Grinding Media Market Overview:

The global grinding media market is steadily growing, driven by rising demand in industries such as mining, cement production, power generation, and chemical-based processing. This market comprises a variety of grinding media, such as steel balls, ceramic media, cast iron, and forged steel. Our paper analyses procurement trends in detail, with an emphasis on cost optimization strategies and the use of advanced technologies to improve procurement, supply chain management, and operational effectiveness.

Key future procurement problems include managing raw material costs, guaranteeing supply chain stability, preserving product quality, and adhering to environmental regulations. Using digital procurement tools and strategic sourcing techniques is crucial for optimizing grinding media procurement and retaining long-term competitiveness. As global demand continues to rise, particularly in industries like mining and cement, companies are utilizing market intelligence to enhance operational efficiency, mitigate risks, and secure reliable sources of high-performance grinding media.

- Market Size: The global Grinding Media market is projected to reach USD 11.97 billion by 2035, growing at a CAGR of approximately 3.61% from 2025 to 2035

Growth Rate: 3.61%

- Sector Contributions: Growth in the market is driven by:

- Manufacture and Supply Chain Optimization: Companies are using technology to optimise production processes and improve supply chain management, resulting in more efficient product delivery.

- Mining and Cement Industry Growth: As the mining and cement industries expand, improved grinding media are increasingly being used to improve productivity, efficiency, and quality control.

- Technological Advancements: AI and machine learning offer predictive maintenance, quality optimization, and increased efficiency by evaluating real-time data from machines and operations.

- Innovations: Modular grinding media solutions enable organizations to select the materials and sizes that best meet their specific grinding requirements, decreasing waste and increasing cost-effectiveness.

- Investment Initiatives: Businesses are rapidly investing in automated grinding technologies and cloud-based platforms to minimize operational expenses and offer remote monitoring for greater access and control.

- Regional Insights: Asia Pacific and North America are major contributors to the growth of the grinding media market, thanks to strong infrastructure and rising demand for effective grinding solutions in the mining and cement industries.

Key Trends and Sustainability Outlook:

- Cloud Integration: The increasing use of cloud-based platforms in the grinding media business enables better data storage, real-time monitoring, and efficient management.

- Advanced Features: The use of AI, IoT, and sophisticated sensors in grinding media manufacturing improves decision-making, operational transparency, and predictive analytics capabilities.

- Focus on Sustainability: There is an increasing need for eco-friendly materials and energy-efficient technology to reduce environmental impact, particularly in resource-heavy industries like mining and cement.

- Customization Trends: There is an increasing need for customized grinding media solutions adapted to specific industrial needs, such as energy-efficient grinding in the mining sector.

- Data-Driven Insights: Companies are increasingly using real-time analytics and data-driven insights to monitor grinding media wear, optimize inventory, and estimate demand, reducing downtime.

Growth Drivers:

- Digital Transformation: The increasing use of digital technology in industries such as mining, cement, and power production is driving demand for sophisticated grinding media solutions that improve productivity and efficiency.

- Demand for Process Automation: Industries are increasingly depending on automated grinding media solutions to decrease manual labour, improve operational efficiency, and ensure product uniformity.

- Scalability Needs: Businesses are looking for grinding media solutions that are flexible to expanding operations and capable of handling rising production demands without compromising quality or performance.

- Regulatory Compliance: As environmental rules become more stringent, grinding media solutions are being developed to assist industry in meeting sustainability targets.

- Globalization: The expanding global need for grinding media solutions that fulfill multi-regional requirements, such as multi-currency operations and adherence to regional standards, is pushing the need for efficient solutions.

Overview of Market Intelligence Services for the Grinding Media Market:

Recent evaluations have identified major obstacles in the grinding media business, including high production costs and the requirement for material and size customization. Market intelligence reports give firms with meaningful insights into procurement prospects, allowing them to identify cost-cutting methods, optimize supplier management, and improve production efficiency. These insights also help to comply with industry quality requirements and manage manufacturing costs effectively, all while maintaining high-quality operating operations.

Procurement Intelligence for Grinding Media: Category Management and Strategic Sourcing

To remain competitive in the grinding media industry, businesses are optimizing procurement processes using expenditure analysis and supplier performance tracking. Effective category management and strategic sourcing are critical for lowering procurement costs and maintaining a steady supply of high-quality grinding media. Businesses can improve their procurement strategy, negotiate better rates, and find trusted suppliers of efficient and long-lasting grinding media to satisfy their production needs by accessing relevant market data.

Pricing Outlook for Grinding Media: Spend Analysis

The price prognosis for grinding media is projected to be moderately volatile, with potential swings caused by a variety of reasons. Material technological developments, need for bespoke grinding media solutions, regional pricing disparities, and production costs are all important factors to consider. Furthermore, the expanding use of energy-efficient technologies and the growing emphasis on sustainability and environmental regulations put increased pressure on grinding media pricing.

