Alcohol Packaging Market Summary

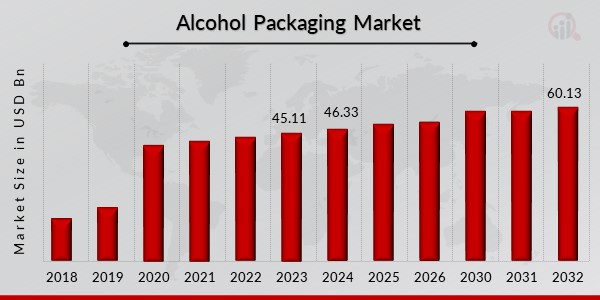

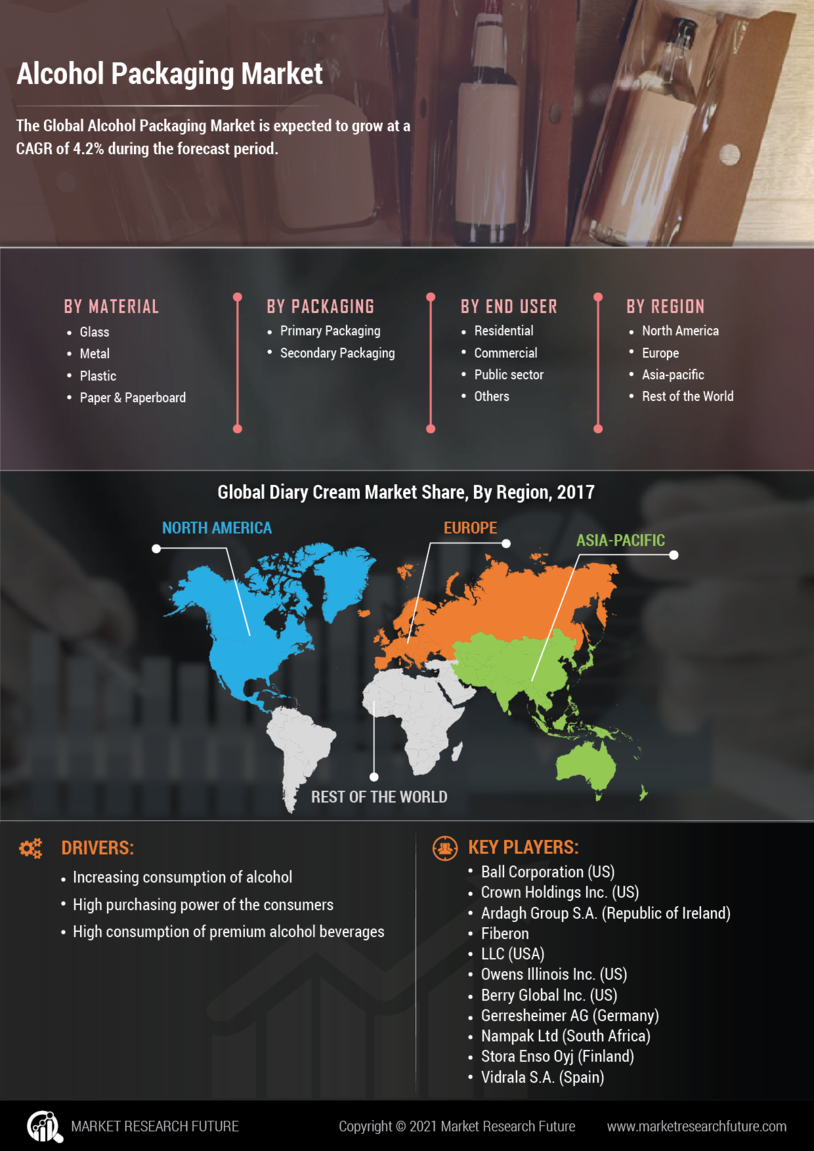

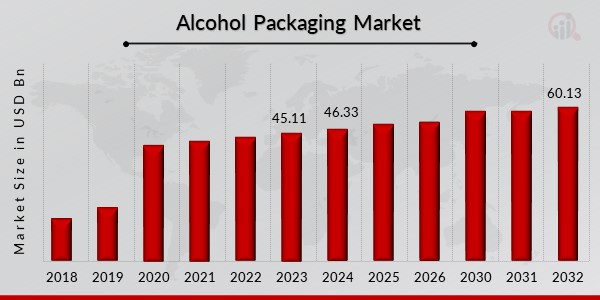

As per Market Research Future Analysis, the Alcohol Packaging Market was valued at USD 45.11 Billion in 2023 and is projected to grow to USD 60.13 Billion by 2032, with a CAGR of 3.30% from 2024 to 2032. The market is driven by increasing demand for sustainable packaging and convenience, alongside the impact of COVID-19 on supply chains. Major regions affected include Europe and Asia-Pacific, with companies innovating eco-friendly solutions. Recent developments include Diageo's partnership with ecoSPIRITS for circular packaging and the launch of sustainable packaging initiatives in the wine industry. The market is segmented by material, packaging, application, and region, with North America holding the largest share due to high urbanization and disposable income.

Key Market Trends & Highlights

The Alcohol Packaging Market is witnessing significant trends driven by sustainability and innovation.

- Market Size in 2023: USD 45.11 Billion.

- Projected Market Size by 2032: USD 60.13 Billion.

- CAGR from 2024 to 2032: 3.30%.

- North America holds the largest market share due to high urbanization and disposable income.

Market Size & Forecast

2023 Market Size: USD 45.11 Billion

2024 Market Size: USD 46.33 Billion

2032 Market Size: USD 60.13 Billion

CAGR (2024-2032): 3.30%

Major Players

Vidrala S.A. (Spain), Stora Enso Oyj (Finland), Nampak Ltd. (South Africa), Gerresheimer AG (Germany), Berry Global, Inc. (US), Ball Corporation (US), Owens Illinois Inc. (US), Fiberon LLC (USA), Ardagh Group S.A. (Republic of Ireland), Crown Holdings, Inc. (US)

Alcohol Packaging Market COVID-19 Analysis

