Emergence of Smart Cities

The emergence of smart cities is a transformative factor for the Global 5G Chipset Market Industry. Urban areas are increasingly adopting smart technologies to improve infrastructure, enhance public services, and promote sustainability. 5G technology is integral to the development of smart cities, as it facilitates seamless communication between devices, sensors, and systems. This interconnectedness is essential for applications such as smart traffic management, energy-efficient buildings, and public safety systems. The anticipated growth in the market, with a valuation of 7.65 USD Billion in 2024, reflects the increasing investment in smart city initiatives, which are expected to drive demand for advanced 5G chipsets.

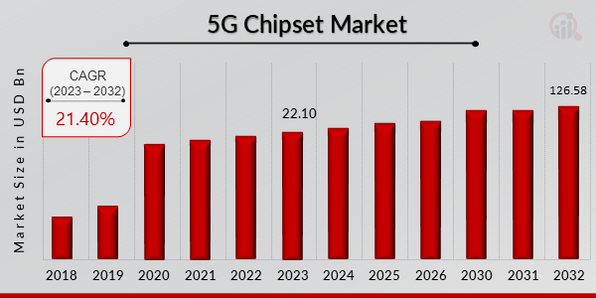

Market Growth Projections

The Global 5G Chipset Market Industry is poised for remarkable growth, with projections indicating a market size of 60 USD Billion by 2035. This growth trajectory is supported by a compound annual growth rate (CAGR) of 20.59% from 2025 to 2035, suggesting a robust expansion driven by technological advancements and increasing demand across various sectors. The proliferation of 5G-enabled devices and applications is likely to fuel this growth, as industries seek to leverage the benefits of high-speed connectivity. The market's evolution is expected to reflect broader trends in digital transformation, positioning 5G chipsets as a cornerstone of future technological developments.

Expansion of IoT Applications

The expansion of Internet of Things (IoT) applications is a critical driver for the Global 5G Chipset Market Industry. As industries increasingly adopt IoT technologies, the need for efficient and high-performance chipsets becomes paramount. The integration of 5G technology with IoT devices enables real-time data processing and communication, which is essential for applications in smart homes, industrial automation, and healthcare monitoring. This trend is expected to contribute significantly to the market's growth, with projections indicating a market size of 60 USD Billion by 2035. The synergy between 5G and IoT is likely to create new opportunities and enhance operational efficiencies across various sectors.

Government Initiatives and Investments

Government initiatives and investments in 5G infrastructure are pivotal for the Global 5G Chipset Market Industry. Many countries are actively promoting the rollout of 5G networks to enhance national competitiveness and economic growth. For instance, substantial funding is being allocated to develop 5G infrastructure, which is expected to create a conducive environment for chipset manufacturers. These investments not only facilitate the deployment of 5G technology but also stimulate innovation within the industry. As governments recognize the strategic importance of 5G, the anticipated growth rate of 20.59% CAGR from 2025 to 2035 underscores the potential for substantial advancements in the chipset market.

Increased Adoption of Autonomous Vehicles

The increased adoption of autonomous vehicles is significantly influencing the Global 5G Chipset Market Industry. As automotive manufacturers integrate advanced technologies into their vehicles, the demand for high-speed, low-latency communication systems becomes essential. 5G chipsets play a crucial role in enabling vehicle-to-everything (V2X) communication, which enhances safety and efficiency on the roads. The automotive sector's transition towards electrification and automation is likely to drive substantial growth in the chipset market, as these vehicles require sophisticated communication systems to operate effectively. This trend aligns with the overall market growth trajectory, potentially contributing to the projected market size of 60 USD Billion by 2035.

Rising Demand for High-Speed Connectivity

The Global 5G Chipset Market Industry is experiencing a surge in demand for high-speed connectivity, driven by the increasing reliance on mobile data and the proliferation of smart devices. As of 2024, the market is valued at approximately 7.65 USD Billion, reflecting the growing need for faster and more reliable internet services. This demand is further fueled by advancements in technologies such as IoT and smart cities, which require robust connectivity solutions. The transition from 4G to 5G is pivotal, as it promises to enhance user experiences across various sectors, including healthcare, automotive, and entertainment, thereby propelling the growth of the industry.