Summary Overview

Hydraulic Fracturing Services Market Overview:

The global hydraulic fracturing services market is steadily growing, driven by rising demand in industries like as oil and gas, energy, and mining. This market encompasses a wide range of hydraulic fracturing services, including conventional, unconventional, and sophisticated fracking techniques. Our research includes a thorough examination of procurement trends, with an emphasis on cost-cutting techniques and the use of digital tools to enhance service delivery and operations.

The key future problems in hydraulic fracturing services involve managing high operational costs, assuring scalability, maintaining safety requirements, and integrating advanced technology with existing infrastructure. Digital technologies and data-driven choices are critical for increasing service efficiency, streamlining operations, and maintaining long-term competitiveness. As worldwide demand continues to climb, businesses are harnessing market intelligence to improve operational efficiency and decrease environmental risks, and navigate the complexities of the ever-evolving energy landscape

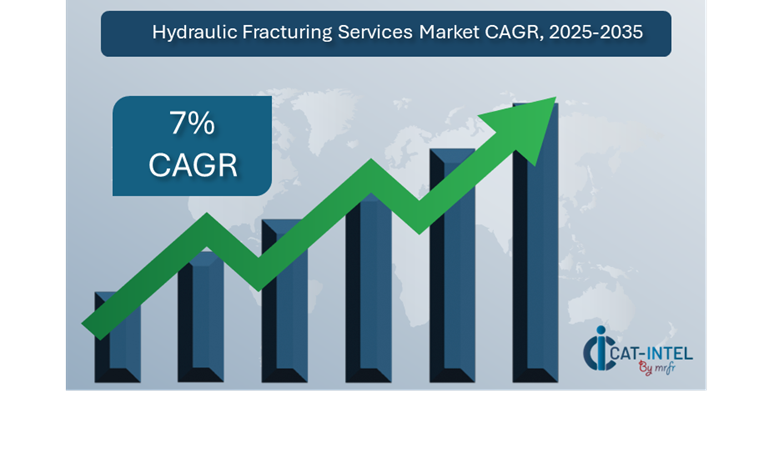

Market Size: The global Hydraulic Fracturing Services market is projected to reach USD 62 billion by 2035, growing at a CAGR of approximately 7% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Operational Optimization: Service providers are increasingly using digital tools to simplify operations, track performance, and improve decision-making abilities.

-

Cloud-Based Solutions: Cloud integration provides scalability, cost efficiency, and improved data access, minimizing the need for large infrastructure investments while increasing operational flexibility.

-

Technological Advancements: Predictive analytics and automated systems improve efficiency, allowing service providers to better estimate demand, reduce downtime, and manage resources.

-

Innovations: Developing more adaptable and inventive procedures. This customization aids in energy extraction while addressing the unique challenges of various reservoirs.

-

Investment Initiative: Companies are rapidly investing in advanced technologies like automation, data analysis, and real-time monitoring systems to improve operational efficiency, lower costs, and increase safety.

-

Regional Insights: North America and Asia Pacific are the key contributors to the hydraulic fracturing market, owing to their strong digital infrastructure and modern fracturing technology.

Key Trends and Sustainability Outlook:

-

Environmental Focus: Fracking technology innovations provide better resource management, reduced water usage, and a lower environmental imprint, all of which accord with global sustainability goals.

-

Data-Driven Insights: Advanced data analytics are becoming important for hydraulic fracturing service providers. These tools assist with demand forecasting, inventory optimization, performance tracking, and environmental effect monitoring.

-

Customization Trends: Fracturing Services are becoming more customized to meet unique needs, with enhanced solutions intended for certain resource types and environmental circumstances.

-

Advanced Features: Using IoT sensors for real-time monitoring allows you to check well performance, optimize pressure levels, and spot potential concerns during hydraulic fracturing operations -

Focus on Sustainability: New fracking procedures are being developed to reduce water usage throughout the hydraulic fracturing process, thereby addressing concerns about water scarcity and environmental impact.

Growth Drivers:

-

Digital Transformation: The growing use of digital technologies like as AI, IoT, and automation is increasing production and efficiency in hydraulic fracturing.

-

Process Automation: The desire to cut costs and improve operational efficiency is driving the introduction of automated fracking systems that eliminate manual intervention and operational bottlenecks.

-

Scalability and Flexibility: As energy demand rises, hydraulic fracturing enterprises want scalable solutions that can adapt to changing reservoir types and energy market variations.

