- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

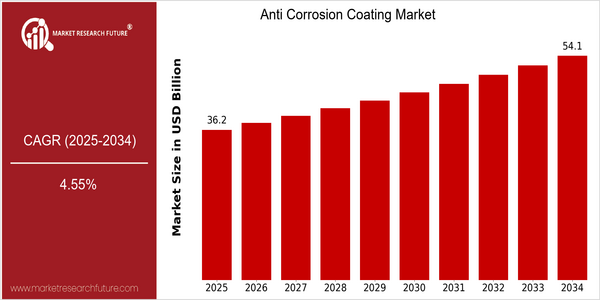

Anti Corrosion Coating Market Size Snapshot

| Year | Value |

|---|---|

| 2025 | USD 36.22 Billion |

| 2034 | USD 54.06 Billion |

| CAGR (2025-2034) | 4.55 % |

Note – Market size depicts the revenue generated over the financial year

The Anti-corrosion Coatings Market is expected to reach a significant growth, with the current market size of 36.22 billion in 2025 and expected to reach 54.06 billion by 2034, at a CAGR of 4.55% during the forecast period. This growth is driven by the growing need to protect assets and increase the lifespan of the assets in the harsh environment. The expansion of the market is also influenced by the increasing construction activities, especially in the emerging economies, and the strict regulations regarding the prevention of corrosion. The technological developments in the formulation of coatings, such as the development of high-performance and environmentally friendly coatings, also contribute to the growth of the market. The leading companies in this industry are PPG Industries, AkzoNobel, and Sherwin-Williams. Strategic initiatives such as the establishment of new research and development associations, the investment in the development of new production methods, and the launch of advanced coating products are expected to further strengthen their market positions. Anti-corrosion coatings will continue to develop in the future as industries continue to pay attention to the issues of life and economy.

Regional Deep Dive

Anticorrosion Coatings Market is experiencing a considerable growth in all regions. It is driven by increasing industrialization, rising construction activities, and stringent government regulations. In North America, the market is characterized by the use of advanced technology and a strong focus on the environment, while in Europe, the focus is on the regulatory framework and innovation in eco-friendly coatings. In Asia-Pacific, the market is characterized by the rapid urbanization and industrialization, which increases the demand for protective coatings. The Middle East and Africa are influenced by the growing oil and gas industry, while Latin America is adopting the anticorrosion solutions gradually due to the increasing number of construction projects.

North America

- A new EPA regulation on VOCs has prompted manufacturers to develop low-VOC, water-based, and water-based coatings.

- PPG Industries and Sherwin-Williams are investing heavily in research and development of advanced coatings, which will be used for the production of aircraft and automobiles.

- In the United States, where the trend toward greater social responsibility is gaining ground, the demand for bio-based protective coatings is on the rise.

Europe

- A new REACH regulation is driving manufacturers to reformulate their products, thereby increasing the demand for environmentally friendly anti-corrosion coatings.

- The development of new coatings based on the new findings of the nanoscopic world, which are mainly based on BASF and AkzoNobel, are giving rise to coatings that offer greater protection and longer service life.

- ANTI-CORROSION COATINGS. The post-COVID-I9 construction boom is pushing up demand for anti-corrosive coatings, especially in Germany and France, where the demand for such coatings is growing.

Asia-Pacific

- The Belt and Road Initiative has led to a major increase in the development of China’s construction and transportation industries, and the need for anticorrosive paints.

- The growth in the automobile industry in India is pushing the manufacturers to adopt advanced coatings. In response, companies like Asian Paints have expanded their product lines to include anti-corrosion solutions.

- This is the result of the increasing awareness of the importance of corrosion prevention in the region, and the resultant increase in research and development expenditure by companies such as Nippon Paint.

MEA

- The petroleum industry in the Gulf states is a major driver for the anticorrosion coatings industry. Companies like Jotun and Hempel are well equipped to offer specialized solutions for the harshest of conditions.

- Government initiatives to diversify economies away from oil dependency have led to an increase in investment in infrastructure and thus to a greater demand for protective coatings.

- The severe climatic conditions of this region require the use of high-performance anti-corrosion coatings, and manufacturers have had to develop and adapt their products accordingly.

Latin America

- The building of the new railways and the other works of the country, as well as the other works of the old railways, have created opportunities for the manufacturers of the paints and the suppliers of the various kinds of anticorrosion paints.

- Tintas Coral is one of the companies in the region that is at the forefront of this change.

- In Chile and Peru, mining activities are increasing, which makes the demand for anti-corrosion paints greater than ever.

Did You Know?

“Corrosion accounts for about 30 per cent of the total costs of maintenance in industry.” — NACE International

Segmental Market Size

Anticorrosive Coatings Market is characterized by steady growth, mainly due to the increasing demand for protective coatings in various industries such as oil and gas, marine and construction. Among the main reasons for this are the stricter regulations for reducing the harmful effects of the environment, the need for maintenance of the existing industrial equipment, especially those which are already old, and the need for new constructions. In addition, technological advances in the composition of coatings have improved their performance and resistance, thus stimulating the market even further.

The market is currently in a mature stage of development, with PPG Industries and AkzoNobel at the forefront of the innovation. The main application areas are protective coatings for pipes, bridges and industrial equipment, where resistance to the effects of weathering and rust are essential. As a result of trends such as the ‘green’ movement and government initiatives for the promotion of eco-friendly products, the market is expected to grow further, as industries seek to comply with increasingly stringent regulations. Nanotechnology and new formulations of polymers are the most important factors influencing the evolution of this technology.

Future Outlook

Anti-corrosion coatings are a major source of protection against the ravages of rust. Industry growth is based on a growing need for protective coatings in various sectors, such as oil and gas, marine, and construction, where corrosion protection is essential to ensure the longevity and productivity of assets. As industry increasingly focuses on the environment and regulatory compliance, the adoption of new anti-corrosion technologies will increase, thereby driving penetration and market share.

The development of the new green coatings and the progress in nanotechnology are reshaping the market. The shift towards water-based and low-VOC paints is being driven by increasingly stringent legislation on the environment. Nanotechnology is enabling the production of high-performance coatings, enabling the incorporation of smart coatings, which enable the end-user to monitor the level of corrosion in real time. Also, the growing importance of the maintenance of the public network and the development of new sources of energy, such as wind and solar power, will lead to a growing demand for high-performance anti-corrosion solutions and a more promising outlook for the future.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 30.31 Billion |

| Growth Rate | 4.55% (2022-2030) |

Anti Corrosion Coating Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.