Summary Overview

Lithium Market Overview:

The global lithium market is expanding rapidly, driven by rising demand in major industries such as electric vehicles (EVs), energy storage, consumer electronics, and industrial production. This market encompasses several types of lithium manufacturing and processing, such as lithium carbonate, lithium hydroxide, and lithium-ion battery-grade materials. Our paper provides a thorough examination of sourcing trends, with a particular emphasis on cost-effectiveness, risk reduction, and digital innovation in lithium supply chains.

Stakeholders address key issues, including unpredictable raw material pricing, supply chain interruptions, extraction process scalability, environmental concerns, and assuring sustainable sourcing procedures. Strategic sourcing, innovation in mining and refining processes, and increased supply chain transparency are critical to maintaining long-term competitiveness in a continuously changing market.

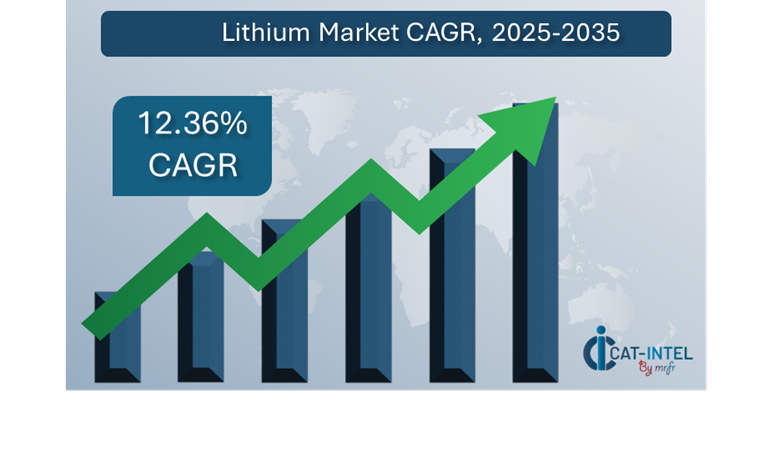

Market Size: The global Lithium market is projected to reach USD 40 billion by 2035, growing at a CAGR of approximately 12.36% from 2025 to 2035.

Growth Rate: 12.36%

-

Sector Contributions: Growth in the market is driven by: -

Expansion of EV and Battery Manufacturing: Lithium consumption is increasing exponentially due to rising demand for electric cars and large-scale battery storage systems. -

Consumer Electronics and Portable Devices: With an increasing need for longer battery life and faster charging capabilities, lithium is essential for powering smartphones, laptops, and wearables. -

Technological Transformation: Technological improvements in battery chemistry, direct lithium extraction (DLE), and recycling are transforming the business. -

Innovation Highlights: Companies are building flexible, modular lithium processing units to minimize initial costs and expedite scalability. -

Vertical Integration: Major businesses are investing in the whole lithium supply chain, from extraction to battery manufacture, to assure dependability and cost control. -

Regional Insights: Asia Pacific and North America are driving market growth thanks to rapid EV adoption, supporting government regulations, and smart investments in lithium mining.

Key Trends and Sustainability Outlook:

-

Green Lithium Initiatives: Companies are investing in low-impact mining and carbon-neutral processing to achieve ESG objectives and regulatory requirements. -

Advanced Materials Innovation: Solid-state battery and lithium-sulphur research is influencing the future of high-capacity energy storage. -

Traceability and Transparency: The use of blockchain and digital tracking technologies improves supply chain integrity and sustainability reporting. -

Customization and Localization: There is a growing need for region-specific lithium grades designed for a variety of industrial uses. -

Data-Driven Insights: Real-time analytics allow more informed decision-making, from anticipating supply and demand to optimizing logistics and production schedules.

