Summary Overview

Hydraulic and Pneumatic Components Market Overview:

The global hydraulic and pneumatic components market is experiencing steady expansion, fuelled by demand throughout industries such as manufacturing, construction, automotive, and energy. This market encompasses a wide range of products, including pumps, cylinders, valves, actuators, and compressors. Our report delves deeply into key market trends, with a focus on cost-cutting strategies and the use of advanced technologies to boost operating efficiency and performance.

Key future challenges in the hydraulic and pneumatic components market involve regulating production costs, ensuring system scalability, ensuring equipment reliability, and integrating new technologies into existing infrastructure. Adoption of smart technologies, such as IoT-enabled elements and automated systems, is critical for improving efficiency and achieving sustainability goals. By embracing modern sourcing practices and staying ahead of technological advances, businesses can ensure long-term success in this rapidly evolving market.

-

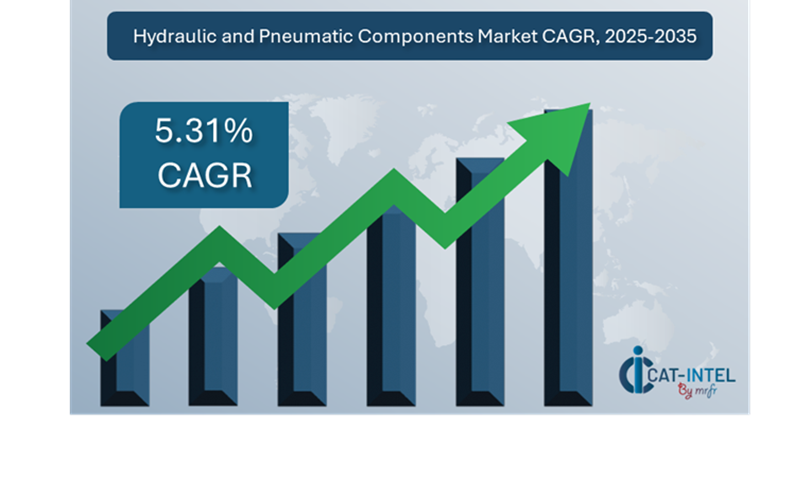

Market Size: The global Hydraulic and Pneumatic Components Market is projected to reach USD 90 billion by 2035, growing at a CAGR of approximately 5.31% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: Hydraulic and pneumatic components are critical to boosting operational efficiency in industries such as automotive, construction, and manufacturing, where precision and dependability are essential.

-

Industrial Growth and Automation: Hydraulic and pneumatic systems enhance the efficiency and efficacy of heavy machinery, robotics, and automated production lines.

-

Technological Advancement: Integration of sensors, IoT, and AI for maintenance planning, real-time monitoring, and optimizing systems.

-

Innovations and Customization: Modular hydraulic and pneumatic systems enable organizations to select only the necessary components for individual applications, driving innovation and customization.

-

Investment Initiatives: Advanced materials and energy-efficient technologies are reducing costs and improving the environmental impact of hydraulic systems.

-

Regional Insights: Rising industrial activity and demand for innovative manufacturing solutions continue to drive growth in North America and Asia Pacific.

Key Trends and Sustainability Outlook:

-

Cloud Integration: Hydraulic and pneumatic systems provide scalability, cost effectiveness, and remote access to real-time data, allowing for better decision-making and preventative maintenance.

-

Advance Features: Integrating AI, IoT, and machine learning into hydraulic and pneumatic systems improves automation and decision-making capabilities.

-

Sustainability Needs: Increasing use of energy-efficient components and systems to reduce waste and improve resource management.

-

Customization Trends: Systems built for the automotive or food processing industries are now being tailored to satisfy the specific needs of those industries.

-

Data-Driven Insights: Advanced analytics for hydraulic and pneumatic systems provide businesses with actionable insights into performance metrics and energy efficiency and equipment health.

Growth Drivers:

-

Digital Transformation: Manufacturing and construction is increasing demand for innovative hydraulic and pneumatic solutions.

