Summary Overview

Industrial Ethanol Market Overview

The global industrial ethanol market is growing steadily, driven by rising demand in key industries such as automotive, pharmaceuticals, drinks, and chemicals. This market encompasses a wide range of industrial ethanol uses, including fuel-grade, beverage-grade, and pharmaceutical-grade ethanol. Our research includes a complete examination of procurement trends, emphasizing cost-cutting measures and the use of innovative technology to improve production and distribution.

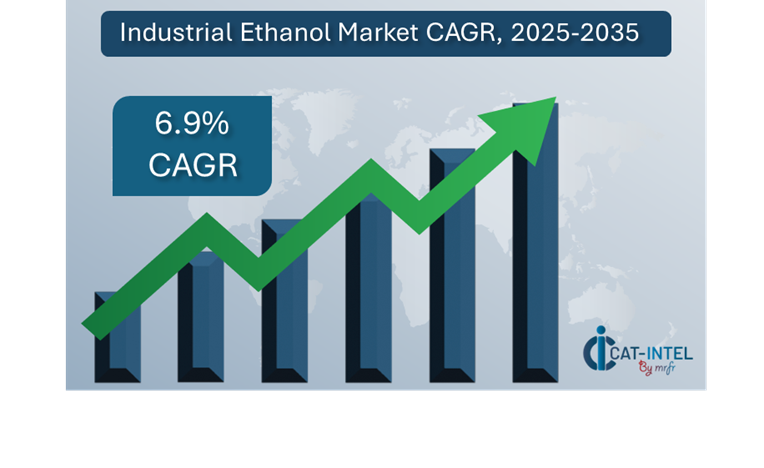

Key future problems in the industrial ethanol industry include controlling production costs, guaranteeing supply chain scalability, maintaining regulatory compliance, and enhancing environmental sustainability. Adoption of digital technologies and strategic sourcing are critical for optimizing ethanol production and maintaining long-term industry competitiveness. As worldwide demand for ethanol keeps increasing, companies are using market intelligence to improve operational efficiency, meet sustainability goals, and mitigate potential risks.Market Size: The global Industrial Ethanol market is projected to reach USD 185.49 billion by 2035, growing at a CAGR of approximately 6.9% from 2025 to 2035.

Growth Rate: 6.9%

Manufacturing and Supply Chain Optimization: The industrial ethanol market is seeing a surge in demand for real-time data and process integration, which ensures effective management from raw material procurement to final delivery.

Retail and E-Commerce Growth: The expansion of the e-commerce and retail industries is increasing the demand for industrial ethanol in the production of alcoholic beverages, medications, and sanitizing products

Technological Transformation: Advances in artificial intelligence (AI) and machine learning are improving industrial ethanol production by streamlining processes and increasing operational efficiency.

Innovations: The development of modular manufacturing platforms and flexible ethanol applications enables enterprises to select and integrate only the functionalities required, lowering costs and complexity.

Investment Initiatives: Industrial ethanol companies are progressively investing in cloud-based solutions to minimize infrastructure costs, increase scalability, and enable remote accessibility.

Regional Insights: Asia Pacific and North America continue to be major contributors to the industrial ethanol market, owing to strong digital infrastructure, rising demand, and increased adoption of cloud-based production.

Key Trends and Sustainability Outlook:

Cloud Integration: Cloud technologies are increasingly being used in the industrial ethanol industry because they provide scalability, cost effectiveness, and increased data access, making production easier to track.

Advanced Features: The integration of AI, IoT, and blockchain technology increases decision-making, transparency, and automation, which is critical for waste reduction

Focus on Sustainability: Modern production processes enable more effective resource management, energy use optimization, and improved environmental impact tracking, all of which help to achieve global sustainability goals.

Customization Trends: There is an increasing demand for industry-specific solutions in industrial ethanol production, such as customized bioethanol processes, fuel ethanol, and pharmaceutical-grade ethanol.

Data-Driven Insights: Advanced analytics help organizations in the industrial ethanol industry estimate demand precisely, manage inventories more efficiently, and measure performance indicators.