Growth Drivers:

-

Electrification of Transportation: Government laws and customer choices are hastening the shift to electric mobility, increasing lithium demand. -

Energy Storage Expansion: Grid-scale and home battery storage systems are critical to stabilizing renewable energy and need significant lithium inputs. -

Global Supply Diversification: Efforts to lessen reliance on a small number of lithium-producing countries are promoting exploration and development in new market segments. -

Sustainability and Compliance: The growing need to fulfill environmental, social, and governance requirements is pushing innovation in lithium mining and processing. -

Technology Integration: Advanced digital tools and automation are expediting lithium operations from discovery to production and delivery.

Overview of Market Intelligence Services for the Lithium Market:

Recent industry evaluations have highlighted critical issues in the lithium supply chain, including as high production and extraction costs, rising demand for customized lithium grades, and volatile raw material pricing. In today's changing world, market intelligence studies give critical insights into procurement prospects, allowing firms to create cost savings, build supplier relationships, and improve sourcing results. These insights enable businesses to sustain excellence in operations while effectively managing procurement risks and expenses

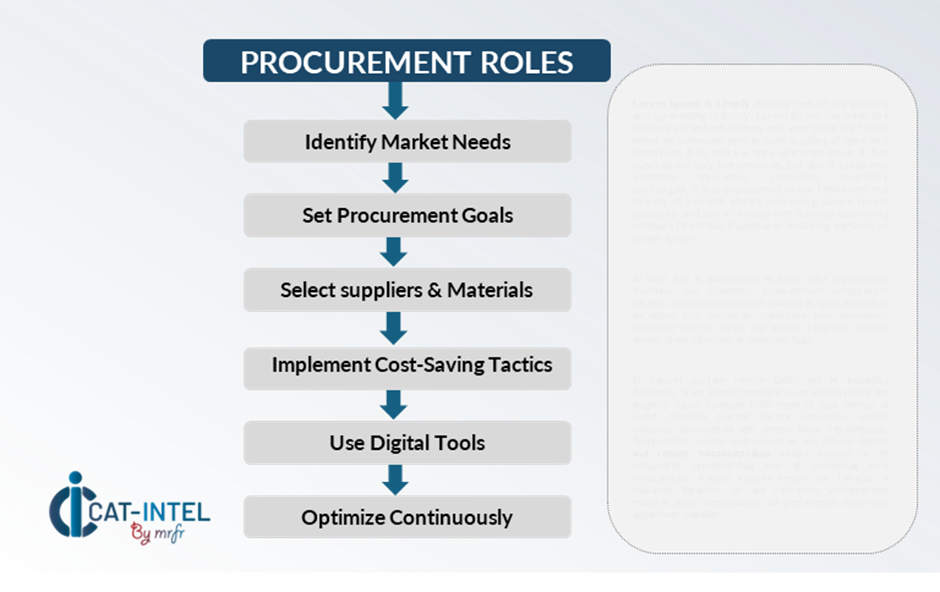

Procurement Intelligence for Lithium Category Management and Strategic Sourcing

To remain competitive in a rapidly evolving global lithium market, companies are improving their procurement strategies by gaining visibility into procurement patterns, identifying areas for consolidation and efficiency, and segmenting procurement strategies by lithium types (e.g., lithium carbonate vs. lithium hydroxide) and sourcing regions to drive strategic focus. Businesses that link procurement with long-term strategic goals may assure supply chain resilience, cost-effective sourcing, and sustainable development in a market where demand for energy storage, electric cars, and high-tech manufacturing continues to rise.

Pricing Outlook for Lithium Spend Analysis

The pricing prognosis for lithium is projected to continue volatile, impacted by a variety of market forces. Key pricing considerations include technical advances in battery materials and extraction processes, surges in demand from the electric vehicle (EV) and energy storage industries, grade and purity customization requirements for specialized applications and environmental regulations and ESG compliance costs.

Graph shows general upward trend pricing for Lithium and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To manage volatility and maintain cost efficiency, businesses are focusing on streamlining sourcing operations and aligning procurement with long-term business goals, building partnerships with high-performing, ESG-compliant suppliers, and ensuring price stability through structured, long-term agreements.

