Summary Overview

Industrial Motors Market Overview

The global industrial motors market is steadily expanding, driven by demand from industries such as manufacturing, energy, automotive, and logistics. This market contains a wide variety of industrial motor types, including electric motors, hydraulic motors, and pneumatic motors. Our paper provides a thorough examination of procurement trends, emphasizing cost-cutting measures and the use of innovative technology to increase operational efficiency.

Key future problems in the industrial motors sector include controlling rising production costs, assuring long-term durability, maintaining energy efficiency standards, and integrating new motor technology into current systems. Digital solutions for monitoring motor efficiency and predictive maintenance, as well as strategic sourcing strategies, are critical to streamlining procurement processes and preserving long-term competitiveness.

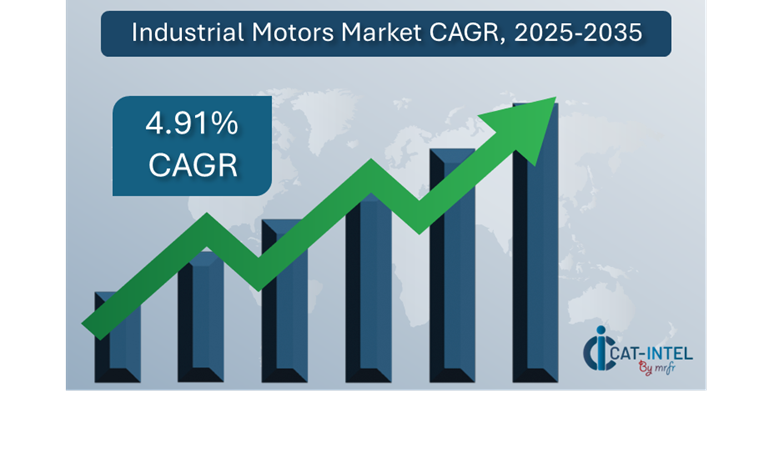

Market Size: The global Industrial Motors market is projected to reach USD 35.2 billion by 2035, growing at a CAGR of approximately 4.91% from 2025 to 2035.

Growth Rate: 4.91%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: Businesses are concentrating on enhancing workflows and visibility to minimize inefficiencies and increase production.

Retail and E-Commerce Growth: As the retail and e-commerce industries grow, businesses are being pushed to embrace new technology to improve inventory management to fulfil rising customer demands while retaining operational efficiency.

Technological Transformation: Advances in Artificial Intelligence (AI) and Machine Learning are changing the way business’ function, particularly in process automation, predictive analytics, and data-driven decision making.

Innovations: The introduction of modular solutions allows firms to choose and integrate exactly the functionalities they require, lowering costs and simplifying complexity.

Investment Initiatives: There is a definite trend of businesses investing in cloud-based systems to cut infrastructure costs, obtain real-time information, and increase accessibility.

Regional Insights: Asia Pacific and North America are leading markets, owing to strong digital infrastructure and high demand for cutting-edge technology across a wide range of industries.

Key Trends and Sustainability Outlook

Cloud Integration: Cloud-based solutions are becoming more popular due to their scalability, cost-effectiveness, and ability to improve data access across enterprises, allowing businesses to run more efficiently.

Advanced Features: Integrating AI, IoT, and blockchain technology into modern systems improves decision-making, automation, and transparency.

Focus on Sustainability: Modern solutions help firms achieve their sustainability goals by optimizing resource management, decreasing waste, and boosting tracking and reporting capabilities.

Customization Trends: There is an increasing demand for industry-specific solutions that address the specialized needs of industries such as healthcare, manufacturing, and energy.

Data-Driven Insights: The use of advanced analytics gives firms a clear grasp of performance measures, allowing them to estimate demand and make better decisions.

Growth Drivers

Digital Transformation: Companies are increasingly using digital technologies to boost productivity, efficiency, and competitiveness. The increasing transition to digital-first strategy is a major driver of industry growth.

Demand for Process Automation: Automating repetitive operations is a top priority for firms looking to reduce operational bottlenecks and boost productivity.

