- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

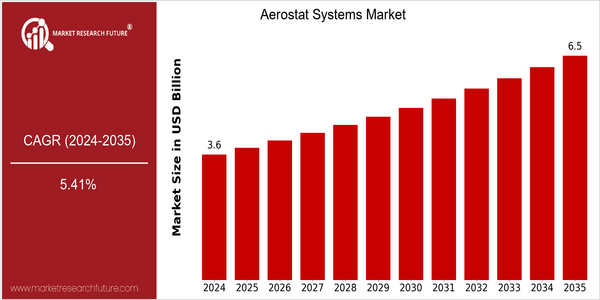

| Year | Value |

|---|---|

| 2024 | USD 3.64 Billion |

| 2035 | USD 6.5 Billion |

| CAGR (2025-2035) | 5.41 % |

Note – Market size depicts the revenue generated over the financial year

The Aerostat Systems Market is poised for significant growth, with a current market size of USD 3.64 billion in 2024, projected to reach USD 6.5 billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 5.41% from 2025 to 2035, indicating a robust demand for aerostat systems across various applications. The increasing need for surveillance, communication, and reconnaissance capabilities in both military and civilian sectors is a primary driver of this market expansion. Additionally, advancements in aerostat technology, such as enhanced payload capacities and improved operational efficiencies, are further propelling market growth. Key players in the aerostat systems market, including companies like Lockheed Martin, Raytheon Technologies, and Aerostar, are actively investing in research and development to innovate and enhance their product offerings. Strategic initiatives such as partnerships and collaborations are also becoming more prevalent, enabling these companies to leverage complementary technologies and expand their market reach. For instance, recent product launches focusing on hybrid aerostat systems that integrate drone technology are indicative of the industry's shift towards more versatile and efficient solutions. As the market continues to evolve, these factors will play a crucial role in shaping the future landscape of aerostat systems.

Regional Market Size

Regional Deep Dive

The Aerostat Systems Market is experiencing significant growth across various regions, driven by advancements in surveillance, communication, and reconnaissance technologies. In North America, the market is characterized by a strong presence of defense contractors and government agencies investing in aerostat systems for border security and disaster management. Europe is witnessing increased adoption of aerostat systems for environmental monitoring and public safety, while Asia-Pacific is rapidly expanding its market due to rising defense budgets and technological innovations. The Middle East and Africa are focusing on security applications, particularly in conflict zones, and Latin America is exploring aerostat systems for agricultural monitoring and disaster response.

Europe

- The European Union has initiated several projects aimed at enhancing border security through the use of aerostat systems, particularly in response to the increasing challenges of illegal immigration.

- Innovations in aerostat technology, such as the development of hybrid systems that combine aerostats with drones, are being spearheaded by companies like Airbus and Thales.

Asia Pacific

- Countries like India and Japan are significantly increasing their defense budgets, leading to a surge in demand for aerostat systems for surveillance and reconnaissance purposes.

- The collaboration between local firms and international defense contractors is fostering innovation in aerostat technology, with projects like India's 'Aero India' showcasing advancements in this field.

Latin America

- Countries such as Brazil and Mexico are exploring the use of aerostat systems for agricultural monitoring, leveraging their capabilities for crop surveillance and environmental assessment.

- Government initiatives aimed at disaster response and management are driving interest in aerostat systems, with projects focused on enhancing emergency response capabilities.

North America

- The U.S. Department of Defense has been actively integrating aerostat systems into its surveillance operations, particularly along the southern border, enhancing border security and situational awareness.

- Companies like Raytheon and Lockheed Martin are leading the development of advanced aerostat systems, focusing on improving payload capabilities and operational efficiency.

Middle East And Africa

- The UAE has invested heavily in aerostat systems for military applications, with companies like Abu Dhabi Autonomous Systems Investments (ADASI) developing advanced surveillance aerostats.

- The ongoing conflicts in the region have accelerated the adoption of aerostat systems for real-time intelligence gathering and monitoring.

Did You Know?

“Aerostat systems can remain airborne for extended periods, often exceeding 30 days, making them ideal for persistent surveillance and monitoring applications.” — Aerospace and Defense Industry Reports

Segmental Market Size

The Aerostat Systems Market is currently experiencing stable growth, driven by increasing demand for surveillance and communication solutions in various sectors. Key factors propelling this segment include the rising need for border security and disaster management, as well as advancements in aerostat technology that enhance operational efficiency. Regulatory policies promoting the use of unmanned aerial systems for public safety further bolster demand in this area. Currently, the adoption of aerostat systems is in the scaled deployment stage, with notable examples including the U.S. military's use of aerostats for surveillance in conflict zones and the deployment of aerostat systems by companies like Raven Industries for monitoring agricultural fields. Primary applications encompass border surveillance, disaster response, and telecommunications, with regions such as North America and Europe leading in implementation. Trends such as increased government investment in defense and security, along with sustainability initiatives aimed at reducing carbon footprints, are accelerating growth. Technologies like lightweight materials and advanced sensor integration are shaping the evolution of aerostat systems, making them more versatile and efficient.

Future Outlook

The Aerostat Systems Market is poised for significant growth from 2024 to 2035, with the market value projected to increase from $3.64 billion to $6.5 billion, reflecting a compound annual growth rate (CAGR) of 5.41%. This growth trajectory is underpinned by the increasing demand for surveillance, reconnaissance, and communication capabilities across various sectors, including defense, disaster management, and commercial applications. As governments and private entities continue to invest in advanced aerial surveillance technologies, the penetration of aerostat systems is expected to rise, with usage rates potentially reaching 15-20% in key markets by 2035, driven by their cost-effectiveness and operational flexibility compared to traditional aircraft and drones. Key technological advancements, such as improvements in aerostat design, payload capacity, and energy efficiency, are anticipated to further enhance the appeal of these systems. Additionally, supportive government policies aimed at bolstering national security and disaster response capabilities will likely catalyze market expansion. Emerging trends, including the integration of artificial intelligence and machine learning for data analysis and operational efficiency, will also play a crucial role in shaping the future landscape of the aerostat systems market. As these systems become more sophisticated and versatile, they are expected to capture a larger share of the aerial surveillance market, positioning themselves as essential tools for both public and private sector applications.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 14.38% (2023-2030) |

Aerostat Systems Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.