Global Aerospace Aluminium Market Overview

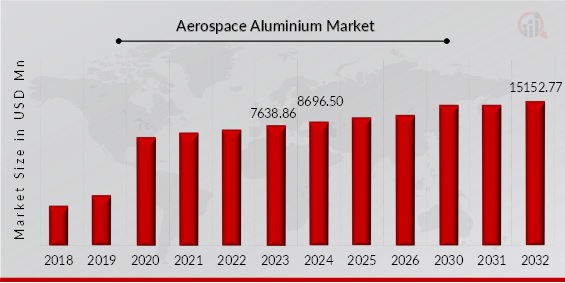

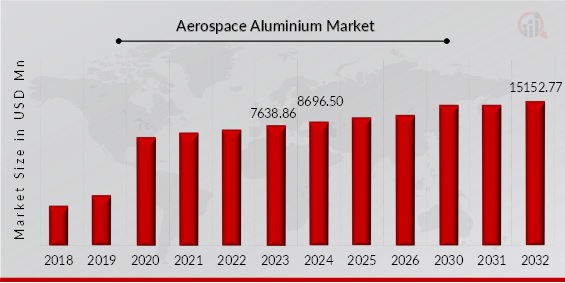

Aerospace Aluminium Market Size was valued at USD 7638.86 million in 2023. The Aerospace Aluminium Market industry is projected to grow from USD 8696.50 million in 2024 to USD 15152.77 million by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% during the forecast period (2024 - 2032). During the forecast period we may see a rapid demand for aerospace aluminium with increasing urbanization and rapidly expanding aviation sector. The increasing industry’s need for lighter and sustainable materials for improving aircraft performance, fuel efficiency, and environmental sustainability is positively influencing the market of aerospace aluminium. Advanced aluminium alloys are increasingly used in complex and high-performance structural components, as they are needed to handle the demanding conditions of high-altitude flight while minimizing overall aircraft weight. Moreover, aerospace aluminium’s ability to be recycled without losing strength or quality further supports industry sustainability goals, thereby making it appealing to manufacturers. The market growth is further amplified by emerging markets in various regions, which are witnessing increasing aerospace investments and fleet expansions, thus driving greater demand for aluminium as a preferred choice in new aircraft manufacturing.

The study aims to provide a clear picture of current consumption of aerospace aluminium and potential future growth. Various aerospace aluminium manufacturers are adopting numerous business development strategies to strengthen their position in the market. For instance, in June 2020, Constellium SE announced that it has signed a multi-year contract with Airbus. The new 10-year agreement supports all Airbus’ programs. Under this agreement, Constellium will supply Airbus with a broad range of advanced aluminium rolled and extruded products, including wing skin panels, sheets for fuselage panels, and rectangular and pre-machined plates for structural components. This agreement strengthens the long-standing partnership between Constellium and Airbus and further demonstrates the leadership role that Constellium holds in the market for advanced aluminium products and solutions. Further, in October 2023, Thyssenkrupp renewed the contract to keep serving Boeing with aluminium components for the aerospace industry. With a strong focus on aluminium flat and extrusion products, thyssenkrupp Aerospace manages a global control tower for Boeing's materials supply chain, delivering solutions that go beyond the value-added services of a traditional materials distributor. Such strategies by the industry players are supporting the market growth of aerospace aluminium considerably.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Aerospace Aluminium Market Trends

INCREASING DEMAND FOR LIGHTWEIGHT MATERIALS

The demand for lightweight materials in the aerospace sector is increasing considerably due to rising fuel costs, environmental concerns and the need to improve the overall efficiency and performance of the aircraft. Aerospace aluminium has emerged as a critical component especially due to its high strength-to-weight ratio, durability and recyclability. Fuel efficiency has become paramount for airlines and aerospace manufacturers. Fuel accounts for a significant portion of operating expenses and thus companies are finding ways to reduce weight, as lighter aircraft consume less fuel. Aluminium alloys used in aircraft construction are lightweight and can significantly reduce their overall mass without impacting structural integrity. Aerospace aluminium can effectively offer an ideal balance between weight and durability and therefore when they are integrated into aircraft design, these aluminium alloys contribute to significant fuel savings over time. This economic incentive is a major driver of aluminium demand in the aerospace sector.

