Summary Overview

IT Break-Fix Services Market Overview

The global IT Break-Fix Services market is steadily expanding, fuelled by rising demand in businesses such as manufacturing, retail, healthcare, and logistics. This sector provides a diverse range of services, such as hardware repair, system troubleshooting, software patches, and network assistance. Our paper provides an in-depth analysis of upcoming IT break-fix trends, with an emphasis on cost optimization tactics, effective service delivery models, and the use of new digital tools to simplify operational operations.

Key issues in the IT Break-Fix Services industry include controlling service costs, providing quick response times, maintaining good service quality, and adjusting to quickly changing technology landscapes. Digital solutions and preventive service management are critical to increasing service efficiency, assuring customer pleasure, and maintaining long-term competitiveness. As the global need for dependable IT infrastructure develops, businesses are using data analytics and market intelligence to optimize service operations, reduce downtime, and limit potential hazards.

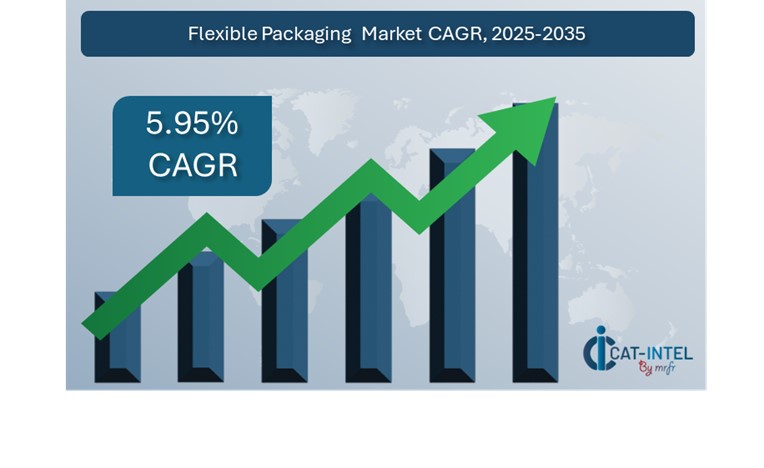

Market Size: The global IT Break-Fix Services market is projected to reach USD 3200 billion by 2035, growing at a CAGR of approximately 7.2% from 2025 to 2035.

-

Sector Contributions: Growth in the market is driven by: -

Manufacturing and Supply Chain Optimization: Real-time diagnostics and seamless integration of IT infrastructure are becoming increasingly important in order to improve operations and reduce downtime.

-

Retail and E-Commerce Expansion: Businesses in the retail and e-commerce sectors are increasingly relying on IT break-fix services to keep operations running smoothly, particularly when dealing with high transaction volumes.

-

Technological Advancements: AI, machine learning, and predictive analytics are driving the growth of IT break-fix services, allowing for faster issue detection and proactive solutions before system breakdowns occur.

-

Innovations: IT service providers increasingly provide modular solutions that allow enterprises to select certain services they need, reducing both costs and service complexity.

-

Investment Initiatives: Businesses are investing in remote support services that provide efficient, cloud-based solutions for quick troubleshooting and problem resolution.

-

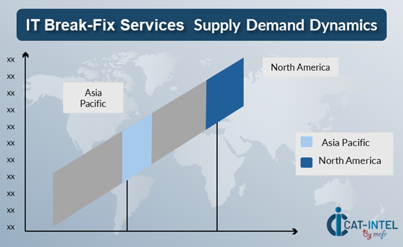

Regional Insights: North America and Asia Pacific continue to be significant contributors to the IT break-fix services market, owing to their strong digital infrastructure and quick adoption of innovative IT service models.

Key Trends and Sustainability Outlook:

-

Cloud Integration: As organizations embrace remote work and digital operations, there is a strong drive for cloud-based IT services, which provide rapid response times, scalability, and cost-efficiency.

-

Advanced Capabilities: Integrating AI, IoT, and blockchain technologies into IT support services improves diagnostic automation and system transparency.

-

Sustainability Goals: As ecological responsibility becomes a concern, IT break-fix services focus on lowering the environmental Impact by increasing energy conservation and extending the life of IT devices.