Scalability Requirements: As organizations expand, they demand technologies that can scale alongside them. Companies are investing in solutions that offer seamless integration and performance while also facilitating future development and expansion.

Regulatory Compliance: The necessity for enterprises to comply with various regulations drives the adoption of systems that automate reporting, ensure data accuracy, and simplify compliance management.

Globalization: As organizations develop globally, there is an increasing demand for solutions that support multi-currency, multi-language, and globally compliant requirements, allowing them to function more efficiently across borders.

Overview of Market Intelligence Services for the Industrial Motors Market

Recent research has identified various problems in the industrial motors market, including high implementation costs and the requirement for system customization. Market intelligence studies provide useful insights into procurement prospects, allowing businesses to identify cost-cutting methods, optimize supplier relationships, and improve the overall effectiveness of their motor system integration projects. These insights also help in meeting industry standards, ensuring excellent operational quality, and successfully managing expenses.

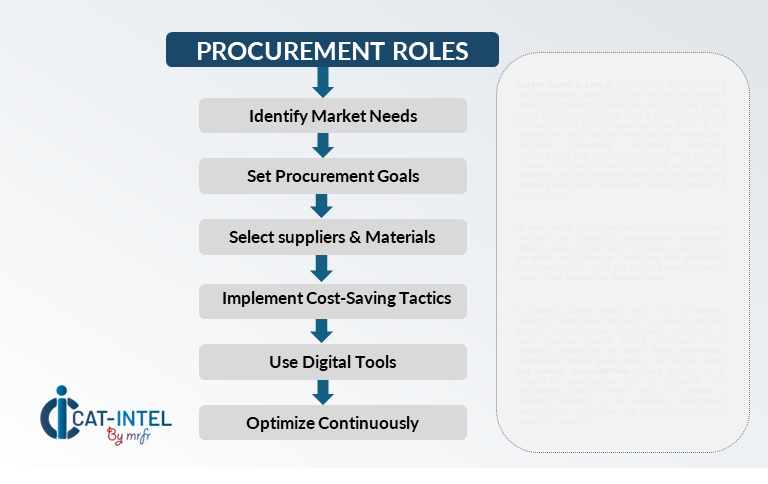

Procurement Intelligence for Industrial Motors: Category Management and Strategic Sourcing

In the competitive industrial motors industry, organizations are improving their procurement procedures through expenditure analysis and vendor performance tracking. Effective category management and strategic sourcing are critical tactics for lowering procurement costs while maintaining a consistent supply of high-quality motor solutions. Businesses can use actionable market intelligence to optimize their procurement strategy, negotiate advantageous terms, and obtain trusted suppliers for their industrial motor needs.

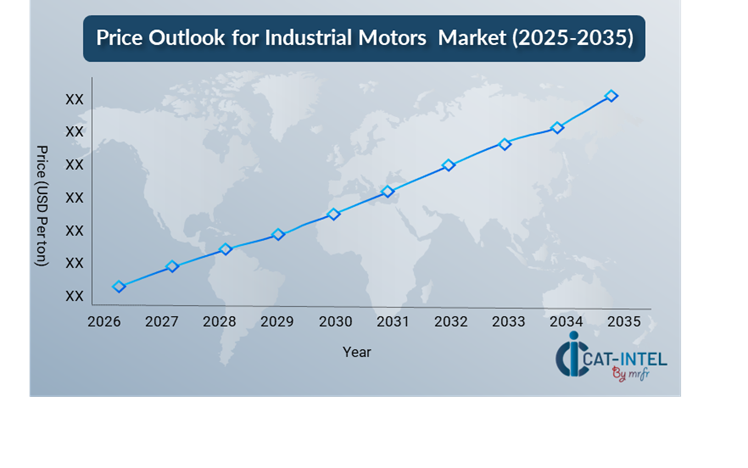

Pricing Outlook for Industrial Motors: Spend Analysis

The pricing prognosis for industrial motors is projected to remain moderately dynamic, with swings influenced by several major factors. These include technology breakthroughs, increased demand for energy-efficient and customisable motor solutions, and regional pricing differences. Furthermore, as AI and IoT become more integrated, as well as a greater emphasis on meeting energy and environmental regulations, prices are anticipated to rise.