Furthermore, governments and international bodies are implementing stringent regulations aiming at reducing greenhouse gas emissions. Lighter aircraft require less fuel, which directly leads to fewer carbon emissions and thus usage of aerospace aluminium aligns with regulatory requirements for greener aviation practices as it contributes to lower fuel consumption. Also, aluminium is a sustainable material due to its recyclability. It can be recycled with minimal energy consumption and can be reused without significant degradation of its properties. This attribute of aluminium has made it an attractive option for manufacturers aiming to meet environmental regulations while promoting a circular economy within industry. Lightweight materials contribute to improved flight performance and this factor is positively influencing the demand for aluminium in aerospace as aircraft can achieve greater range and higher payload capacities. Further, reduced weight allows for increased fuel efficiency and often better flight handling, which ultimately enhances safety and operational reliability. The high tensile strength of aerospace aluminium alloys offers the required structural resilience for various aerospace applications such as wings, fuselage and landing gear. Its ability to withstand high stress, corrosion, and temperature fluctuations ensures that performance improvements do not compromise safety, and this is contributing significantly to boosting its demand.

Moreover, aluminium’s resistance to corrosion is a key advantage in aerospace applications, where exposure to the environmental elements is constant. High corrosion resistance helps in increasing the component lifespans and fewer maintenance requirements, which is beneficial for airlines that are aiming to minimize downtime and maintenance costs. This low-maintenance advantage, combined with aluminium’s weight benefits, has made aerospace aluminium as a preferred material in aircraft design and construction. The demand for air travel is witnessing substantial growth globally. This surge in passenger numbers is driving the demand for new aircraft, which are increasingly being built with lightweight materials to improve their operational efficiency and lower costs.

GROWTH OF COMMERCIAL AVIATION INDUSTRY

The rapid growth of the commercial aviation industry is contributing substantially towards propelling the demand for aerospace aluminium. With increased air traffic, fleet expansions and the need for efficient & sustainable aircraft, the demand for materials such as aerospace aluminium is increasing. As air travel is becoming more accessible and affordable, especially in emerging economies, the commercial aviation industry is witnessing robust growth. Aluminium has become a vital material used in this sector as its lightweight properties make it ideal for constructing aircraft that are fuel-efficient and capable of handling long distances, further meeting the demands of a growing global market. By investing in new, aluminium-intensive aircraft, airlines can meet capacity demands while minimizing operational costs. Airlines globally are replacing older, less fuel-efficient aircraft with newer models that incorporate more lightweight materials, including aerospace aluminium. Moreover, in response to the rising fuel costs and environmental regulations, the commercial aviation industry is focusing on reducing fuel consumption and lowering emissions and this is driving the shift towards lighter aircraft, as they consume less fuel and contribute to lower greenhouse gas emissions. The commercial aviation industry is expanding significantly in various parts of the world. This expansion is strongly driven by growing populations, increased disposable income and rising investment in aviation infrastructure. In order to cater to the rising demand for air travel, airlines are investing in new fleets with lightweight aluminium-intensive aircraft. Aerospace aluminium enables aircraft to travel long distances with lower operational costs, which is vital for airlines operating in emerging markets with expanding networks. Advancements in aerospace aluminium alloys have played a crucial role in making the material stronger, lighter and more resistant to corrosion and fatigue. These properties are pivotal for commercial aircraft, which undergo constant stress and exposure to varying temperatures and environmental conditions. Minimizing maintenance downtime is one of the critical factors in the commercial aviation industry and aerospace aluminium’s corrosion resistance and durability helps in reducing the frequency of maintenance cycles, making it a cost-effective option for airlines. This reduced need for maintenance and repair, in addition to aluminium’s ease of fabrication and repair, makes it a suitable material. As airlines focus on optimizing uptime and reducing costs, aerospace aluminium continues to be a vital material in commercial aviation.

