry. favourable policies and incentives for energy production, coupled with an increasing push for energy independence, create a favourable environment for the growth of the fracking proppants market.

- Investment in the Energy Sector: North American energy businesses are constantly investing in new extraction methods and expanding production capacity.

North America Remains a key hub Fracking Proppants Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The fracking proppants market has a broad and competitive supplier ecosystem, with global industry leaders and regional providers affecting major market parameters including as pricing, product quality, and delivery capabilities. This landscape influences the availability and cost of proppants, with larger suppliers providing a diverse variety of standardized items and smaller, niche businesses focused on specialized, high performance, or environmentally friendly proppants. Well-established manufacturers of ceramic, sand, and resin coated proppants dominate the fracking proppant market, providing

Comprehensive solutions for largescale energy corporations. Smaller providers, on the other hand, are more focused on specific demands, such as providing proppants for unusual drilling settings or offering items that fulfil stricter environmental regulations. As energy firms prioritize sustainability and efficiency in their extraction operations, proppant suppliers are investing in innovations such as ecofriendly materials, longer lasting products, and tailored solutions that work seamlessly with new extraction methods. To address the changing demands of the oil and gas sector, suppliers are looking into flexible pricing methods such as volume-based concessions and long-term agreements.

Key Suppliers in the Fracking Proppant Market include:

- Carbo Ceramics Inc.

- SaintGobain Proppants

- S. Silica Holdings Inc.

- HiCrush Partners LP

- Fairmount Santrol

- Preferred Sands

- Ceradyne Inc

- Fores

- Rohde AG

- China National Petroleum Corporation (CNPC)

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The fracking proppants industry is expanding rapidly as energy companies increasingly use sophisticated materials to optimize drilling and extraction operations. This trend is especially noticeable in emerging nations, where the need for efficient, high-performance proppants is increasing. |

|

Cloud Adoption |

The fracking industry is increasingly using digital solutions and cloud-based platforms. As businesses adopt hybrid work patterns and remote operations, cloud-based technologies offer scalability, cost savings, and quicker access to operational data. |

|

Product Innovation |

Prominent manufacturers are focused on innovation to fulfils the changing needs of the oil and gas industry. Advanced proppants, including as ceramic and resin coated proppants, are intended to endure high-pressure situations while increasing hydraulic fracturing efficiency. |

|

Technological Advancements |

Machine learning, data analytics, and automation are transforming the manufacture and performance of fracking proppants. These technologies allow for better prediction of proppant performance, optimization of production processes, and improved quality control. |

|

Global Trade Dynamics |

Changes in trade rules, regulatory requirements, and economic policies have an impact on the supply and demand dynamics of the fracking proppants industry. Navigating complex supply networks and complying with various regulations are challenges for international oil and gas corporations. |

|

Customization Trends |

As oil and gas firms operate in a variety of tough environments, there is a growing demand for bespoke proppants adapted to individual well conditions and geological formations. This trend includes modular solutions that may be changed to meet the specific needs of each project. |

|

Fracking Proppants Attribute/Metric |

Details |

|

Market Sizing |

The global Fracking Proppants market is projected to reach USD 28.02 billion by 2035, growing at a CAGR of approximately 10.18% from 2025 to 2035. |

|

Fracking Proppants Technology Adoption Rate |

The fracking proppants industry is fast growing for as oil and gas companies use improved proppants to boost extraction efficiency and well productivity for about 50%. A trend toward more durable and specialized proppants, such as ceramic and resin coated versions, is propelling growth in strategic markets. |

|

Top Fracking Proppants Industry Strategies for 2025 |

Key tactics include innovation in product development, a focus on sustainability, and customization of proppants for specific extraction conditions, such as high pressure or deepwater drilling, leading to more personalized solutions. |

|

Fracking Proppants Process Automation |

About 45% of proppant manufacturers are automating critical activities like manufacturing line monitoring, quality control, and logistics. This automation lowers human error, increases production efficiency, and assures high-quality standards in proppant manufacturing, allowing suppliers to fulfil increased demand more effectively. |

