Summary Overview

Industrial Pumps Market Overview

The global industrial pumps market is steadily expanding, driven by rising demand in key industries such as manufacturing, oil and gas, water treatment, and chemicals. This market includes a wide variety of pump types, such as centrifugal, positive displacement, peristaltic, and diaphragm pumps. Our research presents an in-depth analysis of procurement trends, with a particular emphasis on cost-cutting methods and the use of innovative digital tools to streamline procurement and operations.

Key future problems in the industrial pumps sector include controlling capital and maintenance costs, assuring product scalability and dependability, addressing sustainability concerns, and providing seamless integration with current systems and infrastructure. Digital technologies, including as predictive maintenance and smart monitoring systems, are becoming increasingly important for optimizing pump performance, decreasing downtime, and increasing overall efficiency.

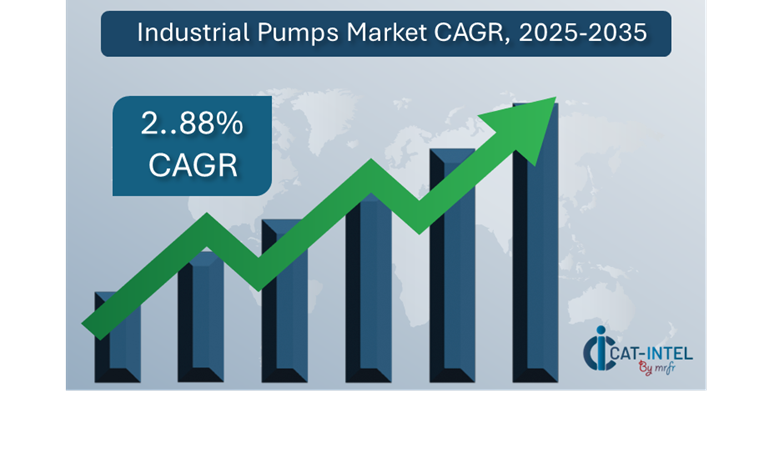

Market Size: The global Industrial Pumps market is projected to reach USD 447.49 billion by 2035, growing at a CAGR of approximately 2.88% from 2025 to 2035.

Growth Rate: 2.88%

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: There is a growing demand for real-time data and process integration to streamline operations and boost productivity.

Retail and E-Commerce Growth: Increased demand for industrial pumps in retail and e-commerce logistics necessitates effective fluid management and handling systems for processes such as inventory processing, packaging, and shipping.

Technological Transformation: Advancements in AI, IoT, and machine learning are improving pump performance through predictive analytics, monitoring, and automation, resulting in smarter systems.

Innovations: The rise of modular pump systems enables organizations to choose and integrate only the pump types and functionality required, lowering operational costs and system complexity.

Investment Initiatives: Companies are increasingly investing in high-performance, energy-efficient industrial pumps to optimize energy usage and save operational expenses.

Regional Insights: Asia Pacific and North America continue to be significant participants in the industrial pumps market, thanks to their strong manufacturing bases and increasing adoption of modern, cloud-based systems.

Key Trends and Sustainability Outlook

Energy Efficiency: There is a growing use of energy-efficient industrial pumps that contribute to sustainability goals, reduce energy consumption, and assist businesses in meeting environmental standards.

Smart Pump Solutions: The integration of IoT, AI, and blockchain in industrial pumps is resulting in smarter decision-making, increased automation, and improved operational transparency.

Focus on Sustainability: Industrial pumps are increasingly being built to optimize resource utilization, decrease waste, and enhance efficiency, harmonizing with corporate sustainability objectives through improved monitoring and reporting.

Customization Trends: There is an increasing need for industry-specific pumps designed for sectors such as chemicals, pharmaceuticals, and food processing, all of which have distinct fluid handling requirements.

Data-Driven Insights: Advanced monitoring and analytics provide businesses with data on pump performance, allowing for more accurate forecasts, maintenance plans, and process optimization.

Growth Drivers:

Digital Transformation: As industrial operations migrate to digital technologies, smart pumps and real-time monitoring systems are being adopted to improve productivity and operational efficiency.

Demand for Process Automation: A greater reliance on automated pump systems for repetitive operations such as fluid transfer, resulting in fewer operational bottlenecks and downtime.