Graph shows general upward trend pricing for Grinding Media and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement procedures, improve supplier management, and implement tailored grinding media solutions are critical for cost control. Leveraging digital tools for market monitoring, analytics-based pricing predictions, and effective contract management can help to reduce costs while sourcing grinding media.

Partnering with reputable grinding media providers, negotiating long-term contracts, and investigating bulk purchase or subscription-based pricing models are all important techniques for effectively managing expenses. Despite these obstacles, focusing on scalability, assuring high-quality production, and implementing sustainable practices will be crucial to retaining cost-effectiveness and operational excellence in the grinding media market.

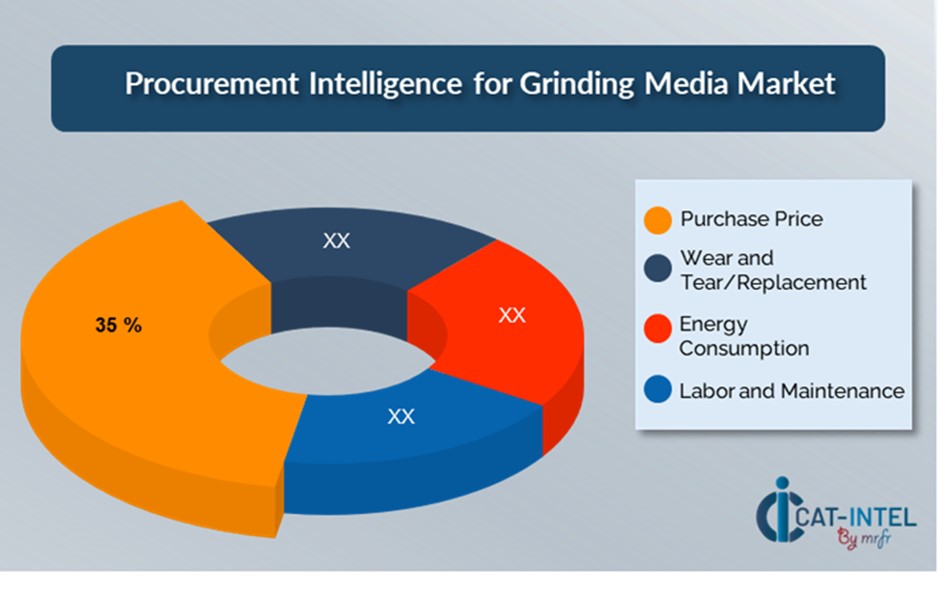

Cost Breakdown for Grinding Media: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Purchase Price: (35%)

- Description: This is the initial outlay for purchasing grinding media, which may cover the cost of the raw material, production, and shipping.

- Trend: To lower this upfront expense, there has been a trend toward long-term contract negotiations and material sourcing optimization.

- Wear and Tear/Replacement: (XX%)

- Energy Consumption: (XX%)

- Labor and Maintenance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the grinding media industry, streamlining procurement processes and implementing effective negotiation strategies can result in significant cost savings and increased operational efficiency. Long-term agreements with grinding media providers, particularly those that provide bespoke solutions or bulk purchase alternatives, can result in more beneficial price structures and terms, such as volume discounts and bundled service packages. Negotiating multi-year contracts and securing favourable rates can help to reduce price swings and ensure continuous supply.

Collaborating with grinding media providers who prioritize innovation and material scalability provides additional benefits, such as access to modern manufacturing techniques, energy-efficient media, and sustainable material options, all of which lower long-term operational costs. Implementing digital solutions for procurement, such as supply chain management systems and use analytics, increases transparency, reduces waste, and optimizes media utilization during production.

Supply and Demand Overview for Grinding Media: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The grinding media market is steadily expanding, driven by rising demand in industries such as mining, cement manufacturing, energy storage, and chemical processing. Technological breakthroughs, industry-specific customizing needs, and global economic situations all have an impact on supply and demand.

Demand Factors:

- Industrial Automation and Process Optimization: The increasing demand for automated grinding solutions and streamlined production processes is driving demand for high-quality grinding media in industries such as mining and cement production.

- Technological Advancements: The adoption of improved grinding media technologies, including as energy-efficient materials and sustainable processes, is driving demand for increasingly specialized goods to fulfil the needs of changing industries.

- Industry-Specific Requirements: Mining and cement industries demand grinding media solutions that are adapted to their specific operational needs, such as material hardness, energy use and environmental impact.

- Integration with Other Equipment: The growing need for grinding media that works smoothly with other mining equipment and processing systems is pushing innovation in the grinding media market.

