Fuel Oil Market Overview:

The global fuel oil market is steadily growing, driven by rising demand in industries such as energy, transportation, production, and shipping. This market covers a wide range of fuel oil products, such as heavy fuel oil, marine fuel, and industrial-grade oils. Our paper provides a detailed examination of procurement trends, with a particular emphasis on cost-cutting techniques and the use of sophisticated technology to expedite procurement and operational procedures.

The key future problems in fuel oil procurement are controlling fluctuating prices, guaranteeing supply chain stability, maintaining environmental compliance, and improving fuel efficiency. The implementation of digital solutions, such as predictive analytics and automated procurement, is crucial for improving fuel procurement and guaranteeing long-term operational sustainability. As global demand rises, corporations are leveraging the market.

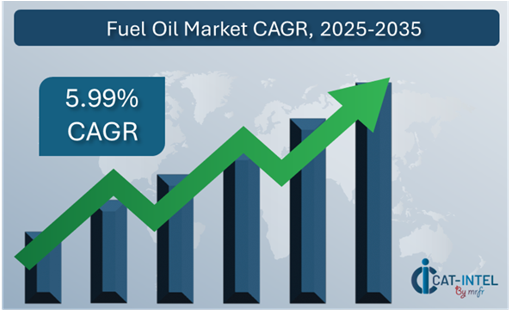

- Market Size: The global Fuel Oil market is projected to reach USD 364.14 billion by 2035, growing at a CAGR of approximately 5.99% from 2025 to 203

Growth Rate: 5.99%

- Sector Contributions: Growth in the market is driven by:

- Manufacturing and Supply Chain Optimization: Streamlining operations with digital solutions allows businesses to track inventory, optimize production processes, and improve supply chain visibility.

- Retail and E-commerce Growth: Implementing modern technologies to improve inventory management, demand forecasting, and customer relationship management (CRM). Efficient procurement techniques enable firms to satisfy increased client expectations while lowering operational costs.

- Technological Transformation: Advances in artificial intelligence, machine learning, and predictive analytics are aiding the fuel oil sector by allowing for more accurate demand forecasts, optimal fuel management, and increased supply chain efficiency.

- Innovations: Modular fuel oil procurement solutions enable businesses to select certain characteristics that meet their needs, making it easier to grow operations, decrease costs, and streamline complications.

- Investment initiatives: Companies are increasing their investments in cloud-based procurement solutions, for managing large volumes of fuel oil transactions while offering the flexibility to operate remotely and securely.

- Regional insights: Asia Pacific and North America are major regions in the fuel oil market, thanks to strong digital infrastructure and increasing usage of cloud-based solutions.

Key Trends and Sustainability Outlook:

- Cloud Integration: Cloud technologies improve resource management, data analytics, and integration across supply chain functions.

- Advanced features: The integration of AI, IoT, and blockchain technology improves decision-making, automation, and transparency in the fuel oil industry.

- Focus on Sustainability: The fuel oil industry is increasingly focusing on sustainability, with digital solutions that allow businesses to measure fuel usage, optimize consumption, and assure compliance with environmental regulations.

- Customization trends: There is an increasing demand for industry-specific solutions that address the specialized needs of sectors such as shipping, transportation, and industrial fuel usage.

- Data-Driven Insights: Advanced analytics and business intelligence in procurement systems enable organizations in the fuel oil sector to estimate demand, track performance indicators, and improve inventory management.

Growth Drivers:

- Digital Transformation: The fuel oil market is undergoing widespread digital transformation, with real-time data, automation, and digital technologies driving the change throughout supply chains.

- Demand for Process Automation: The fuel oil business clearly demonstrates the growing demand for automation to remove repetitive tasks and streamline operations.

- Scalability Requirements: As worldwide demand for fuel oil climbs, businesses are increasingly looking for scalable solutions that can grow with their operations.

- Regulatory Compliance: Due to regulatory demands in the fuel oil sector, enterprises must comply with environmental standards, safety rules, and reporting requirements.

- Globalization: With the increasing need for petroleum oil across global markets, businesses are seeking solutions that can support multi-currency, multi-language, and international compliance requirements.