Graph shows general upward trend pricing for Industrial Motors and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve vendor management, and implement flexible motor solutions will be critical for cost reduction. Digital solutions for market monitoring, advanced analytics-based pricing forecasting, and contract administration streamlining can all help to increase cost efficiency. Building solid partnerships with reputable motor suppliers, negotiating long-term contracts, and investigating volume-based pricing models are all critical tactics for effectively controlling motor-related expenses. Despite these obstacles, concentrating on scalability, assuring strong execution, and leveraging energy-efficient technologies will be critical to sustaining cost-effectiveness and operational excellence in the industrial motors industry.

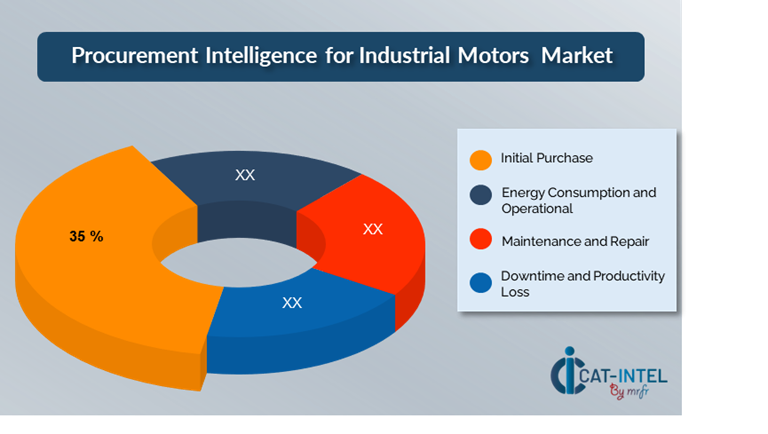

Cost Breakdown for Industrial Motors: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

1. Initial Purchase: (35%)

Description: Prices vary depending on motor type (AC, DC, synchronous, induction, and so on), motor power, and other features such as energy efficiency or application customisation.

Trend Point: There is a trend towards choosing energy-efficient motors, which may have a higher initial purchase cost but result in significant energy savings throughout the motor's lifetime.

Energy Consumption and Operational: (XX%)

Maintenance and Repair: (XX%)

Downtime and Productivity Loss: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the industrial motors business, streamlining procurement processes and using strategic negotiation methods can result in significant cost savings and improved operational efficiency. Long-term partnerships with motor suppliers, particularly those that provide energy-efficient and customisable solutions, can result in more favourable price structures and terms, such as volume discounts and bundled service packages. Companies can negotiate multi-year contracts and investigate subscription-based models to get lower rates and better manage pricing swings over time.

Partnering with motor suppliers who value innovation and scalability provides additional benefits, such as access to advanced features like predictive maintenance tools, IoT integration, and configurable settings. These features help to lower long-term operational expenses and improve system reliability. Implementing digital procurement tools like contract management systems and usage analytics increases transparency, reduces over-provisioning, and ensures optimal motor utilization. Diversifying vendor alternatives and implementing a multi-vendor strategy can reduce reliance on a single supplier, eliminate risks such service disruptions, and increase negotiating power, resulting in better price and service terms.

Supply and Demand Overview for Industrial Motors: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The industrial motors market is expanding steadily, propelled by rising demand for energy-efficient solutions, developments in automation, and digital transformation activities in industries like as manufacturing, energy, and logistics. Technological breakthroughs, sector-specific needs, and global economic conditions all have an impact on supply and demand dynamics

Demand Factors:

Digital Transformation Initiatives: The growing demand for automation and real-time data management in areas such as manufacturing and energy is pushing the development of modern industrial motor systems capable of supporting smart factories and enhanced performance monitoring.

