Summary Overview

Industrial Turbines Market Overview

The global industrial turbines market is growing steadily, driven by rising demand in industries such as energy, manufacturing, and utilities. This market includes a diverse range of turbine types, such as gas turbines, steam turbines, and wind turbines. Our paper provides a detailed examination of procurement trends, with an emphasis on cost-cutting techniques and the use of innovative technology to improve procurement and operational procedures.

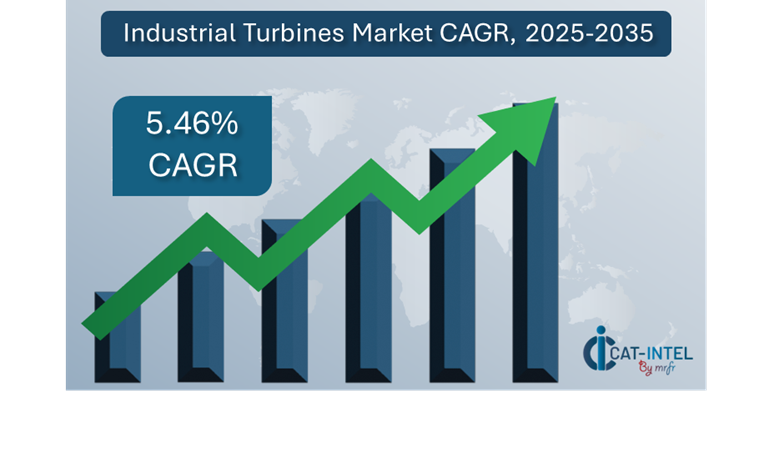

Key future problems in the industrial turbines industry include managing capital expenditures, guaranteeing long-term operational efficiency, meeting sustainability targets, and optimizing maintenance schedules. The use of digital monitoring tools and predictive analytics is critical for optimizing turbine performance and reducing downtime. As the global need for clean energy and efficient power generation grows, companies are increasingly relying on market intelligence to increase productivity, minimize operational risks, and remain competitive in the changing energy economy. Market Size: The global Industrial Turbines market is projected to reach USD 307.6 billion by 2035, growing at a CAGR of approximately 5.46% from 2025 to 2035.

Growth Rate: 5.46%

Growth Rate: 5.46%

Manufacturing and Energy Generation Optimization: Real-time data and seamless process integration are becoming increasingly important in optimizing the performance and efficiency of industrial turbines.

Expansion of the Energy and Utility Sectors: Urbanization and industrialization have increased the demand for dependable power sources, resulting in a higher use of industrial turbines in energy plants

Technological Transformation: Advances in artificial intelligence (AI) and machine learning are improving turbine operations, allowing for predictive maintenance and better energy production predictions.

Innovations: Modern turbines are becoming more modular and adaptable, enabling energy suppliers to pick and integrate only the components that match their individual requirements.

Investment Initiatives: Companies are progressively investing in new turbine technology to extend turbine life, lower operational costs, and increase energy output.

Regional Insights: Asia Pacific and North America remain important regions in the industrial turbines market due to their strong digital infrastructure and growing use of renewable energy sources.

Key Trends and Sustainability Outlook:

Digital Integration: More businesses are implementing digital monitoring systems and cloud-based solutions to increase turbine performance, boost remote accessibility, and cut infrastructure costs.

Advanced Features: The integration of AI, IoT, and blockchain technology improves decision-making, streamlines maintenance operations, and ensures more transparency in energy generation

Focus on Sustainability: Turbines, particularly wind and gas turbines, play an important role in advancing sustainability measures. These systems are intended to improve resource efficiency, reduce emissions, and ensure compliance with environmental regulations.

Customization Trends: Industry-specific turbine solutions are propelling the development of specialized turbines for areas such as renewable energy, manufacturing, and power production.