Overview of Market Intelligence Services for the Fuel Oil Market:

Recent investigations have highlighted significant issues in the fuel oil business, such as high procurement costs and the need for customized supply chain solutions. Market intelligence studies provide meaningful insights into procurement prospects, assisting businesses in identifying cost-saving methods, optimizing supplier management, and increasing the success of procurement efforts. These insights also help to ensure compliance with industry rules, high-quality operational processes, and optimal cost management.

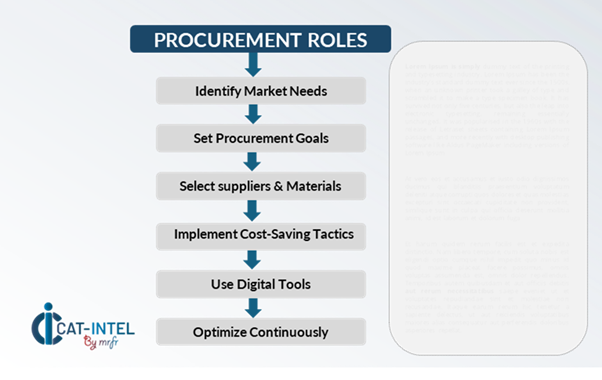

Procurement Intelligence for Fuel Oil: Category Management and Strategic Sourcing

To remain competitive in the fuel oil market, businesses are streamlining their procurement procedures through rigorous expenditure analysis and vendor efficiency monitoring. Effective category management and strategic sourcing are critical in minimizing procurement costs while assuring a consistent supply of high-quality gasoline. Businesses can use actionable market intelligence to optimize their procurement strategies, negotiate advantageous terms, and get the best possible pricing for their fuel oil requirements. This approach not only helps in cost reduction but also guarantees compliance with environmental and regulatory standards, ensuring a stable supply chain in an increasingly dynamic market.

Pricing Outlook for Fuel Oil: Spend Analysis

The price prognosis for fuel oil is projected to continue moderately volatile, with changes affected by several factors. Key drivers include technical developments in fuel management, rising demand for greener and more efficient energy solutions, global supply and demand changes, and regional pricing differences. Furthermore, the increasing use of automation, predictive analytics, and IoT in fuel management applications, combined with a growing emphasis on environmental sustainability and regulatory compliance, is putting upward pressure on fuel oil prices.

Graph shows general upward trend pricing for Fuel Oil and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve supplier management, and implement flexible fuel procurement options are critical for cost control. Leveraging digital technologies for market monitoring, pricing forecasting, and improved contract administration can help to increase cost efficiency and provide a more proactive approach to market changes.

Partnering with reputable gasoline suppliers, negotiating long-term contracts, and investigating bulk purchase options are all excellent strategies for managing fuel oil expenses. Despite these obstacles, concentrating on supply chain resilience, meeting sustainability goals, and leveraging data-driven insights for procurement decisions will be critical to preserving cost-effectiveness and operational efficiency in the fuel oil industry.

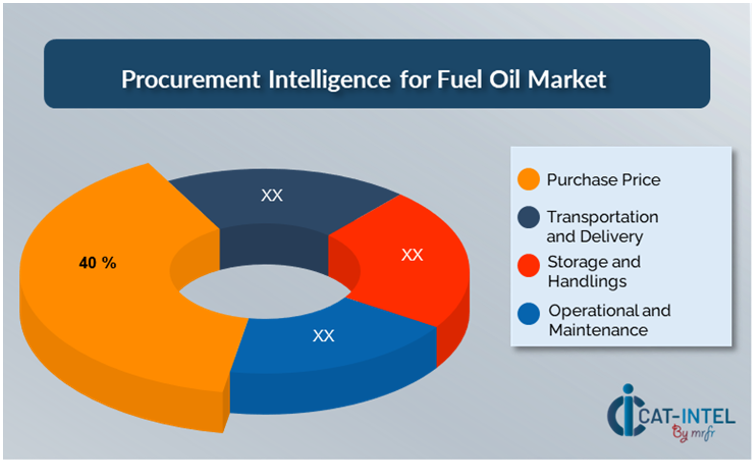

Cost Breakdown for Fuel Oil: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Purchase Price: (40%)

-

- Description: The buy price is the amount paid to obtain fuel oil, which is governed by worldwide market pricing, supply and demand, and geopolitical variables.

- Trend: Market instability, such as changes in global crude oil prices, OPEC+ production decisions, and the transition to more sustainable energy sources, has had an increasing impact on fuel oil purchasing prices.