-

Customization Demand: From healthcare to manufacturing, businesses are looking for specialized IT services that are adapted to their individual operating requirements, ensuring that downtime is avoided, and system reliability is maximized.

-

Data-Driven Insights: With increasingly advanced analytics tools, firms can watch system performance, predict future breakdowns, and make informed choices about IT infrastructure administration.

Growth Drivers:

-

Digital Transformation: The rapid use of digital technologies across businesses is boosting the demand for dependable IT break-fix services, as businesses strive to maintain maximum IT performance.

-

Demand for Automation: As businesses seek to automate routine tasks, there is a growing demand for break-fix services to guarantee that systems and devices stay fully operational, preventing disruptions to automated processes.

-

Scalability Requirements: Businesses require IT services that can scale with them, ensuring that their infrastructure stays strong, and issues are fixed rapidly even as the company grows.

-

Compliance Needs: IT break-fix services are becoming increasingly important in helping businesses achieve compliance standards by maintaining the security and correctness of their data and systems.

-

Globalization: As companies expand globally, they need IT services that enable multi-region operations, ensuring that systems work seamlessly across numerous currencies, languages, and regulatory landscapes.

Overview of Market Intelligence Services for the IT Break-Fix Services Market:

Recent evaluations have highlighted critical concerns such as excessive service costs and the necessity for customized IT support solutions. Market intelligence studies provide practical insights into procurement prospects, helping firms identify cost-cutting measures, optimize relationships with suppliers, and improve service delivery performance. These insights also help to maintain compliance with industry standards and high-quality operational processes while successfully controlling costs.

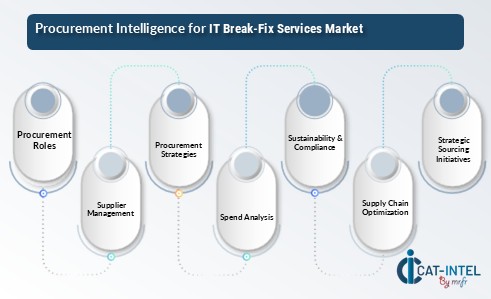

Procurement Intelligence for IT Break-Fix Services: Category Management and Strategic Sourcing

To remain competitive in the IT break-fix services industry, firms are fine-tuning procurement processes through spend monitoring and vendor performance tracking. Effective category management and strategic sourcing are critical for lowering service costs and providing continuous access to dependable IT assistance. By employing actionable market intelligence, organizations can improve their procurement strategies, negotiate better terms with service providers, and get the best IT support solutions to fit their needs.

Pricing Outlook for IT Break-Fix Services: Spend Analysis

The pricing prognosis for IT break-fix services is projected to be moderately dynamic, impacted by several factors. Key factors include technological improvements, demand for remote assistance and cloud-based solutions, customized requirements, and regional pricing disparities. Furthermore, the growing reliance on AI and IoT for proactive diagnostics, along with a heightened emphasis on data security and compliance, is driving up service prices.

Graph shows general upward trend pricing for IT Break-Fix Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to optimize procurement procedures, improve vendor management, and implement flexible, modular service solutions are critical for managing costs in IT break-fix services. Leveraging digital technologies for market monitoring, using analytics to forecast prices, and enhancing contract management techniques can all help to streamline operations and reduce costs

Building good partnerships with reputable IT service providers provides consistent service quality and reliability. Long-term contracts involving service providers might result in better pricing and prioritized assistance. Exploring a subscription service pricing models, such as managed IT services, can provide cost predictability while maintaining access to necessary support when needed.

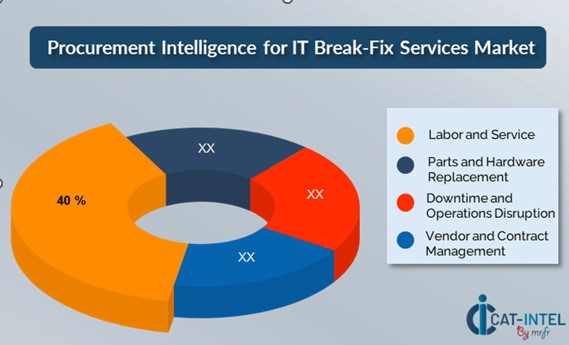

Cost Breakdown for IT Break-Fix Services: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Labor and Service: (40%)

-

Description: Labor and service expenses cover professional technicians, engineers, and support workers who provide break-fix services like diagnostics, repairs, and hardware replacements.