Energy Efficiency and Sustainable Trends: Rising environmental concerns and regulatory demands are driving companies to use energy-efficient motors that lower operating costs and carbon footprints.

Industry-special Requirements: Industries such as automotive, aerospace, and manufacturing have special motor requirements, including motors that meet with safety rules and complex operational workflows.

Integration Capabilities: There is a growing demand for industrial motors that connect easily with automation systems, Internet of Things devices, and advanced sensors, as well as predictive maintenance and system optimization.

Supply Factors:

Technological Advancements: AI, machine learning, and IoT are improving industrial motor functionality, allowing for features such as predictive maintenance and increased energy economy.

Vendor Ecosystem: The number of suppliers to the industrial motor market is increasing, ranging from huge multinational manufacturers to niche businesses offering specialized solutions.

Global Economic Factors: Exchange rates, shifting material costs, and regional labour charges all have a significant impact on the pricing and availability of industrial motors.

Scalability and Flexibility: The growing demand for scalable motor solutions that can be adapted to diverse applications has resulted in modular motor systems that cater to businesses of different sizes and complexities.

Regional Demand-Supply Outlook: Industrial Motors

The Image shows growing demand for Industrial Motors in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Industrial Motors Market

Asia Pacific, particularly the East Asia, is a dominant force in the global Industrial Motors market due to several key factors:

Rapid Industrialization Growth: The region's fast industrialization, combined with the rise of industries such as automotive, textiles, chemicals, and electronics, has resulted in a considerable increase in demand for industrial motors.

Governmental Initiatives: Governments in Asia-Pacific are investing extensively in infrastructure development, industrial upgrading, and smart manufacturing programs.

Competitive Manufacturing Costs: The Asia-Pacific area provides a cost advantage due to the availability of low-priced labour, as a result, the region has developed into a global hub for motor manufacturing, with many foreign companies sourcing motors from Asian vendors.

Adoption of Automation and Robotics: Asia-Pacific is leading the use of automation, robotics, and IoT technologies, especially in industries such as automotive, electronics, and logistics.

Focus on Energy Efficiency: Countries like Japan and South Korea have been the pioneers in energy-efficient devices, while growing economies like India and China are increasingly concerned with sustainability.

Asia Pacific Remains a key hub Industrial Motors Price Drivers Innovation and Growth.

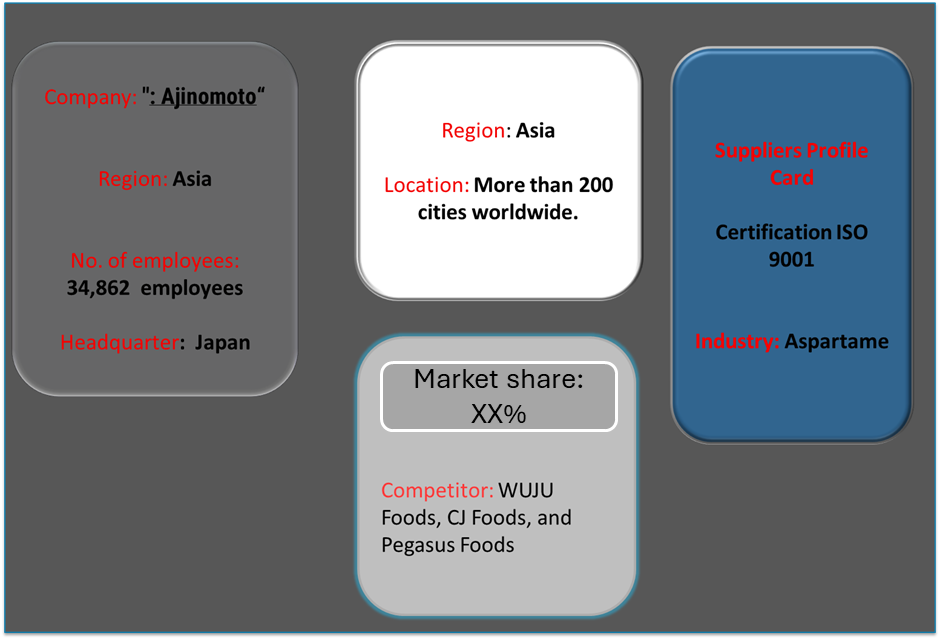

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the industrial motors market is similarly broad and fiercely competitive, with a mix of global industry leaders and regional competitors shaping market dynamics. The market is controlled by well-known worldwide manufacturers that offer a wide range of industrial motors, while smaller, niche suppliers focus on specialty sectors or advanced features like energy efficiency, IoT integration, and predictive maintenance.

