Agricultural Biologicals Market Summary

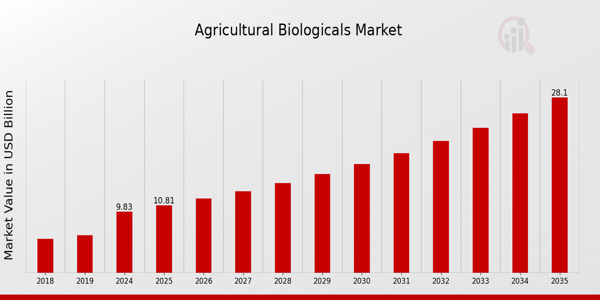

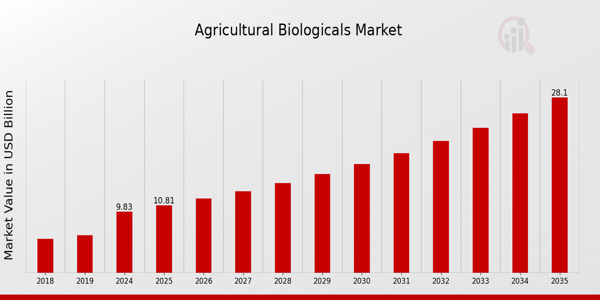

As per Market Research Future Analysis, the Agricultural Biologicals Market was valued at 8.9 USD Billion in 2023 and is projected to grow from 9.83 USD Billion in 2024 to 28.11 USD Billion by 2035, reflecting a CAGR of 10.02% from 2025 to 2035. The market is driven by increasing demand for sustainable agricultural practices, government support for organic farming, and advancements in biotechnology.

Key Market Trends & Highlights

The Agricultural Biologicals Market is witnessing significant trends that are shaping its growth trajectory.

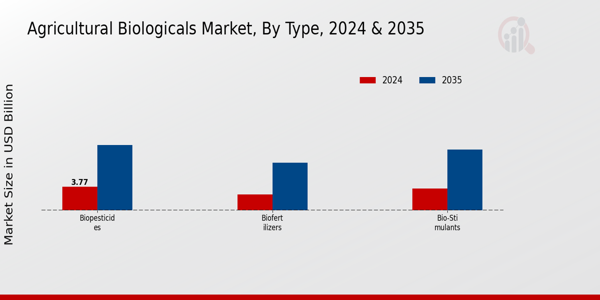

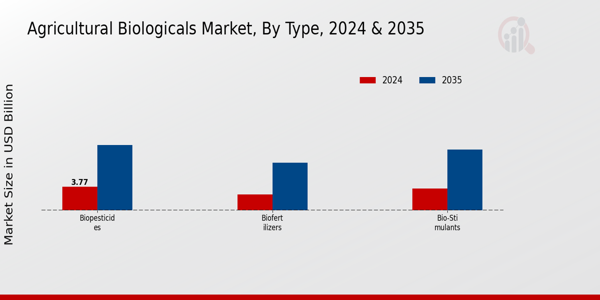

- Biopesticides are expected to grow from 3.77 USD Billion in 2024 to 10.56 USD Billion by 2035.

- Bio-Stimulants are projected to increase from 3.5 USD Billion in 2024 to 9.83 USD Billion by 2035.

- Biofertilizers are set to rise from 2.56 USD Billion in 2024 to 7.72 USD Billion by 2035.

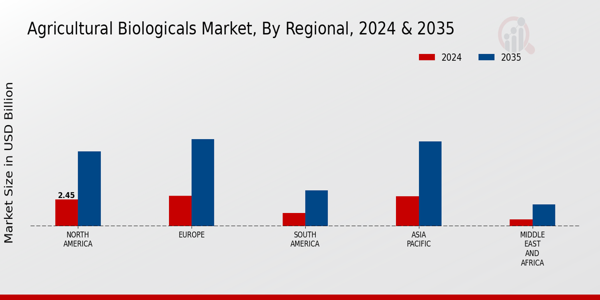

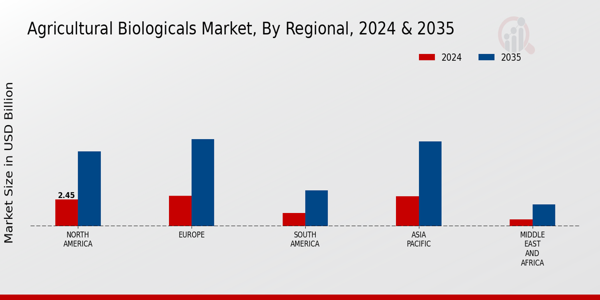

- North America is expected to reach 6.92 USD Billion by 2035, showcasing its dominant market position.