- Transportation and Delivery: (XX%)

- Storage and Handling: (XX%)

- Operational and Maintenance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the fuel oil industry, streamlining procurement processes and using strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Long-term relationships with fuel suppliers, particularly those that provide flexible, dependable supply models and sustainability-focused solutions, can result in more attractive price structures and terms, such as bulk discounts and bundled service packages. Exploring contract-based or subscription models for gasoline supply can also give potential. Collaboration with fuel providers that value innovation, sustainability, and scalability provide additional benefits such as access to energy-efficient solutions, real-time consumption tracking, and enhanced fuel management systems. These advances can assist to cut long-term operational expenses and improve fuel efficiency.

Using digital procurement technologies, such as contract management systems and usage analytics, improves transparency, minimizes waste, and ensures efficient fuel utilization. Diversifying supplier alternatives and implementing a multi-vendor approach can help to reduce reliance on a single provider, lower the risk of supply disruptions, and increase negotiation power for better terms and reliable fuel delivery. Companies that implement these techniques can achieve increased resilience, efficiency in operations, and cost management in the fuel oil market.

Supply and Demand Overview for Fuel Oil: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The fuel oil market is expanding steadily, propelled by rising worldwide energy demand, technological improvements, and shifting environmental priorities in businesses such as logistics, production, and shipping. Geopolitical stability, market restrictions, and the growing desire for sustainable energy solutions all have an impact on supply-and-demand dynamics.

Demand Factors:

- Energy Transition Initiatives: Industries are adopting sustainable and cost-effective fuel oil options to meet growing demand for cleaner and more efficient fuel solutions.

- Global Energy Demand: Rising consumption in rising economies and industries like transportation and industrial output is pushing up demand for fuel oil, especially in places with limited access to alternate energy sources.

- Industry-Specific Requirements: Sectors like shipping, heavy industry, and power generation require fuel oil solutions tailored to their specific energy needs and environmental compliance standards.

- Technological Advancements: The proliferation of IoT devices and data analytics for fuel management is driving up demand for comprehensive fuel management systems that optimize usage and efficiency.

Supply Factors:

- Technological Innovations: Advances in fuel refining, automation, and monitoring systems improve the availability and quality of fuel oil, while also boosting supply chain efficiency and lowering prices.

- Vendor Ecosystem: An increasing number of providers, including large-scale manufacturers and smaller, specialist providers, are forming a competitive market that provides a varied range of fuel oil products to fulfil industrial needs.

- Global Economic Conditions: Geopolitical stability, changes in crude oil prices, and labour expenses all have a substantial impact on the price and availability of fuel oil.

- Regulation Compliance and Sustainability: Increasing regulatory challenges and a global shift toward environmental sustainability are forcing suppliers to provide more environmentally friendly and compliant fuel oil solutions, hence contributing to the market's evolution.

Regional Demand-Supply Outlook: Fuel Oil

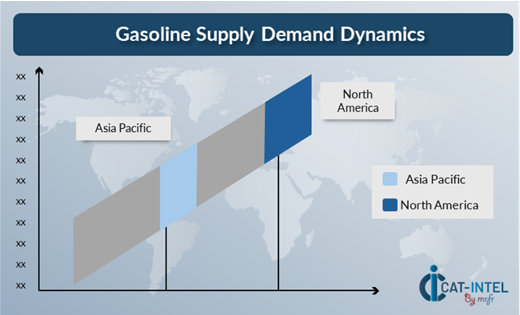

The Image shows growing demand for Fuel Oil in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Fuel Oil Market

Asia Pacific, particularly the West Asia, is a dominant force in the global Fuel Oil market due to several key factors:

- Rapid Industrialization and Economic Growth: The Asia-Pacific area, particularly China and India, has experienced rapid industrialization and economic growth in recent decades. This has resulted in increased demand for energy resources, especially fuel oil, to support industries such as production, transport, and electricity generation.

- High Energy Consumption: Asia-Pacific is home to several of the world's top energy consumers. The region's rapid urbanization and expanding middle class have increased demand for transportation fuels, electricity, and industrial energy, transforming it into a major fuel consumer.

- Strategic Location of Fuel Production and Transportation: The Asia-Pacific area offers direct access to key oil-producing countries and shipping routes, particularly in the Middle East, Southeast Asia, and Australia.

