Summary Overview

Industrial Filters Market Overview:

The global industrial filters market is steadily expanding, driven by rising demand in industries such as manufacturing, automotive, healthcare, and energy. This market covers a wide range of industrial filter solutions, such as air filters, water filters, oil filters, and gas filters, which serve a variety of applications. Our paper provides a detailed examination of procurement trends, with an emphasis on cost-cutting techniques and the use of modern filtration technologies to improve operational efficiency.

The key problems in the industrial filters market are managing procurement costs, assuring product dependability and performance, preserving environmental sustainability, and integrating filters into existing systems. The implementation of digital solutions for monitoring and maintaining filter performance, as well as strategic sourcing, plays an important role in streamlining the procurement process and ensuring long-term competitiveness. As global demand grows, businesses are increasingly depending on market information to drive operational efficiencies and mitigate the risks associated with supply chain disruptions and regulatory compliance.

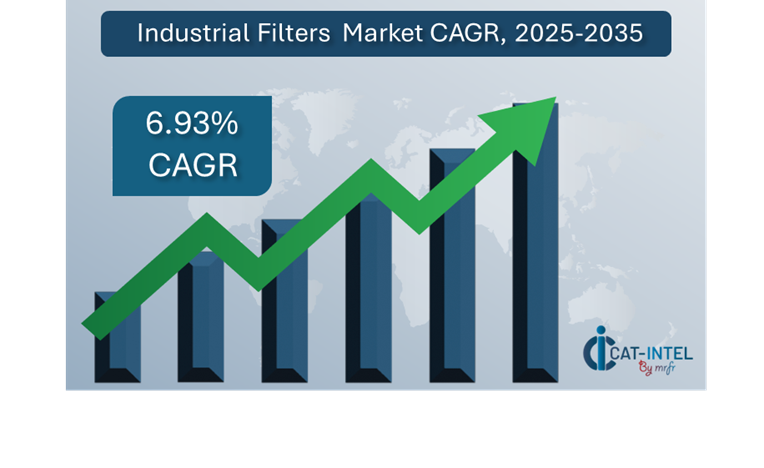

Market Size: The global Industrial Filters market is projected to reach USD 8.28 billion by 2035, growing at a CAGR of approximately 6.93% from 2025 to 2035.

Growth Rate: 6.93%

Growth Rate: 6.93%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: Industries are increasingly relying on real-time data and linked processes to streamline operations, boost efficiency, and eliminate waste.

Growth in Key Sectors: Adoption of advanced filtration systems is increasing in key areas such as automotive, healthcare, and food processing, resulting in improved product quality, safety, and operating efficiency.

Technological Advancements: Automation, artificial intelligence, and machine learning are dramatically increasing filter performance monitoring and predictive maintenance, resulting in higher efficiency and less downtime.

Innovations: The creation of modular filtering systems allows firms to select and integrate only the essential components, which minimizes both capital expenditure and system complexity.

Investment Initiatives: Companies are investing in cutting-edge filtration technology, such as cloud-based monitoring tools, to reduce operational costs and enable remote management of filter systems.

Regional Insights: North America and Asia Pacific are important regions for market growth because to their strong industrial base, improved infrastructure, and growing usage.

Key Trends and Sustainability Outlook:

Cloud Integration: The growing use of cloud-based solutions in the industrial filters market improves scalability, allows for more effective data administration, and provides better access to performance.

Advanced Features: The combination of IoT sensors, AI, and blockchain technology improves transparency, automation, and decision-making in industrial filtration systems, resulting in improved operational standards.

Focus on Sustainability: With increasing environmental restrictions, industrial filters are playing an important role in maintaining compliance with sustainability goals, enhancing resource utilization, and reducing environmental impact.

Customization Trends: Tailored filtering solutions created expressly for diverse industries such as pharmaceuticals, chemicals, and food manufacturing are becoming increasingly popular, catering to industry-specific needs and standards.

Data-Driven Insights: Advanced analytics allows businesses to monitor filter performance, identify usage patterns, optimize replacements, and assure peak efficiency while lowering costs and downtime.

Growth Drivers:

Digital Transformation: The growing use of digital technologies is boosting production, improving maintenance schedules, and streamlining filter operations throughout sectors.

