Summary Overview

IT Managed Security Services Market Overview

The global IT Managed Security Services (MSS) market is expanding rapidly, driven by increased demand for improved cybersecurity in a variety of industries, including healthcare, banking, retail, and government. This market covers a variety of security services, including network security, endpoint protection, cloud security, and managed detection and response (MDR). Our paper provides a detailed examination of procurement trends, with an emphasis on cost-effective tactics and the use of innovative digital tools to improve security postures and expedite processes.

Future IT security management problems include limiting implementation costs, assuring scalability to address increasing threats, protecting data privacy, and integrating MSS with current IT infrastructures. Using cutting-edge digital security tools and implementing strategic cybersecurity frameworks is critical for enhancing security service acceptance and assuring sustained resilience. As global demand for cybersecurity solutions grows, enterprises are implementing sophisticated threat intelligence and proactive security measures to improve operational efficiency, decrease vulnerabilities, and efficiently manage risks.

-

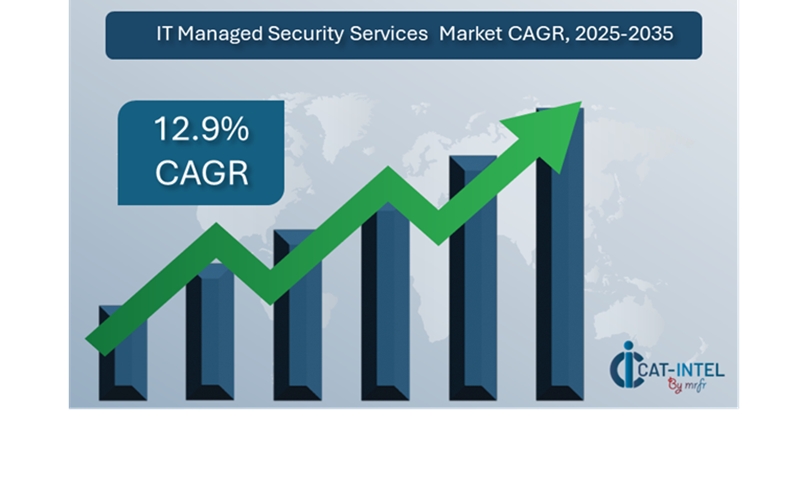

Market Size The global IT Managed Security Services market is projected to reach USD 102.74 billion by 2032, growing at a CAGR of approximately 12.9% from 2024 to 2032.

Growth Rate 12.9%

-

Sector Contributions Growth in the market is driven by -

Manufacturing and Supply Chain Optimization There is an increased requirement for real-time safety surveillance and incident management to protect key infrastructure and assure supply chain continuity.

-

Retail and E-Commerce Growth There is a growing demand for sophisticated cybersecurity solutions to protect online transactions, customer data, and e-commerce sites.

-

Technological Transformation AI and machine learning advancements increase IT managed security services by providing automated threat detection, predictive analytics, and real-time threat information.

-

Innovations Modular security service options enable businesses to select and integrate only the security services they require, lowering complexity and costs.

-

Investment Initiatives Businesses are heavily investing in cloud-based security services to safeguard distributed systems, lower infrastructure costs, and secure remote staff security.

-

Regional Insights North America and Asia Pacific are key market contributors, driven by high demand for cybersecurity and digital infrastructure expansion.

Key Trends and Sustainability Outlook

-

Cloud Integration The market is being driven by the growing usage of cloud-managed security services for improved scalability, cost effectiveness, and real-time data access.

-

Advanced Features Integrating AI, IoT, and blockchain into security services improves decision-making, threat technology, and transparency when dealing with security concerns.

-

Focus on Sustainability Managed security services assist firms in meeting sustainability objectives through optimal resource management and effective risk mitigation measures.

-

Customization Trends Growing need for sector-specific cybersecurity solutions customized for businesses such as healthcare, finance, and manufacturing to satisfy their specific security demands.

-

Data-driven Insights Using advanced analytics in security services enables firms to track security metrics, improve threat detection, and optimize protection measures.

Growth Drivers

-

Digital Transformation As enterprises increasingly adopt digital technologies, there is a greater demand for effective, scalable cybersecurity solutions.

-

Demand for Process Automation Businesses are increasingly relying on managed security services to automate attack response, eliminate operational risks, and assure seamless business continuity.

-

Scalability Requirements Businesses want security solutions that can scale with their expanding operations, providing flexible and seamless protection across environments.

-

Regulatory Compliance As global cybersecurity rules become more stringent, enterprises are increasingly turning to managed security services to assure compliance and data accuracy in reporting.

-

Globalization As organizations develop worldwide, there is a greater demand for security services that address multi-regional, multi-compliance, and multi-lingual requirements for full cross-border protection.