To acquire volume-based discounts and price predictability to ensure supply continuity, particularly in geopolitically or environmentally risky places. While pricing issues remain, concentrating on supply scalability, engaging in sustainable sourcing techniques, and harnessing data-driven procurement insights will be critical to attaining cost control and operational resilience in the changing lithium market.

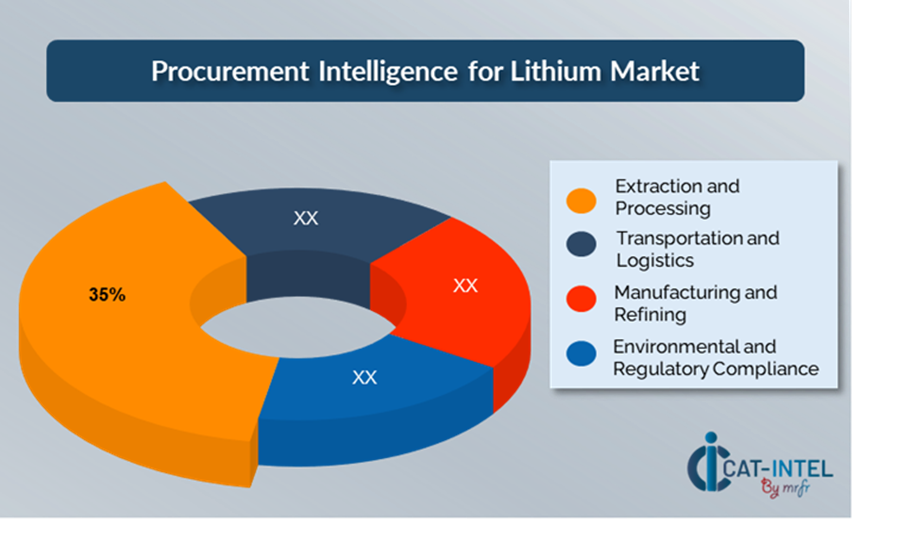

Cost Breakdown for Lithium Total Cost of Ownership (TCO) and Cost-Saving Opportunities

- Extraction and Processing: (35%)

-

Description: The price of lithium extraction (from brine or hard rock) and refining procedures, such as turning spodumene or lithium brine into commercial products (lithium hydroxide and lithium carbonate). T -

Trend: Advancements in extraction and automation technology are reducing energy usage, increasing efficiency, and lowering prices.

- Transportation and Logistics: (XX%)

- Manufacturing and Refining: (XX%)

- Environmental and Regulatory Compliance: (XX%)

Cost-Saving Opportunities Negotiation Levers and Purchasing Negotiation Strategies

In the quickly expanding lithium industry, streamlining procurement procedures and employing smart negotiating strategies are crucial for reducing costs and improving supply chain efficiency. Establishing long-term supply agreements with reputable lithium suppliers, particularly those who invest in sustainable methods and Scalable extraction technology can enable favourable pricing and terms, such as bulk discounts and integrated shipping or processing services.

Partnering with manufacturers who have advanced capabilities, such as direct lithium extraction (DLE) or low-carbon processing, promotes long-term cost efficiency and reduces environmental impact. Digital procurement systems, such as contract lifecycle management tools, performance dashboards, and predictive analytics, provide for transparent supervision of contract conditions, utilization rates, and delivery performance. Strategic collaborations with technologically innovative and sustainability-focused suppliers, together with digitally connected procurement techniques, are critical to retaining a competitive advantage in the global lithium market by delivering cost efficiency and long-term operational value.

Supply and Demand Overview for Lithium: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The global lithium market continues to see continuous expansion, driven by rising renewable energy programs and expanding electrification activities in industries including automotive, energy storage, electronics, and manufacturing. Technological innovation, regional legislation, and macroeconomic conditions are all influencing the supply-demand balance.

