Graphite Market Overview:

The global graphite market is steadily expanding, driven by demand from a variety of industries, including automotive, electronics, renewable energy, and manufacturing. This market contains three forms of graphite: natural, synthetic, and expanded graphite, each fulfilling a distinct industrial use. Our research includes a detailed examination of procurement trends, with an emphasis on cost-cutting methods and the use of sophisticated technology to improve procurement and operations.

Major future procurement difficulties include managing variable raw material costs, guaranteeing supply chain resilience, maintaining quality standards, and adjusting to changing environmental rules. Digital procurement technologies and strategic sourcing are critical to optimizing graphite sourcing and maintaining long-term competitiveness. Companies are utilizing the growing global demand for electric cars (EVs), batteries, and renewable energy technology market intelligence to enhance operational efficiency, reduce supply chain risks, and identify cost-saving opportunities.

- Market Size: The global Graphite market is projected to reach USD 35.50 billion by 2035, growing at a CAGR of approximately 5.97% from 2025 to 2035

Growth Rate: 5.97%

- Sector Contributions: Growth in the market is driven by:

- Manufacturing and Supply Chain Optimization: Graphite suppliers and manufacturers are working to improve logistics and ensure on-time delivery, particularly in industries such as automotive, electronics, and energy storage.

- Retail and E-Commerce Growth: The increasing demand for graphite in industries such as electric vehicles (EVs) and consumer electronics is pushing investments in inventory management and demand forecasting.

- Technological Transformation: Advances in artificial intelligence and machine learning are improving graphite production and refinement, particularly through the optimization of extraction procedures.

- Innovations: Modular graphite solutions, such as customisable materials for specific applications in electronics, energy storage, and industrial use, enable enterprises to select only the graphite kinds that fit their requirements.

- Investment Initiatives: Companies within the graphite supply chain are progressively investing in green technology and sustainable mining techniques. to reduce environmental impact and ensure the long-term availability of this vital resource.

- Regional Insights: Asia Pacific and North America are the main contributors to the global graphite market, owing to high demand from the electric car industry and electronics production.

Key Trends and Sustainability Outlook:

- Cloud Integration: The use of cloud-based solutions in graphite supply chain management is growing, providing for more scalability, cost efficiency, and data availability.

- Advanced Features: Integrating AI, IoT, and blockchain into graphite manufacturing improves decision-making, automation, and transparency.

- Focus on Sustainability: The graphite industry is emphasizing responsible mining operations, minimizing environmental damage, and adhering to sustainability targets.

- Customization Trends: Demand for industry-specific graphite solutions is increasing, including high-purity graphite for batteries and specialized graphite for industrial uses.

- Data-Driven Insights: The application of advanced analytics in graphite supply chains enables firms to properly estimate demand and optimize inventory management.

Growth Drivers:

- Digital Transformation: The increasing use of digital technologies in graphite manufacturing and supply chain management boosts productivity and efficiency.

- Demand for Process Automation: The graphite sector is increasingly reliant on automation to streamline production processes, decrease human error, and improve operational efficiency.

- Scalability Requirements: As global demand for graphite rises, particularly with the advent of electric vehicle (EV) batteries, graphite companies are looking for scalable solutions that can increase production capacity.

- Regulatory Compliance: As environmental concerns and laws tighten across the world, graphite firms are increasingly implementing systems to assist them comply with environmental rules and industry standards.

- Globalization: Businesses require solutions that can handle multi-currency transactions, manage cross-border supply chains, and comply with a wide range of regulatory requirements in different regions.

Overview of Market Intelligence Services for the Graphite Market:

Recent research has identified important issues in the graphite business, including fluctuating raw material pricing, supply chain interruptions, and the need for sustainable sourcing procedures. Market intelligence studies provide meaningful insights into procurement prospects, assisting businesses in identifying cost-saving strategies, optimizing supplier management, and improving the whole procurement process. These insights help assure compliance with industry rules and high operating standards, as well as smart cost management.