Overview of Market Intelligence Services for the IT Managed Security Services Market

Recent evaluations have highlighted significant hurdles in the IT Managed Security Services (MSS) sector, including high implementation costs, the requirement for system modification, and the complexity of integrating modern security solutions. Market intelligence studies give actionable information to assist businesses address these obstacles by identifying cost-cutting options, optimizing vendor relationships, and improving implementation success. These insights also help firms ensure compliance with cybersecurity rules and industry standards, as well as maintain high-quality security measures and manage costs effectively.

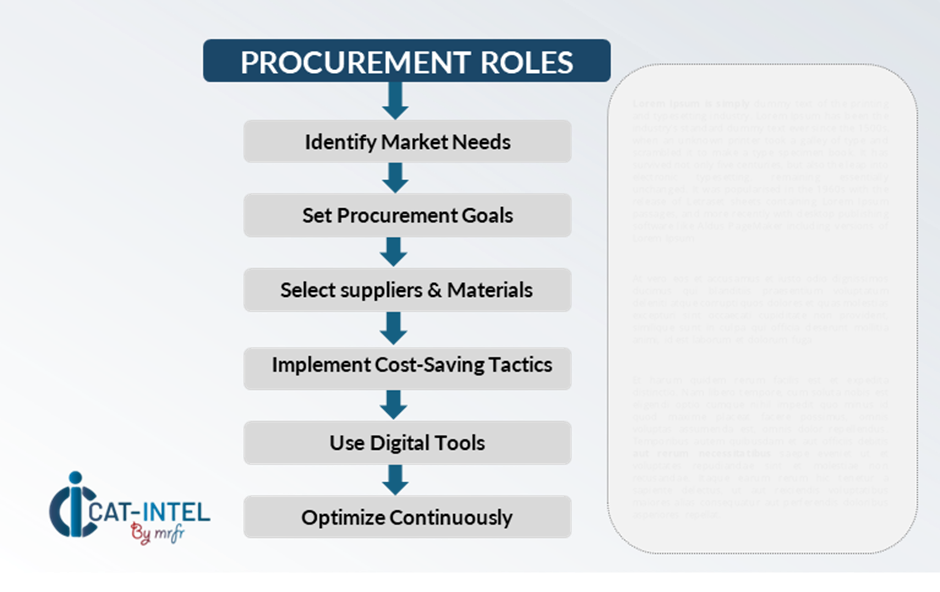

Procurement Intelligence for IT Managed Security Services Category Management and Strategic Sourcing

To stay competitive in the continuously changing MSS market, businesses are optimizing procurement methods through spend monitoring and vendor performance tracking. Effective category management and strategic sourcing are critical for minimizing procurement costs while maintaining access to high-quality, dependable security solutions. Businesses that use actionable market knowledge can improve their procurement strategy, negotiate better security service terms, and secure comprehensive, specialized protection that matches their specific operating demands.

Pricing Outlook for IT Managed Security Services Spend Analysis

The price landscape for IT Managed Security Services (MSS) is projected to remain moderately volatile, affected by several critical factors. These changes are driven by advancements in security technology, increased demand for cloud-based solutions, customization requirements, and regional pricing discrepancies. Furthermore, the growing usage of AI, machine learning, and IoT connectivity, combined with a greater emphasis on data protection and compliance, is driving up MSS pricing pressure.

Graph shows general upward trend pricing for IT Managed Security Services and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To effectively manage costs, firms must streamline their procurement procedures, improve vendor management, and investigate modular security solutions that allow for a customized strategy. Leveraging digital technologies for market surveillance, utilizing forecasting of prices analytics, and streamlining contract administration can all help to increase cost efficiency.

Partnering with reputable MSS providers to provide dependable and cost-effective solutions, and negotiating multi-year contracts to secure advantageous terms and minimize escalating service prices. Despite these hurdles, prioritizing scalability, guaranteeing robust implementation, and implementing cloud-based security platforms will be critical for preserving cost-effectiveness while providing top-tier protection and superior operation.