Demand Factors:

-

Electrification and Renewable Energy Transition: The growing manufacturing of electric vehicles (EVs) and grid-scale energy storage systems is driving up demand for lithium.

-

Battery Manufacturing Expansion: Rapid expansion in lithium-ion battery manufacturing in Asia, Europe, and North America drives demand for battery-grade lithium compounds (carbonate and hydroxide).

-

Specialized Industry Needs: Industries such as aerospace, defence, and consumer electronics demand high-purity lithium that meets certain performance requirements.

-

Integration with Advanced Technologies: Lithium's support for next-generation battery chemistries, including solid-state and lithium-sulphur batteries, is fuelling demand growth via innovation.

Supply Factors:

-

Technological Advancements in Extraction and Processing: New extraction and processing technologies, such as direct lithium extraction (DLE), are improving supply potential, efficiency, and environmental effect. -

Global Producer Landscape: A diversified mix of incumbent producers and new market entrants, notably in Latin America's Lithium Triangle and Australia, helps to create a competitive and developing supply ecosystem. -

Macroeconomic and Geopolitical Factors: Global lithium pricing and availability are influenced by factors such as fluctuating currency rates, geopolitical conflicts, and regional labor costs. -

Scalability and Resource Flexibility: New projects are constructed with modular infrastructure, allowing producers to adjust output to market demand while reducing risk.

Regional Demand-Supply Outlook Lithium

The Image shows growing demand for Lithium in both Asia Pacific and North America, with potential price increases and increased Competition.

Asia Pacific Dominance in the Lithium Market

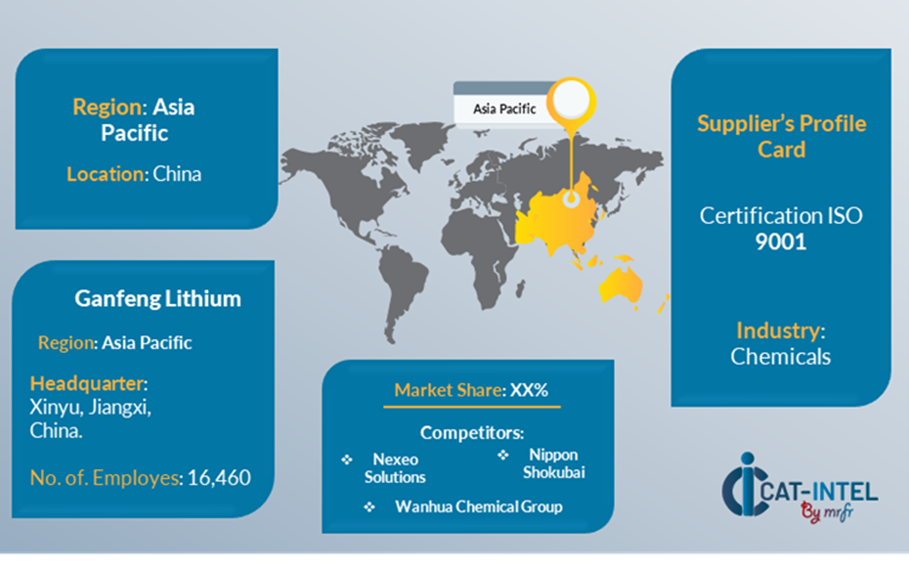

Asia Pacific, particularly China, is a dominant force in the global Lithium market due to several key factors:

-

Strong Demand from Battery Manufacturing Hubs: China alone accounts for more than 70% of worldwide battery cell manufacturing, creating a massive demand for lithium hydroxide and carbonate. -

Rapid Expansion of Electric Vehicle Markets: Government subsidies, pollution laws, and aggressive EV objectives are all pushing ongoing increases in lithium usage for batteries.