Growth Drivers:

Digital Transformation: As industries around the world digitize, there is an increasing acceptance of technology that improve operational productivity and process efficiency in the industrial ethanol industry.

Demand for Process Automation: Automated technologies are being used in industrial ethanol production to expedite repetitive tasks, decrease operational bottlenecks, and maintain product quality consistency

Scalability Needs: Businesses in areas such as fuel, medicines, and beverages are looking for scalable production systems that can smoothly integrate into expanding operations.

Regulatory Compliance: As environmental and safety requirements tighten, industrial ethanol producers rely on digital tools and automated systems to ensure compliance.

Globalization: Organizations to implement solutions that support multi-country, multi-currency operations, allowing them to address various market needs while adhering to international regulations.

Overview of Market Intelligence Services for the Industrial Ethanol Market:

Recent evaluations have identified major problems in the industrial ethanol sector, including high production costs and the need for process optimization. Market intelligence studies give firms with practical data to assist them uncover cost-cutting opportunities, optimize supplier management, and improve production efficiency. These insights also help to assure compliance with industry rules, high-quality production procedures, and effective cost management.

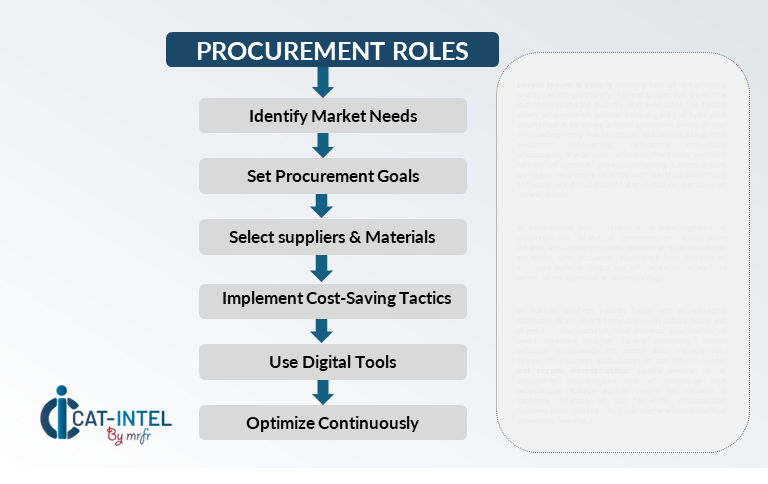

Procurement Intelligence for Industrial Ethanol: Category Management and Strategic Sourcing

To remain competitive in the industrial ethanol market, organizations are fine-tuning their procurement procedures through extensive spend analysis and supplier performance monitoring. Effective category management and strategic sourcing are critical for lowering procurement costs and maintaining a consistent supply of high-quality raw materials for ethanol production. Businesses can use actionable market knowledge to optimize their procurement strategy, negotiate advantageous terms with suppliers, and better manage the complexity of procuring vital supplies, such as corn or sugarcane, in line with production demands. This method allows businesses to remain competitive while ensuring the long-term viability of their operations.

Pricing Outlook for Industrial Ethanol: Spend Analysis

The pricing prognosis for industrial ethanol is projected to remain moderately dynamic, with changes caused by a variety of variables. Changes in supply and demand, technological developments in manufacturing processes, and regional pricing variations are all important drivers. Furthermore, the increased adoption of sustainable practices and green energy programs, combined with rising demand for ethanol in industries such as automotive and chemical manufacture, is putting upward pressure on prices.