Scalability Requirements: As industries grow, there is a greater requirement for scalable pumps that can seamlessly integrate into expanding processes and satisfy larger capacity demands.

Regulatory Compliance: Industrial pumps assist organizations comply with industry regulations such as safety norms and environmental rules.

Globalization: As organizations develop worldwide, there is an increasing demand for industrial pumps that can support multi-region activities such as fluid management and assuring compliance with global standards.

Overview of Market Intelligence Services for the Industrial Pumps Market:

Recent industrial pump market evaluations have found important difficulties, such as high capital investment prices and the necessity for system customisation to meet unique operating needs. Market intelligence studies offer valuable information that assist businesses in identifying cost-saving opportunities, optimizing supplier relationships, and ensuring simpler implementation procedures. These insights not only aid in complying with industry rules, but also in maintaining high-quality operational standards, thereby efficiently controlling both upfront and long-term expenditures.

Procurement Intelligence for Industrial Pumps: Category Management and Strategic Sourcing

To remain competitive in the industrial pump industry, businesses are improving their procurement procedures by doing detailed spend analysis and monitoring vendor performance. Effective category management and strategic sourcing are critical in lowering procurement costs while maintaining a consistent supply of high-quality, dependable pumps. Businesses may improve their procurement strategy, negotiate better terms with suppliers, and get the most value for their pump solutions by employing actionable market knowledge, resulting in increased operational efficiency and long-term profitability.

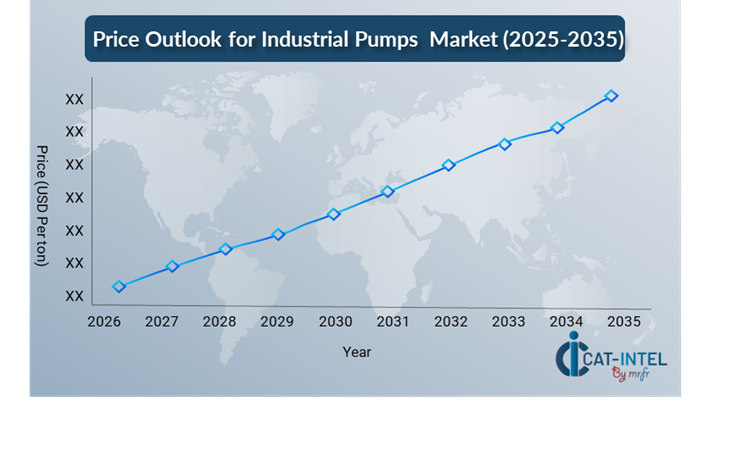

Pricing Outlook for Industrial Pumps: Spend Analysis

The price prognosis for industrial pumps is projected to be moderately volatile, affected by a number of major factors. Price changes are caused by advancements in pump technology, increased demand for energy-efficient and IoT-integrated systems, and customization requirements for specific sector needs. Furthermore, rising global material costs, regional pricing discrepancies, and compliance with environmental standards are all anticipated to drive up the cost of industrial pumps.

Graph shows general upward trend pricing for Industrial Pumps and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve vendor management, and implement modular pump solutions are critical measures for cost control in the industrial pumps sector. Leveraging digital tools for market monitoring, sophisticated analytics-based price forecasting, and implementing efficient contract management procedures can all help to increase cost efficiency.

Partnering with reputable pump suppliers, negotiating long-term contracts, and investigating flexible pricing structures such as pay-per-use or performance-based pricing are all critical tactics for effectively managing industrial pump expenses. Despite these hurdles, focusing on scalability, guaranteeing seamless connection with current systems, and implementing energy-efficient and smart pump technologies will be critical for long-term cost-effectiveness and operational excellence.

