- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

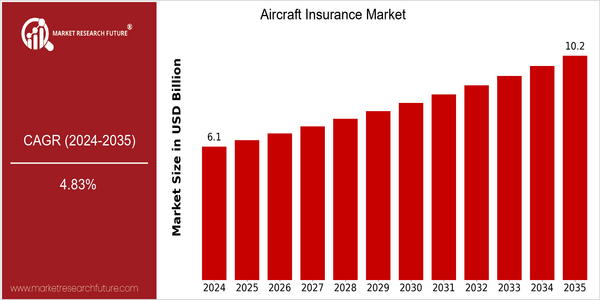

| Year | Value |

|---|---|

| 2024 | USD 6.07 Billion |

| 2035 | USD 10.2 Billion |

| CAGR (2025-2035) | 4.83 % |

Note – Market size depicts the revenue generated over the financial year

The aircraft insurance market is expected to grow significantly in the next few years, with the market value in 2024 expected to reach $ 6.07 billion, and $ 10.2 billion in 2035. The CAGR from 2025 to 2035 is 4.8%. The growing demand for air travel and the development of the aviation industry are driving the need for comprehensive insurance solutions that cover various risks associated with the operation of aircraft. The growing fleet of aircraft owned by both public and private operators, the complexity of managing risks in the air transport industry, and the need for insurance solutions will also drive the growth of the aircraft insurance market. The growth of the market is due to several factors, including the development of new aircraft and engines, which will increase the efficiency and safety of flights, and the growing awareness of risk management among the participants in the aviation industry. The need for compliance with international safety standards and regulatory requirements also forces the carriers to invest in more extensive insurance coverage. The market is highly competitive, and the leading players, such as Allianz, AIG, and Marsh, are constantly introducing new products and entering into strategic alliances to strengthen their positions in the market. These companies are also investing in the development of digital solutions to optimize the insurance process, which will also stimulate the growth of the market.

Regional Market Size

Regional Deep Dive

The aircraft insurance market is characterized by a complex interplay of regulations, technological developments and changing customer needs in different regions. In North America, the market is driven by a strong aviation industry with a large number of commercial and private aircraft. This has led to an increased demand for comprehensive insurance solutions. Europe is characterized by a variety of national regulations and an increasing focus on sustainability. The Asia-Pacific region is experiencing rapid growth, due to increasing air traffic and the construction of new airports. The Middle East and Africa are emerging markets with unique challenges and opportunities, especially with regard to regulatory frameworks and economic development. Latin America is still a developing market, but there is a steady increase in air traffic and insurance penetration, driven by economic growth and modernization of the aviation industry.

Europe

- The European Union's Green Deal is pushing for more sustainable aviation practices, leading to a rise in demand for insurance products that cover eco-friendly aircraft and operations.

- Regulatory changes in countries like the UK and Germany are creating a more competitive environment, encouraging insurers to innovate and offer tailored solutions to meet diverse customer needs.

Asia Pacific

- The rapid expansion of low-cost carriers in countries like India and Southeast Asia is driving the need for affordable and comprehensive aircraft insurance solutions, prompting local insurers to develop competitive products.

- Government initiatives in China to bolster the aviation sector are leading to increased investments in aircraft insurance, with companies like PICC and China Pacific Insurance playing pivotal roles.

Latin America

- The growth of air travel in Brazil and Mexico is prompting local insurers to enhance their offerings, with companies like MAPFRE leading the way in developing tailored aircraft insurance products.

- Economic recovery post-pandemic is driving increased investments in aviation, which is expected to result in a higher uptake of aircraft insurance across the region.

North America

- The Federal Aviation Administration (FAA) has introduced new regulations aimed at enhancing safety standards, which in turn is expected to increase the demand for specialized aircraft insurance products.

- Recent technological innovations, such as the use of drones and advanced analytics in risk assessment, are reshaping the insurance landscape, prompting companies like AIG and Allianz to adapt their offerings.

Middle East And Africa

- The UAE's investment in aviation infrastructure, including the expansion of Dubai International Airport, is expected to significantly boost the demand for aircraft insurance in the region.

- Regulatory bodies in Africa are increasingly focusing on harmonizing aviation regulations, which could lead to a more stable insurance market and attract foreign investment.

Did You Know?

“Did you know that the global aircraft insurance market is influenced by over 200 different regulatory bodies worldwide, each with its own set of rules and requirements?” — Aviation Insurance Association

Segmental Market Size

The aircraft insurance market is currently undergoing a steady increase, prompted by the growing demand for air travel and the expansion of the aviation industry. The main growth drivers are the increasing regulatory requirements for safety and the rising need for comprehensive risk management solutions from both commercial and private operators. New aircraft technology also requires a new generation of insurance products to cover the special risks associated with these aircraft. Currently, the market is in a period of maturity, with companies such as Allianz and AIG leading the way in the provision of new and innovative insurance solutions. In terms of application, the main areas of application are insurance cover for commercial air operators, freight transport, and private jets. In each of these areas, special policies are available to cover liability, hull damage, and passenger risks. The most important trends driving the market’s development are the growing emphasis on sustainable aviation, which is leading to the development of new green policies, and the digital transformation, which is bringing about a more accurate assessment of risk and the faster handling of claims using advanced data analysis and artificial intelligence.

Future Outlook

The aircraft insurance market is expected to grow significantly from 2024 to 2035, with an estimated CAGR of 4.83%. This growth is supported by the increase in air traffic, which is expected to double by 2035, according to the International Air Transport Association. The need for comprehensive insurance coverage is therefore critical to the commercial and private aviation industry, which will further increase the penetration of the market. The emergence of new technology and regulatory changes will also shape the aircraft insurance market. Artificial intelligence and big data are expected to enhance the efficiency and accuracy of risk assessment and underwriting, resulting in more specialized insurance products. Furthermore, the implementation of stricter safety regulations and environmental policies will force insurers to adapt their product offerings, especially in terms of climate risk management and sustainability. As a result, the market will likely see a shift towards more innovative products such as pay-as-you-fly schemes and coverage for new aircraft technology, such as electric and driverless aircraft.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 14.59 Billion |

| Growth Rate | 2.42% (2024-2032) |

Aircraft Insurance Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.