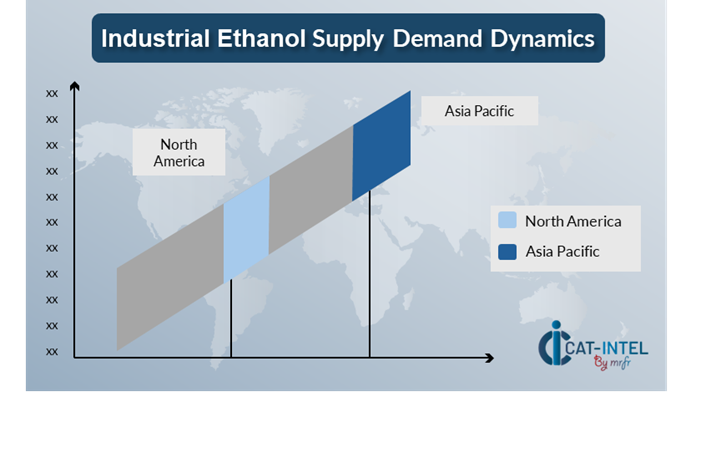

Graph shows general upward trend pricing for Industrial Ethanol and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To reduce costs, businesses should prioritize optimizing procurement tactics, enhancing supplier relationships, and investigating alternative production methods, suchas the use of renewable feedstocks. Utilizing modern digital tools for market analysis, price forecasting, and inventory management will be critical to improving cost efficiency.

Strategic alliances with dependable suppliers, negotiating long-term contracts, and evaluating flexible pricing structures can all help you manage spending more effectively. Despite these hurdles, prioritizing innovation in production processes, adhering to sustainability standards, and reacting to changing market demands will be critical for long-term profitability and operational success in the industrial ethanol sector.

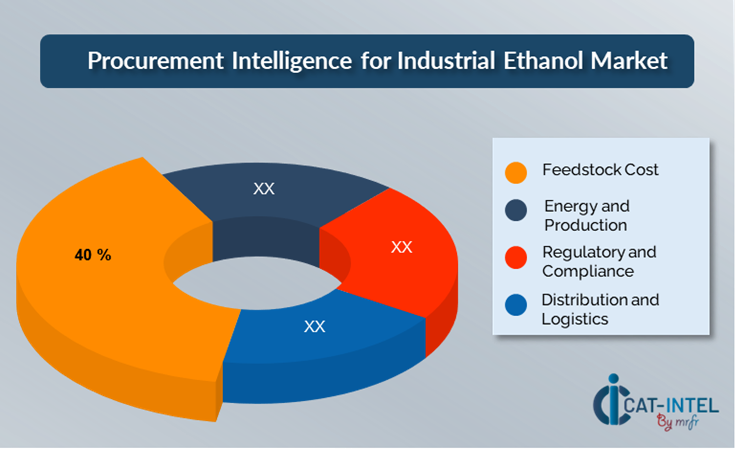

Cost Breakdown for Industrial Ethanol: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

1. Feedstock Cost: (40%)

1. Feedstock Cost: (40%)

Description: Corn, sugarcane, and other biomass are common feedstocks for industrial ethanol production. Prices for various basic commodities vary according to agricultural output, seasonal harvests, and market demand.

Trend: Diversifying feedstocks can help reduce supply chain risks and price volatility. Sustainable and second-generation feedstocks are also gaining appeal, which might reduce long-term prices.

Energy and Production: (XX%)

Regulatory and Compliance: (XX%)

Distribution and Logistics: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the industrial ethanol market, streamlining procurement processes and using strategic negotiation strategies can result in significant cost savings and improved operational efficiency. Long-term relationships with suppliers, particularly those that provide sustainable and renewable feedstocks, can result in more attractive price structures and terms, such as volume discounts and bundled service packages. Flexible pricing structures, such as contract-based agreements with price-lock mechanisms, allow you to obtain cheaper rates while reducing price volatility over time.

Collaborating with suppliers who prioritize innovation and scalability provides additional benefits, such as access to cutting-edge production technologies, increased yield efficiency, and environmentally sustainable practices that can help lower long-term operational costs. Implementing digital procurement technologies like supply chain management platforms and use analytics improves transparency, lowers waste, and maximizes feedstock utilization. Diversifying supplier options and implementing a multi-supplier approach can lessen reliance on a single source, minimize risks such as supply chain disruptions, and strengthen negotiating leverage.