Procurement Intelligence for Graphite: Category Management and Strategic Sourcing

To remain competitive in the graphite market, businesses are optimizing procurement procedures using spend analysis and vendor performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs and maintaining a consistent supply of high-quality graphite. Businesses that use actionable market knowledge can improve their procurement strategy, negotiate better rates, and acquire trustworthy graphite sources for industries such as electric vehicle production, electronics, and energy storage.

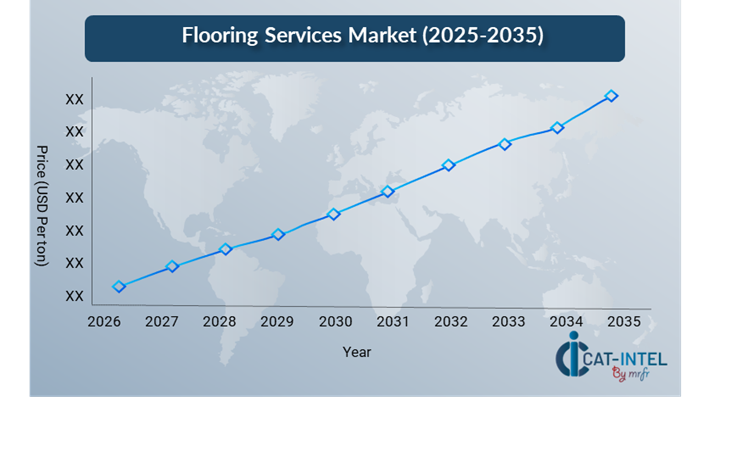

Pricing Outlook for Graphite: Spend Analysis

The graphite pricing outlook is projected to remain moderately dynamic, with potential fluctuations caused by a variety of causes. Technological developments in extraction and refining techniques, rising demand in areas such as electric vehicles (EVs), renewable energy storage, and electronics, and geographical supply and demand disparities are all significant factors.

Graph shows general upward trend pricing for Graphite and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, strengthen supplier relationships, and implement sustainable sourcing strategies are critical to minimizing graphite costs. Leveraging digital tools for market monitoring, analytics-based pricing predictions, and effective contract administration can help to reduce costs even more.

Partnering with reputable graphite suppliers, negotiating long-term contracts, and investigating flexible pricing structures are all critical tactics for effectively managing graphite procurement costs. Regardless of these obstacles, focusing on scalability, guaranteeing a consistent supply of high-quality minerals, and implementing sustainable mining and production processes will be important to sustaining cost-effectiveness and long-term operational success.

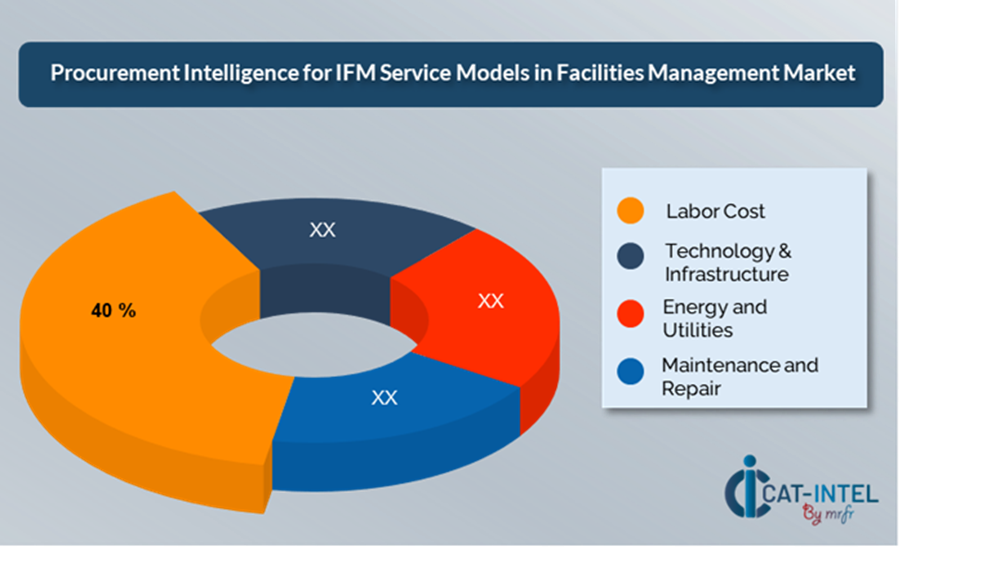

Cost Breakdown for Graphite: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Raw Material Extraction: (45%)