Aerospace Aluminium Market Segment Insights

Aerospace Aluminium by grade Insights

The Aerospace Aluminium Market segmentation, based on the grade, the global Aerospace Aluminiums market has been bifurcated into 2024 Grade, 7075 Grade, 6061 Grade, 6082 Grade, and Others. In 2023, the 7075 Grade segment drove the Aerospace Aluminium Market by holding a substantial market share. It is projected to register a CAGR of 40.4% during the projected timeframe. 7075 grade aluminum is considered one of the strongest aluminum alloys available and is particularly favored in the aerospace sector for its exceptional mechanical properties. With zinc as its primary alloying element, 7075 offers high strength, low weight, and excellent resistance to stress corrosion cracking, making it ideal for highly stressed structural components such as aircraft frames, landing gears, and military applications. The alloy's ability to retain its strength at elevated temperatures adds to its appeal in aerospace applications where performance is critical. The processing techniques for 7075 have evolved, leading to improved fabrication methods and enhanced characteristics, ensuring that components manufactured from this alloy can withstand the rigorous demands of flight and combat environments.

Analyst Review: The global aerospace aluminum market is driven by the aerospace industry's need for lightweight, durable, and corrosion-resistant materials. Aluminum alloys are widely used in aircraft, spacecraft, and defense applications due to their high strength-to-weight ratio and cost-effectiveness. The market is primarily driven by the growing demand for commercial aircraft, military aircraft, and space exploration initiatives. Major market players are the giant aircraft manufacturers Boeing, Airbus, and Lockheed Martin. Advancements in technology are in terms of the development of aluminum alloys with improved performance. There will be fluctuation in the raw material prices, thereby affecting supply chain conditions; the market will grow with stable increments. Growth will also come from the increase in air travel, defense expenditure, and space exploration activities.

Aerospace Aluminium by Process Insights

Based on the process, the global Aerospace Aluminiums market has been bifurcated into Casting, Extrusion, Welding, Forging, and Others. In 2023, the Casting segment drove the Aerospace Aluminium Market by holding a substantial market share during the assessment period. This segment accounted for the largest share of the market in 2023 and is expected to remain dominant during the forecast period. Casting is a pivotal process in the global aerospace aluminum market, allowing for the production of intricate components with high dimensional accuracy and complex geometries. In this process, molten aluminum is poured into molds, where it solidifies into the desired shape. Various casting techniques, such as sand casting, die casting, and investment casting, cater to different manufacturing needs and specifications. Investment casting, for instance, is particularly valued in aerospace applications due to its ability to create parts with excellent surface finish and detail, making it ideal for critical components like engine housings, brackets, and structural elements. The casting process not only reduces material waste but also enables manufacturers to produce lightweight components that contribute to overall fuel efficiency in aircraft. As aerospace designs continue to evolve, advancements in casting technologies, including improved alloy formulations and process automation, enhance the capabilities and performance of cast aluminum parts, ensuring they meet the rigorous safety and performance standards required in the industry.

Aerospace Aluminium by End Use Insights

Based on the End Use, the global Aerospace Aluminiums market has been bifurcated into Commercial Aviation, Business & General Aviation, Military & Defense, and Others. In 2023, the Commercial Aviation segment drove the Aerospace Aluminium Market by holding a substantial market share during the assessment period. This segment accounted for the largest share of the market in 2023 and is expected to remain dominant during the forecast period. The commercial aviation segment is a major driver of the global aerospace aluminum market, as it encompasses a vast array of aircraft used for passenger and cargo transport. Airlines are continually seeking ways to improve fuel efficiency and reduce operational costs, and aluminum’s lightweight properties make it an ideal choice for airframe construction, wings, and other structural components. Modern commercial aircraft, such as the Boeing 787 and Airbus A350, utilize advanced aluminum alloys extensively to achieve optimal performance and fuel savings. Additionally, the trend towards larger, more fuel-efficient aircraft has increased the demand for high-strength, lightweight aluminum materials that can withstand the rigorous demands of flight while maintaining safety standards. The ongoing recovery of global air travel, combined with the introduction of new aircraft models and advancements in aluminum manufacturing technologies, positions the commercial aviation sector as a key area of growth within the aerospace aluminum market.