-

Demand for Automation: Hydraulic and pneumatic components are in great demand due to the growing use of automated systems across sectors.

-

Scalability Needs: Companies seek scalable solutions that are flexible, reliable, and integrate seamlessly with expanding industrial processes.

-

Regulatory Compliance: Maintaining consistent performance and correct records for audits and reporting, in line with industry standards and laws. -

Globalization: Global production and supply networks necessitate adaptable, scalable solutions to address difficulties.

Overview of Market Intelligence Services for the Hydraulic and Pneumatic Components Market:

Recent research has identified important constraints in the hydraulic and pneumatic components market, such as high production costs and the necessity for component customisation to suit industry-specific specifications. Market intelligence studies give significant data that assist businesses in identifying cost-cutting opportunities, optimizing supplier management, and improving component procurement success rates. These insights not only assure compliance with industry standards but also help to maintain high-quality operational procedures while successfully managing costs.

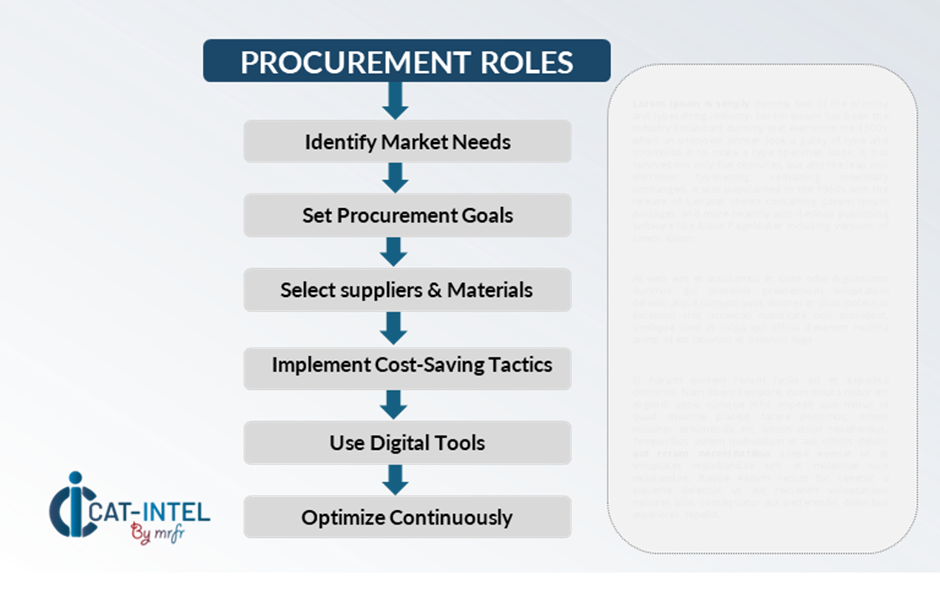

Procurement Intelligence for Hydraulic and Pneumatic Components Market: Category Management and Strategic Sourcing

To remain competitive in the hydraulic and pneumatic components market, organizations are improving procurement procedures through extensive expenditure monitoring and supplier performance tracking. Effective category administration and strategic purchasing are critical for lowering procurement costs and maintaining a consistent supply of high-quality components. By using actionable market intelligence, Businesses can refine their procurement methods, allowing them to negotiate better prices for the purchase of hydraulic and pneumatic systems, components, and parts.