- Government Policies and Investments in Energy Infrastructure: The region's fuel market supremacy is attributed to government policies that prioritize energy security, economic growth, and independence.

- Global Fuel Exporter Position: Countries such as Singapore are important global refining hubs, exporting refined oil products, whereas China and India have a substantial presence in the global petroleum market through production, refining, and consumption operations.

Asia Pacific remains a key hub Fuel Oil Price Drivers Innovation and Growth

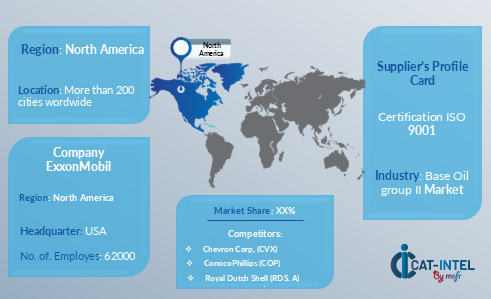

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the fuel oil industry is simultaneously diverse and competitive, with a combination of global energy behemoths and regional providers playing important roles in defining market dynamics. These vendors have a significant impact on pricing models, supply chain stability, and product quality. Large, well-established oil and gas firms dominate the market, offering a diverse range of petroleum-based goods, while smaller, specialist providers focus on specific sectors such as environmentally friendly fuels or tailored delivery systems.

The fuel oil supplier ecosystem encompasses critical energy locations and includes both global businesses and inventive local providers that meet industry-specific needs, such as those in transportation, electricity generation, and manufacturing. As the demand for cleaner and more efficient energy develops, fuel oil producers are developing technology such as fuel optimization systems, providing more sustainable fuel options, and responding to regulatory requirements. They are also providing more flexible pricing and purchasing options to satisfy the changing needs of businesses in a dynamic global energy landscape. This ensures their continued competitiveness in a sector that is continually changing to suit both environmental and financial demands.

Key Suppliers in the Fuel Oil market include:

- Saudi Aramco

- ExxonMobil

- Shell

- BP

- Chevron

- TotalEnergies

- Rosneft

- China National Petroleum Corporation (CNPC)

- Gazprom

- Eni

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The fuel oil market is rising rapidly, owing to increased energy demand across industries, particularly in emerging economies where industrialization and transportation needs are growing. |

|

Cloud Adoption |

Cloud technology enable organizations to access real-time data, boost supply chain visibility, and remotely monitor fuel consumption. This move also encourages cost savings, scalability, and seamless integration across multi-location operations. |

|

Product Innovation |

Fuel oil suppliers are progressively proposing novel solutions to meet changing market expectations. These advancements include the incorporation of cutting-edge technologies such as IoT for real-time fuel monitoring, AI-powered fuel optimization tools, and automated systems for more effective inventory management. |

|

Technological Advancements |

IoT integration, machine learning, and automation are improving fuel oil management by giving predictive insights into consumption patterns, improving supply chain logistics, and automating routine tasks such as ordering and delivery. |

|

Global Trade Dynamics |

Multinational fuel suppliers must navigate complex regulatory regimes while assuring compliance and managing the logistics of providing fuel to different locations with different economic and political landscapes. |

|

Customization Trends |

Companies are increasingly looking for modular fuel management systems and procurement solutions that can be integrated with their existing business tools. Flexible solutions that can adapt to specific business needs, such as predictive fuel ordering, tailored pricing models, or environmentally friendly fuel sources, are becoming increasingly important for fulfilling the expectations of various industries and areas. |

|

Fuel Oil Attribute/Metric |

Details |

|

Market Sizing |

The global Fuel Oil market is projected to reach USD 364.14 billion by 2035, growing at a CAGR of approximately 5.99% from 2025 to 2035. |

|

Fuel Oil Technology Adoption Rate |

The fuel oil industry is seeing an increase in the adoption of modern technology, with more than 60% of energy-related enterprises using digital solutions for fuel management and procurement. |

|

Top Fuel Oil Industry Strategies for 2025 |

Integrating AI and machine learning for optimized fuel consumption tracking, automating inventory and order management, prioritizing environmental compliance through sustainable practices, and adopting smart fuel monitoring systems for greater visibility are all key strategies for fuel oil companies. |

|

Fuel Oil Process Automation |

Approximately 50% of fuel oil suppliers are automating their operations, particularly in routine procedures like supply chain management, order monitoring, and fuel forecasting. |

