- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

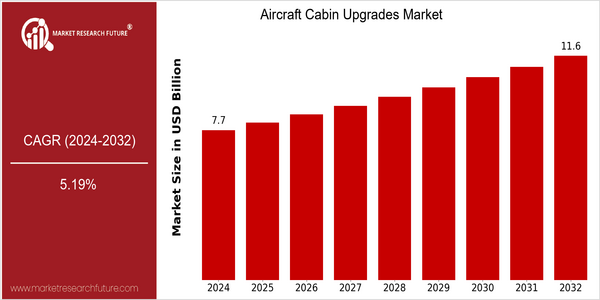

| Year | Value |

|---|---|

| 2024 | USD 7.738 Billion |

| 2032 | USD 11.6 Billion |

| CAGR (2024-2032) | 5.19 % |

Note – Market size depicts the revenue generated over the financial year

Aircraft cabin upgrade market is expected to reach $ 7.738 billion by 2024, and is projected to reach $ 11.6 billion by 2032. The compound annual growth rate (CAGR) of this market is 5.19 percent. The main reason for the growth of the market is the growing demand for a comfortable and luxurious air travel experience. Moreover, technological advancements in the field of cabin equipment, such as smart systems and improved materials, have also encouraged the investment in the cabin equipment market. The major players in the market, such as Boeing, Airbus and Zodiac Aerospace, are pursuing a strategic approach to this growth. This includes the development of cabin specialists and the emergence of a partnership between the aircraft manufacturer and the cabin specialist. The aim is to provide the aircraft with a tailor-made solution to meet the needs of the aircraft and passengers. In addition, the introduction of new products, such as seats with new designs and new entertainment systems, will play an important role in attracting new customers and increasing customer satisfaction. The market for aircraft cabin equipment is expected to grow significantly in the coming years.

Regional Market Size

Regional Deep Dive

The Aircraft Cabin Upgrades Market is experiencing a high growth rate across the globe, driven by the increasing passenger demands for comfort and luxury, and the efforts of the operators to enhance operational efficiency and brand differentiation. In North America, the market is characterized by a high demand for premium cabin experience, while in Europe, retrofitting initiatives are on the rise owing to the stringent regulatory environment. Asia-Pacific is a rapidly growing region, characterized by the growing middle class and the rising demand for air travel. The Middle East and Africa are focusing on luxury cabin retrofits to attract the upscale travelers, while Latin America is gradually modernizing its fleet to enhance its competitiveness.

Europe

- European airlines, including Lufthansa and Air France, are leading the way in sustainable cabin upgrades, focusing on eco-friendly materials and energy-efficient systems to align with the EU's Green Deal initiatives.

- The European Union's stringent noise and emissions regulations are pushing airlines to retrofit older aircraft with modern cabin designs that not only enhance passenger experience but also reduce environmental impact.

Asia Pacific

- The Asia-Pacific region is witnessing a boom in low-cost carriers, which are increasingly investing in cabin upgrades to differentiate themselves from competitors and attract more passengers.

- Major players like Singapore Airlines and Qantas are implementing innovative cabin designs and technology, such as mood lighting and advanced air filtration systems, to enhance passenger comfort and well-being.

Latin America

- Latin American airlines are modernizing their fleets with cabin upgrades to compete with international carriers, focusing on improving passenger comfort and service quality.

- Regulatory changes in countries like Brazil are encouraging airlines to invest in cabin enhancements, as the government aims to boost tourism and improve the overall travel infrastructure.

North America

- Airlines in North America, such as Delta and United, are investing heavily in cabin upgrades, including the introduction of lie-flat seats and enhanced in-flight entertainment systems to meet the demands of business travelers.

- The Federal Aviation Administration (FAA) has introduced new regulations aimed at improving passenger safety and comfort, which has prompted airlines to consider cabin upgrades as a means to comply with these standards.

Middle East And Africa

- Middle Eastern airlines, such as Emirates and Qatar Airways, are known for their luxurious cabin offerings, and they continue to set trends with innovative features like onboard lounges and shower spas.

- The region's focus on tourism and business travel is driving investments in cabin upgrades, with governments supporting initiatives to enhance the overall travel experience as part of their economic diversification strategies.

Did You Know?

“Did you know that the average passenger spends about 3 hours in the air per flight, making cabin comfort a critical factor for airlines looking to enhance customer satisfaction?” — International Air Transport Association (IATA)

Segmental Market Size

The Aircraft Cabin Upgrading Market is experiencing steady growth, driven by rising passenger expectations for comfort and enhanced in-flight experiences. The demand for cabin improvements is also driven by the growing focus on passenger satisfaction and the need to differentiate services in the increasingly competitive environment. Also, regulatory requirements for safety and compliance with the latest standards are pushing the industry to invest in cabin modernizations. Currently, the market is at a mature stage of development, with leading players like Airbus and Boeing driving innovation in the field of cabin improvements. North America and Europe are the leaders in cabin design and technology. The main applications of cabin modernizations are smart cabin systems, improved seating layouts, and enhanced in-flight entertainment. The trend toward sustainability, driven by government regulations and consumers’ preferences, is expected to accelerate market growth. In addition, the Internet of Things (IoT) for smart cabin management and lightweight materials for the seats are influencing the development of the cabin improving market, helping to meet the requirements for operational efficiency and comfort.

Future Outlook

Aircraft Cabin Upgrading Market is Expected to Grow Significantly from 2024 to 2032. From 7.73 billion to 11.6 billion, with a CAGR of 5.19%. The main reasons for this growth are the increased demand for a better passenger experience, the need for differentiation in the services offered by the various operators, and the ongoing emphasis on the sustainable development of the aviation industry. Also, as a result of the modernization of the fleet, the use of advanced cabin technology, such as improved seats, improved entertainment systems and improved materials, will increase, resulting in a higher penetration rate among both low-cost and full-service carriers. The development of technology will also play a key role in the future of the aircraft cabin upgrade market. Lightweight composite materials and sustainable materials will continue to develop, which will increase both the efficiency of operations and the comfort of passengers. The integration of smart technology, such as the Internet of Things, will also play a significant role in promoting the demand. Regulations, such as the reduction of carbon emissions and the improvement of passenger safety, will also have an impact on the cabin upgrade program, and will force the operators to adopt more sustainable and technologically advanced solutions. As a result, the cabin upgrade market will move towards a more premium product, and the operators will increasingly regard cabin upgrade as a strategic investment to increase customer loyalty and improve operating efficiency.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 7.3 Billion |

| Growth Rate | 6.00% (2023-2032) |

Aircraft Cabin Upgrades Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.