- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

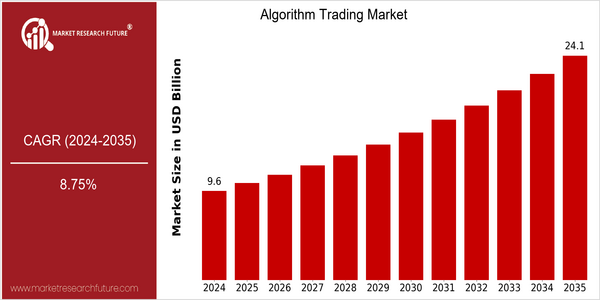

Algorithm Trading Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 9.58 Billion |

| 2035 | USD 24.1 Billion |

| CAGR (2025-2035) | 8.75 % |

Note – Market size depicts the revenue generated over the financial year

The market for algo-trading is expected to grow considerably, from $9.5 billion in 2024 to $ 24.1 billion in 2035. Its annual growth rate, based on a CAGR of 8.75% from 2025 to 2035, is high, indicating a strong demand for financial services. This upward trend is due to the growing complexity of financial markets and the need for speed and efficiency in trading. In the era of technological competition, when all market players want to use the latest developments to gain a competitive advantage, algo-trading has become an essential tool for institutional investors and hedge funds. The growth of the market for algo-trading is due to several factors. Big data, machine learning and artificial intelligence are increasingly used by traders to develop more sophisticated strategies for analyzing market data in real time. The development of cloud computing and the growth of high-frequency trading strategies are also driving the growth of the market. As for the main players in the market, such as Bloomberg, Thomson Reuters and Interactive Brokers, they are investing in the development of new tools and establishing strategic alliances in order to improve their algo-trading services. These developments not only improve the efficiency of trading but also offer their clients advanced tools to help them navigate the constantly changing financial landscape.

Regional Deep Dive

The Algorithmic Trading Market is experiencing strong growth in various regions of the world, driven by technological advancements, rising market volatility and the demand for more efficient trading strategies. North America has a high concentration of financial institutions and technology companies, which stimulates innovation and competition. Europe is experiencing a regulatory environment which aims to improve transparency and protect the interests of investors. The Asia-Pacific region is rapidly adopting algorithmic trading, driven by the growth of equities and the increasing participation of retail investors. Middle East and Africa are gradually adopting algorithmic trading, supported by government initiatives to modernize financial markets. In Latin America, interest in algorithmic solutions is growing as the local stock exchanges improve their technological infrastructure.

North America

- The SEC has proposed new rules to increase transparency in the use of such programs, and to restore confidence in the markets.

- Goldman Sachs and JP Morgan Chase have invested heavily in these trading systems.

- The development of fintechs in the region is promoting competition and the development of trading technology. QuantConnect and TradeAlgo are two companies that are gaining a lot of traction.

Europe

- Consequently, the Markets in Financial Instruments Directive II, or MiFID II, has imposed stricter regulations on the use of this method of trading, and has required greater accountability and transparency from trading firms.

- Machine-learning methods are being used by banks such as UBS and Deutsche Bank to optimize their trading strategies.

- In London the Stock Exchange has taken steps to encourage the use of these devices by introducing new markets and by making changes to the technology of the exchange in order to make it more receptive to high-frequency trading.

Asia-Pacific

- In countries like Japan and Australia, the rapid development of the exchange market is accelerating the use of algorithms, and companies are using them more and more to manage risks.

- Regulations in Asia, such as those of the Monetary Authority of Singapore, have been actively encouraging the use of these new methods of trading in order to increase market efficiency and to encourage foreign investment.

- The technological development and the increase in the number of investors have been taken advantage of by companies like Nomura and Macquarie.

MEA

- The Dubai Financial Market has launched a program to encourage the use of the algorithmic trading system, aiming to modernize the market and attract foreign investors.