|

Fuel Oil Process Challenges |

The fuel oil sector faces several challenges, including fluctuating global fuel prices, the high cost of implementing sustainable energy solutions, the difficulty of managing varied regulatory requirements across regions, and overcoming infrastructural limits in distant areas |

|

Key Suppliers |

Leading competitors in the fuel oil industry include global businesses such as Saudi Aramco, Exxon Mobil and Shell, as well as regional suppliers that provide specialized services tailored to local demands. |

|

Key Regions Covered |

Asia-Pacific and North America are among the most important regions for fuel oil use. These locations are seeing high demand in industries including transportation, heavy production, and power generation. |

|

Market Drivers and Trends |

Fuel oil market growth is being driven by rising worldwide energy consumption, particularly in emerging nations, as well as the adoption of digital technology for improved fuel tracking, forecasting, and sustainability efforts. Additionally, there is a growing focus on sustainability, pushing the industry to explore alternative fuels and green initiatives. |

Frequently Asked Questions (FAQ):

Our procurement intelligence services offer comprehensive analysis of the fuel oil market, identifying key suppliers and evaluating industry trends. We provide spend analysis, supplier evaluations, and strategic sourcing recommendations to help secure competitive pricing and reliable fuel oil solutions.

We assist in calculating the TCO for fuel oil by considering factors such as the cost of procurement, transportation, storage, maintenance, and compliance-related expenses. This thorough analysis ensures a clear understanding of the long-term financial impact of sourcing fuel oil.

Our risk management services help identify and mitigate risks such as price volatility, supply chain disruptions, regulatory compliance issues, and supplier reliability. We support secure and cost-effective fuel oil procurement processes by developing strategies to address these challenges.

Our Supplier Relationship Management (SRM) services focus on building strong, long-term partnerships with fuel suppliers. We assist in contract negotiations, monitor supplier performance, and ensure smooth integration into your operations for reliable fuel supply.

We recommend best practices such as vendor segmentation, price benchmarking, risk assessment, and regular supplier performance evaluations. These practices help ensure transparent and effective fuel oil procurement, reducing costs while maintaining a steady supply.

Digital tools enhance fuel oil procurement by automating supplier selection, streamlining contract management, and improving order tracking and forecasting. These tools help reduce procurement costs and increase operational efficiency in the fuel oil supply chain.

Our supplier performance management services evaluate metrics like fuel delivery accuracy, supply reliability, and compliance with sustainability standards. By monitoring these factors, we ensure that suppliers consistently meet your expectations, minimizing disruptions and enhancing long-term supply reliability.

We assist in negotiations by leveraging market intelligence, tracking pricing trends, and applying strategies like multi-year contracts, volume-based discounts, and flexible payment terms. These tactics help secure advantageous terms and cost-effective fuel oil procurement agreements.

We offer tools that provide insights into fuel pricing trends, supplier capabilities, and supply chain forecasts. These resources help you make informed, data-driven decisions for fuel oil procurement and identify the most suitable suppliers.

We help ensure compliance with industry regulations and environmental standards by verifying that fuel suppliers meet all necessary safety, quality, and environmental requirements. This ensures adherence to legal and sustainability standards throughout the procurement process.

We recommend diversifying supplier sources, exploring multiple delivery channels, and implementing contingency plans to mitigate risks such as price volatility and supply disruptions. Leveraging cloud-based systems for real-time monitoring can also enhance visibility and responsiveness.

Our tracking solutions monitor key performance metrics, including delivery times, fuel quality, pricing consistency, and regulatory compliance. This helps assess supplier reliability, track performance trends, and inform future procurement decisions.

We identify suppliers who prioritize sustainable practices, such as using renewable fuel sources, adopting low-emission technologies, and complying with environmental regulations. These practices help align your procurement strategy with your organization’s sustainability goals.

Our pricing analysis compares supplier rates, tracks fuel price fluctuations, and applies negotiation strategies to secure competitive fuel oil pricing. This ensures cost-effective procurement while maintaining high-quality products and reliable supply.

We offer tools and strategies to enhance transparency in fuel oil procurement by implementing real-time tracking systems, digital dashboards, and detailed reporting mechanisms. These solutions provide clear insights into fuel inventory levels, delivery schedules, and supplier performance, enabling better decision-making and minimizing potential procurement risks.