- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

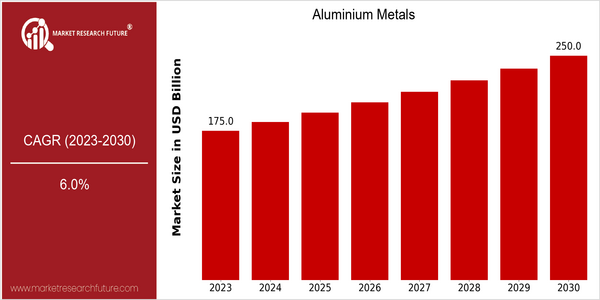

| Year | Value |

|---|---|

| 2023 | USD 175.0 Billion |

| 2030 | USD 250.0 Billion |

| CAGR (2023-2030) | 6.0 % |

Note – Market size depicts the revenue generated over the financial year

The global aluminium metals market is currently valued at approximately USD 175.0 billion in 2023 and is projected to reach USD 250.0 billion by 2030, reflecting a robust compound annual growth rate (CAGR) of 6.0% over the forecast period. This growth trajectory indicates a strong demand for aluminium across various sectors, driven by its lightweight properties, corrosion resistance, and recyclability, which make it an ideal material for applications in automotive, aerospace, construction, and packaging industries. Several factors are propelling this market expansion, including the increasing adoption of aluminium in electric vehicles (EVs) and renewable energy applications, where its lightweight nature contributes to improved energy efficiency. Technological advancements in aluminium production and recycling processes are also enhancing the material's sustainability profile, further attracting investment. Key players in the market, such as Alcoa Corporation, Rio Tinto, and Norsk Hydro, are actively pursuing strategic initiatives, including partnerships and investments in innovative technologies, to bolster their market positions and meet the rising demand for aluminium products.

Regional Market Size

Regional Deep Dive

The Aluminium Metals Market is characterized by a robust demand across various sectors, including automotive, construction, and packaging, driven by the lightweight and corrosion-resistant properties of aluminium. In North America, the market is bolstered by a strong manufacturing base and increasing investments in infrastructure projects. Europe showcases a commitment to sustainability, with a focus on recycling and circular economy initiatives, while Asia-Pacific is witnessing rapid industrialization and urbanization, leading to heightened demand for aluminium products. The Middle East and Africa are experiencing growth due to rising construction activities and government initiatives aimed at diversifying economies. Latin America, while still developing, is seeing increased interest in aluminium for renewable energy applications and automotive manufacturing.

Europe

- The European Union has implemented stringent regulations aimed at reducing carbon emissions, which is driving the demand for low-carbon aluminium production methods, with companies like Hydro and Rusal investing in green technologies.

- The European Aluminium Association is actively promoting the recycling of aluminium, which is expected to significantly increase the availability of recycled aluminium in the market, thereby reducing dependency on primary aluminium production.

Asia Pacific

- China remains the largest producer and consumer of aluminium, with state-owned enterprises like China Hongqiao Group leading the market; recent government policies are encouraging the use of aluminium in electric vehicles to support the country's green energy goals.

- India is witnessing a surge in aluminium demand due to its booming construction and automotive sectors, with companies like Hindalco Industries expanding their production capacities to meet this growing need.

Latin America

- Brazil is emerging as a significant player in the aluminium market, with companies like Companhia Brasileira de Alumínio (CBA) expanding their operations to cater to both domestic and export markets, particularly in the automotive sector.

- Government programs aimed at promoting renewable energy are driving the demand for aluminium in solar panel manufacturing, with several projects underway to increase local production capabilities.

North America

- The U.S. government has introduced initiatives to promote domestic aluminium production, including tariffs on imported aluminium to protect local manufacturers, which is expected to enhance the competitiveness of U.S. aluminium producers like Alcoa Corporation.

- Innovations in aluminium alloys and manufacturing processes are being spearheaded by companies such as Novelis, which is focusing on producing high-recycled content aluminium for automotive applications, aligning with the growing trend towards sustainability.

Middle East And Africa

- The UAE is investing heavily in aluminium production, with Emirates Global Aluminium (EGA) being a key player; the company is focusing on expanding its production capabilities and enhancing sustainability practices.

- Saudi Arabia's Vision 2030 initiative is promoting diversification away from oil, leading to increased investments in the aluminium sector, particularly in downstream applications such as automotive and construction.

Did You Know?

“Aluminium is the most recycled metal in the world, with over 75% of all aluminium ever produced still in use today, making it a key player in the circular economy.” — International Aluminium Institute

Segmental Market Size

The Aluminium Metals Market is currently experiencing stable growth, driven by its essential role in various industries such as automotive, aerospace, and construction. Key factors propelling demand include the increasing focus on lightweight materials to enhance fuel efficiency in vehicles and the rising adoption of aluminium in sustainable building practices due to its recyclability. Regulatory policies promoting energy efficiency and emissions reduction further bolster this segment's relevance in the market. Currently, the adoption of aluminium in manufacturing processes is in a mature stage, with companies like Alcoa and Rio Tinto leading the way in innovative applications. Notable regions such as North America and Europe are at the forefront, implementing advanced technologies in aluminium production and recycling. Primary applications include automotive components, packaging materials, and structural elements in buildings. Trends such as the push for sustainability and government mandates on emissions are accelerating growth, while technologies like advanced alloy development and automated manufacturing processes are shaping the segment's evolution.

Future Outlook

The Aluminium Metals market is poised for significant growth from 2023 to 2030, with a projected market value increase from $175.0 billion to $250.0 billion, reflecting a robust compound annual growth rate (CAGR) of 6.0%. This growth trajectory is underpinned by the increasing demand for lightweight materials across various industries, particularly in automotive and aerospace sectors, where aluminium's strength-to-weight ratio is highly valued. Additionally, the construction industry is expected to drive demand as sustainable building practices gain traction, with aluminium being a preferred choice due to its recyclability and energy efficiency. By 2030, the penetration of aluminium in these sectors is anticipated to rise significantly, with usage rates potentially exceeding 30% in automotive applications alone, as manufacturers seek to enhance fuel efficiency and reduce emissions in compliance with stringent regulations. Key technological advancements, such as the development of new alloys and improved recycling processes, are expected to further bolster the market. Innovations in manufacturing techniques, including additive manufacturing and advanced casting methods, will enhance the performance characteristics of aluminium products, making them more appealing to end-users. Policy drivers, particularly those aimed at reducing carbon footprints and promoting sustainable materials, will also play a crucial role in shaping the market landscape. As governments worldwide implement stricter environmental regulations, the aluminium industry is likely to benefit from increased investments in green technologies and recycling initiatives, positioning it as a cornerstone of the circular economy. Overall, the Aluminium Metals market is set for a dynamic evolution, driven by a confluence of demand, innovation, and regulatory support.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 150 Billion |

| Market Size Value In 2023 | USD 175 Billion |

| Growth Rate | 6.00% (2023-2030) |

Aluminium Metals Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.