Data-Driven Insights: Advanced data analytics in turbine operations improves demand forecasting, energy optimization, and predictive maintenance

Growth Drivers:

Energy Transition and Digitalization: The move to renewable energy sources, as well as the use of digital technology in energy production, are increasing demand for innovative and efficient industrial turbines.

Need for Automation in Energy Production: AI and machine learning are being integrated into industrial turbines to automate maintenance activities, improve performance, and eliminate operational disturbances.

Scalability and Adaptability: The growing requirement for scalable energy solutions capable of managing rising energy demands across industries is driving demand for modular and flexible industrial turbines.

Regulatory Compliance: Manufacturers are increasingly depending on advanced turbine systems to automate reporting, improve efficiency, and ensure regulatory compliance.

Globalization and Clean Energy Demand: To meet worldwide energy standards, there is an increasing demand for industrial turbines that support multi-country operations, including multi-currency and multi-language capabilities.

Overview of Market Intelligence Services for the Industrial Turbines Market:

Recent market evaluations have identified significant obstacles in the industrial turbines sector, including as high startup costs, long-term maintenance costs, and the need for tailored solutions to satisfy specific energy requirements. Market intelligence studies offer essential insights into procurement prospects, allowing businesses to develop cost-cutting initiatives, optimise supplier management, and improve the effectiveness of turbine system deployment. These insights also help with compliance with industry standards, assuring high-quality operational performance while successfully managing costs.

Procurement Intelligence for Industrial Turbines: Category Management and Strategic Sourcing

To preserve a competitive advantage in the industrial turbines industry, businesses are streamlining their procurement processes through spend analysis and supplier performance tracking. Effective category management and strategic sourcing are critical in lowering procurement costs while maintaining a consistent supply of advanced turbine systems. Businesses can improve their procurement strategy, negotiate more effectively with turbine manufacturers, and achieve better terms for turbine purchases and maintenance services by employing actionable market intelligence.

Pricing Outlook for Industrial Turbines: Spend Analysis

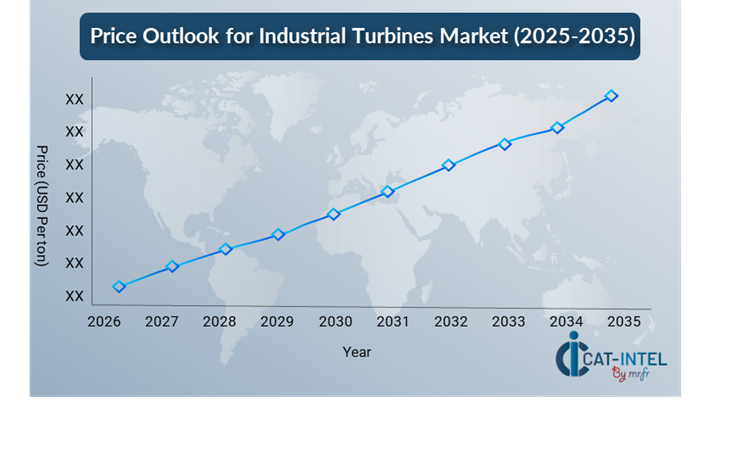

The pricing prognosis for industrial turbines is likely to be moderately dynamic, with probable swings caused by a variety of variables. Technological improvements, rising demand for energy-efficient and sustainable solutions, customisation requirements for specific industrial applications, and regional pricing variances all have a significant impact on turbine pricing.