-

Trend: Automation techniques such as remote diagnostics are increasingly being used to cut labour expenses and enhance response times, allowing firms to save on technician charges.

- Parts and Hardware Replacement: (XX%)

- Downtime and Operations Disruption: (XX%)

- Vendor and Contract Management: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the IT break-fix services market, streamlining procurement processes and using strategic bargaining strategies can result in significant cost savings and increased operational efficiency. Long-term agreements with service providers, particularly those that provide remote and cloud-based support solutions, can assist achieve better pricing structures and terms, such as volume discounts and bundled service packages. Developing long-term connections with reputable IT service providers ensures priority assistance and competitive pricing. Service agreements that last several years can lock in rates and prevent unexpected expense increases.

Collaborating with providers who prioritize technical innovation, such as AI integration, IoT for predictive diagnoses, and modular service offerings, can save long-term operational costs and improve system performance. Adopting a multi-vendor approach helps lessen reliance on a single supplier, lowering the risk of service disruptions or a lack of support. It also increases negotiating leverage by having other options, allowing for more advantageous conditions during contract negotiations.

Supply and Demand Overview for IT Break-Fix Services: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The IT break-fix services industry is steadily expanding, fuelled by increased digital transformation in industries such as manufacturing, retail, and healthcare. The supply and demand dynamics of this market are influenced by technical breakthroughs, industry-specific needs, and global economic variables.

Demand Factors:

-

Digital Transformation: The requirement to maintain a flawless IT infrastructure and minimize system downtime drives the demand for quick, efficient break-fix services.

-

Cloud Adoption Trends: Businesses require services to assure the stability and functionality of their cloud-based infrastructure, typically on a subscription model for cost predictability.

-

Industry-Specific Requirements: Sectors such as healthcare and manufacturing require IT break-fix services that are tailored to their specific demands, assuring regulatory compliance and ongoing key operations.

-

Integration Capabilities: As businesses install sophisticated software and hardware solutions, there is an increasing demand for IT services that work smoothly with additional company systems and IoT devices.

Supply Factors:

-

Technological Advancements: Advances in AI, machine learning, and predictive analytics are improving the capabilities of IT break-fix services, allowing for proactive issue detection and speedier resolution.

-

Vendor Ecosystem: With an increasing number of IT service providers, including niche specialists and large-scale vendors, firms looking for break-fix services have a variety of possibilities.

-

Global Economic Factors: Exchange rates, labour costs, and provincial technology adoption rates determine the availability and pricing of IT services.

-

Scalability and Flexibility: Modern IT break-fix service providers are increasingly offering systems that can be tailored to the needs of organizations of various kinds, ranging from small startups to huge corporations.

Regional Demand-Supply Outlook: IT Break-Fix Services

The Image shows growing demand for IT Break-Fix Services in both North America and Asia Pacific, with potential price increases and increased Competition.

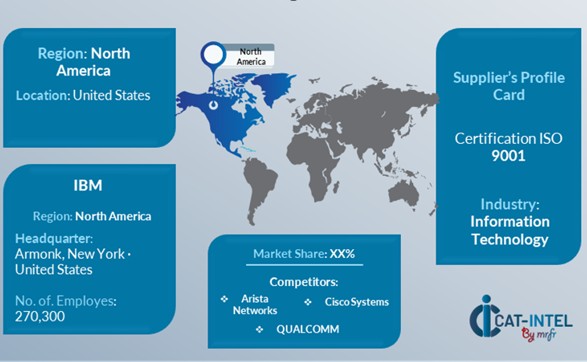

North America: Dominance in the IT Break-Fix Services Market

North America, particularly the United States, is a dominant force in the global IT Break-Fix Services market due to several key factors:

-

Advanced Technological Infrastructure: North America has a highly advanced and sophisticated technology infrastructure, with widespread use of complex IT systems across industries.

-

High Enterprises Concentration: The region is home to several significant corporations, government institutions, and data centres, all of which require regular maintenance and timely IT help.

-

Major IT Service Providers: Leading IT service companies like IBM, Dell, Cisco, and HP have a strong presence in North America, with established networks for providing break-fix support.