-

Regulatory Compliance: Digital tools assist businesses in complying with rules by automating reporting processes, assuring correct data, and increasing operational transparency.

-

Globalization: Global energy firms want solutions that can extend across multiple locations while being regulatory compliant and operationally efficient.

Overview of Market Intelligence Services for the Hydraulic Fracturing Services Market:

Recent evaluations have identified major hurdles in the hydraulic fracturing services sector, including high operational costs and the requirement for service customization to match specific geological and environmental circumstances. Market intelligence reports offer significant insights regarding procurement opportunities, assisting businesses in identifying cost-saving strategies, optimizing supplier relationships, and ensuring project success. These insights also help comply with industry standards, maintain high-quality operational processes, and effectively manage costs throughout the hydraulic fracturing project lifecycle.

Procurement Intelligence for Hydraulic Fracturing Services: Category Management and Strategic Sourcing.

To remain relevant in the hydraulic fracturing services market, organizations are streamlining their procurement procedures through rigorous spend monitoring and vendor performance tracking. Effective category administration and strategic sourcing are crucial for lowering procurement costs while maintaining a consistent supply of high-quality services and equipment. Businesses can use actionable market intelligence to enhance their procurement strategy, negotiate advantageous terms with service providers, and guarantee that hydraulic fracturing projects are completed efficiently, safely, and under budget.

Pricing Outlook for Hydraulic Fracturing Services: Spend Analysis

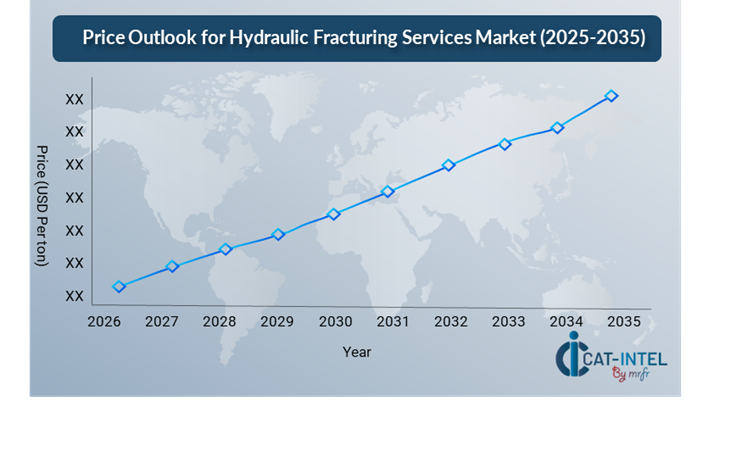

The pricing prognosis for hydraulic fracturing services is projected to remain moderately dynamic, with potential fluctuations caused by several factors. Advancements in extraction technology, an increase in demand for environmentally sustainable practices, fracking technique customization, and regional pricing discrepancies are all important drivers. Furthermore, the expanding use of digital monitoring systems, along with a greater emphasis on safety standards and regulatory compliance, is putting upward pressure on prices in the hydraulic fracturing services sector.

Graph shows general upward trend pricing for Hydraulic Fracturing Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve vendor management, and implement flexible, modular service offerings are critical for cost control. Leveraging digital tools for market monitoring, pricing forecasting through analytics, and productive contract administration can help hydraulic fracturing operations become more cost-effective.

Partnering with reputable service providers, negotiating long-term contracts, and investigating performance-based pricing models are all critical techniques for effectively managing hydraulic fracturing costs. Regardless of these obstacles, focusing on scalability, guaranteeing strong project execution, and implementing innovative technology for real-time data collecting and optimization will be crucial to sustaining cost-effectiveness and operational excellence in the hydraulic drilling services market.

