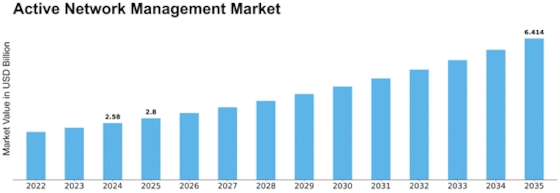

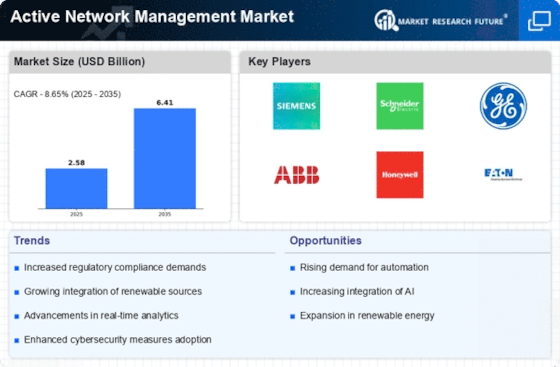

Active Network Management Size

Active Network Management Market Growth Projections and Opportunities

In the rapidly evolving landscape of the Active Network Management (ANM) market, companies employ various market share positioning strategies to establish a competitive edge. One prominent strategy is differentiation, where companies strive to distinguish their ANM solutions from competitors by emphasizing unique features and functionalities. This might include advanced real-time monitoring capabilities, predictive analytics for network optimization, or innovative demand-response mechanisms. By offering a differentiated value proposition, companies aim to attract utility providers and grid operators seeking tailored ANM solutions that can effectively address their specific operational challenges.

Cost leadership is a significant market positioning strategy within the ANM sector. Given the cost-sensitive nature of utility and energy industries, companies focus on optimizing operational efficiencies, minimizing deployment costs, and providing cost-effective ANM solutions. By offering competitive pricing structures, companies target utilities and grid operators looking for efficient network management solutions without compromising on the reliability and performance of their energy grids.

Innovation plays a pivotal role in market share positioning within the ANM market. As the energy landscape undergoes transformations, companies invest in research and development to introduce cutting-edge technologies. This may involve the integration of artificial intelligence for predictive grid maintenance, the development of advanced control algorithms, or the incorporation of renewable energy forecasting tools. By staying at the forefront of innovation, companies not only cater to the current needs of utility providers but also position themselves as forward-thinking partners ready to address the challenges of the evolving energy sector.

Strategic partnerships and collaborations are crucial components of market share positioning strategies in the ANM sector. Collaborations with utility companies, grid operators, technology providers, and government entities can create synergies that enhance the overall value proposition of ANM solutions. Such partnerships enable companies to offer comprehensive and integrated solutions that address a broader range of operational needs within the energy sector. Additionally, alliances can provide access to new markets, expand customer bases, and foster a collaborative ecosystem that drives innovation.

Geographic focus is a nuanced approach to market positioning, particularly in the globalized ANM market. Some companies concentrate their efforts on specific regions where there is high demand for grid management solutions or where regulatory environments present favorable conditions. This targeted approach allows for a more localized marketing and sales strategy, taking into account regional energy policies, grid infrastructure, and market dynamics. Successfully navigating diverse global markets requires a deep understanding of local nuances and a flexible approach to cater to the varied needs of energy stakeholders.

Security considerations are increasingly critical in the ANM market, given the potential impact of cyber threats on critical energy infrastructure. Companies invest in robust cybersecurity measures to ensure the integrity and confidentiality of data transmitted across energy networks. Addressing security concerns is not only a regulatory requirement but also a key factor in gaining the trust of utility providers and grid operators who rely on secure and resilient ANM solutions to manage their energy networks effectively.

Leave a Comment