|

Fracking Proppants Process Challenges |

Several difficulties are preventing future growth in the fracking proppants market, including high production costs, supply chain complexity, and environmental concerns. |

|

Key Suppliers |

Carbo Ceramics, SaintGobain Proppants, and US Silica are top suppliers of fracking proppants for the shale oil and gas business. |

|

Key Regions Covered |

The biggest demand for fracking proppants is in North America, particularly the United States, which maintains a leader in shale oil and gas extraction. Other rising markets include parts of Asia Pacific and the Middle East, where energy production is quickly increasing. |

|

Market Drivers and Trends |

Increased demand for energy, stricter environmental restrictions are driving the development of ecofriendly proppants to reduce emissions. |

What procurement intelligence services can aid in sourcing fracking proppants?

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide a comprehensive market analysis for fracking proppants, identifying major suppliers and evaluating trends such as material innovations and sustainability efforts. We offer spend analysis, supplier evaluations, and sourcing strategies to help secure reliable and cost-effective proppants for energy extraction.

We assist in assessing the TCO for fracking proppants by considering factors such as proppant cost, delivery logistics, handling expenses, and environmental impact fees. This detailed analysis ensures you understand the full financial commitment, including long term operational and environmental costs.

Our risk management services address key challenges like supply chain disruptions, regulatory compliance, and potential cost fluctuations. These strategies help minimize risk exposure and ensure a reliable supply of proppants under varied market conditions.

Our Supplier Relationship Management (SRM) services focus on building long term partnerships with proppant suppliers. We assist in contract negotiations, performance tracking, and ensuring suppliers align with your operational and environmental standards.

We recommend best practices such as vendor segmentation, cost benefit analysis, performance monitoring, and supplier diversification. These methods enable a more efficient and transparent procurement process, reducing the risk of supply shortages and price volatility.

Digital tools optimize procurement by streamlining supplier selection, enhancing logistics management, and automating procurement workflows. These improvements help reduce lead times, manage costs more effectively, and improve the overall operational efficiency of sourcing proppants.

Our supplier performance management services monitor key metrics like delivery timeliness, proppant quality, and customer service. This ensures that suppliers consistently meet your expectations and allows you to make informed decisions about future contracts and partnerships.

We support negotiations by leveraging market insights, benchmarking pricing, and recommending strategies such as long-term agreements, volume-based discounts, and flexible payment terms. These approaches help secure favourable terms for proppant procurement.

We offer tools that provide insights into pricing trends, supply chain performance, and vendor capabilities. These resources enable data driven decision making and help you navigate the competitive landscape of the fracking proppants market.

We help you ensure compliance with environmental regulations, quality standards, and industry best practices by assessing supplier adherence to required certifications and sustainability initiatives, supporting your regulatory and operational needs.

We recommend strategies such as maintaining multiple supplier relationships, utilizing local suppliers for backup, and adopting flexible contract terms. These measures help mitigate risks from supply chain disruptions due to fluctuating demand or unexpected global events.

Our tracking solutions monitor supplier metrics such as on time delivery, proppant quality, and responsiveness to issues. These data points help assess supplier reliability and guide future purchasing decisions.

We identify suppliers who use ecofriendly materials, adopt energy efficient manufacturing practices, and offer low carbon footprint products. Aligning with these suppliers supports both your environmental goals and regulatory compliance.

Our pricing analysis compares supplier rates, evaluates market trends, and applies strategic negotiation techniques to achieve the best possible pricing. These efforts help ensure cost-effective procurement without sacrificing product quality or supplier reliability.

We help streamline your procurement process by implementing automated systems for order tracking, inventory management, and supplier communications. By leveraging digital tools for real time monitoring, predictive analytics, and demand forecasting, you can reduce lead times, avoid stockouts, and optimize procurement workflows for greater operational efficiency.