-

Hybrid Work Models: The COVID-19 epidemic has hastened the trend to hybrid and remote work paradigms, growing reliance on IT infrastructure.

-

Emphasis on Innovation: Businesses in areas such as banking, healthcare, and technology cannot afford operational delays, making the region a primary driver of IT support services.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the IT break-fix services market is both diversified and competitive, with a mix of global and regional service providers affecting the industry. These vendors influence key elements such as pricing models, service levels, and technical support quality. Established IT service businesses dominate the market, providing complete support solutions, while smaller, specialist suppliers focus on specific sector needs such as managed services, cloud support, or sophisticated diagnostics employing artificial intelligence.

As businesses strive to prioritize operational efficiency and avoid downtime, IT break-fix service providers are expanding their capabilities in cloud computing, predictive maintenance, and AI-powered diagnostics. Providers in various countries adapt to local business demands, with those in growing markets offering low pricing and bespoke solutions that address the unique IT issues of local businesses. Global suppliers, on the other hand, use their extensive knowledge and resources to help international corporations.

Key Suppliers in the IT Break-Fix Services Market Include:

- IBM

- HPE

- Dell Technologies

- Cisco Systems

- Accenture

- Wipro

- Tata Consultancy Services

- Fujitsu

- Lenovo

- Unisys

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

As organizations become more reliant on digital infrastructure, particularly in emerging economies, the demand for quick and effective IT support services to deal with system failures, maintenance needs, and troubleshooting develops. |

Cloud Adoption |

With the advent of workarounds and the decentralization of IT infrastructure, organizations are increasingly turning to cloud-based solutions for IT break-fix services to provide quick response times and flexibility in managing their support requirements. |

Product Innovation |

IT service providers are expanding their range of services to include sophisticated features such as AI-powered diagnostics, statistical analysis, and real-time issue resolution, which allow for faster problem detection and more efficient troubleshooting, reducing downtime and improving productivity for businesses. |

Technological Advancements |

Machine learning, IoT integration, and robotic process automation (RPA) are among the technological breakthroughs that are improving IT break-fix capabilities. The use of IoT devices enables proactive monitoring of systems, eliminating the requirement for emergency break-fix interventions. |

Global Trade Dynamics |

Companies that manage complex IT infrastructures and cross-border supply chains demand support services that are compliant with local rules and adaptable to changing economic situations.

|

Customization Trends |

Companies are increasingly choosing services that work seamlessly with their existing systems, third-party tools, and specialist software. This trend is increasing demand for flexible, scalable service models that offer bespoke solutions to specific company needs. |

|

IT Break-Fix Services Attribute/Metric |

Details |

Market Sizing |

The global IT Break-Fix Services market is projected to reach USD 3200 billion by 2035, growing at a CAGR of approximately 7.2% from 2025 to 2035. |

IT Break-Fix Services Technology Adoption Rate |

Approximately 60% of firms globally use some type of IT break-fix services, with an increasing preference for cloud-based support solutions. |

Top IT Break-Fix Services Industry Strategies for 2025 |

Businesses are increasingly embracing mobile-friendly IT support systems that provide remote access to break-fix services, resulting in faster problem resolution and greater flexibility for remote or hybrid work environments. |

IT Break-Fix Services Process Automation |

Routine support operations including system monitoring, diagnostics, and troubleshooting are automated in around 50% of IT break-fix service systems. |

IT Break-Fix Services Process Challenges |

Integration Issues: Businesses frequently struggle to integrate break-fix services into current IT systems, especially if they have complicated or outdated infrastructures. |

Key Suppliers |

Leading IT break-fix service providers include worldwide technology businesses like IBM, HP Enterprise, and Cisco Systems, which provide comprehensive solutions across industries. |

Key Regions Covered |

North America, Europe, and Asia-Pacific are popular regions for IT break-fix service adoption, with strong demand in industries that include manufacturing, retail, and healthcare. |

Market Drivers and Trends |

The rise of cloud computing and hybrid work styles has heightened the demand for remote IT support services, allowing organizations to maintain and incorporate AI and IoT. IT break-fix services are increasingly employing these technologies to better diagnostics and automate troubleshooting and improve system efficiency. |