The outbreak of the COVID-19 pandemic has had a huge impact on the food supply chain in all regions. The Alcohol Packaging market participating regions include North America, Europe, Asia-Pacific, South America, and others like the rest of the world. Due to the spread of COVID-19, there has been a growth in the number of death cases and the introduction of long-term health impacts. This has further, increased in the government imposing severe lockdown regulations that are impacting all aspects of the economy.

Governments around the world have developed rules and policies for responding to the various impacts caused by COVID-19 for avoiding situations like supply chain disruptions, higher raw material prices, and others like the severe economic fallout for employees. Europe and the Asia Pacific are emerging as some of the major regions that are significantly impacted by the outbreak of the COVID-19 scenario.

This is because of the rising number of cases that have been recorded in the regions, especially in the countries like Spain, Italy, France, Germany in Europe, and others like Japan, China, and South Korea in the Asia Pacific.

Companies that are a part of different countries are coming up with innovative technologies that are friendly to environmental concerns and further, protect alcohol from any kind of contamination with germs.In November 2023, Diageo—the manufacturer of Johnnie Walker Whisky, Don Julio Tequila, and Guinness—partnered up with ecoSPIRITS to pilot circular packaging across Gordon’s Gin (initially), Captain Morgan Rum and Smirnoff Vodka brands in their first 18 markets. This partnership follows Diageo’s successful ecoSPIRITS program in Indonesia.In November 2018, Kronesrevised its module HE for filling beer.

For example, numerous new technological features and design enhancements ensure that the filling system offers several features, including safety concerns of users/operators friendly or space-saving hygiene purposes.In February 2018, Amcor Flexibles Kreuzlingen AGapplied for apatent on flexible multilayer packaging film with ultra-high barrier properties.