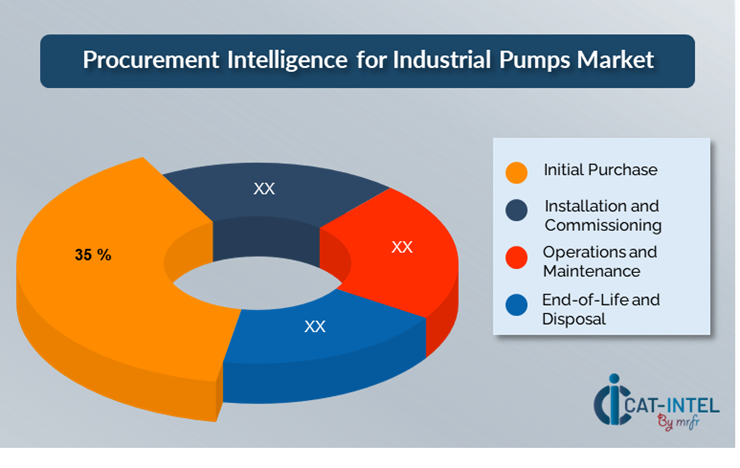

Cost Breakdown for Industrial Pumps: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Initial Purchase: (XX%)

Description: The initial purchase price includes the pump itself, modification, installation, and transportation.

Trend: As enterprises strive for more efficient and durable pumps, there is a greater emphasis on purchasing energy-efficient pumps with longer lifecycles.

Installation and Commissioning: (XX%)

Operations and Maintenance: (XX%)

End-of-Life and Disposal: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the industrial pump business, streamlining procurement processes and using strategic negotiation methods can result in significant cost savings and increased operational performance. Long-term partnerships with reputable pump suppliers, particularly those that provide innovative and energy-efficient solutions, can result in more favourable price structures and terms, such as volume-based discounts and bundled service packages. Additionally, looking into subscription-based pricing structures or performance-based agreements might provide chances to lock in competitive prices and prevent price volatility over time.

Collaboration with pump providers who prioritize innovation, energy efficiency, and scalability provides additional benefits, such as access to smart monitoring systems, predictive maintenance capabilities, and modular pump solutions, all of which contribute to lower long-term operational costs. Implementing digital procurement technologies, such as supplier performance tracking and contract management platforms, enhances transparency, minimizes over-purchasing, and optimizes pump usage across various applications.

Supply and Demand Overview for Industrial Pumps: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The industrial pumps market is also growing steadily, driven by rising demand for effective fluid management solutions in industries such as manufacturing, oil and gas, water treatment, and chemicals. Technological innovation, industry-specific needs, and global economic conditions all have an impact on supply and demand dynamics.

Demand Factors:

Digital Transformation Initiatives: As companies strive for improved operational efficiency, there is a growing demand for modern, automated fluid handling systems that interact with digital solutions for real-time monitoring and maintenance.

Adoption of Energy-Efficient Solutions: As firms strive to reduce operational expenses while also avoiding environmental effect, there is a growing desire for energy-efficient industrial pumps.

Industry-special Requirements: Industries such as pharmaceuticals, food and beverage, and chemicals have special needs, necessitating industrial pumps customized to fulfil regulatory standards and ensure efficient handling of sensitive materials.

Integration Capabilities: There is a growing demand for industrial pumps that can work seamlessly with other business systems, IoT devices, and automated control systems to improve monitoring and operating efficiency.

Supply Factors:

Technological Advancements: Improvements in pump design, materials, and integration with digital technologies such as IoT, AI, and machine learning, which improve the functionality and performance of industrial pumps.

Vendor ecosystem: An increasing number of industrial pump manufacturers, ranging from prominent worldwide giants to niche suppliers offering specialized solutions, present consumers with a diverse range of possibilities.

Global Economic Factors: Changes in raw material costs, labour prices, and regional demand all have an impact on pump pricing and availability.

Scalability and Flexibility: Modern industrial pumps are becoming more modular and adaptable, allowing vendors to provide solutions that cater to enterprises of different sizes and specific operational needs.

Regional Demand-Supply Outlook: Industrial Pumps

The Image shows growing demand for Industrial Pumps in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Industrial Pumps Market

Asia Pacific, particularly the East Asia, is a dominant force in the global Industrial Pumps market due to several key factors:

Industrial Development and Infrastructure: Large-scale industrial developments and urbanization are driving up demand for industrial pumps in areas such as manufacturing, water treatment, oil and gas, and chemicals.

Strong Manufacturing Base: The region's manufacturing sector is growing, especially in areas like automotive, chemicals, food and beverage, and pharmaceuticals, which is driving demand for innovative pump solutions.

Energy and Water Infrastructure Needs: The need for water treatment systems, sewage management, and energy generation is skyrocketing in the region, where fast population growth and urbanization put further strain on energy and water infrastructure.