Demand for Process Automation: Industrial filters are becoming an increasingly important component of automated systems, eliminating the need for manual monitoring and minimizing human error, resulting in smoother operations and less bottlenecks.

Scalability Requirements: Industries are increasingly seeking filter solutions that can scale with increased production capabilities, guaranteeing that the filtration systems remain effective as operations expand.

Regulatory Compliance: As environmental and safety standards tighten, industrial filtration systems play an important role in ensuring that businesses follow regulations by increasing performance tracking, reporting, and quality control.

Globalization: As industries expand their operations globally, there is an increasing demand for innovative filtration systems that can meet multi-region, multi-application, and various regulatory requirements.

Overview of Market Intelligence Services for the Industrial Filters Market:

Recent evaluations have highlighted major hurdles in the industrial filters industry, including as high initial prices and the necessity for system customisation to match unique operational requirements. Market intelligence studies give useful information that assist firms in identifying cost-saving options, optimizing supplier relationships, and increasing the effectiveness of filter system deployment. These insights not only help to comply with industry laws, but also to maintain high operating standards while successfully managing costs.

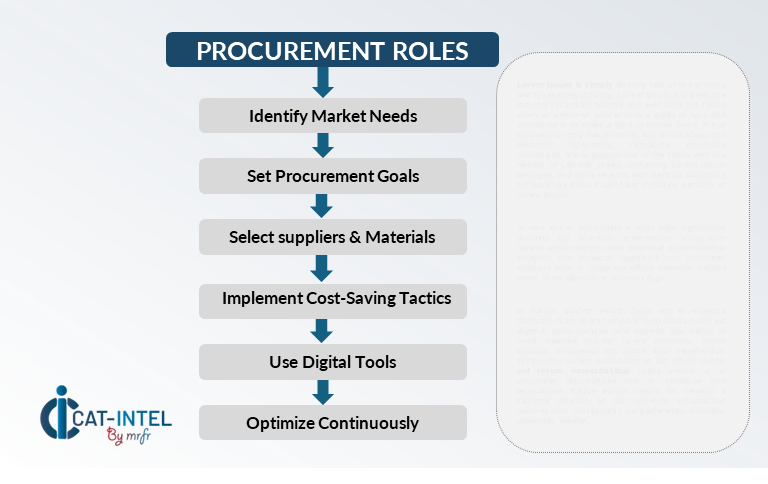

Procurement Intelligence for Industrial Filters: Category Management and Strategic Sourcing

To remain competitive in the industrial filter market, businesses are improving procurement procedures by applying spend analysis and monitoring vendor performance. Effective category management and strategic sourcing are critical for reducing procurement costs while guaranteeing a consistent supply of high-quality filtering goods. Businesses that use actionable market intelligence can improve their procurement strategy, negotiate better deals with suppliers, and ensure that their filtering systems fulfil both operational and regulatory criteria.

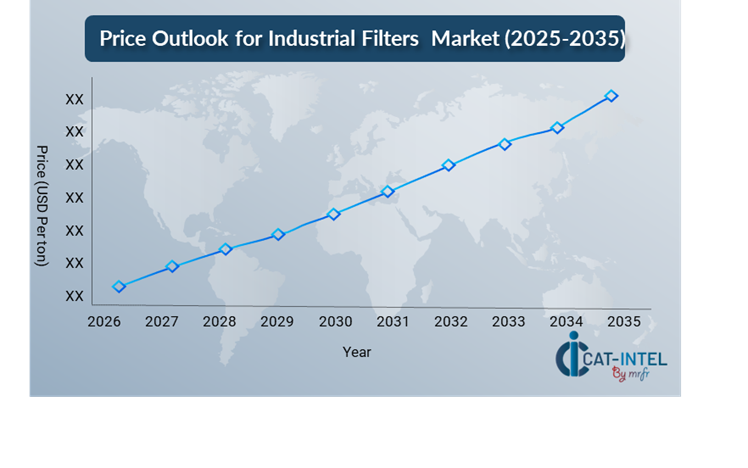

Pricing Outlook for Industrial Filters: Spend Analysis

The pricing prognosis for industrial filters is expected to be moderately dynamic, with swings caused by a variety of variables. Technological developments, increased demand for specialized filtration systems, customized requirements, and regional pricing discrepancies are all key drivers. Furthermore, the increasing integration of smart technologies such as IoT and AI along with increased focus on sustainability and regulation is putting greater pressure on filter pricing.