Supply Factors:

- Technological Advancements: In material science, production techniques, and energy-efficient grinding media, leading to increased competitiveness.

- Vendor ecosystem: An increasing variety of grinding media suppliers, including both large-scale and specialized manufacturers, provides buyers with a wide range of quality, pricing, and customisation possibilities.

- Global Economic: Exchange rates, labour costs, and regional market dynamics have a considerable impact on grinding media pricing, availability, and competitiveness.

- Scalability and Customization: Modern grinding media solutions are becoming more modular, allowing vendors to cater to enterprises of all sizes and complexity, providing personalized solutions for industries ranging from small-scale mining to large-scale cement plants.

Regional Demand-Supply Outlook: Grinding Media

The Image shows growing demand for Grinding Media in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Grinding Media

Asia Pacific, particularly China, is a dominant force in the global Grinding Media market due to several key factors:

- Strong Manufacturing Base: Asia-Pacific countries, particularly China, India, and Japan, have a huge and well-established manufacturing sector. This region is home to many enterprises that use grinding media in mineral processing, cement manufacture, and other heavy industries.

- Significant Mining and Mineral Processing Industry: The Asia-Pacific area dominates the worldwide mining sector, with large reserves of coal, iron ore, gold, and other minerals, mainly in China, India, Australia, and Indonesia.

- Cost Effectiveness and Production Capacity: Asia-Pacific has low-cost labour and ample raw materials, allowing producers to make grinding media at a lower price. China is a major exporter of grinding media because of its low manufacturing costs.

- Rapid Industrialization and Infrastructure Development: Many Asia-Pacific countries, particularly China and India, are undergoing rapid industrialization and infrastructure development, resulting in increased demand for resources such as cement, steel and chemicals.

- Growing Export and Trade Networks: Asia-Pacific has well-established export and trade networks, with large export capacity to Europe, North America, and the Middle East.

Asia Pacific Remains a key hub Grinding Media Price Drivers Innovation and Growth

Supplier Landscape: Supplier Negotiations and Strategies

The grinding media market's supplier landscape is diversified and competitive, with global market leaders and regional providers influencing industry dynamics. These vendors have a significant impact on pricing strategies, material customization, and quality control. Well-established manufacturers dominate the market, providing comprehensive grinding media solutions, while smaller, specialized companies focus on certain industry verticals or unique features such as sustainable materials, energy-efficient choices, and sophisticated wear-resistant media.

The ecosystem across important industrial regions comprises both prominent global suppliers and creative local firms. Catering to industry-specific requirements. As companies in industries such as mining, cement, and energy storage prioritize cost-efficiency and process optimization, grinding media suppliers are developing new material technologies, incorporating cutting-edge manufacturing techniques, and providing flexible pricing models to meet changing business demands.

Key Suppliers in the Grinding Media market include:

- Shandong Huamin Steel Ball Joint-Stock Co.

- Moly-Cop

- Magotteaux

- Scaw Metals Group

- Sunjin Precision

- TOYO Grinding Ball Co., Ltd.

- Huihe Mining Parts

- FLSmidth

- Jinan Xinte Casting and Forging

- Dahe Grinding Media

Key Developments Procurement Category Significant Development:

Significant Development | Description |

Market Growth | The grinding media market is expanding rapidly due to increased demand in industries such as mining, cement production, energy storage, and chemical processing, as businesses strive to raise productivity, reduce energy consumption, and improve grinding efficiency in emerging countries.

|

Cloud Adoption | The grinding media market is shifting towards cloud-based solutions, driven by the demand for scalability, cost-efficiency, and improved access to real-time data. This trend is accelerating as firms increasingly use remote monitoring and advanced analytics to optimize output. |

Product Innovation | Advanced materials like ceramic-based media, energy-efficient grinding balls, and solutions specially designed to meet industry demands are being added to the range of products offered by grinding media suppliers. Particularly in industries like cement and mining, these improvements seek to maximize energy usage, minimize wear, and increase grinding efficiency. |

Technological Advancements | The capabilities of grinding media are being improved by innovations including robotic automation in production processes, IoT integration for real-time performance monitoring, and AI-driven wear analysis. forecasts for media consumption and wear. |

Global Trade Dynamics | The adoption patterns of grinding media are being impacted by changes in regional economic policies, trade rules, and compliance requirements, especially for multinational corporations that oversee intricate supply chains. Pricing and availability are also being impacted by changes in the price of raw materials and tariffs on essential components like steel. |

Customization Trends | There is a growing need for specialized grinding media solutions that are suited to operational requirements, like material composition, modular designs, and unique sizes. Businesses look for solutions that work well with their grinding mills and offer flexibility in their grinding processes. |