- Description: The cost of collecting and processing graphite is a significant component of TCO. This comprises the mining, refining, and separation processes required to produce high-purity graphite.

- Trend: As the demand for high-quality graphite, notably for lithium-ion batteries, rises, firms invest in more efficient extraction technology to lower processing costs.

- Transportation and Logistic: (XX%)

- Labor and Workforce: (XX%)

- Energy and Utility: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the graphite business, streamlining procurement processes and using strategic bargaining strategies can lead to significant cost reductions and increased operational efficiency. Creating long-term partnerships with graphite suppliers, especially those who provide sustainable sourcing and innovative processing technologies can result in more beneficial price structures and terms, such as volume-based discounts and bundled service packages. Flexible pricing structures and multi-year contracts allow you to secure reduced rates while mitigating price changes over time.

Collaborating with graphite suppliers who value innovation and scalability provides additional benefits, such as access to sophisticated extraction and processing technology, sustainable mining techniques, and enhanced logistics. These characteristics contribute to lower long-term operational costs. Implementing digital procurement technologies, such as contract management platforms and market intelligence tools, increases transparency, reduces overstocking, and maximizes material utilization. Diversifying vendor options and implementing multi-vendor methods can reduce reliance on a single supplier, eliminate risks like supply chain disruptions, and improve negotiation leverage, assuring a stable and cost-effective supply of graphite for industries like electric vehicle manufacturing, electronics, and energy storage.

Supply and Demand Overview for Graphite: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The graphite market is growing steadily, driven by rising demand in industries such as electric vehicle (EV) manufacturing, energy storage, and electronics. Technological breakthroughs, industry-specific customizing needs, and global economic situations all have an impact on supply and demand.

Demand Factors:

- Digital Transformation Initiatives: The expanding use of digital technology in industries such as EV production and energy storage is pushing up demand for high-quality graphite for batteries, electronics, and other vital uses.

- Cloud Adoption Trends: As graphite supply chains grow in complexity, cloud-based technologies are increasingly being employed to improve inventory management, logistics, and traceability.

- Industry-certain Requirements: Industries such as battery production and renewable energy demand graphite with certain properties, such as purity and grain size, that are customized to their needs.

- Integration Capabilities: The growing demand for electric vehicles and energy-efficient solutions necessitates graphite systems that work smoothly with other modern materials and technologies such as lithium-ion batteries and supercapacitors.

Supply Factors:

- Technological Advancements: Innovations in mining, refining, and synthetic graphite manufacture are improving graphite quality and increasing extraction efficiency.

- Vendor Ecosystem: An increasing number of graphite suppliers, including large-scale and specialist vendors in synthetic and natural graphite, guarantees that buyers in various industries have a varied variety of possibilities.

- Global Economic Concerns: Exchange rates, geopolitical concerns, labour costs, and regional demand for batteries and electronics all have a substantial impact on graphite pricing, availability, and the global supply chain.

- Scalability and Flexibility: As graphite production technologies become more modular, providers can increase production in response to expanding worldwide demand while adapting to changing industry needs, ranging from high-end electronics to bulk energy storage solutions.

Regional Demand-Supply Outlook: Graphite

The Image shows growing demand for Graphite in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Graphite Market

Asia Pacific, particularly China, is a dominant force in the global Graphite market due to several key factors:

- Abundant Natural Graphite Resources: China alone accounts for a sizable percentage of global output, ensuring a consistent supply of flake and amorphous graphite.