Aerospace Aluminium by Regional Insights

Based on Region, the Aerospace Aluminium market is segmented into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. The Asia-Pacific Aerospace Aluminium market held the maximum market share and is also expected to account for the significant revenue share during the forecast period. The North American aerospace aluminum market is an important part of the broader aerospace industry. This is primarily driven by increasing demand for lightweight, high-strength materials in aircraft manufacturing. Aluminum is extensively used due to its excellent strength-to-weight ratio, corrosion resistance, and cost-effectiveness. The aerospace sector in the region is an important driver of demand for aluminum, including both commercial, military, and space applications. In North America, the U.S. is its largest producer and consumer, with big companies such as Boeing and Lockheed Martin driving up aluminum component demand in aircraft and spacecraft. Aluminum alloys of 2024 and 7075 are particularly preferred due to their increased durability and resistance against stress and fatigue. The market is influenced by air travel growth, military procurement orders, advancement in aerospace technology, and sustainability efforts. Manufacturers that focus on reducing carbon emission are now looking at more lightweight materials for fuel efficiency, thereby increasing the demand for aerospace-grade aluminum.

Aerospace Aluminium Key Market Players & Competitive Insights

Aerospace Aluminium Market is characterized by a high level of competition, with many players emerging for market share. The top 10 companies in the market account for a significant market share of Aerospace Aluminium Market. The competitive landscape of Aerospace Aluminium Market is dynamic, with companies constantly innovating and expanding their product offerings. Despite the challenges, several factors are driving growth in the aerospace aluminium market, including a rising demand for lightweight materials and the expansion of the commercial aviation industry. The market is expected to experience significant growth in the coming years, driven by emerging opportunities in aerospace manufacturing within various markets.

The market is benefiting from the development of new technologies. The key players in the Aerospace Aluminium Market include Alcoa Corporation, Constellium, Kaiser Aluminium, Hindalco Industries Ltd., Thyssenkrupp, AMG (Advanced Metallurgical Group), VSMPO-AVISMA Corporation, Aluminium Precision Products, Inc., Mifa Aluminium, Wuxi HENG TAI AEROSPACE Science and Technology Co., Ltd. and UACJ Corporation. These companies compete based on product quality, innovation, price, customer service, and market share. Companies also engage in various strategic initiatives, such as mergers and acquisitions, new product launches, partnerships, joint ventures, and expansions, to enhance their market position and expand their product portfolio. Companies are also focusing on developing new and innovative products that meet the specific needs of their customers. Companies will need to continue to innovate and expand their product offerings to remain competitive. For instance, on 3 June 2020, Constellium SE signed a multi-year contract with Airbus. The new 10-year agreement supports all Airbus’ programs. Under this agreement, Constellium will supply Airbus with a broad range of advanced aluminium rolled and extruded products, including wing skin panels, sheets for fuselage panels, and rectangular and pre-machined plates for structural components. This agreement strengthens the long-standing partnership between Constellium and Airbus and further demonstrates the leadership role that Constellium holds in the market for advanced aluminium products and solutions.

Alcoa Corporation: Alcoa is recognized as a global leader in the production of bauxite, alumina, and aluminium products, with a vision focused on reinventing the aluminium industry for a sustainable future. The company emphasizes a values-based approach that includes integrity, operational excellence, care for people, and courageous leadership. Its purpose is articulated as turning raw potential into real progress. Since pioneering the process that made aluminium both affordable and essential to modern life, Alcoa's skilled workforce has developed innovative solutions and best practices that enhance efficiency, safety, sustainability, and community strength in the regions where they operate. Currently, Alcoa maintains operations or ownership interests in 27 locations across nine countries, with its global headquarters situated in Pittsburgh, Pennsylvania, USA. The company’s common stock is listed on the New York Stock Exchange, and its business is structured into two segments: Alumina and Aluminium. The Alumina segment encompasses global bauxite mines and alumina refineries. Alcoa holds significant mining operations in Australia and South America, positioning itself as one of the world’s leading bauxite miners. Additionally, it operates one of the largest alumina businesses outside of China, with refineries located on three continents. The Aluminium segment includes aluminium smelting and casting operations, along with the majority of the company's energy assets.