Supply and Demand Overview for Industrial Ethanol: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The industrial ethanol market is likewise expanding rapidly, driven by a variety of factors influencing supply and demand dynamics. As enterprises seek more sustainable solutions and include renewable energy sources, the demand for ethanol is steadily increasing. These transitions are influenced by technical improvements, industry-specific requirements, and global economic conditions.

Demand Factors:

Sustainability and Green Energy Initiatives: The growing global emphasis on lowering carbon footprints is boosting demand for ethanol as a biofuel alternative in industries such as automobiles, energy, and chemicals.

Regulatory Support and Policy Incentives: Government regulations and subsidies for biofuels, including ethanol, are driving demand, particularly in countries that prioritize energy independence and environmental sustainability.

Diversification of End-Use Applications: With increased demand for industrial applications, ethanol is broadening its use beyond traditional biofuels such as solvents, pharmaceuticals, and even in consumer products like sanitizers.

Advancements in Production: Innovations in fermentation, distillation, and substrate processing are making ethanol production more efficient and cost-effective, enhancing its appeal as a renewable energy source.

Supply Factors:

Technological Advancements: Biotechnology innovations, including as enhanced enzymes and genetically engineered organisms, are increasing ethanol yield and efficiency.

Feedstock Availability: The supply of ethanol is heavily controlled by the availability and cost of feedstocks such as corn, sugarcane, and cellulosic materials.

Global Economic Factors: Changes in fuel prices, trade rules, and labour costs can all have an impact on ethanol production costs and market availability.

Scalability and Adaptability: Modern ethanol production plants are becoming more modular, allowing providers to scale up or down in response to market demand and geographical variances.

Regional Demand-Supply Outlook: Industrial Ethanol

The Image shows growing demand for Industrial Ethanol in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Industrial Ethanol Market

Asia Pacific, particularly the Southeast Asia, is a dominant force in the global Industrial Ethanol market due to several key factors:

Demand For Renewable Energy: Asia-Pacific countries, especially India and China, are investing heavily in renewable energy sources like ethanol to lessen their reliance on fossil fuels.

Large Agricultural Base: The Asia-Pacific area has a large agricultural sector that provides ample feedstocks such as sugarcane, corn, and rice husks, which are essential for ethanol manufacturing.

Governmental Policies and Incentives: Several Asian-Pacific nations have implemented favourable policies and incentives to promote the use of ethanol in transportation and other sectors.

Expanding Industrial Applications: In addition to the biofuel business, industrial ethanol is increasingly being used in areas such as medicines, chemicals, and consumer goods throughout Asia-Pacific

Focus on Environmental Concerns: Governments and companies are implementing climate action programs, which include adopting cleaner and more sustainable alternatives like ethanol, making it an attractive option for reducing carbon footprints.

Asia Pacific Remains a key hub, Industrial Ethanol Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the industrial ethanol market is similarly diversified and competitive, with a mix of global industry heavyweights and regional competitors influencing production and distribution. These vendors have a significant impact on aspects including price structures, feedstock sources, production technologies, and product quality. Large-scale manufacturers dominate the industry, offering proven, dependable ethanol solutions, while smaller, specialist players focus on certain market niches, such as bioethanol for specialized uses or low-carbon production methods.

The industrial ethanol provider ecosystem encompasses significant producing regions such as the Americas, Europe, and portions of Asia, with both global firms and local suppliers catering to a wide range of needs, from high-volume fuel production to specialized ethanol solutions for pharmaceuticals and chemicals. As the demand for sustainable and renewable energy solutions rises, ethanol suppliers are focusing on improving production capabilities, integrating new technologies, and providing flexible pricing models to meet the changing needs of industries like energy, automotive, and manufacturing. With a sustained focus on sustainability and environmental effect, many ethanol producers are developing green production technologies such as second-generation biofuels (cellulosic ethanol) and investing in innovations such as carbon capture and renewable feedstocks.

