Elevation in Construction Input Prices Induces the Stagnancy in the Pre-Engineered Buildings Sector

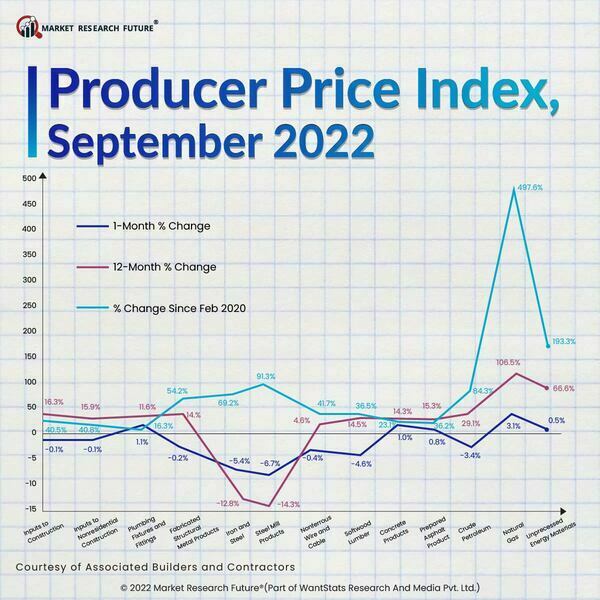

Elevated inflation and interest rates recently resulted in considerable stagnancy in the building and construction industry across the continents. Though the construction input prices lowered slightly in September, the wholesale price businesses received for building and construction products and materials rose more than expected. A similar factor is anticipated to raise the chances of a hike in interest rates in the battle against inflation in the building and construction industry, including the pre-engineered buildings category.

Though even a few construction materials have witnessed a slight down in prices, the non-residential construction input prices, including the pre-engineered buildings category, are still up from a year ago. Roofing and fabricated structural metal products, one of the product categories under pre-engineered buildings, are consistently experiencing high costs. Moreover, the stringent COVID-19 lockdown in Asian countries such as China, Japan, India, and the European Union has induced severe energy crises and disruption in the supply chain. This scenario increased construction materials and equipment prices, even if the year-by-year price increases were moderate.

The hike in costs and rates has already limited the penetration and growth of the building and construction market, including the pre-engineered buildings market. This malaise will likely spread across all areas where the construction is going forward. From the contractor’s perspective, they are vigorously preparing for their balance sheets with a considerable downturn, even though many firms currently operate at total capacity.

In summation of all, the surge in construction inputs prices has slowed the pre-engineered buildings market momentum. This is not welcoming news for players operating in the global building and construction and pre-engineered buildings market. The other market experts and economists also announced a similar scenario for the overall band construction sector, considering the newest producer price index numbers. Besides this, any slight or sudden drop in construction material prices may give relief to contractors and investors to a certain extent.