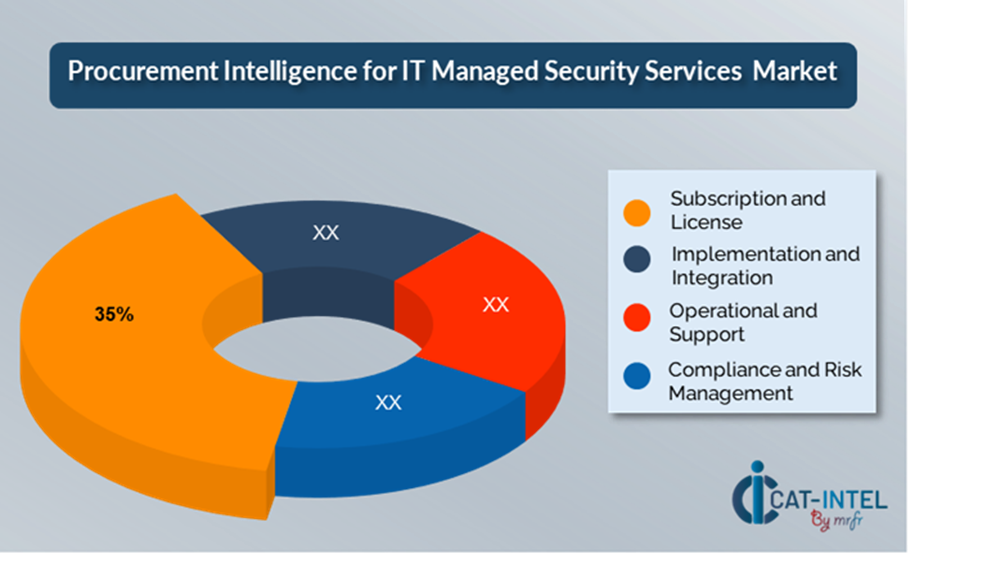

Cost Breakdown for IT Managed Security Services Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Subscription and License (35%)

-

Description IT Managed Security Services typically incur subscription or licensing fees, which vary based on user count, endpoints, and security complexity.

-

Trend Points More businesses are adopting subscription-based pricing models, which allow for fewer unpredictable and scalable expenses than traditional license fees.

- Implementation and Integration (XX%)

- Operational and Support (XX%)

- Compliance and Risk Management (XX%)

Cost-Saving Opportunities Negotiation Levers and Purchasing Negotiation Strategies

In the IT Managed Security Services (MSS) market, streamlining procurement processes and using strategic negotiation strategies can result in significant cost savings and improved security operations. Long-term partnerships with MSS providers, particularly those offering cloud-based or hybrid solutions, can lead to more attractive pricing arrangements, such as volume discounts and bundled service packages. By committing to subscription-based models and multi-year contracts, businesses can obtain reduced rates and mitigate the impact of pricing volatility over time.

Collaborating with suppliers who deliver scalable cloud security solutions that use sophisticated technologies such as AI and machine learning results in further cost savings. These advances can save long-term operational costs by enhancing threat detection, response time, and overall security efficiency. A multi-vendor approach may minimize reliance on a single provider, alleviate risks like service disruptions, and increase negotiation leverage. This technique provides increased flexibility, assisting firms to retain robust security across various contexts and lessen potential vulnerabilities.

Supply and Demand Overview for IT Managed Security Services Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The IT Managed Security Services (MSS) market is steadily expanding, driven by the growing demand for stronger cybersecurity measures in industries such as healthcare, banking, retail, and government. Advanced security technologies, industry-specific requirements, and global economic conditions all have an impact on market dynamics.

Demand Factors

-

Cybersecurity and Digital Transformation Initiatives require comprehensive security solutions with centralized threat management, automated responses, and real-time monitoring for digital infrastructures.

-

Cloud Security Trends The growing popularity of cloud computing has resulted in a higher demand for cloud-based security services, owing to the need for scalable, cost-effective, and adaptable security solutions.

-

Industry-Specific Security Healthcare and finance have unique regulatory and security needs that ensure compliance with standards such as HIPAA, PCI DSS, and GDPR.

-

Integration Capabilities As businesses adopt more diversified technologies, the demand for security solutions that smoothly interact with other business systems grows.

Supply Factors

-

Technological Advancements Innovations in AI, machine learning, and big data analytics are improving the capabilities of MSS providers, enabling for predictive threat detection, automated response, and proactive threat intelligence

-

Vendor Ecosystem With an expanding number of MSS providers, ranging from specialized niche players to large-scale providers, enterprises have a choice of options to select from.

-

Global Economic Factors Exchange rates, labour costs, and regional digital technology adoption rates all have an impact on the pricing and availability of managed security services.

-

Scalability and Flexibility MSS providers are increasingly providing scalable and adaptable solutions to enterprises of all sizes and complexities.

Regional Demand-Supply Outlook IT Managed Security Services

The Image shows growing demand for IT Managed Security Services in both North America and Asia Pacific, with potential price increases and increased Competition.

North America Dominance in the IT Managed Security Services Market

North America, particularly the United States, is a dominant force in the global IT Managed Security Services market due to several key factors

-

High Cybersecurity Threats Regulatory obligations, including as GDPR, HIPAA, and different industry-specific compliance standards, contribute to the demand for managed security services.

-

Number of Enterprises With a varied range of industries including banking, healthcare, and retail, North American firms are early adopters of MSS to protect sensitive data and secure their networks.