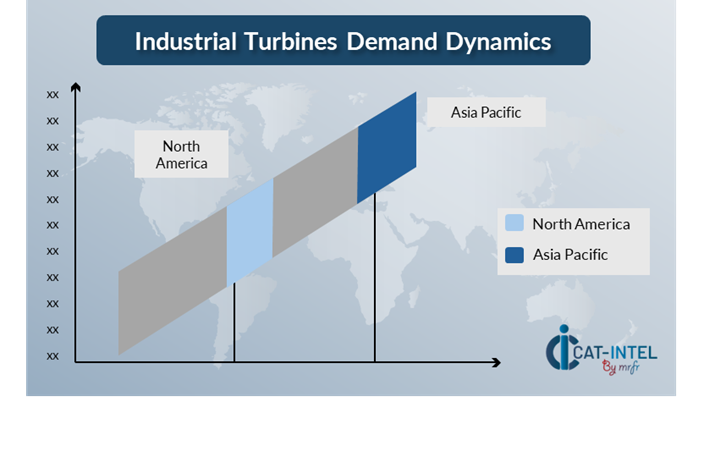

Graph shows general upward trend pricing for Industrial Turbines and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To effectively manage costs, businesses must focus on improving procurement procedures, strengthening supplier relationships, and implementing modular turbine solutions adapted to unique operational requirements. Leveraging digital technologies for market research, predictive pricing analytics, and effective contract administration can help to expedite procurement processes and reduce costs.Partnering with reputable turbine manufacturers, negotiating long-term service agreements, and investigating performance-based pricing models are all effective techniques for managing turbine costs. Businesses can strike a balance between cost-effectiveness and good operational efficiency by focusing on long-term, cloud-based monitoring solutions and maintaining a strong implementation foundation.

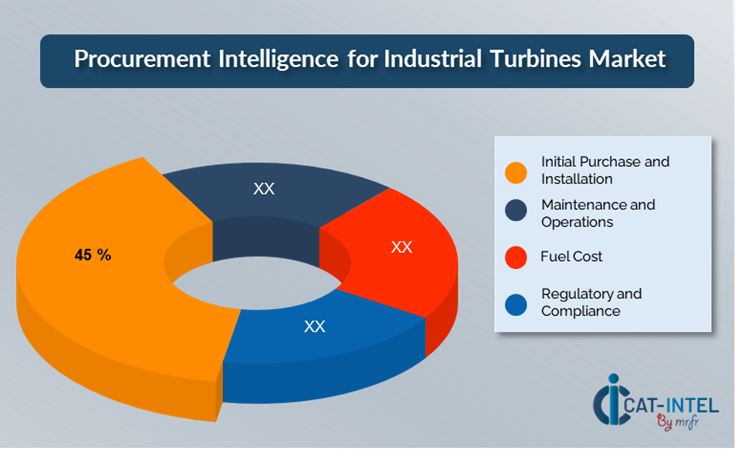

Cost Breakdown for Industrial Turbines: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Initial Purchase and Installation: (45%)

Description: The initial cost of purchasing and installing the turbine, including procurement, transportation, and assembly. It frequently includes the costs of turbine production, equipment, and installation services.

Trend Point: The rise in energy efficiency standards and innovation, particularly for high-performance turbines, is raising the cost of advanced turbines.

Maintenance & Operations: (XX%)

Fuel Cost: (XX%)

Regulatory and Compliance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the industrial turbines industry, managing procurement processes and using strategic negotiation methods are critical for realizing considerable cost savings and enhancing operational efficiency. Long-term collaborations with turbine manufacturers, particularly those that provide sophisticated energy solutions and digital monitoring capabilities, can result in more attractive price structures and terms, such as volume-based discounts and bundled maintenance packages. Subscription-based models and long-term service agreements allow you to secure reduced rates while limiting future price rises over time. Collaborating with turbine providers who value innovation and scalability provides significant benefits. These collaborations provide access to cutting-edge technology such as predictive maintenance, AI-powered performance optimization, and IoT-enabled monitoring systems. These skills can reduce long-term operational costs by boosting turbine efficiency, reducing downtime, and increasing energy output. Implementing digital technologies for procurement, such as predictive analytics platforms and use monitoring systems, allows firms to improve procurement transparency, avoid over-purchasing of turbines, and optimize system utilization.