This product is expected to increase the range of products, especially in food and beverages.In November 2023, Mother of Pearl Vodka of the Sea, an Australian beverage company launched their grape-based vodka in paper bottles made by Frugalpac, a sustainable packaging maker in UK.The Portman Group in the United Kingdom introduced an Alcohol Alternatives Guidance in January 2024 as a responsible marketing and sales initiative for alcohol alternatives with an ABV of not less than 0.5%.Carlsberg Marston's Brewing Company won the Grocer’s New Product and Packaging Awards 2023 for its Wainwright Ale which is a beer wholly malted from English grains and inspired by Alfred Wainwright in November 2023.

Competitive Landscape

List of the most prominent major key companies in the alcohol packaging market all across the globe are mentioned below:

- Nampak Ltd. (South Africa)

- Gerresheimer AG (Germany)

- Ardagh Group S.A. (Republic of Ireland)

- Crown Holdings, Inc. (US)

These major key players adopt various strategies to endure their market position in the alcohol packaging market share in the global market by going for mergers, and acquisitions, by collaborating, establishing a partnership, setting up a new joint venture, developing a new product line, innovation in the existing product, developing a unique production process, and many others to expand their customer base in the untapped market of the alcohol packaging market all across the globe.

Market Dynamics

Drivers

There has been an increase in the global population followed by the rising disposable income in most of the developing economies that are creating new avenues for packaged beverages. According to the information that has been circulated by the Brewers Association, the total value of the beer market was approximately USD 94.1 billion in 2020. However, the total craft beer market was estimated at a market value worth USD 22.2 billion. The alcohol per capita (15+) consumption in liters, as the measurement figure was recorded at 8.6 liters in 2010.

This amount had increased to 8.8 liters in 2016, according to the information circulated by the WHO.

Restraints

Packaging waste is recognized to cause harm to the ecosystem as it takes decades to decompose. Global market governments across the globe that are a part of the alcohol packaging market size are addressing the issue by imposing strict norms and laws that the alcohol packaging industry is subjected to follow. For instance, the governments in the European countries are taking various steps to deal with packaging waste and recycling issues.

Technology Analysis

The has been an increase in the awareness of environmental safety among consumers followed by the rising adoption of eco-friendly products that provide manufacturers of beverage packing products with immense opportunities. According to a study that has been conducted by the National Retail Federation, stats suggest that 69% of participants in the North American region are ready to pay a premium price for recycled products. However, 80% of participants wish to know the origin of products they buy.

Market Segmentation

The alcohol packaging market has been bifurcated worldwide based on the material, packaging, application, and region.

Based on the Material

The market has been divided all across the globe based on the material into paper and paperboard material, plastic material, metal material, and glass material. Owing to the presence of various properties like chemical inertness, the flexibility of shape, and water-resistance and hence it holds the largest alcohol packaging market share.

Based on the Packaging

The alcohol packaging industry has been divided all across the globe based on the packaging into primary and secondary packaging. Primary packaging is further bifurcated into pouches, growlers, liquid brick cartons, bag-in-box, cans, and bottles. The secondary packaging is further bifurcated into folding cartons, boxes, and many others.

Based on the Application

The alcohol packaging market has been divided all across the globe based on the application into spirits, wine, beer, and others. Owing to the increasing consumption of beer among the masses, the largest market share is held by the beer packaging segment.

Based on the Region

The market has been bifurcated all across the globe based on the region into the North American region, Asia-Pacific region, European region, Latin American region, and the Middle East and African region.

Regional Analysis

The alcohol packaging market has been divided all across the region into the North American region, Asia-Pacific region, European region, Latin American region, and the Middle East and African region. The largest market share in the global market is held by the North American region owing to the presence of countries like the US, Canada, and Mexico that have high urbanization rates, the standard of living, growing disposable income, and hence creates more demand in this region. The presence of various major key players is another factor that drives the market demand.