Key Suppliers in the Industrial Ethanol Market Include:

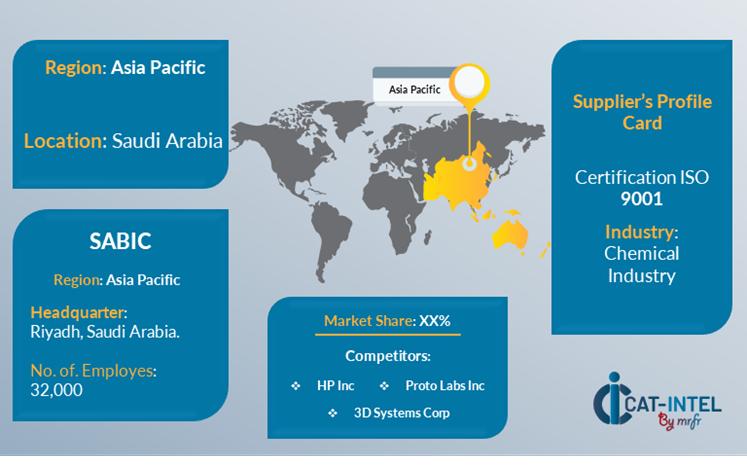

SABIC (Saudi Basic Industries Corporation)

Archer Daniels Midland Company (ADM)

POET LLC

Green Plains Inc.

Neste Corporation

Cargill Inc.

Cosan S.A.

British Petroleum (BP)

Indian Oil Corporation

-

Thai Ethanol Manufacturing Co. Ltd.

Key Developments Procurement Category Significant Development:

Significant Development

Description

Market Growth

The industrial ethanol industry is also expanding rapidly, propelled by rising demand for biofuels, particularly in the transportation, energy, and manufacturing sectors.

Cloud Adoption

The ethanol market is shifting toward more efficient production methods and distribution models, with more use of cloud technologies for supply chain management and production monitoring.

Product Innovation

The industrial ethanol market is focused on innovation, particularly breakthroughs in fermentation technology, greater feedstock use, and the development of second-generation biofuels like cellulosic ethanol.

Technological Advancements

The industrial ethanol sector is also benefiting from technological improvements, such as IoT integration in production facilities to improve monitoring, predictive maintenance, and efficiency.

Global Trade Dynamics

Changes in global trade restrictions and policy reforms are also affecting the industrial ethanol market, particularly in large producers such as the United States and Brazil.

Customization Trends

As the demand for more sustainable and efficient energy sources develops, ethanol producers are focusing on customized solutions that address specific regional or industry demands. Modular production systems that can respond to fluctuations in feedstock availability are becoming more widespread.

Industrial Ethanol

Attribute/Metric

Details

Market Sizing

The global Industrial Ethanol market is projected to reach USD 185.49 billion by 2035, growing at a CAGR of approximately 6.9% from 2025 to 2035.

Industrial Ethanol Technology Adoption Rate

Around 70% of industrial ethanol production facilities use sophisticated production technology, such as sustainable and bio-based feedstocks, automation, and digital monitoring systems, to improve efficiency.

Top Industrial Ethanol Industry Strategies for 2025

Key objectives include expanding sustainable production methods, using second-generation biofuels, optimizing supply chain logistics, increasing feedstock use, and capitalizing on government incentives and subsidies for renewable energy.

Industrial Ethanol Process Automation

Approximately 60% of industrial ethanol producers are implementing automation in their operations to improve production efficiency, reduce waste, and optimize fermentation processes.

Industrial Ethanol Process Challenges

Major problems include variable feedstock prices, supply chain interruptions, regulatory compliance for emissions and environmental requirements, and reliance on government biofuel incentives.

Key Suppliers

Leading industrial ethanol producers include SABIC and Archer Daniels Midland Company, they focus on large-scale ethanol production and renewable energy integration.

Key Regions Covered

Asia Pacific, North America, and Europe are key regions for industrial ethanol production and use, with high demand from the automotive, energy, and chemical industries.

Market Drivers and Trends

Growth is being driven by rising demand for biofuels, government policies favouring renewable energy, technological breakthroughs in bioethanol production, and the incorporation of sustainable and innovative feedstocks such as agricultural waste.