Supply and Demand Overview for Industrial Turbines: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The industrial turbines market is steadily expanding, driven by rising demand for energy efficiency and sustainable power generating solutions in sectors such as energy, manufacturing, and utilities. Technological improvements, industrial requirements, and global economic situations all have an impact on market dynamics.

Demand Factors:

Sustainability and Energy Efficiency Initiatives: As enterprises work to decrease carbon emissions and improve energy use, demand for industrial turbines, particularly those employed in renewable energy generation, is increasing.

Adoption of Renewable Energy Sources: The global trend toward renewable energy is driving up demand for turbines, notably wind and gas turbines, which are critical for capturing energy from natural resources in a more sustainable manner.

Industry-Specific Requirements: Industries such as manufacturing and power generation require turbines adapted to specific operational needs and energy output requirements, and regulatory standards.

Integration Capabilities: Demand for advanced turbine solutions is increasing due to the growing requirement for turbines that interact smoothly with digital monitoring systems, predictive maintenance tools, and Internet of Things devices.

Supply Factors:

Technological Advancements: Improvements in turbine design, such as materials, aerodynamics, and control systems, are improving turbine performance and increasing supplier competitiveness.

Vendor Ecosystem: With an increasing number of turbine manufacturers, purchasers have a variety of options, ranging from tiny enterprises specializing in renewable energy turbines to bigger, more established providers.

Global Economic Factors: Economic variations can affect the cost of raw materials, transportation, and labour, influencing the entire pricing structure of the worldwide turbine market.

Scalability and Flexibility: Modern industrial turbines are more modular, allowing providers to offer solutions adapted to various corporate sizes, and turbines can scale dependent on the energy demands of the user.

Regional Demand-Supply Outlook: Industrial Turbines

The Image shows growing demand for Industrial Turbines in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Industrial Turbines Market

Asia Pacific, particularly Japan, is a dominant force in the global Industrial Turbines market due to several key factors:

Rapid Industrialization and Urbanization: The region is experiencing major industrialization and urbanization, which is boosting demand for energy and, as a result, industrial turbines for power generation.

Growing Renewable Energy Investments: Countries such as China and India are focusing on increasing their renewable energy capacity, which is driving demand for wind turbines and gas turbines as part of their sustainable energy transition.

Expanding Manufacturing Sector: The rising manufacturing sector requires efficient power generating technologies, resulting in higher adoption of industrial turbines.

Government Policy Incentives: Many governments in the region offer subsidies, tax breaks, and favourable policies to encourage energy infrastructure development, including the use of industrial turbines.

Cost-Effective Production: Local turbine manufacturers in China, Japan, and South Korea can create turbines at competitive rates, increasing regional and global demand.

Asia Pacific Remains a key hub Industrial Turbines Price Drivers Innovation and Growth.

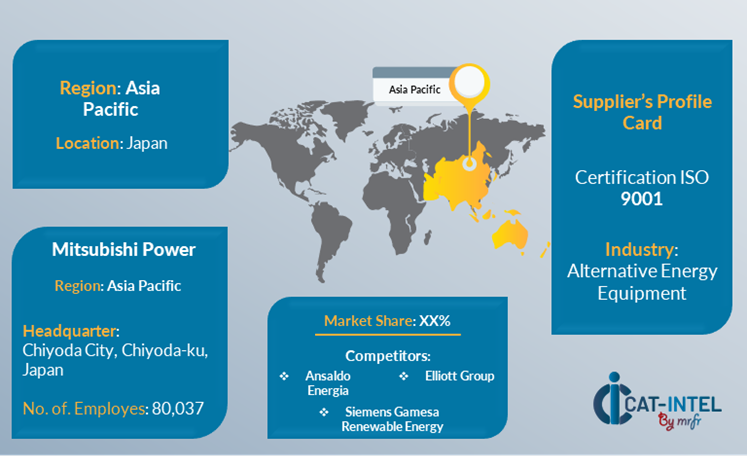

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the industrial turbines market is broad and highly competitive, with an assortment of global market giants and regional players. These vendors have a significant impact on aspects like as pricing, turbine customisation, and service quality. While large, well-known turbine manufacturers dominate the market with comprehensive solutions, smaller, niche players are carving out their own area by focusing on specific energy sectors or offering unique features like as superior efficiency technologies and sophisticated monitoring systems.