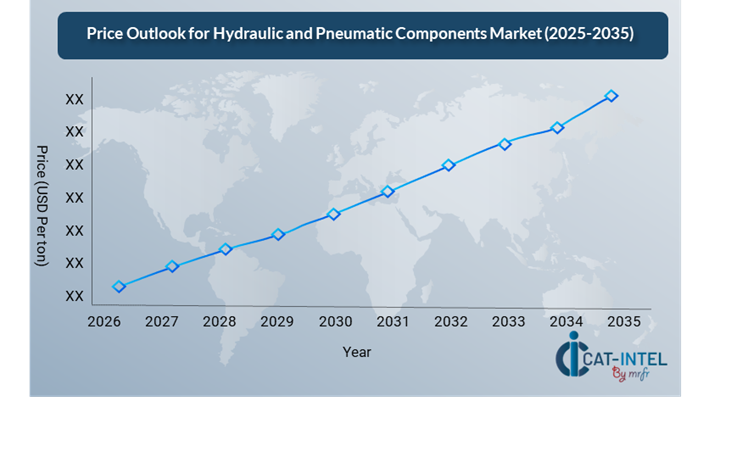

Pricing Outlook for Hydraulic and Pneumatic Components Market: Spend Analysis

The pricing prognosis for hydraulic and pneumatic components is projected to remain moderately volatile, with potential fluctuations affected by several major factors. These include technical developments, increased demand for customized solutions, regional pricing disparities, and variations in raw material costs. Furthermore, the growing adoption of automation and IoT-integrated systems puts upward pressure on component pricing, as organizations demand more advanced features for improved performance, efficiency, and connectivity.

Graph shows general upward trend pricing for Hydraulic and Pneumatic Components Market and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Streamlining procurement procedures through improved expenditure analysis, strategic sourcing, and supplier performance monitoring is critical for cost management. Businesses can better discover cost-cutting opportunities and ensure a steady supply of components of superior quality.

As businesses advance toward automation and smart production, the scalability of hydraulic and pneumatic components becomes more essential. Businesses should prioritize sourcing solutions that can scale with their operations and integrate easily with emerging technologies such as AI, IoT, and robotics. This provides both cost efficiency and long-term operational excellence.

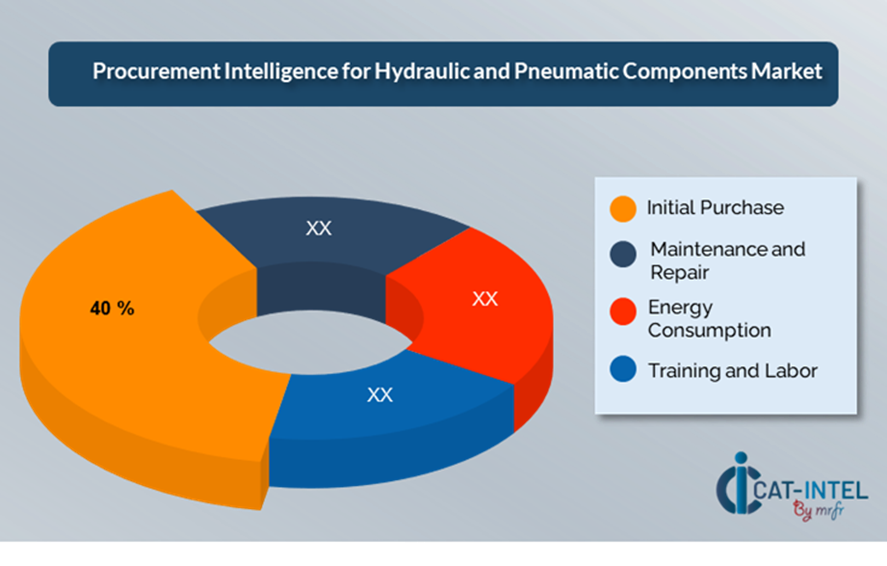

Cost Breakdown for Hydraulic and Pneumatic Components Market: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Initial Purchase: (40%)

-

Description: This represents the initial cost of purchasing hydraulic and pneumatic components, such as pumps, valves, actuators, cylinders, filters, and other important components.

-

Trend: Modular and uniform components enable flexibility and scalability, leading to lower long-term costs and improved ROI.

- Maintenance and Repair: (XX%)

- Energy Consumption: (XX%)

- Training and Labor: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the hydraulic and pneumatic components sector, streamlining procurement processes and using strategic negotiation strategies can lead to significant cost savings and increased operational efficiency. Long-term partnerships with component suppliers, particularly those that provide advanced and bespoke solutions, can result in more attractive price structures and terms, such as volume discounts, loyalty agreements, and bundled service packages. Subscription-based approaches and multi-year contracts provide chances to negotiate reduced rates while mitigating price rises over time.

