Top Industry Leaders in the 2-Ethylhexanol Market

2-Ethylhexanol, or 2-EH, might not be a household name, but this versatile chemical plays a crucial role in a surprising variety of industries. From plasticizers in your phone case to coatings on your car, 2-EH is like the secret ingredient in countless everyday products. Let's delve into the competitive landscape of the 2-Ethylhexanol market, exploring the strategies, market share factors, industry news, and recent developments shaping this dynamic space.

2-Ethylhexanol, or 2-EH, might not be a household name, but this versatile chemical plays a crucial role in a surprising variety of industries. From plasticizers in your phone case to coatings on your car, 2-EH is like the secret ingredient in countless everyday products. Let's delve into the competitive landscape of the 2-Ethylhexanol market, exploring the strategies, market share factors, industry news, and recent developments shaping this dynamic space.

Strategies Adopted by 2-EH Titans:

-

Product Diversification: Leading players like INEOS, Mitsubishi Chemical Corporation, and SABIC are expanding their offerings beyond traditional plasticizers. They're venturing into 2-EH acrylate for paints and adhesives, 2-EH nitrate for solvents and lubricants, and even bio-based 2-EH for sustainable applications. -

Regional Focus: Asia-Pacific, particularly China, dominates the market, consuming over 60% of global 2-EH. Companies are establishing manufacturing facilities and distribution networks in these regions to capitalize on the demand boom. -

Sustainability Push: Environmental concerns are influencing the market. Companies are developing bio-based 2-EH options, implementing cleaner production processes, and exploring ways to recycle waste 2-EH, aiming to reduce their environmental footprint. -

Vertical Integration: Gaining control over the supply chain is crucial. Companies are acquiring raw material suppliers, processing facilities, and even downstream distributors to ensure stable pricing, product quality, and market reach.

Factors Influencing Market Share:

-

Production Capacity: The ability to consistently meet demand is key. Companies with larger, well-distributed production facilities hold an advantage. -

Cost-Effectiveness: 2-EH is a price-sensitive commodity. Efficient production processes, resource optimization, and competitive pricing strategies are crucial for market dominance. -

Technical Expertise: Understanding the nuances of different 2-EH derivatives and their applications allows companies to tailor solutions and niche markets. -

Collaboration and Partnerships: Forming alliances with research institutions, technology providers, and end-user industries can accelerate innovation and market penetration.

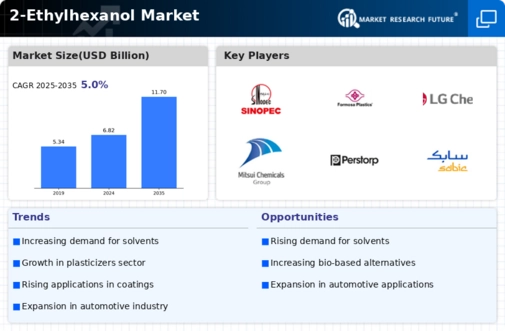

Key Companies in the 2-Ethylhexanol market include

- BASF SE

- Sinopec

- Eastman Chemical Company

- Formosa Plastics Corporation

- LG Chem

- OXEA GmbH

- Mitsui Chemicals, Inc.

- China National Petroleum Corporation

- Perstorp

- SABIC

- Nan Ya Plastics Corporation

- INEOS

- Arak Petrochemical Corporation among others

Recent Developments:

-

September 2023: LyondellBasell and INEOS announce a partnership for 2-EH production in Europe, aiming to optimize costs and supply chain efficiency. -

October 2023: Eastman Chemical unveils a new line of 2-EH derivatives for use in lubricants, catering to the growing demand for sustainable and high-performance lubricants. -

November 2023: Evonik introduces a bio-based 2-EH alternative with comparable performance to traditional grades, further strengthening its sustainability credentials. -

December 2023: The European Union proposes stricter regulations on the use of certain 2-EH derivatives in plastics, prompting manufacturers to explore alternative formulations.