Market Size & Forecast

2023 Market Size: USD 8.9 Billion

2024 Market Size: USD 9.83 Billion

2035 Market Size: USD 28.11 Billion

CAGR (2025-2035): 10.02%

Largest Regional Market Share in 2024: North America.

Major Players

Key players include Valent Biosciences, Bayer, Corteva Agriscience, Syngenta, and Dow AgroSciences.

Key Agricultural Biologicals Market Trends Highlighted

The Agricultural Biologicals Market has been experiencing significant trends driven by various market factors. With an increasing emphasis on sustainable farming practices, there is a heightened demand for environmentally friendly agricultural solutions. Governments across various regions are implementing policies that promote the use of biological inputs, recognizing their potential to reduce chemical residues and enhance soil health.

This shift in regulatory frameworks acts as a key market driver, encouraging farmers to adopt agricultural biologicals as viable alternatives to chemical inputs. Moreover, the growing consumer preference for organic and sustainably sourced food is creating opportunities for producers of agricultural biologicals.Farmers are looking to leverage these alternatives to meet the rising demand for organic products, enabling them to access new market segments. Additionally, advancements in biotechnology are paving the way for the development of innovative biological products that can enhance crop yield and resistance to pests and diseases.

These technological innovations represent an opportunity to capture market share and improve agricultural productivity on a scale. Recent times have seen significant trends in the integration of digital tools and precision agriculture in conjunction with agricultural biologicals. This convergence allows for better targeting and application of biological solutions, resulting in increased efficiency and efficacy.Climate change concerns also drive interest in biological solutions, as they often have a lower environmental impact compared to traditional inputs. Overall, the Agricultural Biologicals Market is poised for growth, fueled by regulatory support, consumer preferences, and technological advancements, all contributing to a more sustainable agricultural landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Agricultural Biologicals Market Drivers

Growing Demand for Sustainable Agriculture Practices

The necessity to limit the use of chemical fertilizers and pesticides has prompted a shift toward sustainable agriculture techniques. The Agricultural Biologicals Market Industry is profiting from this demand since it provides environmentally friendly solutions to improve soil fertility and crop production. According to the Food and Agriculture Organization, more than 75% of the world's food is produced in systems that deplete natural resources, forcing governments and organizations like the United Nations to urge for agricultural biodiversity conservation methods. In keeping with this, governments are enacting rules to encourage organic farming, which frequently uses agricultural biologicals.

This shift toward sustainable farming techniques is expected to considerably affect the growth dynamics of the Agricultural Biologicals Market Industry, increasing the long-term viability of agricultural outputs throughout the world.

Innovation and Technology Advancement in Agricultural Inputs

The Agricultural Biologicals Market Industry is poised for robust growth due to advancements in technology and innovation in agricultural inputs. Research and Development initiatives are increasingly focused on developing more effective bio-based solutions that improve farm productivity and efficiency.

For instance, the market for agricultural biologicals is projected to be positively influenced by innovations from reputable organizations such as the International Society for Plant Pathology, which highlights the efficacy of microbial inoculants in enhancing crop responses.The World Bank indicates that innovations in biotechnology can increase crop yields by up to 30% in some regions, underscoring the potential market impact of technological advancements in the sector.

Increased Government Support and Policy Frameworks

Government initiatives and supportive policies to promote the use of agricultural biologicals have a substantial impact on market growth. Various countries are enacting regulations encouraging the use of organic farming inputs, as evidenced by changes in the European Union’s Common Agricultural Policy, which emphasizes sustainability in agriculture.

The Agricultural Biologicals Market Industry stands to benefit significantly from this support, with the EU reporting that organic farming land has increased by over 10% since the last comprehensive assessment.Such policy shifts indicate a conducive environment for growth in the market and underscore the commitment to sustainable agricultural practices, increasing the potential of agricultural biologicals in various regions.