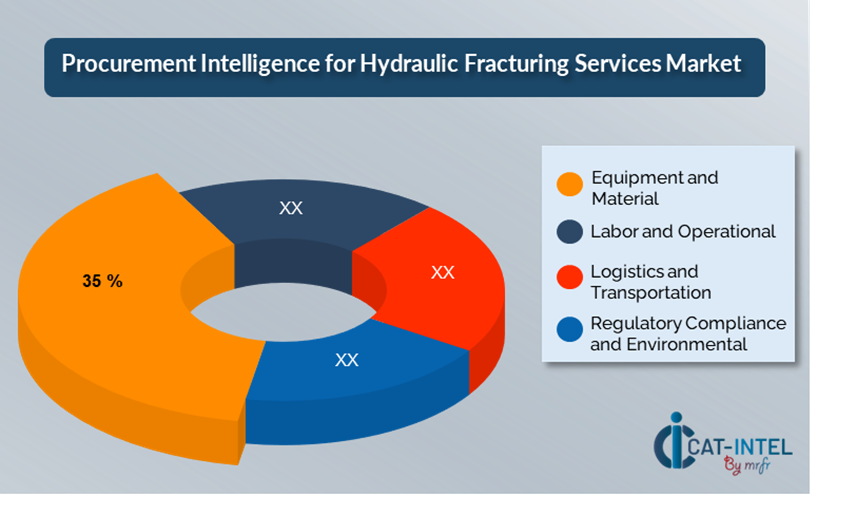

Cost Breakdown for Hydraulic Fracturing Services: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Equipment and Material: (35%)

-

Description: This category comprises the cost of hydraulic fracturing equipment, including as pressure pumps, fracturing fleets, downhole tools, chemicals, proppants (such as sand), and fluids.

-

Trend: As technology progresses, businesses are investing in more durable and efficient equipment to avoid downtime and maintenance expenses.

- Labor and Operational: (XX%)

- Logistics and Transportation: (XX%)

-

Regulatory Compliance and Environmental: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the hydraulic fracturing services sector, streamlining procurement processes and using strategic negotiation strategies can result in considerable cost reductions and improved operational efficiency. Long-term relationships with reputable service providers, particularly those that supply modern fracking technology and digital monitoring systems, can result in more attractive pricing structures and terms, such as volume-based discounts and bundled service packages. Multi-year contracts and performance-based pricing structures provide chances to achieve reduced rates while managing price volatility over time.

Collaborating with hydraulic fracturing service providers who value innovation and scalability gives additional benefits, such as access to sophisticated real-time data analytics, AI-driven optimization tools, and tailored fracking solutions. These qualities can lower long-term operating expenses by increasing efficiency, safety, and oversight of resources. Implementing digital procurement technologies such as contract management systems and usage analytics improves transparency, reduces resource overprovisioning, and optimizes service utilization.

Supply and Demand Overview for Hydraulic Fracturing Services: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The hydraulic fracturing services market is growing steadily, owing to rising energy demand and technological developments in extraction techniques. Factors that influence supply and demand dynamics include fracking technology advancement, industry-specific requirements, and global economic conditions.

Demand Factors:

-

Energy Demand and Exploration: The desire for more efficient resource extraction is driving up demand for hydraulic fracturing services in industries such as oil, gas, and mining.

-

Adoption of Advanced Technologies: As digital tools and automation are integrated into hydraulic fracturing, there is a growing desire for scalable, data-driven solutions that improve fracking operations.

-

Environmental Requirements: Industries like as oil and gas require hydraulic fracturing services that are specifically customized to meet severe environmental standards and sustainability objectives.

-

Operational Efficiency Needs: Needs for operational efficiency include services that connect smoothly with other energy management tools and tracking systems, ensuring real-time data, safety, and optimal performance.

Supply Factors:

-

Technological Advancements: Enhanced drilling techniques, AI-driven optimization, and real-time monitoring systems are improving service offerings and boosting supplier competitiveness.

-

Service Provider Ecosystem: The expanding number of hydraulic fracturing service providers, ranging from niche specialists to large-scale operators, provides purchasers with a variety of options while encouraging competition and innovation.

-

Global Economic Factors: Changes in the energy market, labour prices, and regional technological adoption rates all have an impact on the pricing and availability of hydraulic fracturing services. -

Scalability and Flexibility: Modern hydraulic fracturing services are growing more modular, allowing suppliers to handle a wide range of extraction projects, from small-scale to huge, complex operations.

Regional Demand-Supply Outlook: Hydraulic Fracturing Services

The Image shows growing demand for Hydraulic Fracturing Services in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Hydraulic Fracturing Services Market

North America, particularly the United States, is a dominant force in the global Hydraulic Fracturing Services market due to several key factors:

-

Abundant Shale Resources: North America, particularly the United States and Canada, contains huge shale oil and natural gas deposits, including the Permian Basin and Marcellus Shale.

-

Technological Innovation and Advancements: North America is a hotbed of hydraulic fracturing technology, including advances in fracking equipment, real-time data analytics, artificial intelligence integration, and automation.

-

Established Infrastructure: The region has well-developed energy production infrastructure, such as pipelines, transportation networks, and processing facilities, which promotes the expansion of hydraulic fracturing services.