- Large-Scale Production Capacity: China is the world leader in graphite mining and refining, allowing for economies of scale that lower prices and increase production efficiency.

- Strong Demand from Key Industries: As the global demand for electric vehicles and energy storage systems grows, so does the demand for high-quality graphite, with the Asia-Pacific region leading the way in production and supply.

- Technological Advancements and Processing Knowledge: The region has great knowledge in graphite processing and refining, as well as a large investment in innovative technology to improve graphite processing efficiency and quality.

- Strategic Trade and Export Networks: Asia-Pacific countries have created trade routes and export networks, allowing them to meet global graphite demand.

Asia Pacific Remains a key hub Graphite Price Drivers Innovation and Growth

Supplier Landscape: Supplier Negotiations and Strategies

The graphite market's supplier landscape is diversified and competitive, with global market leaders and regional providers influencing industry dynamics. These vendors have a significant impact on pricing models, material quality, and supply chain efficiency. Well-established mining and processing companies dominate the industry, providing high-quality natural and synthetic graphite, while smaller, specialized competitors specialize in specific uses such as battery-grade graphite or high-purity electronics materials.

The graphite supplier ecosystem in key production zones includes both established global vendors and innovative local businesses that cater to industry-specific needs. Graphite suppliers are advancing production capabilities, integrating cutting-edge technologies, and offering flexible pricing models to meet the changing needs of industries such as EVs, renewable energy storage, and electronics.

Key Suppliers in the Graphite market include:

- China Northern Rare Earth Group High-Tech Co., Ltd. (CNG)

- Syrah Resources Limited

- BTR New Energy Materials Inc.

- Graphite India Limited

- Tianqi Lithium Corporation

- Mason Graphite Inc.

- Focus Graphite Inc.

- GrafTech International Ltd.

- Heilongjiang Aoyu Graphite Group

- Northern Graphite Corporation-

Key Developments Procurement Category Significant Development:

|

Significant Development |

Description |

|

Market Growth |

The graphite industry is experiencing substantial expansion because to increased demand from industries such as EVs, renewable energy storage, and electronics, which prioritize energy efficiency and sustainability in their products. |

|

Cloud Adoption |

The graphite market is seeing an increase in the use of cloud-based solutions, particularly for optimizing supply chain management, tracking material provenance, and improving inventory forecasting in the production of graphite-based batteries and other applications. |

|

Product Innovation |

Graphite suppliers are expanding their offers with cutting-edge solutions including AI-driven data analytics, real-time monitoring, and bespoke goods tailored to high-demand industries such as energy, automotive, and electronics. |

|

Technological Advancements |

Artificial intelligence, IoT integration, and automated manufacturing methods are propelling the next wave of graphite innovation. These innovations offer real-time tracking, predictive insights for material optimization, and automated manufacturing processes. |

|

Global Trade Dynamics |

Changes in international trade restrictions, shifting environmental legislation, and regional economic conditions are redefining the graphite industry. Companies, particularly those in global supply chains, must adjust to new compliance rules and tariffs while also dealing with the complexity of cross-border sourcing, shipping, and distribution. |

|

Customization Trends |

There is an increasing demand for graphite solutions suited to specific industry requirements. Companies are looking for bespoke solutions with modular designs and seamless integration capabilities, which will provide better flexibility, performance optimization, and interoperability with other innovative technology. |

|

Graphite Software Attribute/Metric |

Details |

|

Market Sizing |

The global Graphite market is projected to reach USD 35.50 billion by 2035, growing at a CAGR of approximately 5.97% from 2025 to 2035. |

|

Graphite Technology Adoption Rate |

65% of industries globally utilize graphite, with an increasing trend towards battery-grade graphite for electric vehicles (EVs) and energy storage systems due to demand for sustainable and high-performance materials.