Agricultural Biologicals Market Segment Insights

Agricultural Biologicals Market Type Insights

The Agricultural Biologicals Market is experiencing significant growth, driven by an increasing demand for sustainable agricultural practices ly. Within this market, the Type segmentation highlights three main categories: Biopesticides, Bio-Stimulants, and Biofertilizers, each playing a pivotal role in enhancing crop yield while minimizing environmental impact.

Biopesticides are valued at 3.77 USD Billion in 2024 and are expected to grow to 10.56 USD Billion by 2035, showcasing their dominant position in the market with major shareholding due to their efficacy in pest control and reduced chemical usage in farming.This segment continues thriving as farmers seek alternatives to synthetic pesticides that can harm beneficial organisms and degrade soil health. Meanwhile, Bio-Stimulants, valued at 3.5 USD Billion in 2024, are projected to reach 9.83 USD Billion by 2035, highlighting their significance in promoting plant growth and resilience against environmental stressors, thus improving overall productivity.

This increasing importance is indicative of a shift towards holistic and environmentally sustainable agricultural practices as well, making it a compelling area of investment.Finally, Biofertilizers hold a market valuation of 2.56 USD Billion in 2024, set to escalate to 7.72 USD Billion by 2035. This reflects a substantial growth opportunity, attributed to their role in enhancing soil fertility and nutrient availability, which is critical given today's challenges of soil degradation and nutrient depletion.

The Agricultural Biologicals Market segmentation paints a clear picture of a growing sector that is being shaped by consumer demand for sustainable agriculture, enabling a favorable environment for advancements in biotechnological solutions that could revolutionize traditional farming methods.Overall, the blend of environmental needs and innovative agricultural practices drives the market forward, making each of these segments a key players in the ongoing transition towards more eco-friendly agricultural solutions.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Agricultural Biologicals Market Source Insights

The Agricultural Biologicals Market, particularly in terms of Source, represents a key component of sustainable agricultural practices, with projections showing the market was valued at 9.83 USD Billion in 2024. The importance of agricultural biologicals is underscored by the increasing demand for environmentally friendly farming solutions. The sources can be categorized into Microbials, Biochemicals, and Others, each serving vital roles in enhancing crop productivity.

Microbials, for instance, are gaining traction due to their efficacy in soil health and plant growth promotion, significantly impacting crop yields and creating a more resilient agricultural system.Biochemicals, on the other hand, are crucial for their role in pest management and plant nutrition, aligning with sustainability goals. There are also various other biological sources that contribute to the diversity and effectiveness of agricultural solutions. Collectively, these segments reflect the growing trend towards biologically based solutions in agriculture, driven by the need for reduced chemical use, regulatory pressures, and consumer preferences for organic products.

The continuous innovation and research in these areas not only present growth opportunities but also address challenges such as soil degradation and pest resistance, ensuring a balanced ecosystem in agriculture.

Agricultural Biologicals Market Mode of Application Insights

The Agricultural Biologicals Market is poised for significant growth, with a projected valuation of 9.83 USD Billion in 2024. The Mode of Application segment plays a crucial role in this expansion, comprising various methods such as Foliar Sprays, Soil Treatment, Seed Treatment, and others. Each of these methods contributes to the overall efficiency and effectiveness of agricultural practices. Foliar Sprays, for instance, offer quick absorption of nutrients directly through plant leaves, making them a popular choice among farmers seeking immediate results.Soil Treatment ensures optimal soil health and fertility, which is essential for sustainable farming and crop yield.

Seed Treatment protects seeds from diseases and pests right from the start, showcasing its significance in enhancing germination rates and crop performance. This diverse range of application methods is influenced by evolving agricultural practices and the increasing need for environmentally friendly solutions in farming. As awareness around sustainable agriculture grows, the importance of these applications will continue to drive innovation and investment in the Agricultural Biologicals Market revenue, further shaping market growth and dynamics.

Agricultural Biologicals Market Crop Types Insights

The Agricultural Biologicals Market is projected to reach a value of 9.83 billion USD in 2024, highlighting the growing demand for sustainable agricultural practices across various crop types. The segmentation within this market comprises diverse categories, including Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Others. Each of these categories plays a crucial role in food security and agricultural sustainability.