-

Capital Availability: North America sees significant investment in energy exploration and production, particularly from large oil and gas firms and private investors. -

Regulatory Climate: In the United States, the regulatory climate has aided the spread of hydraulic fracturing by encouraging energy independence and the development of unconventional resources.

North America Remains a key hub Hydraulic Fracturing Services Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The hydraulic fracturing services market has a broad and competitive supplier ecosystem, with global market leaders and regional players affecting industry dynamics. These vendors have a significant impact on issues such as service pricing, customisation, technological integration, and operational success. Well-established service providers dominate the market, offering comprehensive hydraulic fracturing solutions, while smaller, niche competitors focus on specific sector demands or new features like enhanced data analytics, automation, and sustainability practices.

The hydraulic fracturing service ecosystem spans important regions, with notable global operators and creative local providers meeting industry-specific needs. As businesses prioritize effectiveness, cost-effectiveness, and ecological responsibility, hydraulic fracturing companies are developing new technologies, combining AI-driven optimization, and implementing cloud-based monitoring systems. Flexible service models, such as pay-per-use or performance-oriented pricing, are being introduced to address the changing needs of the power and resource extraction industries.

Key Suppliers in the Hydraulic Fracturing Services Market Include:

- Halliburton

- Schlumberger

- Baker Hughes

- Weatherford International

- National Oilwell Varco

- Cameron International

- FMC Technologies

- Superior Energy Services

- Trican Well Service

- TechnipFMC

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The hydraulic fracturing services market is expanding rapidly, driven by rising energy demand, advances in extraction technology, and increased exploration activity, particularly in emerging oil and gas markets. |

Cloud Adoption |

The hydraulic fracturing services business is increasingly turning to digital and cloud-based solutions, driven by the demand for scalability, continuous surveillance, and remote access. |

Product Innovation |

Hydraulic fracturing service providers are increasing their products to include AI-powered predictive analytics, real-time data processing, and specialized procedures for certain geological formations. |

Technological Advancements |

Machine learning, IoT sensor integration, and robotic process automation (RPA) are improving hydraulic fracturing capabilities, increasing operational efficiency, and automating repetitive activities, resulting in lower costs and greater safety. |

Global Trade Dynamics |

Changes in trade legislation, compliance with environmental standards, and regional economic policies are all impacting hydraulic fracturing adoption patterns, particularly among multinational energy corporations that manage complicated, cross-border extraction operations. |

Customization Trends |

Customizable service offerings, such as changeable fracking procedures and compliance with local environmental rules, enable operators to better optimize processes and satisfy project-specific requirements. |

|

Hydraulic Fracturing Services Attribute/Metric |

Details |

Market Sizing |

The global Hydraulic Fracturing Services market is projected to reach USD 62 billion by 2035, growing at a CAGR of approximately 7% from 2025 to 2035.

|

Hydraulic Fracturing Services Technology Adoption Rate |

Around 60% of oil and gas businesses worldwide have implemented modern hydraulic fracturing technologies, with a substantial move toward technological advances, real-time monitoring, and data-driven optimisation for increased operational efficiency.

|

Top Hydraulic Fracturing Services Industry Strategies for 2025 |

Key efforts include using AI and machine learning for predictive maintenance, emphasizing environmentally friendly fracking processes, implementing real-time data analytics for optimization, and improving safety measures through remote monitoring and automation. |

Hydraulic Fracturing Services Process Automation |

Around 50% of hydraulic fracturing operations currently use automation for activities like pressure management, chemical injection, and well performance monitoring, enhancing efficiency and lowering the hazards associated with human error. |

Hydraulic Fracturing Services Process Challenges |

Major hurdles include high operating expenses, environmental problems (e.g., water usage and emissions), adherence to regulations, and the difficulty of integrating new technology into existing infrastructure. |

Key Suppliers |

Leading hydraulic fracturing service providers include Halliburton, Schlumberger, and Baker Hughes, who provide comprehensive solutions for resource extraction and reservoir management.

|

Key Regions Covered |

North America, primarily the United States and Canada, as well as Asia-Pacific, are major markets for hydraulic fracturing, with significant demand in the Middle Eastern and Latin American oil and gas sectors.

|

Market Drivers and Trends |

Growth is being driven by rising global energy demand, technological advances in fracking equipment, a focus on cost reduction, environmental sustainability practices in the extraction process, and higher regulatory compliance requirements.

|