- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

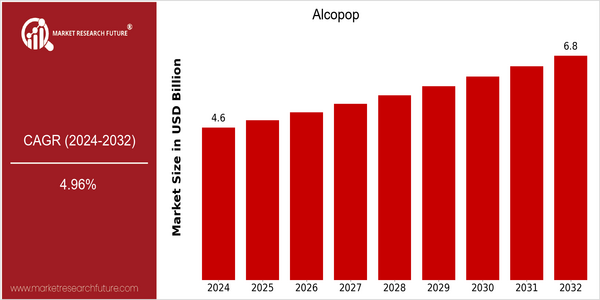

| Year | Value |

|---|---|

| 2024 | USD 4.62 Billion |

| 2032 | USD 6.81 Billion |

| CAGR (2024-2032) | 4.96 % |

Note – Market size depicts the revenue generated over the financial year

The world alcopop market is projected to grow steadily, from a value of $ 4.62 billion in 2024 to $ 6.81 billion in 2032. The CAGR is 4.9% for the period. The increasing popularity of flavoured alcoholic beverages, especially among the younger generation, is a major factor driving the growth. Alcopops, which are characterized by their sweet taste and brightly coloured packaging, are particularly attractive to a population seeking an easier introduction to the alcoholic beverages market. In addition, several factors are driving the growth of the alcopop market, such as the development of new product formulations and the strategic marketing of these beverages. Companies are also focusing on developing low-alcohol and ready-to-drink beverages to cater to the health-conscious consumers. Also, the growth of e-commerce platforms has facilitated the availability of these products, thereby increasing their sales. Diageo, Anheuser-Busch InBev, and Bacardi are the major players in the market. They are constantly launching new products to expand their share of the market. Recent product launches, such as those based on the collaboration of well-known brands with alcopops, have attracted the interest of consumers, thereby contributing to the growth of the alcopop market.

Regional Market Size

Regional Deep Dive

Alcopop is a brand name for a wide range of flavoured alcoholic drinks that are especially popular with younger consumers looking for easy-drinking, sweet, alcoholic beverages. In North America, the market is being driven by a growing trend towards ready-to-drink products, and there is a noticeable rise in popularity of craft and artisanal brands. In Europe, the market is influenced by a long tradition of flavoured spirits and a strict regulatory framework that controls alcohol production and marketing. The Asia-Pacific region is a rapidly growing market, with changing preferences and growing disposable income. In the Middle East and Africa, the market is constrained by cultural and religious traditions. In Latin America, the market is growing rapidly, with local brands and new flavours gaining popularity.

Europe

- The European market has seen a surge in low-alcohol and no-alcohol alcopops, driven by health-conscious consumers; brands like BrewDog have launched non-alcoholic versions to cater to this trend.

- The European Union's stringent regulations on alcohol advertising have led companies to adopt more creative marketing strategies, focusing on social media and influencer partnerships to reach their target audience.

Asia Pacific

- In countries like Japan and Australia, the introduction of unique local flavors, such as yuzu and native fruits, has attracted a younger demographic, enhancing the appeal of alcopops.

- The increasing popularity of e-commerce platforms in the region has allowed alcopop brands to reach consumers directly, bypassing traditional retail channels and expanding their market presence.

Latin America

- The Latin American market is characterized by a growing trend of flavored spirits, with brands like Cerveza Patagonia introducing innovative alcopop flavors that appeal to local consumers.

- Regulatory changes in countries like Brazil have made it easier for new entrants to launch alcopop products, fostering a competitive environment that encourages innovation and variety.

North America

- The rise of hard seltzers has significantly impacted the Alcopop market, with brands like White Claw and Truly leading the trend, prompting traditional alcopop brands to innovate and diversify their offerings.

- Regulatory changes in states like California and New York have allowed for more flexible marketing strategies for alcopops, enabling brands to target younger demographics more effectively.

Middle East And Africa

- In the Middle East, the alcopop market is heavily influenced by cultural norms, with brands like Al Ain Water introducing non-alcoholic alternatives to cater to the region's predominantly Muslim population.

- The African market is witnessing growth in local brands that incorporate indigenous flavors, with companies like Namibia Breweries launching products that resonate with local tastes and preferences.

Did You Know?

“Did you know that alcopops were originally developed in the 1990s as a way to attract younger drinkers to the alcohol market, and they have since evolved into a multi-billion dollar segment?” — Market Research Reports

Segmental Market Size

The alcopops segment is a significant player in the beverage market. It is characterized by its stable growth, which is mainly due to changing consumer preferences towards flavoured alcoholic beverages. In addition, the growing popularity of ready-to-drink (RTD) beverages among younger consumers, who are looking for variety and convenience, as well as the development of new marketing strategies, which are based on lifestyle trends, are contributing to the growth of this segment. Moreover, favourable regulatory policies in many regions are enhancing the potential of the segment. The alcopop segment is currently in its mature stage of development, with Smirnoff Ice and Mike’s Hard Lemonade as the main players in North America and Europe. These beverages are mainly used at social events, festivals and during casual dining. The growing focus on health and the trend towards more sustainable products are driving the growth of the alcopop segment, with the development of low-calorie and organic formulations. Also, technological developments, such as advanced flavouring techniques and more sustainable packaging, are contributing to the evolution of this segment and ensuring its relevance in a highly competitive landscape.

Future Outlook

Alcopop will grow steadily from 2024 to 2032, when it will rise from $462,000 to $681,000, a compound annual growth rate of 4.96%. It is a trend that is driven by the increasing demand for alcoholic beverages with a taste of fruit, especially among younger people, who are looking for new and convenient drinking options. As the market matures, we expect penetration rates to increase, so that alcopops will account for an estimated 15% of the alcoholic beverage market in 2032, compared to about 10% in 2024. This will be driven by the changing preferences of consumers and the continued trend towards premiumization in the beverage industry. In particular, we expect that innovations in production and packaging will enhance product offerings, making alcopops more appealing to health-conscious consumers. In particular, innovations such as low-calorie formulas and the use of natural ingredients are expected to appeal to the market's target audience. Furthermore, we expect regulatory changes in different regions to support the expansion of the market, as governments become more aware of the potential for taxation of alcoholic beverages with a taste of fruit. The rise of e-commerce and the development of direct-to-consumer sales channels will also support market growth, as these allow brands to reach a wider audience and quickly respond to changes in consumer preferences. The market for alcopops will continue to grow, driven by a combination of technological developments and changing consumer behavior.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 4.1 Billion |

| Market Size Value In 2023 | USD 4.37 Billion |

| Growth Rate | 5.80% (2023-2032) |

Alcopop Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.