The second-largest market share in the global market is held by the European region owing to the presence of well-established technologically advanced infrastructure that requires more demand advanced packaging and hence creates more growth opportunities in this region. The increasing disposable income is another factor that fuels more market demand.

The third-largest market share in the global market is held by the Asia-Pacific region owing to the presence of highly populous countries like China, India along with Japan, South Korea, and many others that drive the market demand in this region. Moreover, increasing commercial and residential growth is another factor that drives the market demand.

The Middle East and African region along with the Latin American region show the least market share due to the presence of low infrastructure in both these regions. Low per capita income is another factor that restrains the market growth in these regions.

Recent Developments

November 2023: The Aluminum Packaging Coalition (APC) released a report that found that aluminum cans are the most sustainable beverage packaging option. The report found that aluminum cans have a lower carbon footprint than glass bottles and plastic bottles and that they are more easily recycled.

December 2023: The Wine Institute, a trade association representing California wineries, announced that it was launching a new initiative to promote the use of sustainable packaging in the wine industry. The initiative includes a certification program for wineries that use sustainable packaging practices.

In October 2023,

Stoelzle Glass Group, the world leader in high-quality glass bottles for spirits and liquors, presented its newest collection- the Signature Collection. This stunning line debuting at Luxepack Monaco features ten uniquely designed glass bottles.

In March 2023,

Ardagh Group-Glass - North America, a division of Ardagh Group, collaborated with Bragg Live Food Products to introduce a 16-ounce glass bottle for their line of apple cider vinegar beverages.

In December 2023

, a female-founded NA craft cocktail brand, Tilden, launched new bottles of Tandem and Lacewing flavors, which are contained in 200 ml bottles. These multi-serve bottles are made to accentuate bar carts, beverage menus and social events but without any adaptogens, additives, sugars or preservatives.

Report Overview

This global alcohol packaging market research report includes the following components mentioned below:

This global alcohol packaging market research report contains characteristics that drive the growth of the alcohol packaging market in the global market and the factors that restrict its growth in the global market. The technical analysis worldwide during the forecasted period is mentioned. The impact of COVID 19 on the alcohol packaging market in the global market is mentioned. The future growth rate in the alcohol packaging market during the review period is estimated and mentioned.

Intended Audience

Regulatory organizations, alcohol packaging equipment manufacturers, traders, distributors, and dealers, alcohol packaging manufacturers, suppliers, distributors, and retailers, distribution vendors, research institutes, government associations, and end-users.

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 45.11 Billion |

| Market Size 2024 |

USD 46.33 Billion |

| Market Size 2032 |

USD 60.13 Billion |

| Compound Annual Growth Rate (CAGR) |

3.30% (2024-2032) |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Historical Data |

2018 & 2020 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Application, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and, Turkey, GCC, Brazil, and Argentina |

| Key Companies Profiled |

H.B. Fuller, Henkel, Bostik, Lubrizol, BASF, DSM, Hunstman, 3M, Eastman, Evonik, Ashland, Wacker Chemicals, Dow Chemical Company, Morchem, Inktech, Mitsui Chemicals, Sika, ExxonMobil Chemical |

| Key Market Opportunities |

Growing organic growth strategies by major key players |

| Key Market Dynamics |

Increasing demand for flexible adhesive in packaging industry |

Alcohol Packaging Market Highlights:

Frequently Asked Questions (FAQ):

Owens Illinois Inc. (US), Crown Holdings, Inc. (US), Ball Corporation (US), Fiberon, LLC (USA), Ardagh Group S.A. (Republic of Ireland), are investing heavily in the global alcohol packaging market.

The alcohol packaging market is anticipated to grow at a higher CAGR of 3.30% in the global market during the forecasted period.

North America is to score the highest CAGR in the forecast period.

Surge in the disposable income of consumers, as well as, high consumption of alcohol in the region are the prime factor leading global alcohol packaging market.

The three main segments of global alcohol packaging market are material, packaging, and application.