Graph shows general upward trend pricing for Industrial Filters and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve supplier management, and implement modular filtration systems are critical for cost control. Businesses can increase cost efficiency and reduce procurement-related expenses by leveraging digital solutions for market monitoring, pricing forecasting via analytics, and contract administration simplification.

Partnering with reputable filter vendors, negotiating long-term contracts, and considering subscription-based pricing structures can all help you manage filter expenses more effectively. Despite these hurdles, prioritizing scalability, maintaining seamless integration, and adopting innovative filtration technologies will be critical to achieving cost-effectiveness and operational excellence.

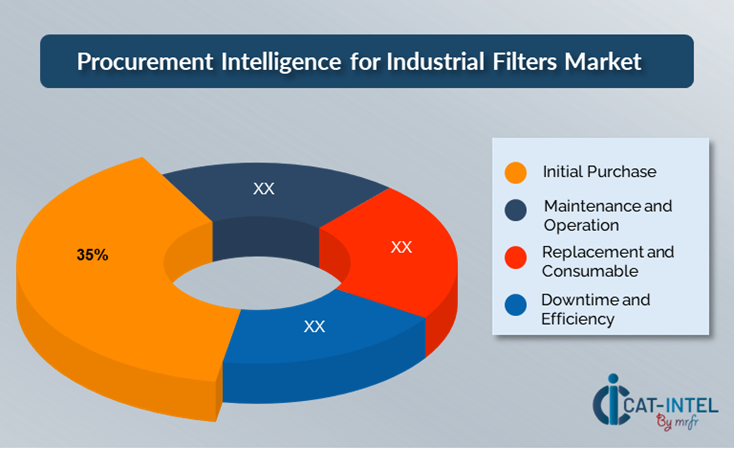

Cost Breakdown for Industrial Filters: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

1. Initial Purchase: (35%)

1. Initial Purchase: (35%)

Description- The upfront cost for filtration equipment includes filter units, installation, and setup. It also includes the cost of any initial infrastructure needed to integrate with existing systems.

Trend: Modular and scalable filtration solutions are becoming more popular, allowing organizations to start with what they need and expand as needed.

2. Maintenance and Operation: (XX%)

3. Replacement and Consumable: (XX%)

4. Downtime and Efficiency: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the industrial filter market, streamlining procurement processes and utilizing strategic negotiation strategies can result in significant cost savings and increased operational performance. Long-term partnerships with reputable filter providers, particularly those who provide advanced, cloud-enabled solutions, might result in more favourable pricing structures, such as volume-based discounts and bundled service packages. Subscription-based arrangements and multi-year contracts allow you to lock in reduced rates and defend against price rises over time.

Collaborating with filter providers who value innovation and scalability provides additional benefits, such as access to next-generation filtration technology, sophisticated monitoring systems, and customizable solutions tailored to specific industry demands. This can lower long-term operational costs by improving filter performance and longevity. Implementing digital procurement solutions, such as supplier management systems and use statistics, increases transparency, reduces overprovisioning, and assures optimal filter utilization.

Supply and Demand Overview for Industrial Filters: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The industrial filters market is expanding steadily, driven by increased demand for advanced filtering solutions in industries such as manufacturing, automotive, healthcare, and energy. The dynamics of supply and demand in this market are driven by technical breakthroughs, industry-specific needs, and worldwide economic conditions.

Demand Factors:

Environmental and Regulatory Compliance: As enterprises confront stronger environmental laws, there is a growing demand for high-performance filtration systems that meet sustainability and safety requirements.

Technological Advancements: The increased emphasis on smart technologies and IoT integration is driving demand for more modern industrial filters capable of real-time performance monitoring and filtering process optimization.

Customization: Industries such as healthcare, food processing, and pharmaceuticals demand bespoke filtration systems tailored to their unique operational needs, including strict hygiene and safety standards.

Operational Efficiency: There is an increasing demand for filtration systems that assist organizations in improving operating efficiency, reducing energy usage, and lowering maintenance costs.

Supply Factors:

Technological Advancements: Filtration technology innovations, such as improved materials and AI-driven performance monitoring, are improving filter solution capabilities.

Vendor Ecosystem: The market is seeing a wide array of filter vendors, ranging from multinational corporations to niche players, offering a wide range of solutions to fulfil varied industry requirements.