For instance, Cereals and Grains are the backbone of diets worldwide, driving the need for effective biological solutions to enhance yield and resilience against pests.Meanwhile, Oilseeds and Pulses contribute significantly to protein sources and are increasingly favored due to their environmental benefits. Fruits and Vegetables also exhibit strong growth potential, being essential for nutrition and health, leading to enhanced market interest in biological products tailored to these crops. The market growth is further supported by increasing consumer awareness regarding organic farming and biopesticides.

Challenges such as regulatory hurdles and the need for streamlined Research and Development in agricultural biologicals must be addressed to optimize the benefits of these segments in the future.Overall, the Agricultural Biologicals Market presents a dynamic landscape driven by the diverse needs of different crop types, ensuring sustainable agricultural practices while meeting food demands.

Agricultural Biologicals Market Regional Insights

The Agricultural Biologicals Market is expected to experience significant growth, with a market valuation of 9.83 USD Billion in 2024, growing notably in various regions. North America holds a considerable share, valued at 2.45 USD Billion in 2024, with projections to reach 6.92 USD Billion by 2035, showcasing its dominant position due to advanced agricultural practices and high demand for sustainable products.

Europe follows closely, valued at 2.8 USD Billion in 2024, increasing to 8.05 USD Billion in 2035, driven by stringent regulations on chemical pesticides and a strong preference for organic farming.The Asia Pacific region is also emerging as a significant player, with an expected value of 2.75 USD Billion in 2024 and 7.83 USD Billion by 2035, as countries in this region are focusing on increasing agricultural productivity to meet food security needs.

South America is projected to grow from 1.2 USD Billion in 2024 to 3.3 USD Billion in 2035, aided by the region's vast agricultural land and focus on bio-based solutions. Lastly, the Middle East and Africa segment, although smaller, valued at 0.63 USD Billion in 2024 and poised to reach 2.01 USD Billion in 2035, presents opportunities as agricultural innovations are increasingly adopted to combat climatic challenges.These dynamics underscore the varied growth potential across regions, catering to different agricultural practices and sustainability efforts.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Agricultural Biologicals Market Key Players and Competitive Insights

The Agricultural Biologicals Market is characterized by a dynamic landscape where innovation and sustainability are at the forefront of agricultural practices. The competition within this market is increasingly driven by a growing emphasis on environmentally friendly and sustainable farming practices, leading to the development and adoption of biological solutions such as biopesticides, biofertilizers, and natural growth stimulants. Companies are leveraging advancements in biotechnology and R&D to create products that not only enhance crop yields but also appeal to environmentally conscious consumers and farmers.

This competitive environment necessitates that companies remain agile in their strategic initiatives, including collaborations, mergers, and acquisitions, to enhance their product offerings and improve market share while addressing the dynamic regulatory landscape and evolving market demands across different regions.Valent Biosciences has established a strong foothold in the Agricultural Biologicals Market by focusing on innovative biological solutions that promote sustainable agricultural practices. The company's strengths lie in its robust research and development commitment, producing a diverse range of biopesticides and soil health products that cater to various crops and pest management issues.

Valent Biosciences is known for its expertise in microbial and biochemical solutions, which not only enhance productivity but also align with trends towards sustainable agriculture. The company's extensive distribution network and strong relationships with key agricultural stakeholders allow it to effectively reach farmers across diverse markets. This level of market penetration showcases Valent Biosciences' capacity to respond quickly to market shifts and produce effective biological solutions that meet the needs of modern agriculture.Bayer, a key player in the Agricultural Biologicals Market, showcases a multifaceted presence through its extensive portfolio of products that includes innovative biopesticides and crop protection solutions.

The company leverages its significant investment in research and development to continually enhance its offerings, with a focus on delivering sustainable and effective tools for farmers worldwide. Bayer's strengths are further amplified by its robust market presence and strategic mergers and acquisitions that have expanded its capabilities in the agricultural biologicals domain. The company's commitment to sustainability is evident in its ongoing initiatives to reduce chemical inputs while improving crop health and yield, placing it in a strategic position to address the demand for sustainable agricultural solutions.

Bayer is also recognized for its collaborations with various stakeholders, including academic institutions and agricultural organizations, which bolster its innovation pipeline and enhance its competitive edge within the Agricultural Biologicals Market.