|

|

Top Graphite Industry Strategies for 2025 |

Predictive analytics are used in supply chain management and graphite processing. Customizing graphite production for certain sectors, such as batteries, steel, and electronics, to increase efficiency. To lessen environmental effect, recycled graphite and sustainable mining procedures will be prioritized. |

|

Graphite Process Automation |

55% of graphite producers automate routine operations such as inventory management, quality control, and compliance reporting, resulting in operational efficiency and product consistency. |

|

Graphite Process Challenges |

Graphite extraction and refining, particularly battery-grade graphite, continue to be capital-intensive processes. Traditional mining regions are typically hesitant to adopt newer, more efficient processing technology.

|

|

Key Suppliers |

Leading Suppliers in the market include China Northern Rare Earth Group High-Tech, Syrah Resources and BTR New Energy Materials Inc. |

|

Key Regions Covered |

Asia Pacific and North America remains a dominant, with for increasing adoption of high-purity graphite for green technologies, including EVs and renewable energy systems. |

|

Market Drivers and Trends |

Improved supply chain tracking and management using advanced analytics to optimise graphite production. Adoption of digital platforms for graphite trading and supply chain management, which provide flexibility and scalability.

|

Frequently Asked Questions (FAQ):

Our procurement intelligence services offer detailed market analysis of the graphite supplier landscape. We identify major graphite producers, evaluate industry trends, and provide spend analysis, supplier assessments, and sourcing strategies to help secure reliable graphite sources at competitive prices.

We assist in assessing the TCO for graphite by considering factors such as extraction costs, transportation, refining costs, and logistics. This comprehensive evaluation ensures a clear understanding of the overall financial impact of sourcing graphite for your operations.

Our risk management services address challenges such as supply chain disruptions, geopolitical risks, quality inconsistencies, and price volatility. These strategies ensure that your graphite sourcing remains secure, cost-effective, and reliable.

Our Supplier Relationship Management (SRM) services focus on building strong partnerships with graphite suppliers. We support contract negotiations, monitor supplier performance, and streamline supplier integration into your supply chain, ensuring a long-term, productive relationship.

We recommend procurement best practices such as supplier segmentation, cost analysis, quality control, and ongoing performance evaluation. These practices help ensure a transparent, efficient, and sustainable graphite sourcing process.

Digital tools optimize graphite procurement by automating supplier selection, improving supply chain visibility, and enabling real-time inventory tracking. These advancements reduce costs and enhance procurement efficiency.

Our supplier performance management services assess critical metrics like supply consistency, product quality, and delivery reliability. This ensures high-quality graphite supplies and helps make data-driven decisions for long-term partnerships.

We support negotiations by providing market insights, price benchmarking, and employing strategies like long-term contracts and volume-based discounts to secure favorable terms with graphite suppliers.

We offer tools that provide insights into graphite price trends, supplier capabilities, and market demand forecasts. These resources enable data-driven decisions for efficient and cost-effective graphite sourcing strategies.

We help you adhere to industry regulations and internal standards by ensuring that graphite suppliers meet environmental, quality, and safety standards. This ensures compliance in all sourcing activities while minimizing risks related to sustainability.

We recommend diversifying your supplier base, establishing strategic reserves, and leveraging alternative sourcing methods to reduce risks from supply chain disruptions in the graphite market.

Our tracking solutions measure key performance indicators (KPIs) such as delivery timelines, quality consistency, and price stability. This helps evaluate supplier reliability and improve future procurement strategies.

We identify suppliers focused on eco-friendly mining practices, recycling graphite, and reducing carbon footprints. Aligning with sustainable sourcing practices ensures compliance with growing environmental standards.

Our pricing analysis compares market rates, tracks raw material costs, and applies negotiation tactics to ensure cost-effective graphite procurement while securing high-quality materials for your business needs.

We help mitigate price volatility by employing hedging strategies, securing long-term contracts with fixed pricing, and regularly monitoring market trends. This enables you to better forecast costs, reduce financial risks, and maintain price stability in your graphite procurement process.