Regional dynamics additionally shape the supplier landscape. In North America and Asia, there is a strong push toward renewable energy sources, which is increasing demand for wind turbines and gas turbines for hybrid energy systems. In this changing industry, organizations looking for industrial turbines must explore a variety of supplier options, including large-scale providers with established reputations and boutique manufacturers offering specific characteristics. Companies that work with the proper providers may ensure that their energy demands are met while also enhancing performance, cost-efficiency, and sustainability.

Key Suppliers in the Industrial Turbines Market Include:

Mitsubishi Power

Siemens Energy

General Electric (GE)

Ansaldo Energia

Alstom

Doosan Heavy Industries & Construction

Senvion

Suzlon Energy

Nordex SE

-

Siemens Gamesa

Key Developments Procurement Category Significant Development:

Significant Development

Description

Market Growth

The move to renewable energy sources, such as wind and solar power, is driving up the demand for wind turbines and other energy-efficient turbine technology.

Cloud Adoption

As industries modernize, there is an increasing tendency of integrating digital technologies into turbine systems. These technologies are critical for increasing operational efficiency, decreasing downtime, and optimizing turbine performance.

Product Innovation

Turbine materials, aerodynamics, and turbine design advancements improve energy efficiency, lower costs, and promote the move to renewable energy sources.

Technological Advancements

AI-powered analytics and predictive maintenance technologies improve turbine performance by detecting faults before they cause failures, lowering maintenance costs, and extending turbine lifespans.

Global Trade Dynamics

Multinational corporations with complex supply chains are increasingly investing in turbines that support sustainability while also meeting regulatory requirements in various locations, resulting in turbines that fulfil diverse environmental standards and performance criteria around the world.

Customization Trends

Industrial turbines are becoming more modular, allowing businesses to choose certain features and capabilities according on their individual energy needs and operating requirements, resulting in increased flexibility and scalability.

Industrial Turbines Attribute/Metric

Details

Market Sizing

The global Industrial Turbines market is projected to reach USD 307.6 billion by 2035, growing at a CAGR of approximately 5.46% from 2025 to 2035.

Industrial Turbines Technology Adoption Rate

Approximately 70% of power plants and energy-intensive sectors use advanced turbine systems, with a rising emphasis on renewable energy applications like wind and gas turbines.

Top Industrial Turbines Industry Strategies for 2025

Key strategies in the industrial turbines market include using AI and machine learning for predictive maintenance, developing energy-efficient turbines, growing the usage of digital monitoring and IoT systems, and improving turbine adaptability for a variety of energy sources.

Industrial Turbines Process Automation

To boost efficiency and reduce downtime, over 60% of turbine systems in energy plants automate regular functions such as performance monitoring, diagnostics, and maintenance scheduling.

Industrial Turbines Process Challenges

Major constraints include costly capital investment for advanced turbines, lengthy installation and testing periods, integration with existing infrastructure, and the necessity for constant maintenance to achieve peak performance.

Key Suppliers

Leading industrial turbine manufacturers include Mitsubishi Power, Siemens Energy and General Electric (GE), offering turbines for power generation, renewable energy, and industrial uses.

Key Regions Covered

Asia Pacific, North America and Europe are key locations for turbine adoption, with rising demand in renewable energy projects, power generating, and industrial sectors.

Market Drivers and Trends

Growth factors include rising demand for renewable energy, technological breakthroughs in turbine design, a focus on sustainability and energy efficiency, and the incorporation of digital monitoring technology and predictive analytics to optimize turbine performance.