-

Vertical Integration and Strategic Investment: Asian firms are significantly investing in lithium mining properties in Australia, South America, and Africa. It reinforces the region's dominance in the lithium value chain.

-

Technological Leadership in Energy Storage Solutions: Asia-Pacific is at the cutting edge of battery research, including advances in solid-state batteries, lithium-sulphur batteries, and next-generation storage technologies.

-

Strong Government Support: Governments around the area, particularly China, are promoting lithium-intensive sectors through policy incentives, subsidies, and infrastructural expenditures.

Asia Pacific Remains a key hub Lithium Price Drivers Innovation and Growth.

Supplier Landscape Supplier Negotiations and Strategies

The lithium supply industry is diversified and competitive, dominated by a combination of major global manufacturers and developing regional companies. These suppliers play an important role in influencing crucial market characteristics including price structures, material quality, processing capabilities, and supply chain dependability. The market is dominated by giant multinational mining corporations with vertically integrated operations that provide large-scale lithium extraction, processing, and logistics.

Along with these main businesses, a rising number of niche and mid-sized suppliers are gaining market share by focusing on lithium compounds, environmentally friendly extraction technologies, and customized supply solutions for specialized applications. Rising demand, technological innovation, and environmental imperatives are propelling the lithium supply ecosystem to new heights of sophistication and competition. Businesses managing procurement in this market must carefully assess suppliers not just on pricing, but also on supply reliability, technology capabilities, and long-term strategy alignment to establish a robust and cost-effective supply chain.

Key Suppliers in the Lithium Market Include:

- Ganfeng Lithium

- Albemarle Corporation

- Sociedad Química y Minera (SQM)

- Tianqi Lithium

- Livent Corporation

- FMC Corporation

- Pure Energy Minerals

- Orocobre Limited

- Bacanora Lithium

- Nemaska Lithium

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The global lithium market is rapidly expanding, driven by increased demand for electric cars, grid-scale energy storage, and digital gadgets. |

Cloud Adoption |

To comply with environmental standards and ESG obligations, the sector is heavily promoting sustainable lithium sourcing and low-impact extraction methods.

|

Product Innovation |

Lithium producers are expanding their product lines with battery-grade materials, recovered lithium solutions, and high-purity compounds for applications. |

Technological Advancements |

Innovations in direct lithium extraction (DLE), real-time resource modelling, and AI-driven process optimization are improving production efficiency. |

Global Trade Dynamics |

Trade restrictions, export bans, and evolving geopolitical situations are all affecting lithium supply chains, particularly in major producing areas. |

Customization Trends |

Growing demand for application-specific lithium grades (e.g., hydroxide for EVs, carbonate for storage) is forcing providers to broaden their offerings. |

Lithium Attribute/Metric |

Details |

Market Sizing |

The global Lithium market is projected to reach USD 40 billion by 2035, growing at a CAGR of approximately 12.36% from 2025 to 2035. |

Lithium Technology Adoption Rate |

Advanced technology, such as DLE, automated brine concentration, and real-time analytics are being adopted by over 60% of new lithium extraction projects.

|

Top Lithium Industry Strategies for 2025 |

Companies are focused on vertical integration, strategic offtake agreements, sustainable mining, and global supply diversification to ensure long-term growth.

|

Lithium Process Automation |

About 60% of lithium manufacturing facilities currently use automation in refining, quality control, and logistics, lowering operating costs and human error.

|

Lithium Process Challenges |

Challenges include costly CAPEX, environmental problems, extraction water use, geopolitical threats, and variable demand from downstream battery makers.

|

Key Suppliers |

Major suppliers include Albemarle Corporation, SQM and Livent Corporation.

|

Key Regions Covered |

Leading lithium-producing countries include Australia, Chile, Argentina, and China, with increased interest in Canada and Africa.

|

Market Drivers and Trends |

Key drivers include the EV revolution, the quest for renewable energy, battery technology advancement, and the scramble to obtain vital minerals for national energy security.

|