The industrial motor supplier ecosystem covers major technology regions, with top worldwide suppliers supplemented by creative local firms that address industry-specific needs. As organizations prioritize operational efficiency, automation, and sustainability, motor suppliers are expanding their products to include innovative technology such as artificial intelligence for predictive maintenance, energy-efficient solutions, and cloud-based monitoring capabilities.

Key Suppliers in the Industrial Motors Market Include

Yaskawa Electric Corporation

Siemens AG

ABB Ltd

Schneider Electric

General Electric (GE)

Rockwell Automation

Nidec Corporation

Mitsubishi Electric Corporation

Weg S.A.

Siemens Electric Motor Works

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The industrial motors market is expanding rapidly, fuelled by rising demand for energy-efficient solutions, automation, and advanced technologies in industries such as manufacturing, logistics, and energy. |

Cloud Adoption |

As businesses adopt hybrid and remote work models, cloud integration provides the freedom to manage and analyse motor performance data from anywhere, allowing for preventative maintenance and operational enhancements. |

Product Innovation |

Industrial motor manufacturers are increasing their product offerings with innovations such as IoT-enabled smart motors and energy-efficient designs to meet the growing demand for sustainable and efficient solutions in industries such as manufacturing, energy, and transportation. |

Technological Advancements |

Machine learning, IoT integration, and robotic process automation (RPA) are improving industrial motor capabilities and maximizing overall efficiency, resulting in cost savings and reduced downtime.

|

Global Trade Dynamics |

Changes in global trade restrictions, compliance needs, and regional economic policies are all influencing industrial motor adoption patterns, especially for multinational corporations with complicated and internationally scattered supply chains. |

Customization Trends |

Modular motor designs that allow for configuration, scalability, and connectivity with third-party systems are becoming increasingly popular among enterprises looking for customized solutions to specific operating needs. |

Industrial Motors Attribute/Metric |

Details |

Market Sizing |

The global Industrial Motors market is projected to reach USD 35.2 billion by 2035, growing at a CAGR of approximately 4.91% from 2025 to 2035.

|

Industrial Motors Technology Adoption Rate |

Around 60% of manufacturing organizations worldwide have implemented sophisticated motor technology, with a substantial move toward energy-efficient and IoT-enabled motors for increased performance and sustainability. |

Top Industrial Motors Industry Strategies for 2025 |

Integrating IoT for predictive maintenance, employing energy-efficient motors, automating motor performance monitoring, and emphasizing sustainability are all important solutions for meeting regulatory standards. |

Industrial Motors Process Automation |

Automation is used in around 50% of industrial motor implementations for routine activities including performance monitoring, energy optimization, and predictive maintenance.

|

Industrial Motors Process Challenges |

Major hurdles include high upfront costs, a scarcity of qualified maintenance workers, connection with older systems, and the requirement for ongoing improvements to satisfy energy efficiency standards. |

Key Suppliers |

Leading industrial motor providers include Yaskawa Electric Corporation, Siemens AG and ABB Ltd, who provide comprehensive solutions for areas like as manufacturing, energy, and transportation.

|

Key Regions Covered |

Asia Pacific, North America and Europe are key regions for industrial motor adoption, with major demand in the manufacturing, automotive, and energy industries. |

Market Drivers and Trends |

The growing demand for energy-efficient motors, production automation, IoT connectivity for monitoring and performance analysis, and the requirement to comply with environmental regulations. |