- The regulatory authorities in South Africa are working on a framework to facilitate the introduction of this new form of trading. It is expected that this will enhance the efficiency and the depth of the market.

- It is with the development of the technology that the local firms are beginning to collaborate with the technology suppliers to develop the algo-trading solutions, which is a sign of the growing awareness of the advantages of automation.

Latin America

- B3 is enhancing its technological capacity to support the use of automatic trading systems, and aims to improve market access for retail investors.

- In Mexico, the regulatory framework has changed, creating a more favorable environment for algorithmic trading, encouraging local firms to adopt the most advanced trading technology.

- The development of fintech in the region is also boosting the use of algo-trading, with a number of new firms developing trading platforms that are easier for retail investors to use.

Did You Know?

“Almost seventy per cent of the turnover in the American stock exchanges is now due to the operations of the algorithms, which clearly indicate the hegemony of the new order.” — TABB Group, 2023

Segmental Market Size

The market for the development of trading applications is currently undergoing a phase of accelerated growth, resulting from the growing demand for these solutions across the various financial sectors. The need for a more efficient trading method, and the need to process large amounts of real-time data, which is incompatible with traditional trading methods, are the main drivers of this demand. Also, the regulatory pressure to promote greater transparency and risk management in trading practices is encouraging the use of algorithmic trading strategies.

In the current market, it is the turn of the major banks, such as Goldman Sachs and JP Morgan, to adopt advanced trading systems. High-frequency trading, portfolio management and market-making are the main applications. These applications rely on the use of algorithms to execute the orders at the best price. Artificial intelligence and machine learning are the latest trends which are to bring further innovations in this field and which will allow more complex trading strategies. Cloud computing and big data are also driving the evolution of this type of trading, enabling it to scale up and become more efficient.

Future Outlook

From 2024 to 2035, the global market for algorithmic trading is expected to grow at a CAGR of 8.77%. This growth is driven by the increased use of this type of strategy in different asset classes, which is due to the need for greater trading efficiency, lower transaction costs and increased market depth. The use of technology by both financial institutions and private investors is increasing the penetration of algorithmic trading. By 2035, it is expected that more than 70% of trades on major stock markets will be executed through algorithms, up from an estimated 50% in 2024.

Machine learning, artificial intelligence and big data are the latest technological trends that are expected to drive the growth of the market. These technologies enable more complex data analysis and more accurate prediction, which helps in taking informed decisions in real time. Regulations are evolving to accommodate the rise of algo-trading. The regulatory framework is focusing on ensuring market integrity and transparency. The emergence of decentralised finance and the growing use of blockchain technology will also shape the market for algo-trading, presenting opportunities and challenges for market participants. These changes will continue to shape the market, and as it matures, those involved will need to adapt to stay ahead of the competition and to take advantage of the growth potential.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 14.4 Billion |

| Market Size Value In 2023 | USD 16.1 BillionMarket Billion |

| Growth Rate | 11.9% (2023-2032)Base Year2022Market Forecast Period2023-2032Historical Data2019- 2022Market Forecast UnitsValue (USD Billion)Report CoverageRevenue Forecast, Competitive Landscape, Growth Factors, and TrendsSegments CoveredComponent, Deployment, Type, Type of Trader, and Organization SizeGeographies CoveredEurope, North America, Asia-Pacific, Middle East & Africa, and South AmericaCountries CoveredThomson Reuters (US) 63 moons (India) InfoReach (US) Argo SE (US) MetaQuotes Software (Cyprus) Automated Trading SoftTech (India) Tethys (US) Trading Technologies (US) trade (India) Tata Consulting Services (India) Vela (US) Virtu Financial (US) Symphony Fintech (India) Kuberre Systems (US) iRageCapital (India) Software AG (Germany) QuantCore Capital Management (China) ALGOTRADES - Automated Algorithmic Trading System (US).Key Market OpportunitiesRapid Adoption of AI in Financial Services.Key Market DriversIt is believed that the rise in the use of automated trading software. |

Algorithm Trading Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.