-

Adoption of Cloud-Based Solutions Because of their scalability, flexibility, and cost-effectiveness, cloud-based protection services, such as security-as-a-service and hybrid security remedies, are popular.

-

Skilled Workforce The United States and Canada have premier cybersecurity corporations and research organizations that are pushing improvements in security technology.

-

Advanced Technological Infrastructure North America has a highly sophisticated digital infrastructure, including ubiquitous internet connectivity, advanced cloud computing, and reliable data centres.

North America Remains a key hub IT Managed Security Services Price Drivers Innovation and Growth.

Supplier Landscape Supplier Negotiations and Strategies

The supplier environment in the IT Managed Security Services (MSS) market is diversified and highly competitive, with a mix of global industry stalwarts and regional players. These vendors have a substantial influence on crucial elements such as pricing models, service quality, and security solution customization. The market is dominated by well-known cybersecurity organizations that provide comprehensive managed security services, while smaller, niche players focus on specific sector demands or specialized features like AI-powered threat detection, advanced threat intelligence, and IoT security.

Major global MSS suppliers provide comprehensive security solutions, such as managed detection and response (MDR), network security, endpoint protection, and incident management. These vendors typically have a vast global reach, solid security infrastructure, and a high reputation for dependability, providing enterprises with complete, integrated solutions. As businesses of all sizes adopt managed security services, MSS providers are offering flexible pricing models, including subscription-based services, pay-as-you-go options, and modular security packages. These models provide organizations with greater financial flexibility and the ability to customize services based on their unique needs and budgets.

Key Suppliers in the IT Managed Security Services Market Include

- Cisco Systems

- IBM Security

- Palo Alto Networks

- AT&T Cybersecurity

- Fortinet

- Check Point Software Technologies

- Trend Micro

- SecureWorks (A Dell Technologies Company)

- Symantec (Broadcom)

- CrowdStrike

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

Organizations across industries are using MSS to streamline security operations, enhance threat detection and response times, and protect vital data, especially in emerging economies where digital transformation is rapid. |

Cloud Adoption |

MSS providers are expanding their capabilities to include AI-powered threat detection, real-time analytics, and industry-specific security modules. These solutions help firms keep ahead of growing dangers by providing personalized protection for industries such as healthcare, banking, and manufacturing. |

Product Innovation |

Machine learning, IoT integration, and robotic process automation (RPA) are all examples of innovations that are improving MSS capabilities. These developments give predicted threat knowledge and enable proactive responses. |

Technological Advancements |

The shift to cloud-based security solutions is gaining traction as a result of the growing demand for scalability, cost-efficiency, and remote accessibility, which is in line with the emergence of hybrid work patterns and distributed networks. |

Global Trade Dynamics |

As global trade regulations, compliance standards, and regional economic policies evolve, businesses operating in multiple regions are increasingly adopting MSS to manage complex security needs; however, ensuring consistent security across borders and compliance with varying regulations remains a significant challenge. |

Customization Trends |

Businesses are increasingly searching for flexible, customizable managed security services that adapt to their changing digital landscapes, whether that means integrating with third-party solutions or meeting unique security standards. |

|

IT Managed Security Services Attribute/Metric |

Details |

Market Sizing |

The global IT Managed Security Services market is projected to reach USD 102.74 billion by 2035, growing at a CAGR of approximately 12.9% from 2025 to 2035.

|

IT Managed Security Services Technology Adoption Rate |

Approximately 60% of firms globally use managed security services, with a clear shift toward cloud-based security solutions to improve scalability, save infrastructure costs, and support remote work patterns. |

Top IT Managed Security Services Industry Strategies for 2025 |

MSS providers key initiatives in 2025 include incorporating AI and machine learning for real-time threat detection, offering flexible and scalable security solutions to match the specific needs of businesses, enhancing data privacy measures. |

IT Managed Security Services Process Automation |

Approximately 50% of MSS installations automate normal security procedures such as vulnerability scanning, incident response, and compliance reporting. |

IT Managed Security Services Process Challenges |

Major problems in the MSS industry include managing high deployment and service costs, integrating security systems with legacy infrastructure, a scarcity of trained cybersecurity personnel, and maintaining continuous system updates and monitoring.

|

Key Suppliers |

Leading MSS providers, like, Cisco Systems, IBM Security and Palo Alto Networks, provide complete cybersecurity services across many industries. |

Key Regions Covered |

North America, Europe, and Asia-Pacific are among the most popular MSS adoption regions. Finance, healthcare, and retail are high-demand industries because to the high need for data protection. |

Market Drivers and Trends |

The MSS market is being driven by the rising sophistication of cyberattacks, the growing demand for data protection and compliance, the growing adoption of cloud technologies, and the growing reliance on AI and automation to improve threat detection and incident response.

|