Research Methodology on Activated Carbon Market

Introduction

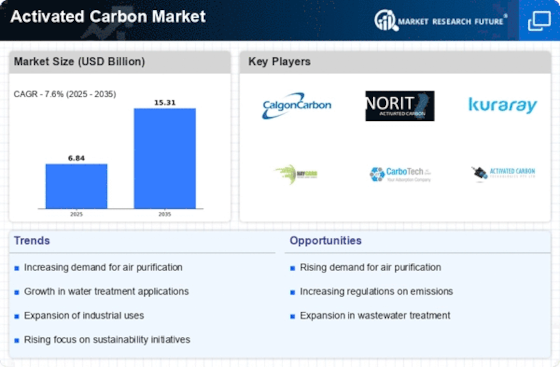

Activated carbon, also referred to as activated charcoal, is an adsorbent material that has become increasingly popular in many industries – from water & air filtration to medical, and food & beverage, amongst others. The activated carbon market is estimated to grow rapidly during the forecast period 2023 to 2030 and is said to have a blistering growth rate.

Research Objectives

The purpose of this research report by Market Research Future is to investigate the growing demand for activated carbon in various industries, analyse the drivers and restraints of the market, and assess the opportunities and challenges faced by the industry. The primary objectives of this research are to:

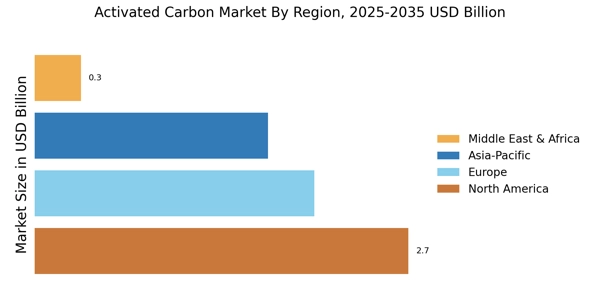

Identify key trends in the global market for activated carbon, and assess their impact on the market size and dynamics.

Analyse the key drivers and restraints influencing the growth of the activated carbon industry and assess opportunities for market expansion.

Analyse the competitive landscape of the activated carbon market, and identify key strategies adopted by leading players in the industry.

Assess the technological advancements in the activated carbon industry, and analyse their potential impact on the market size and dynamics.

Forecast the growth of the activated carbon market, and evaluate major factors driving the growth of the market.

Research Methodology

Primary Research:

Primary research will involve in-depth interviews and surveys with industry experts, potential customers, and key stakeholders in the activated carbon industry. Secondary research is conducted through a literature review and research paper analysis.

Secondary Research:

Market research firms, industry journals, government reports, and white papers are used to acquire relevant data for this research. The sources of data include trade publications, company websites, and databases such as Bloomberg and Factiva.

Data Collection:

The data is collected using a combination of methods, including secondary research, primary research, interviews, and surveys. Data sources include industry journals, company financial statements, market research reports, industry databases, and internet sources such as online magazine articles, press releases, and news websites.

Data Analysis:

The collected data is analyzed using quantitative and qualitative analysis techniques such as regression analysis, factor analysis, and SWOT analysis. The analysis seeks to identify key trends, opportunities, and challenges in the market, and assess their impact on the market size and dynamics.

Market Forecasting:

The market size estimates and forecasts will be determined using a combination of bottom-up and top-down approaches. The bottom-up approach involves the estimation of the total addressable market for activated carbon and making assumptions about the market penetration rate for each industry. The top-down approach involves estimating the total size of the market taking into consideration the current market sizes and projections of potential growth.

Final Report:

After the analysis and forecasting, the final report is prepared based on the findings of the research. The report includes topics such as primary research findings, data analysis, market estimates, market forecasts, market segmentation, and key recommendations.

Conclusion

The proposed research methodology seeks to provide an in-depth analysis of the activated carbon market. It will help in understanding the current trends and dynamics of the market, identifying key drivers and restraints, and analysing opportunities and challenges in the industry. The research also helps in making reliable market estimates and forecasts and making necessary recommendations to ensure the growth of the market.