Grinding Media Attribute/Metric | Details |

Market Sizing | The global Grinding Media market is projected to reach USD 11.97 billion by 2035, growing at a CAGR of approximately 3.61% from 2025 to 2035. |

Grinding Media Technology Adoption Rate | To improve grinding efficiency, lower wear, and maximize production, almost 65% of industries, including mining, cement manufacturing, and energy storage, have implemented improved grinding media solutions. |

Top Grinding Media Industry Strategies for 2025 | Integrating AI and machine learning for predictive wear analysis, optimizing material procurement and manufacturing procedures, and emphasizing sustainability using eco-friendly materials are important tactics in the grinding media sector.

|

Grinding Media Process Automation | Nowadays, basic activities like media replacement, grinding cycle optimization, and energy consumption tracking are automated in around 55% of grinding media implementations, increasing industry operating efficiency.

|

Grinding Media Process Challenges | High material costs, reluctance to embrace new materials, supply chain interruptions, and the constant need for innovation to satisfy the requirements of many industrial applications are some of the major obstacles facing the grinding media market.

|

Key Suppliers | Shandong Huamin Steel Ball Joint-Stock Co., Ltd., Moly-Cop and Magotteaux are leading suppliers in the grinding media market, providing a variety of solutions for the cement, mining, and other processing industries worldwide.

|

Key Regions Covered | With significant demand in sectors including mining, cement manufacturing, and energy storage, Asia-Pacific and North America are leading regions for the adoption of grinding media.

|

Market Drivers and Trends | The market for grinding media is expanding due to the growing demand for affordable solutions that increase grinding efficiency, the increased use of sustainable and energy-efficient grinding media, the requirement for real-time performance monitoring, and the incorporation of cutting-edge technology.

|

Frequently Asked Questions (FAQ):

Our procurement intelligence services provide detailed analysis of the grinding media supplier market, identifying key providers and evaluating industry trends. We offer spend analysis, supplier evaluations, and sourcing strategies to help secure reliable grinding media solutions at competitive prices.

We assist in assessing the TCO for grinding media by accounting for material costs, wear rates, operational efficiency, and maintenance fees. This comprehensive analysis ensures a clear understanding of the overall financial impact of using grinding media over its lifecycle.

Our risk management services address challenges such as supply chain disruptions, variations in material quality, and wear-related performance issues. These strategies help mitigate risks and ensure cost-effective procurement processes for high-quality grinding media.

Our Supplier Relationship Management (SRM) services focus on fostering strong partnerships with grinding media suppliers. We assist in contract negotiations, monitor supplier performance, and streamline their integration into your operations to ensure reliable supply and quality.

We recommend best practices such as vendor segmentation, cost-benefit analysis, quality assurance programs, and ongoing supplier performance tracking. These practices enable effective and transparent procurement of grinding media, ensuring long-term value.

Digital tools enhance grinding media procurement by automating vendor selection processes, improving inventory management, and streamlining supply chain integration. These advancements reduce costs, improve operational performance, and enhance data visibility for better decision-making.

Our supplier performance management services evaluate key metrics such as media wear rates, cost efficiency, and delivery reliability. This ensures that suppliers consistently meet performance expectations, enabling reliable and efficient grinding media procurement.

We support negotiations by leveraging market insights, benchmarking pricing trends, and utilizing strategies such as long-term agreements, bulk discounts, and flexible payment terms. These approaches help secure advantageous terms for sourcing grinding media.

We offer tools that provide insights into material cost trends, supplier capabilities, and performance metrics. These resources enable data-driven decision-making and help optimize procurement strategies for grinding media.

We help you adhere to industry regulations and internal policies by ensuring that suppliers meet environmental standards, safety regulations, and material sourcing certifications. This ensures compliance with quality and sustainability goals.

We recommend maintaining multiple supplier relationships, leveraging local and global sources, and establishing contingency plans to minimize supply chain disruptions. This ensures a stable and continuous supply of grinding media, even during disruptions.

Our tracking solutions monitor performance metrics such as media durability, cost efficiency, on-time delivery, and supplier responsiveness. This helps evaluate supplier reliability and improve future sourcing decisions.

We identify suppliers focusing on sustainable material sourcing, eco-friendly production practices, and recyclable grinding media solutions. This supports alignment with your organization’s sustainability goals and minimizes environmental impact.

Our pricing analysis compares supplier rates, tracks material cost fluctuations, and applies negotiation strategies such as volume-based discounts and contract terms. These efforts help achieve cost-effective procurement while ensuring high-quality grinding media solutions.

We recommend implementing a quality assurance program that includes regular supplier audits, performance testing, and batch tracking to monitor the consistency of grinding media. Additionally, establishing clear quality standards and fostering strong communication with suppliers will help maintain high-quality media over time, ensuring optimal grinding performance and reduced wear costs.