Cost-Effective and Competitive Manufacturing: The region's established supply chain networks and lower labour costs help to keep industrial pumps competitively priced, making them accessible to a wide range of sectors.

Government Initiatives and Investments: Policies fostering industrial expansion, renewable energy, and water management systems are increasing demand for industrial pumps, reinforcing the region's market leadership.

Asia Pacific Remains a key hub Industrial Pumps Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape in the industrial pumps market is similarly broad and competitive, with prominent global manufacturers and specialist regional providers influencing market dynamics. Leading industrial pump firms dominate the market, offering a wide range of pump solutions, while smaller, specialized manufacturers specialize in tailoring solutions for specific industries or unique requirements, such as energy efficiency, IoT integration, and sophisticated materials.

The industrial pump supplier ecosystem is spread across important regions worldwide, with large companies concentrated in industrial hubs such as North America, Europe, and Asia. These large and small vendors provide creative solutions to fulfil the needs of diverse industries, such as manufacturing, water treatment, and oil and gas. As businesses prioritize sustainability and operational efficiency, industrial pump providers are expanding their products to include cutting-edge technology such as IoT for real-time monitoring, AI for predictive maintenance, and energy-efficient pump designs.

Key Suppliers in the Industrial Pumps Market Include

Nanfang Pump Industry Co., Ltd (CNP)

Grundfos

Sulzer

ITT Inc.

Flowserve Corporation

KSB SE & Co. KGaA

Wilo SE

Xylem Inc.

Pentair

Circor International, Inc.

Key Developments Procurement Category Significant Development:

Key Developments Procurement Category Significant Development:Significant Development |

Description |

Market Growth |

The industrial pumps market is expanding rapidly, fuelled by rising demand for efficient fluid management systems in industries such as manufacturing, water treatment, and energy. |

Cloud Adoption |

The industrial pump market is shifting toward cloud-based pump monitoring and management systems, owing to the demand for remote monitoring, real-time data access, and scalable solutions. |

Product Innovation |

Companies are reducing downtime and increasing operational efficiency by integrating AI-powered analytics for real-time performance monitoring, energy management, and predictive maintenance.

|

Technological Advancements |

Automation and artificial intelligence-driven systems are also enabling more accurate fluid management, decreasing human intervention and increasing total fluid transfer efficiency. |

Global Trade Dynamics |

Changes in global trade legislation and regional economic policies are influencing the use of industrial pumps, notably by multinational corporations with complex supply networks. |

Customization Trends |

Modular pump solutions are gaining appeal because they allow organizations to select exactly the components they require, lowering costs and complexity while improving operating performance and flexibility. |

Industrial Pumps Attribute/Metric |

Details |

Market Sizing |

The global Industrial Pumps market is projected to reach USD 447.49 billion by 2035, growing at a CAGR of approximately 2.88% from 2025 to 2035.

|

Industrial Pumps Technology Adoption Rate |

Approximately 60% of enterprises in industries such as manufacturing, water treatment, and oil and gas have used modern industrial pump systems with digital integration to improve monitoring and efficiency. |

Top Industrial Pumps Industry Strategies for 2025 |

Key initiatives include combining energy-efficient pump solutions, integrating IoT and AI for predictive maintenance, using modular pump designs for flexibility, and using automation to streamline fluid handling processes. |

Industrial Pumps Process Automation |

To increase operating efficiency and reduce downtime, over 50% of industrial pump systems now automate regular operations such as flow rate control, pressure management, and pump health monitoring. |

Industrial Pumps Process Challenges |

Major obstacles include high upfront expenditures for advanced systems, assuring compatibility with existing infrastructure, the necessity for regular maintenance and monitoring, and dealing with pump wear and energy consumption issues. |

Key Suppliers |

Leading industrial pump suppliers include Nanfang Pump Industry Co., Ltd (CNP), Grundfos and Sulzer, providing a diverse range of pumps for a variety of industries, including water treatment and chemical processing.

|

Key Regions Covered |

Asia Pacific, North America and Europe are key regions for industrial pump usage, with major demand in industries such as manufacturing, water treatment, and energy. |

Market Drivers and Trends |

Growth is being driven by the growing demand for energy-efficient solutions, the rise of smart pumps that integrate IoT and AI for predictive analytics, regulatory requirements for sustainability, and the growing demand for process automation and resource optimization in fluid handling.

|