Collaborating with suppliers who prioritize innovation and scalability provides additional benefits, including access to new materials, technologies, and smarter integration capabilities. This lowers long-term operational expenses by ensuring that components are efficient and adaptable as firms expand. Similarly, modular components that may be tailored to the individual requirements of various sectors or applications can assist reduce over-provisioning and ensure effective resource usage. Diversifying vendor options and implementing multi-vendor solutions can help to reduce reliance on a single supplier, manage risks such as supply chain interruptions or service failures, and increase negotiation leverage.

Supply and Demand Overview for Hydraulic and Pneumatic Components Market: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The hydraulic and pneumatic components market is also enjoying steady expansion, driven by technological improvements, increased demand for automation, and a need for efficiency across industries such as manufacturing and energy, automotive and construction. Technological developments, industry-specific needs, and global economic considerations all influence the supply and demand dynamics in this market.

Demand Factors:

-

Automation and Industry 4.0 Integration: As companies adopt Industry 4.0, the demand for smart hydraulic and pneumatic elements that can be integrated into automated systems grows.

-

Customization Requirements: Industries including food processing, mining, and healthcare may require tailored solutions to suit specific operational workflows or regulatory criteria.

-

Sustainability and Energy Efficiency: Businesses are increasingly looking for components that can boost operational efficiency while lowering energy usage and waste.

-

Integration with IoT and Smart Systems: Integrated systems provide real-time monitoring, predictive maintenance, and advanced data analytics, hence increasing overall efficiency and minimizing downtime.

Supply Factors:

-

Technological Advancements: Advances in materials, sensor technologies, and smart components that improve hydraulic and pneumatic systems.

-

Vendor Ecosystem: A rising vendor ecosystem offers consumers a broader range of options, from standard solutions to highly individualized systems tailored to specific industry requirements.

-

Global Economic Factors: Exchange rates, labour costs, and regional technology adoption rates all have a substantial impact on hydraulic and pneumatic component prices and availability. -

Scalability and Flexibility: Suppliers may now provide tailored solutions that scale with a company's demands, allowing businesses of all sizes to implement effective systems.

Regional Demand-Supply Outlook: Hydraulic and Pneumatic Components Market

The Image shows growing demand for Hydraulic and Pneumatic Components Market in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Hydraulic and Pneumatic Components Market

North America, particularly the United States, is a dominant force in the global Hydraulic and Pneumatic Components Market due to several key factors:

-

Advanced Manufacturing Base: North America, particularly the United States and Canada, has a strong and diverse industrial base that includes automobiles, aerospace, construction, energy, and manufacturing.

-

Technological Innovation: The region has an elevated prevalence of smart hydraulic and pneumatic components that interface with digital technologies such as artificial intelligence, machine learning, and Internet of Things.

-

Strong investment in Infrastructure: Significant expenditures in infrastructure projects, especially in the construction, transportation, and energy industries, help to drive up demand for hydraulic and pneumatic systems.

-

High-Quality Suppliers and Manufacturers: North America is home to some of the largest and most established hydraulic and pneumatic component providers, such as Parker Hannifin and Moog, along with smaller, niche producers. -

Sustainability and Energy Efficiency: North American enterprises are increasingly focused on decreasing energy consumption and limiting environmental effect, resulting in a greater need for resource-efficient systems.

North America Remains a key hub Hydraulic and Pneumatic Components Market Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The hydraulic and pneumatic components market also has a broad and competitive supplier landscape, with both major, reputable manufacturers and smaller, specialized companies influencing industry dynamics. Large, well-established providers dominate the hydraulic and pneumatic components industry, offering full systems and solutions for industries such as automotive, manufacturing, energy, and construction.