Global Economic Factors: Exchange rates, labour costs, and regional adoption of green technology all have an impact on industrial filter pricing and availability, with costs varied by market.

Scalability and Flexibility: As businesses grow and diversify, there is a rising demand for modular filtering solutions that can be adapted to the size and complexity of operations.

Regional Demand-Supply Outlook: Industrial Filters

The Image shows growing demand for Industrial Filters in both North America and Asia Pacific, with potential price increases and increased Competition.

The Image shows growing demand for Industrial Filters in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Industrial Filters Market

North America, particularly the United States, is a dominant force in the global Industrial Filters market due to several key factors:

Advanced Industrial Infrastructure: North America's industrial sector is highly developed, and all its facilities require advanced filtration systems to ensure efficient operations and regulatory compliance.

Stringent Environmental Regulations: The region is noted for its stringent environmental standards and regulations, such as those imposed by the Environmental Protection Agency (EPA).

Technological Innovation: North America is a leader in the use of cutting-edge technologies such as IoT, AI, and smart filtration systems for real-time monitoring and performance improvement.

Market for Industrial Equipment: The region has a big and diverse industrial base, with significant demand for filtering solutions across numerous industries, including as manufacturing, chemical processing, automotive, and food and beverage industries.

Sustainability Investment: North America is increasingly focusing on sustainability programs, which are encouraging industries to embrace environmentally friendly solutions.

North America Remains a key hub, Industrial Filters Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the industrial filters market is equally diverse and competitive, with global industry leaders and regional suppliers shaping the sector's dynamics. These vendors have an impact on critical elements such as cost, product customisation, and service quality. Large, well-established firms dominate the market by offering comprehensive filtration solutions, while smaller, specialized competitors concentrate in specific applications or provide unique features like smart monitoring systems, sophisticated filtering materials, and customizable solutions.

The industrial filter supplier ecosystem encompasses important technological regions, with both worldwide vendors and innovative local companies meeting the unique needs of numerous industries. As organizations increasingly focus on sustainability, economy, and regulatory compliance, filter vendors are expanding their technological capabilities by incorporating cutting-edge materials, IoT-enabled monitoring, and offering adaptable solutions to satisfy changing industrial demands. Flexible pricing structures, such as subscription-based services and long-term contracts, are becoming more common to meet the diverse demands of organizations of all kinds.

Key Suppliers in the Industrial Filters Market Include:

Donaldson Company, Inc.

Parker Hannifin Corporation

Camfil

MANN+HUMMEL

3M

Filtration Group

HYDAC International

U.S. Filter

Ahlstrom-Munksjö

Pentair.

Key Developments Procurement Category Significant Development:

|

Industrial Filters Attribute/Metric |

Details |

Market Sizing |

The global Industrial Filters market is projected to reach USD 8.28 billion by 2035, growing at a CAGR of approximately 6.93% from 2025 to 2035.

|

Industrial Filters Technology Adoption Rate |

Approximately 60% of companies have implemented advanced filtration technologies, with a noticeable move toward IoT-enabled and cloud-based filtration systems for real-time monitoring and performance enhancement. |

Top Industrial Filters Industry Strategies for 2025 |

Key methods include integrating AI-powered monitoring for predictive maintenance, optimizing filtering operations with modular solutions, promoting sustainability, and improving energy efficiency using sophisticated filtering systems. |

Industrial Filters Process Automation |

Approximately half of industrial filter systems are now automated, with basic processes like filter replacement and performance monitoring being automated to increase efficiency. |

Industrial Filters Process Challenges |

High upfront costs, regulatory compliance difficulties, maintaining optimal filter performance over time, and dealing with supply chain disruptions are all significant concerns. |

Key Suppliers |

Leading industrial filter suppliers include Donaldson Company, Inc. (USA), Parker Hannifin Corporation (USA), and Camfil (Sweden), who provide comprehensive filtration solutions across industries. |

Key Regions Covered |

North America, Europe, and Asia-Pacific are key regions for industrial filter adoption, with major demand in the manufacturing, automotive, and healthcare industries. |

Market Drivers and Trends |

Growth is being driven by a greater emphasis on sustainability, regulatory compliance, breakthroughs in filtration technologies, and the use of IoT and AI to increase performance monitoring and operational efficiency. |