Amorphous Polyethylene Terephthalate Size

Amorphous Polyethylene Terephthalate Market Growth Projections and Opportunities

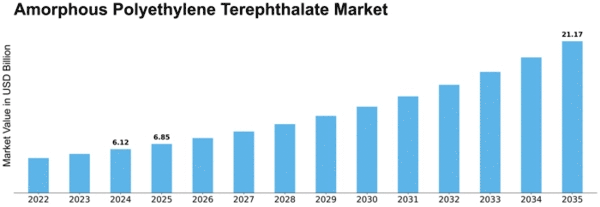

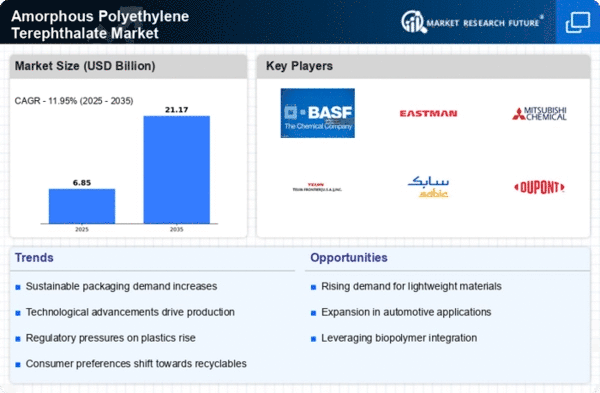

The Amorphous Polyethylene Terephthalate (APET) market is influenced by a myriad of factors that collectively shape its dynamics. One of the primary drivers is the increasing demand for sustainable packaging solutions. With growing environmental awareness, consumers and industries alike are seeking alternatives that reduce the ecological footprint. APET, being recyclable and possessing favorable barrier properties, has gained traction as a preferred material for packaging applications. Amorphous polyethylene terephthalate (APET) market is expected to grow USD 62 billion CAGR 7.30% during the forecast 2021-2030.

Moreover, the packaging industry's overall growth plays a pivotal role in influencing the APET market. As consumer preferences evolve, there is a rising demand for innovative and visually appealing packaging solutions. APET's versatility allows manufacturers to create aesthetically pleasing packaging designs while maintaining product integrity. This adaptability positions APET as a favored choice in sectors such as food and beverage, cosmetics, and pharmaceuticals.

Global economic conditions also significantly impact the APET market. Fluctuations in currency exchange rates, inflation, and overall economic stability can affect the production costs and pricing of APET products. Economic downturns may lead to a shift in consumer spending patterns, influencing the demand for APET-based goods.

Technological advancements and innovations in the production processes contribute to the market's evolution. Continuous efforts to enhance the properties of APET, such as its mechanical strength and thermal stability, drive research and development activities. As manufacturers introduce improved formulations, the market experiences changes in product offerings and competitiveness.

Government regulations and policies related to plastic usage and recycling further shape the APET market. Increasing emphasis on environmental sustainability has led to the implementation of stricter regulations regarding single-use plastics. Governments worldwide are promoting the use of recyclable materials, and APET aligns with these initiatives, fostering its adoption in various industries.

The availability and pricing of raw materials constitute another crucial factor influencing the APET market. PET (Polyethylene Terephthalate), a key raw material for APET, is derived from petroleum-based sources. Fluctuations in oil prices directly impact the production costs of APET. Additionally, the accessibility of PET feedstock and the development of alternative, sustainable sources can influence the market dynamics.

Consumer awareness and preferences regarding health and safety considerations also contribute to the APET market landscape. As consumers become more conscious of the materials used in packaging, there is an increasing demand for products that are free from harmful substances. APET's compliance with food safety regulations and its inert nature make it a suitable choice for packaging food and beverages.

Competitive dynamics within the APET market play a pivotal role in shaping its trajectory. Market players engage in strategies such as mergers, acquisitions, collaborations, and product innovations to gain a competitive edge. The level of competition, market share, and the ability to meet evolving customer demands contribute to the overall market structure.

Global trends, such as the rise of e-commerce, influence the packaging requirements and subsequently impact the APET market. The surge in online shopping has led to a greater need for durable and protective packaging solutions. APET's ability to provide a balance between strength and flexibility positions it as a suitable choice for packaging goods during transportation.

Leave a Comment