Constellium: Constellium is recognized as a global leader in the development and manufacturing of high value-added aluminium products and solutions, as well as in aluminium recycling. The company employs approximately 12,500 people worldwide and operates 25 manufacturing sites across Europe, North America, and China, in addition to maintaining three R&D centers. Headquartered in Paris, Constellium also has corporate offices in Baltimore and Zurich. The company is organized into three primary business units: Aerospace and Transportation (A&T), Packaging and Automotive Rolled Products (P&ARP), and Automotive Structures and Industry (AS&I). Constellium focuses on sustainably transforming aluminium into value-added products, leveraging its intrinsic qualities—lightweight, strong, and recyclable. These solutions enable customers, including canmakers, car manufacturers, and aircraft manufacturers, to create lighter, safer, and cleaner products for everyday use. With a commitment to continuous innovation, Constellium aims to generate greater value for its partners while contributing to a more sustainable future. Additionally, the company prioritizes aluminium recycling to fully realize its circularity and minimize its environmental footprint.

Key Companies in the Aerospace Aluminium Market include:

- Alcoa Corporation

- Constellium

- Kaiser Aluminium

- Hindalco Industries Ltd.

- Thyssenkrupp

- AMG (Advanced Metallurgical Group)

- VSMPO-AVISMA Corporation

- Aluminium Precision Products, Inc.

- Mifa Aluminium

- Wuxi HENG TAI AEROSPACE Science and Technology Co., Ltd.

- UACJ Corporation

Aerospace Aluminium Market Segmentation:

Aerospace Aluminium Grade Outlook

-

2024 Grade

-

7075 Grade

-

6061 Grade

-

6082 Grade

-

Others

Aerospace Aluminium Process Outlook

-

Casting

-

Extrusion

-

Welding

-

Forging

-

Others

Aerospace Aluminium End Use Outlook

Aerospace Aluminium Regional Outlook

- North America

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 7638.86 million |

| Market Size 2024 |

USD 8696.50 million |

| Market Size 2032 |

USD 15152.77 million |

| Compound Annual Growth Rate (CAGR) |

7.2% (2024-2032) |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Data |

2018 to 2022 |

| Forecast Units |

Value (USD Million) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Grade, Process, End Use, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, South Africa and Middle East & Africa |

| Countries Covered |

US, Canada, Germany, UK, France, Spain, Italy, Russia, China, Japan, India, South Korea, Brazil, Mexico, Argentina, South Africa, GCC countries |

| Key Companies Profiled |

Alcoa Corporation, Constellium, Kaiser Aluminium, Hindalco Industries Ltd., Thyssenkrupp, AMG (Advanced Metallurgical Group), VSMPO-AVISMA Corporation, Aluminium Precision Products, Inc., Mifa Aluminium, Wuxi HENG TAI AEROSPACE Science and Technology Co., Ltd., and UACJ Corporation |

| Key Market Opportunities |

Emerging markets for aircraft manufacturing |

| Key Market Dynamics |

Increasing demand for lightweight materials |

Frequently Asked Questions (FAQ) :

Alcoa Corporation, Constellium, Kaiser Aluminium, Hindalco Industries Ltd., Thyssenkrupp, AMG (Advanced Metallurgical Group), VSMPO-AVISMA Corporation, Aluminium Precision Products, Inc., Mifa Aluminium, Wuxi HENG TAI AEROSPACE Science and Technology Co. Ltd., and UACJ Corporation.