In addition to major giants, the market includes smaller, specialist providers who specialize in specific sectors or offer unique technology offers. Suppliers specializing in energy-efficient hydraulic systems, as well as those offering sophisticated materials and smart sensors for predictive maintenance, are gaining traction in industries that require specialist components. These companies are frequently highly inventive, offering solutions adapted to the specialized needs of industries such as food processing, aerospace, and robotics.

Key Suppliers in the Hydraulic and Pneumatic Components Market Include:

- Parker Hannifin Corporation

- Bosch Rexroth AG

- Festo AG & Co. KG

- Schneider Electric

- Eaton Corporation

- Moog Inc

- Sauer-Danfoss (now Danfoss Power Solutions)

- Hyundai Heavy Industries Co., Ltd.

- Kawasaki Heavy Industries, Ltd.

- Yuken Kogyo Co. Ltd.

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

As companies implement automated systems to boost production capacity, the demand for modern hydraulic and pneumatic systems to power machinery and equipment increases, particularly in emerging regions where industrial growth is growing. |

Cloud Adoption |

The increasing usage of cloud technology enables manufacturers to monitor, control, and optimize systems, allowing organizations to measure performance and expedite maintenance operations using cloud-based platforms that provide remote access and scalability. |

Product Innovation |

Suppliers in the hydraulic and pneumatic components industry are constantly improving their solutions to meet the demand for modern, high-performance systems. The integration of AI-powered sensors, real-time monitoring capabilities, and enhanced analytics are some of the innovations. |

Technological Advancements |

Technological developments enhance the capabilities of hydraulic and pneumatic systems through facilitating predictive maintenance, minimizing downtime, and automating repetitive tasks, driving greater efficiency in their systems.

|

Global Trade Dynamics |

Tariffs, regional supply chain issues, and increasing environmental restrictions all have an impact on how hydraulic and pneumatic components are obtained and supplied across regions. |

Customization Trends |

Modular systems that can be adapted or expanded as needed are becoming more popular, providing flexibility for industries with specific needs. These systems integrate third-party tools, such as data analytics systems and IoT devices, to create cohesive, simplified processes and maximize operational efficiency. |

Hydraulic and Pneumatic Components Market Attribute/Metric |

Details |

Market Sizing |

The global Hydraulic and Pneumatic Components Market is projected to reach USD 90 billion by 2035, growing at a CAGR of approximately 5.31% from 2025 to 2035.

|

Hydraulic and Pneumatic Components Market Technology Adoption Rate |

Approximately 45% of industrial enterprises worldwide have implemented modern hydraulic and pneumatic systems, with a substantial move towards IoT-enabled systems for continuous surveillance and predictive maintenance. |

Top Hydraulic and Pneumatic Components Market Industry Strategies for 2025 |

Key tactics include integrating IoT and AI for predictive maintenance, adopting energy-efficient systems to achieve sustainability goals, investing in modular hydraulic and pneumatic solutions for scalability, and focusing on automation for increased operational efficiency.

|

Hydraulic and Pneumatic Components Market Process Automation |

Approximately 50% of hydraulic and pneumatic systems now have automation, with regular functions such as system monitoring, performance tracking, and maintenance scheduling automated to improve overall operating efficiency. |

Hydraulic and Pneumatic Components Market Process Challenges |

Major problems include the high cost of sophisticated systems, integrating with legacy equipment, training staff on new technology, and assuring dependability and uptime in important industries. |

Key Suppliers |

Leading suppliers in the hydraulic and pneumatic components industry are Parker Hannifin Corporation, Bosch Rexroth AG and Festo AG & Co. KG, providing complete solutions for a wide range of industrial applications.

|

Key Regions Covered |

North America, Europe, and Asia-Pacific are major markets for hydraulic and pneumatic components, with strong demand in the manufacturing, energy, and automotive industries. |

Market Drivers and Trends |

Growth is driven by the need for automation in manufacturing processes, greater demand for energy-efficient solutions, expanding usage of IoT for real-time data analytics, and the incorporation of smart technologies into industrial systems. |