Key Companies in the Agricultural Biologicals Market Include

- Valent Biosciences

- Bayer

- Corteva Agriscience

- Syngenta

- Monsanto

- Biobest

- Dow AgroSciences

- Koppert Biological Systems

- Agrium

- BioWorks

- BASF

- Novozymes

- FMC Corporation

- UPL

- Stoller

Agricultural Biologicals Market Industry Developments

The Agricultural Biologicals Market is experiencing significant developments, particularly with companies like Valent Biosciences, Bayer, Corteva Agriscience, and Syngenta leading the way. Recent growth in market valuation has reflected an increasing focus on sustainable agricultural practices, which is prompting a shift from chemical-based solutions to biological alternatives. In July 2023, Bayer announced its collaborative efforts to enhance biocontrol solutions, aiming to address pest management sustainably. In August 2023, Corteva Agriscience unveiled new data on its microbial and plant health products, positioning itself as a key player in the market's growth.

Merger and acquisition activities have also marked the landscape, with Dow AgroSciences, a subsidiary of Dow Inc., acquiring BioWorks in September 2023 to expand its microbial portfolio. Over the past two years, from September 2021 to October 2023, companies have been investing heavily in Research and Development, fueling innovations in biological pest control and plant growth promotion technologies. The push for more environmental compliance has also catalyzed strategic partnerships, especially in regions where regulatory frameworks are promoting the use of biological solutions over chemical ones. These developments underscore the dynamic nature of the Agricultural Biologicals Market.

Agricultural Biologicals Market Segmentation Insights

-

Agricultural Biologicals Market Type Outlook

-

-

Biopesticides

-

Bio-Stimulants

-

Biofertilizers

-

Agricultural Biologicals Market Source Outlook

-

-

Microbials

-

Biochemicals

-

Others

-

Agricultural Biologicals Market Mode of Application Outlook

-

-

Foliar Sprays

-

Soil Treatment

-

Seed Treatment

-

Others

-

Agricultural Biologicals Market Crop Types Outlook

-

-

Cereals & Grains

-

Oilseeds & Pulses

-

Fruits & Vegetables

-

Others

-

Agricultural Biologicals Market Regional Outlook

-

-

North America

-

Europe

-

South America

-

Asia Pacific

-

Middle East and Africa

| Report Attribute/Metric |

Details |

| Market Size 2023 |

8.9(USD Billion) |

| Market Size 2024 |

9.83(USD Billion) |

| Market Size 2035 |

28.11(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

10.02% (2025 - 2035) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2025 - 2035 |

| Historical Data |

2019 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Valent Biosciences, Bayer, Corteva Agriscience, Syngenta, Monsanto, Biobest, Dow AgroSciences, Koppert Biological Systems, Agrium, BioWorks, BASF, Novozymes, FMC Corporation, UPL, Stoller |

| Segments Covered |

Type, Source, Mode of Application, Crop Types, Regional |

| Key Market Opportunities |

Sustainable farming practices adoption, Increased organic farming demand, Innovative biopesticide development, Government support for biological products, Advancements in microbial technologies |

| Key Market Dynamics |

Rising sustainable agriculture demand, Stringent environmental regulations, Increasing pest resistance, Advancements in microbial technology, Growing investment in R&D |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Agricultural Biologicals Market Highlights:

Frequently Asked Questions (FAQ):

The Agricultural Biologicals Market is expected to be valued at 9.83 USD Billion in 2024.

By 2035, the Agricultural Biologicals Market is projected to reach a value of 28.11 USD Billion.

The anticipated CAGR for the Agricultural Biologicals Market from 2025 to 2035 is 10.02%.

Biopesticides are projected to hold the largest market size, valued at 10.56 USD Billion in 2035.

The market size for Bio-Stimulants is expected to reach 3.5 USD Billion in 2024.

North America is anticipated to dominate the market with a value of 6.92 USD Billion by 2035.

The expected market size for South America in 2035 is projected to be 3.3 USD Billion.

Major players in the Agricultural Biologicals Market include Valent Biosciences, Bayer, Corteva Agriscience, Syngenta, and Monsanto.

The market value for Biofertilizers is expected to be 2.56 USD Billion in 2024.

The Middle East and Africa market segment is projected to grow to 2.01 USD Billion by 2035.